Problem definition workshop - Department of Treasury and Finance

advertisement

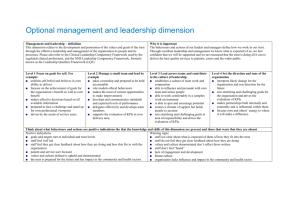

Tips and traps Problem Definition workshop The Secretary Department of Treasury and Finance 1 Treasury Place Melbourne Victoria 3002 Australia Telephone: +61 3 9651 5111 Facsimile: +61 3 9651 5298 www.dtf.vic.gov.au Authorised by the Victorian Government 1 Treasury Place, Melbourne, 3002 © Copyright State of Victoria 2012 This book is copyright. No part may be reproduced by any process except in accordance with the provisions of the Copyright Act 1968. ISBN 978-1-922045-91-1 Published January 2013. If you would like to receive this publication in an accessible format please telephone 9651 0909 or email mailto:information@dtf.vic.gov.au This document is also available in PDF format at www.dtf.vic.gov.au Contents 1. Purpose of this document ....................................................................... 1 2. Context for the Investment Management Standard workshops .............. 2 2.1 3. How many workshops?.................................................................................................. 3 Problem Definition workshop ................................................................. 5 3.1 Purpose of a Problem Definition workshop................................................................... 5 3.2 Responsibility of the facilitator ...................................................................................... 5 3.3 Who should be there? ................................................................................................... 6 3.4 Before the workshop ..................................................................................................... 6 3.5 At the workshop ............................................................................................................ 6 3.6 Step 1: Setting the scene ............................................................................................... 7 3.7 Step 2: Issues identification ........................................................................................... 9 3.8 Step 3: Problem statements .......................................................................................... 9 3.9 Step 4: Benefits ............................................................................................................ 11 3.10 Step 5: Strategic response ........................................................................................... 12 3.11 Step 6: Changes and assets .......................................................................................... 13 3.12 Step 7: Finalise the workshop ...................................................................................... 13 3.13 After the workshop ...................................................................................................... 14 3.14 Templates and examples ............................................................................................. 14 Appendix 1. Shaping new investments using the IMS ........................................... 15 Appendix 2. 16 questions checklist for investment decision-makers .................... 16 Appendix 3. Benefit framework ............................................................................. 17 Appendix 4. Design guidelines – Investment Logic Maps ...................................... 18 Appendix 5. Facilitator feedback form – Problem Definition workshop................ 19 Appendix 6. Quality assessment form – Investment Logic Map ............................ 20 Appendix 7. Sample agenda – Problem Definition workshop................................ 21 Appendix 8. Sample email – before the Problem Definition workshop................. 22 Appendix 9. Sample email – after the Problem Definition workshop.................... 23 Tips and traps Problem Definition workshop i 1. Purpose of this document This is the first of four guidance documents within the ‘shape a new investment’ series of tips and traps, written primarily for facilitators. It provides practical tips and guidance on how to successfully facilitate an initiative-level Problem Definition workshop and prepare an Investment Logic Map (ILM) consistent with the Investment Management Standard (IMS) version 5.0. Guidance on how to facilitate the shaping of programs of new investment and improving the effectiveness of organisations is available in separate documents. This document assumes you have read and understood the IMS – its principles, practices and the theory upon which it is built. It is available on the investment management website at www.dtf.vic.gov.au/investmentmanagement. This document is also used in the facilitator training course. Further detail on the facilitator training course can be found on the investment management website. Tips and traps Problem Definition workshop 1 2. Context for the Investment Management Standard workshops The ability to select the investments providing the most benefit to society is a key component of good government. This is often a complex exercise requiring the contribution of many people who each bring their specialist skills and perspectives. The IMS is a collection of simple, commonsense ideas and practices helping organisations direct resources to deliver the best outcomes. It has been designed to answer many of the key questions required to make an investment decision. These questions are also reflected in the ‘Investment Lifecycle and High Value/High Risk’ business case guidelines and templates. The Victorian Government has aligned these elements of its investment shaping and decision-making processes. The 16 questions decision-makers checklist (see Appendix 2) has been developed as a simple-to-use tool to describe the key information needed to decide on what direction an investment should take. Some of these questions are more applicable at the implementation phase of an investment, while the majority apply to the early planning and strategy phase of an investment’s lifecycle. Together these provide a mechanism allowing decision-makers to assess whether: there is a real problem needing to be addressed at this time; the benefits provided by successfully addressing the problem are of high value to the organisation; the way the problem will be addressed is both strategic and innovative; and