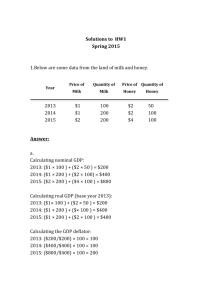

Page 1 ETP Economics HW1 Due date: 23 March 2015 1.Below are

advertisement

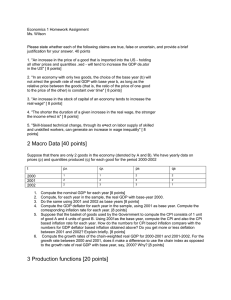

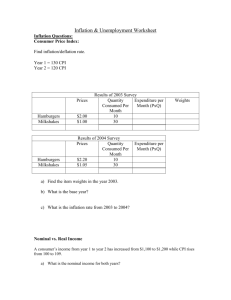

ETP Economics HW1 Due date: 23 March 2015 1.Below are some data from the land of milk and honey. Price of Quantity of Price of Quantity of Year Milk Milk Honey Honey Per worker Per worker Per per worker Per per worker per per h$1 our hour 100 hour 2013 $2 hour 50 2014 $1 200 $2 100 2015 $2 200 $4 100 a. Compute nominal GDP, real GDP, and the GDP deflator for each year, using 2013 as the base year. b. Compute the percentage change in nominal GDP, real GDP and the GDP deflator in 2014 and 2015 from the preceding yea. For each year, identify the variable that doesn’t change. Try to explain why your answer makes sense. c. Did economic well-­‐being rise more in 2014 or 2015? Explain. 2. One day, Barry the Barber, Inc., collects $400 for hair-­‐cuts. Over this day, his equipment depreciates in value by $50. Of the remaining $350, Barry sends $30 to the government in sale taxes, takes home $220in wages, and retains $100 in his business to add new equipment in the future. From the $220 that Barry takes home, he pays $70 in income taxes. Based on this information, compute Barry’s contribution to the following measures of income. a. Gross domestic product b. Net national product c. National income d. Personal income e. Disposable personal income 3. Suppose that people consume only three goods, as shown in the table. Tennis Golf Bottles of 2014 Gatorade balls balls Price Quantity 2015 Price Quantity $2 100 $4 100 $1 200 Tennis Golf Bottles of balls balls Gatorade $2 100 $6 100 $2 200 a. What is the percentage change in the price of each of the three goods? b. Using a method similar to the consumer price index, compute the percentage change in the overall price level. c. If you were to learn that a bottle of Gatorade increased in size from 2014 to 2015, should that information affect your calculation of the inflation rate? If so, how? d. If you were to learn that Gatorade introduced new flavors in 2015, should that information affect your calculation of the inflation rate? If so, how? 4. Suppose that a borrower and a lender agree on the nominal interest rate to be paid on a loan. Then inflation turns out to be higher than they both expected. a. Is the real interest rate on this loan higher or lower than expected? (Using the formula of real interest rate to explain your answer.) b. Does the lender gain or lose from this unexpectedly high inflation? Does the borrowers gain or lose? c. Inflation during 1970s was much higher than most people had expected when the decade began. How did this affect homeowners who obtained fixed-­‐rate mortgages during the 1960s? How did it affect the banks that lent the money? 5. In the 1990s and the first decade of the 2000s, investors from Asian economies of Japan and China made significant direct and portfolio investments in the United States. At the time, many Americans were unhappy that this investment was from foreigners. a. In what way was it better for the United States to receive this foreign investment than not to receive it? b. In what way would it have been better still for Americans to have made this investment?