the solution is likely to be delivered within the time and cost expectations. The workshops forming part of the IMS are used to support the primary investment decision-making functions of an organisation in a number of ways. Investment management can be used to: shape a new investment; prioritise investment proposals; develop new policies; monitor and measure the delivery of benefits; evaluate a program of investment; refocus an organisation to improve its effectiveness; and monitor an organisation’s outcomes. Within organisations, investment decisions are usually made at three levels: new individual investments; programs of investment; and the organisation direction and outcomes. While these levels should naturally connect hierarchically, they are often managed using entirely different processes, in different forums and using different language. By providing an integrated view of IMS practices (Figure 1), closer alignment between levels can be achieved and the logic for investment at each level tested within a broader organisational context. The thinking, principles and workshops incorporated in the IMS can be applied to each of the three levels ensuring consistency of understanding and language. The integrated view of the IMS shows the three levels at which the practices are applied and the workshops extracting the investment logic. These are also aligned to a set of foundation questions that depict change. Tips and traps Problem Definition workshop 2 Figure 1: Integrated view of Investment Management Standard 2.1 How many workshops? While size and complexity are key factors in determining how many workshops will be needed, all discussions of initiative-level investments will be required to follow the same ‘line of enquiry’ (Figure 2) as they develop their respective investment stories. Some investments will only require a single workshop, whereas others may need up to four workshops. In the case of an investment only requiring a single workshop, each area of the line of enquiry are covered but in a faster and less rigorous manner, producing an ILM. Figure 2: Line of enquiry Very large or complex investments will require four workshops, producing four documents that are key to a business case. Small investments may be able to complete the investment story in just one discussion but would only produce an ILM. Tips and traps Problem Definition workshop 3 The factors affecting the complexity of a potential investment are depicted in Table 1. Cost Solution certainty Stakeholder complexity Public accountability Benefit maturity Cost is usually a good proxy of general complexity. In some cases (usually very low cost investments) there is a known solution that is unlikely to be challenged. The larger the number of individual stakeholder groups needing to be engaged increases the difficulty of ensuring the investment is well developed and likely to succeed. The likely ultimate need for public accountability will require that the logic for the investment to be well argued and supported by evidence. The need to define the benefits/key performance indicators (KPI) being delivered to successfully respond to the problem is pivotal to these practices. While some organisations have well-established measurement practices, many don’t. Table 1: Factors affecting investment complexity These factors can be used as a guide to determine whether an investment is likely to be low, medium or high complexity. Figure 3 provides a general indication of the number of workshops required based on the investment complexity. Figure 3: Investment complexity and number of workshops Each workshop produces different documents (Table 2). The conversation regarding the number of workshops must be held with the investor prior to the Problem Definition workshop. Table 2: Investment complexity and documents produced Victorian Government’s budget process Investments falling within the Victorian Government’s budget processes are recommended to complete workshops that support the development of an ILM, benefit management plan, strategic options analysis and investment concept brief. Tips and traps Problem Definition workshop 4 3. Problem Definition workshop This is the first workshop in the IMS and aims to shape an investment that will deliver the maximum benefit to the organisation. Its focus is on primarily determining the problem and the benefits, with greater or lesser emphasis on KPIs and strategic interventions according to the scale of the investment and the number of workshops allocated. 3.1 Purpose of a Problem Definition workshop The primary intent of this workshop is to get a clear understanding of the: 3.2 problem or opportunity impacting the investor and organisation; strength of available evidence to confirm both the cause and effect of the problem; and benefits the organisation can expect in successfully responding to the problem. Responsibility of the facilitator The facilitator’s task is to help the participants develop the most compelling, evidence-based case for investment they can. The output of this particular discussion is the story of the potential investment in the form of an ILM. In developing the ILM the group are effectively producing the executive summary of the business case for a potential investment. There is no ‘right answer’ to the investment story – just a story to which the participants, particularly the investor, have agreed. The place of this discussion within the ‘line of enquiry’ is depicted in Figure 4. Figure 4: Line of enquiry – Problem Definition workshop To be successful, the facilitator must: work with the investor to ensure the right people will be attending and that two hours has been allocated for the discussion; conduct the discussion according to the guidance provided in this document; and take action to finalise the discussion and the ILM within 48 hours. Effectiveness assessment The effectiveness of the facilitator can be assessed using the criteria in the ‘Facilitator feedback form – Problem Definition workshop’(Appendix 5). The effectiveness of the ILM can be assessed using the ‘Quality assessment form – Investment Logic Map’ (Appendix 6). These forms do not need to be completed each time a Problem Definition workshop is held but are required for facilitator accreditation and re-accreditation. Tips and traps Problem Definition workshop 5 3.3 Who should be there? The key person is the investor – the person who has the business problem and will be responsible for delivering the benefits. It is the investor’s responsibility to identify those people who should attend the discussion. The investor should bring together people who understand the problem(s) and can provide evidence validating the identified problem(s) are real. Wherever possible it is valuable to involve people from broader strategic policy areas of the organisation to ensure the problems identified are appropriately informed and challenged. This workshop also provides an opportunity to include key stakeholders who will be important to making the potential investment successful. See Appendix 1 for an information sheet outlining the scope and intent of each workshop. This is helpful in providing the investor and participants with a clear view of the thinking and decisionmaking pathway. It is a good idea for the investor to plan and invite the participants to all of the planned workshops at the same time. This ensures participant availability for both the sessions and any reviewing work set during the workshops. It is recommended the workshops involved in this exercise are held at two-weekly intervals. Experience has shown this provides sufficient time for the thinking of the previous workshop to be absorbed and is not so far distant that the momentum is lost. The ideal number of active participants is between five and eight, depending on the nature of the investment but could be up to 12. 3.4 Before the workshop Ensure the investor is attending the workshop and assist them to identify the other participants. Have the investor send an email outlining the purpose of the discussion to the participants. The ‘sample email – before the Problem Definition workshop may help (Appendix 8). Make sure the venue has been reserved 30 minutes prior to the workshop beginning, it can accommodate the number of participants comfortably and has at least one suitably sized whiteboard – preferably one that can produce screen copies. Access to a flip chart is also helpful. It is wise to take some working whiteboard markers with you as well. 3.5 At the workshop Introduction For a new facilitator here are a few general tips you might find useful to consider and incorporate into your facilitation and workshop management techniques: Setting some expectations You expect people to be at the workshop for the full two hours. Phones should be turned off (unless someone is expecting a critical phone call). It’s not necessary for the workshop participants to bring along any material related to the investment. They are the experts on this subject and it is their knowledge and experience in their field that is needed to inform the discussion. However, as the facilitator you may wish to bring along an example ILM and/or some of the other IMS material to give any participants new to the process. Polite behaviour within the group is expected but this should not compromise the robust and probing nature of the discussion. The workshop is the initial part of the consultation. The feedback process and timing is an equally important part of their participation and engagement in the Problem Definition workshop. Ensure you let participants know it is unlikely there will be sufficient time during the workshop to get the wording of the problem statements exactly right. Therefore the focus will be on getting clear Tips and traps Problem Definition workshop 6 agreement to the intent of the wording during the workshop and undertake wordsmithing in the final copy. Structuring the workshop The structure and time allocation within the Problem Definition workshop will depend on the size and complexity of the investment being discussed and the number of workshops allocated. For a small or low-complexity investment the aim would be to move from defining the problem all the way through to the business changes that make up the solution. For an investment of medium size or complexity the aim would be to develop the problems, benefits and KPIs and, if time permits, a rough start on brainstorming some strategic interventions. For a very large or complex project you would likely only reach the stage of defining the problem and the outline of the benefits within the first workshop. For more information about how many workshops refer to section 2.2. It is recommended you roughly map out how you aim to structure the workshop in terms of the time allocated to each section. Though this structure may well change according to how the discussion progresses or the discovery that the investment is more, or less, complex than previously anticipated. An example of different time allocations for the steps within the Problem Definition workshop is attached at Appendix 7. General timing tips Foremost, remember to maintain a time-pressure awareness throughout the discussion… there is no 121st minute! Allow for ‘venting’ of ideas in the first period (10–15 minutes). Focus on establishing very strong problem statements (no more than four). Extracting these statements is likely to take up a significant proportion of the workshop. It is time well spent though, as their identification is most critical element of a successful investment. Benefits need to be expressed in the context of why the organisation exists and must be able to be supported by good KPIs (meaningful, attributable, measurable). If these are weak you are likely tof find the ILM falls apart at the Benefit Definition workshop. In the last 10–15 minutes gather a list of potential strategic interventions (some of these will be included in the Strategic response column). For major investments, don’t be concerned about selecting interventions or defining the solution. These will be given serious consideration at subsequent workshops. 3.6 Please refer to the sample workshop agenda (Appendix 7). You are encouraged to use the ‘Quality assessment form – Investment Logic Map’ (Appendix 6) to assist in focusing on the right things during the discussion. Step 1: Setting the scene The following is provided as a possible introduction the facilitator might use to set the scene for the discussion. It attempts to establish a climate of robust and open discussion within a two-hour time period. Tips and traps Problem Definition workshop 7 Why are we here? We are here to have an intelligent and open discussion that will extract the story of this potential investment. This investment story will be in the form of an Investment Logic Map. What is an Investment Logic Map? Hand out a copy of the ‘Example – Investment Logic Map (initiative)’. This is to demonstrate the outcome sought in this discussion. This won’t be necessary if the participants have previously participated in a similar discussion that produced an Investment Logic Map (go to www.dtf.vic.gov.au/investmentmanagement for other examples). An Investment Logic Map is a single-page depiction of the logic that underpins an investment. It represents an ‘agreed investment story’ that is created in an informed discussion. It is written in plain English in a way that will allow a layperson to understand the language and the concepts. An Investment Logic Map must speak to the funder in a language they understand. It should tell a compelling story for investment that is logical, able to be supported by evidence and easily understood. Your uncle or aunt must be able to read and understand it. When completed it underpins the executive summary and the headings of the business case. The Investment Logic Map itself becomes the foundation document that will be modified to reflect the logic for an investment throughout its lifecycle. This session will go for two hours… not two hours and five minutes. In that time we will shape and record the story of this investment. In two hours’ time when we look at the whiteboard we will see one of three possible outcomes… each of which is valid and valuable: We will like what we see (validation that the idea has merit). We won’t like what we see (seemed like a good idea at the time). We will have nothing coherent (clearly no point in proceeding). What is my role? My role as the facilitator is to be content free. I am a storyteller and I aim to tell the best investment story that is possible, achievable and can be supported by verifiable evidence. You may not like me today because part of my job as a facilitator is to challenge the assumptions and claims you make and to test their validity. I am paid to detect fiction and ensure what is depicted in the final Investment Logic Map is an accurate reflection of our discussion and the evidence that underpins it. The investor’s role As the investor you are the most important person in the room. This is your forum and you are responsible for delivering this investment. You are the person with the problem or opportunity who will be making or advocating the investment decision, and who will ultimately be responsible for delivering the benefits. Final decisions for this investment will be directed to you. Participants As the other participants you are here to assist the investor to define the problem, the expected benefits and the strategic interventions for this investment. You have been selected to participate because you know most about this problem and its impact. It is your insights that will help to shape and bring rigour to this investment story. Our observers (one or two) are welcome but are expected to listen to the conversation rather than actively participate. Their time to participate is likely to come during subsequent workshops or in the development of the business case. Starting the problem definition discussion In this workshop the challenge for the facilitator is to move the discussion from the solution, where people typically want to start, to the negative impacts or effects that have formed the impetus to make a change. It is useful to start by asking the investor to identify the overarching business outcome they want from this investment. This becomes the initial title for the investment and provides some scope and context for the discussion. This exercise should not take more than one minute. Once the workshop is concluded the participants will have a chance to review the title to ensure it reflects the investment story they have told. At this point a subheading can also be included for simpler projects. This may reflect the desired solution whether this is a project, asset or service. Tips and traps Problem Definition workshop 8 For example: Heading: Improving access to ambulance services in rural areas Subheading: Upgrade to the ambulance fleet Ask the investor to outline the problem that has caused them to consider an investment. Once the investor has finished (three or four minutes), open this up to the rest of the group. Let them ‘vent’ for as long as the group needs, typically five to 10 minutes. This provides an opportunity to establish whether all participants have a shared understanding of context of the problem. Then gather the key issues. Note: It is common practice during the process of developing an ILM to test the initial desired solution thoroughly and a new, better solution will often become apparent. This will be reflected in the subheading as the ILM develops. 3.7 Step 2: Issues identification Write the issues identified by the group on either a separate whiteboard/flip chart or on the righthand side of the whiteboard under the Changes and Assets columns. Once your issues list reaches a natural conclusion, try to identify themes and categorise the list under these themes, for example: inefficiency, service quality, reputation, injury and safety, cost, risk, productivity or waste. The most important issue will become the starting point for the first problem. 3.8 Step 3: Problem statements The problem(s) is/are recorded in the first column of the ILM. A problem is the reason action needs to be considered at this time. Generally, it is couched in negative terms and is made up of two parts – cause and effect. The problem(s) statements are critical to understanding the need for this investment and should enable the reader to get a sense of the level and significance of the investment. For example : Cause: High levels of toxicity Effect: Threaten the presence of rare flora and fauna in the park A problem statement should be: expressed in plain English and have a clearly defined cause and effect; supported by evidence to verify both the problem and the ‘cause and effect’; and compelling and something that we care about (i.e. if the effect or consequence are of little importance or concern, the problem is not compelling). Getting good problem statements At the heart of a good problem statement is the articulation of the cause or what’s broken and the evidentially linked effect or consequence that we care about. Key questions What is the cause and what is the effect or consequence? What are the imperatives for this investment? What will happen if we do nothing? What trigger has made us think that we need to respond now? What is the effect or consequence that we really care about and can we do something about remedying the cause or what is broken? What evidence is there to support the relationship between the cause and the effect that we care about? Participants often come with some firm views about the cause or need for investment. These may or may not be true. Often they are symptoms of the problem rather than the heart of the problem. Sometimes they initially see a problem statement within a political context, for example, it’s an election promise or a Ministers request or it’s a compliance requirement. Good facilitation should Tips and traps Problem Definition workshop 9 work hard to identify the community need that stimulated the election promise, Ministerial request or compliance requirement. Typically all of these situations have a real and evidence-based need that can be described in the problem statement. On other occasions participants arrive with a view of the problem that starts at a very low level such as a broken or outdated asset. If you start here then you are forced too early and often inaccurately down a solution pathway. You will need to work with the group to lift the discussion to a more strategic level. Getting a better understanding of cause and effect will help sharpen the problem statement and provide a better understanding of the problem story. A useful way to do this is to try to unpack an issue by exploring the relationship between cause and effect. The fictional example below demonstrates how carefully unpacking an issue gives an understanding of not only the real problem but also the benefit, potential KPIs and some of the strategic interventions that might be considered. Cause and effect We have an issue around ‘High levels of toxicity in a national park’. Question: What caused the high levels of toxicity? Answer: The water quality was declining. Next question: What is causing the decline in water quality? Answer: Pollution from a nearby factory and increasing run-off of pesticides from agricultural land. Focus first on the factory. Question: What is causing the factory pollution? Answer: Lack of standards-based filtration equipment. Question: Why don’t they have appropriate filtration systems? Answer: Cost and lack of monitoring to ensure compliance. Now let’s look at the pesticide run-off. Question: What’s causing the increase in run-off of pesticides? Answer: Excessive pesticides being used by local farmers. Question: Why are farmers using more pesticides that are of a greater strength than they need? Answer: Outdated farming practice. So we get a better understanding of the factors that contribute to the problem as well as some areas that may need to be addressed within our response: Cost of more effective filtration equipment, monitoring capacity and education for farmers. Now let’s look at the effect of the high level of toxicity in a national park. Question: What is the effect/impact/consequence that is most closely related to this issue that is supported by evidence? Answer: Flora and fauna is threatened. Question: What evidence do you have for this effect? Answer: Increased populations under stress – rare bird population and some indigenous plants; increased levels of pesticides and chemicals in the water. Question: What’s the effect if this threat to flora and fauna is not addressed? Answer: Reduction in local biodiversity. The further down this chain the harder it is to isolate the effect to our problem. It is at this point that we may be able to better understand the benefit if we rectify the negative effect. This often draws out the anticipated benefit. For example, what benefit will arise from reducing or eliminating the threat to flora and fauna might be… protection of local biodiversity. A maximum of four problems are permitted, but in most instances two to three problem statements are sufficient to provide clarity in the problem space. Weightings It is often useful to rank and then allocate weightings at this stage. It ensures only the most compelling problems continue to be discussed. In an ILM a total of 100 per cent is distributed within each of the Problem, Benefit and Strategic response columns. This is distributed to indicate the relative importance of the various elements within each column. To ensure clarity and ease of prioritisation, no items should have the same weighting within each column. Tips and traps Problem Definition workshop 10 Problems rated less than 10 per cent should be questioned regarding the need to mention them at all. The aim is to capture those things that really matter and eliminate the rest. 3.9 Step 4: Benefits This step focuses on determining and articulating the benefits to the community, enterprise or organisation that will be delivered as a result of this investment. The Benefit column articulates the value proposition or successful outcomes that are expected from addressing the negative consequences identified in the problem statements. They should look at the potential to deliver increased value, where possible, while addressing the immediate problem. The benefit statement is made up of an overarching statement that provides line-of-sight to the outcomes the organisation is seeking and is supported by two high-quality KPIs. Benefit statements should provide an obvious connection to government or the organisation’s outcomes but be contextualised to indicate their local impact. This alignment between the high-level enterprise benefits and specific investment benefits is described in the benefit framework (see Appendix 3). A benefit needs to pass three tests: the benefits remove or mitigate the defined problems and are aligned to the outcomes valued and articulated by the organisation; it is supported by two KPIs that are meaningful, measurable and attributable to this investment; and it is cost-effective – the effort required to track the benefit and the KPIs are commensurate with the value and insight that they provide to the organisation. Key questions What value will we get out of this investment and how will we know whether value has been delivered? What benefits will the organisation expect in successfully responding to the problem? What outcomes will we get from remedying this problem? What benefit will government and citizens get from this investment? What part of the government agenda will this investment support? What KPIs will demonstrate value and are outcome focused? Create the links between the problems and the benefits that they respond to. Figure 5 demonstrates this relationship. Figure 5: Problem to benefit relationship It is critical any benefits claimed are supported by reasonable KPIs – ones that are meaningful, attributable and measurable. These KPIs should be outcome rather than output or activity focused. The emphasis should be on the results or impact of the work that is done to deliver the benefit and Tips and traps Problem Definition workshop 11 remediate the problem. Aim for a maximum of four benefits and a maximum of two KPIs for each benefit. Weightings The benefits are weighted in the same way as the problems. If time is short it is often useful to at least rank the benefits at this stage. 3.10 Step 5: Strategic response The Strategic response is the third column of the ILM. It is the strategic option recommended as the preferred response to an identified problem(s). It is made up of one or more strategic interventions. A strategic intervention is a high-level strategic action that could be taken as a response to an identified problem. A valid strategic intervention must have the potential to deliver some or all of the identified KPIs and their target measures. To ensure it is sufficiently high level, its implementation must also allow more than one possible solution. Therefore a strategic intervention needs to pass three tests; it needs to: deliver some of the identified KPIs, their measures and targets; allow more than one possible solution; and be a valid response to the problem(s). Start by saying something like: ‘The purpose of a strategic intervention is to deliver some of the KPIs that have been identified but to remain sufficiently high level so as not to lock us into a specific project option.’ So, how can we intervene? change the demand – stop, slow, divert or increase it; improve productivity – improve its productivity or effectiveness; and change supply – treat it, fix it. If you are only having one workshop, direct the group to select the strongest combination of interventions from this candidate list and connect them to the relevant benefits they relate to. A minimum of four and a maximum of eight strategic interventions is likely as you try to determine the best strategic response. Ultimately you will select a combination of one to four interventions to form the strategic response. If you are having a series of workshops, developing the list of candidate interventions will be as far as you will need to go in this first workshop. Key questions What strategic interventions will best respond to the problems and deliver the benefits? What is our response to the cause aspect of the problem statement? How will we remedy or rectify what is broken? Is it in our power/influence to respond to this? Have we got the right people here to answer this? Do we need to invite others into this conversation if we are genuinely going to deliver on the proposed KPIs? Does this align with the purpose of our organisation(s)? Have we got the right people here to answer this? Do we need to involve another organisation and develop a joint response? Have we canvassed ways to change demand, improve productivity and change supply? Will this deliver on the KPIs, their measures and targets? Weightings If you are only having one workshop you will need to weight the interventions in the same way as you weighted the problems and benefits. If time is short it is often useful to at least rank the interventions at this stage. If you have more than one workshop then weightings will be discussed in a subsequent workshop. Tips and traps Problem Definition workshop 12 3.11 Step 6: Changes and assets The items in the Changes and Assets columns form the solution. This is often the area that the group is most comfortable with. Changes are the things that must be done by the business if the expected benefits are to be delivered. Changes provide the detail of how the strategic response will be put into effect. Assets are any physical item that must be acquired to enable the identified changes to occur. Examples of these are hospitals, pipelines, plants or computer systems. A change must align with at least one strategic intervention. Key questions In all circumstances the questions that this section aims to answer is: What changes are needed to the way we operate? What do we need to do differently? How will we undertake or implement the strategic interventions we identified? Do these changes align with our strategic interventions? Will these changes deliver the benefits and KPIs? Is this approach feasible? Are there any orphaned interventions? No asset can exist without at least one change to support it. Questions around the Asset column should include: What do we need to build, buy or lease to implement our changes and therefore contribute to our strategic intervention? What changes and assets do we need to deliver the benefits and KPIs? Most investments have between six and eight changes and up to four assets. It is recommended to not go beyond this number as adding further changes and assets makes the map complex to evaluate. Weightings Weighting are not required for changes and assets. 3.12 Step 7: Finalise the workshop At the end of the workshop, try to tell the investment story by reading across the map. Ask the participants: Does our title and subtitle reflect the story that we have articulated on this map? Was this the story that we expected/wanted to tell? What outcome did we achieve at the end of this workshop? Validate the idea has merit, go back and do more work before proceeding or stop the investment. Is this the most compelling story for investment and is it validated by evidence? Does the map accurately reflect the discussion we had? Do I have licence to do some wordsmithing to sharpen the statements? Reiterate the feedback process At the close of the workshop, advise participants that within 24 hours (or on the following day) they will be provided with ILM version 0.1. Your email message should contain your observations of strengths and weaknesses of each element of the map. They will be asked to provide suggested changes within 24 hours and ensure they copy in the other participants. There is no point in circulating this draft to people who were not present in the workshop as their comments would lack context – they will be free to make comment when this iteration of the ILM has been completed. Within a further 24 hours you will update the ILM based on participant feedback and distribute version 1.0. Tips and traps Problem Definition workshop 13 3.13 After the workshop The Problem Definition workshop discussion is where the first version of the investment story is extracted. What happens in the following 48 hours is just the finalisation of the discussion. This finalisation should be decisive and only include those people who participated in the discussion. After the first version has been finalised it is then able to be provided to anyone to make whatever comments they wish. The investor takes ultimate responsibility for any subsequent changes to the ILM. Within 24 hours of the session send version 0.1 of the ILM to all participants. Often taking a photo of the whiteboard and circulating this ensures that participants have a copy of the original output prior to wordsmithing and tidying up by the facilitator. Sending the whiteboard output is a matter of personal style. Download the current version of the ILM format from the Investment Management website and complete it with the data from your workshop. Use your storytelling and wordsmithing skills to create a plain-English story that encapsulates the discussion and meets the five tests of the ‘Quality assessment form – Investment Logic Map’ (Appendix 6). Make any observations you have of the draft ILM and suggest where its strengths and weaknesses are and how it might be improved. If you think it worthwhile, provide an alternative version (0.2) for their consideration but be careful that it still reflects their work. Include the list of issues and any interventions that have been gathered during the workshop. Send an email with version 0.1 (and whiteboard output) of the ILM and your observations directly to each of the participants at the session avoiding, if possible, channelling it through a single person. It is important that all participants are involved in finalising the discussion. In the email ask participants to advise you (and copy in all other participants) of any suggested changes within 24 hours and advise them you will make changes and provide them with version 1.0 within 24 hours of that time. All of this reinforces the ‘what do we think today’ principle that underpins this approach. The ‘sample email – after the Problem Definition workshop’ (Appendix 9) may help. Within 48 hours of the discussion send all participants version 1.0 of the ILM. This should respond to any feedback that was provided in response to version 0.1. If no feedback was received finalise this as you have suggested. Suggest or confirm any agreed next step (e.g. Benefit Definition workshop). If it is agreed that there should be the next workshop, a one- to two-week break is thought to be ideal (allowing time for the dust to settle, but still being fresh in the mind of the investor particularly). 3.14 Templates and examples The templates and examples are available for download at www.dtf.vic.gov.au/investmentmanagement. The function of ILMs is to portray the logic underpinning a potential investment on a single page and in a form that can be quickly understood by decision-makers. The things that work when creating an ILM well have been identified and they are provided in ‘Design guidelines – Investment Logic Map’ (Appendix 4). Use these guidelines to develop your ILM. They will help to ensure your map is an effective communication tool that articulates the argument clearly, exposes the logic of your argument and identifies the value proposition inherent in this investment. Tips and traps Problem Definition workshop 14 Appendix 1. Shaping new investments using the IMS The Victorian Government’s Investment Management Standard (IMS) establishes a set of simple practices that enable organisations to select the investments that matter most and shape and implement them so they deliver the maximum benefit and best value for money. The practices can also be used to help prioritise investments, develop policy, evaluate programs and improve the effectiveness of an organisation. The standard supports a way of thinking characterised by the use of simple logic (commonsense), bringing together the best thinkers on a subject, evidence-based discussion and simple storytelling. It also aims to eliminate unnecessary process. In shaping new investments the practices use facilitated two-hour discussions (workshops) to address the four questions that are fundamental to investment decision making: The number of workshops required is determined by the nature of an investment. Large and complex investments might require four separate workshops that would produce four documents critical to establishing a sound business case. Small and simple investments might require just one workshop and would only produce an Investment Logic Map (ILM). The full set of workshops for major investments are depicted below. PROBLEM Investments are made as a considered reaction to an identified problem. This workshop focus is to: define the problem(s) that need to be addressed; validate that the problem is real; and specify the benefits that will result from addressing the problem. The output of this workshop is the first version of an ILM with the problems and benefits defined. BENEFIT Investments are often shaped with little understanding of the benefits expected to be produced. This workshop will: identify the KPIs, measures, targets and timelines that the investment will need to deliver; and specify how the delivery of the benefits will be measured and reported. This workshop will produce a BMP including a benefit map. STRATEGIC RESPONSE Business cases for new investments often fail to properly consider the strategic spectrum of things that could be done to address the identified problem. This workshop will: explore the interventions that could deliver the expected benefits; formulate and evaluate a mix of strategic options; and decide the preferred response. A strategic options analysis document is produced at the end of the workshop. Note: The assumptions made in this workshop are validated as a desk exercise by the group before moving to the next workshop. SOLUTION A solution is developed consistent with the foundations established in previous workshops. This workshop will: identify and evaluate the changes and assets that are required to implement the strategic response and deliver the benefits; and identify cost range, timeframe for project and benefit delivery, key risks, dis-benefits and assumptions associated with the preferred solution. The workshop will produce an ICB, the ILM and BMP will be updated to reflect the agreed solution. Tips and traps Problem Definition workshop 15 Appendix 2. 16 questions checklist for investment decision-makers Tips and traps Problem Definition workshop 16 Appendix 3. Benefit framework Each time an organisation makes an investment there is an expectation that some form of benefit will be returned. It is critical to design investment solutions that provide maximum benefits and to be able to confirm that the expected benefits were delivered. Why is it then that very few investments are able to articulate the benefits they will provide, to define how they will be measured or to actually measure the benefits that are ultimately delivered? In taking a fresh look at the problem of benefit management, it seems that within large organisations there has been an inability to define how each individual investment contributes to the primary benefits that are the point of the organisation’s existence. It is typical and appropriate that everyone within, say Victoria Police, believes their individual investment will provide the benefit of ‘reduced crime’ and everyone in Education will claim theirs will result in ‘better learning outcomes’. But until now there has been limited ability to describe the contribution of an individual investment to ‘reducing crime’ or to achieving ‘better learning outcomes’. The benefit framework that is depicted below has evolved, been trialled and found to be effective at addressing this longstanding problem. The framework is a three-level structure that links the contribution of an individual investment to the outcomes the enterprise is seeking. In the example depicted here, at the enterprise level, the government is seeking to create ‘friendly, confident and safe communities’. To this end they set benefits and targets that must be met at the organisation level – in this case the police are required to ‘reduce crime’. At the investment level it is necessary to demonstrate how a particular investment will contribute to the benefits sought by the organisation. In the fictional example we are using here, the team of forensic scientists are seeking an investment to acquire state-of-art forensic software and to renew their aged computer system. In return for this investment they claim they will ‘reduce crime’. Their evidence to support this claim is that they will reduce the time it takes to provide forensic matches by 30 per cent and obtain 20 per cent more forensic matches. The head of the police organisation is then left to decide the following: How significant will meeting the targets associated with these KPIs be to a reduction in crime? Would the claimed KPIs and their targets be directly attributable to the proposed investment? Would the likely impact on crime reduction be worth the cost of the proposed investment? This benefit framework is used as the basis for considering the validity of potential benefits during the development of ILMs. It has also been used during the development of more than 60 benefit management plans, many of which are now tracking the delivery of benefits. Any KPI selected must be meaningful, attributable and measurable. Tips and traps Problem Definition workshop 17 Appendix 4. Design guidelines – Investment Logic Maps The function of Investment Logic Maps (ILM) is to portray the logic underpinning a potential investment on a single page and in a form that can be quickly understood by decision-makers. Already several thousand ILMs have been developed. On the basis of this experience those things that work well have been identified and they are provided in this design guideline. Use this guidance to develop your ILM. They will help to ensure that your map is an effective communication tool that articulates the argument clearly, exposes the logic of your argument and identifies the value proposition inherent in this investment. Item Template Problem statements Benefit statements KPIs Practice Always use the current ILM template. Current templates can be found at www.dtf.vic.gov.au/investmentmanagement. Maximum of four problem statements. Minimum of four benefits – six interventions. Two KPIs must be included for each benefit. Interventions statements Number of words Maximum of four interventions. Size of boxes Do not alter the size of the box or the font size. No more than two linkages from any element in one direction. A total of 100 per cent to be distributed within each column. This is distributed to indicate the relative importance of the various elements within each column. Elements then re-distribute their percentage to the boxes to which they are connected in the following column. When distributing percentage, no two elements should be given the same weighting (e.g. split problems 50:50). Elements rated less than 10 per cent should be questioned regarding the need to mention them at all. No more than two KPIs per benefit. Connections Use and distribution of percentages (%) Completing the control fields The ideal number of words per box is between eight and 12. Ensure the document control fields have been completed. Reason Formats continue to improve to make them more useful as communication tools, containing better information. Forces decisions as to what are real problems and reduces unnecessary complexity. As with problem statements. Without strong KPIs the benefits the investment is aiming for are unlikely to be delivered. It also focuses the group on determining the most important KPIs that this investment is going to achieve. To demonstrate a wide spread of strategic thinking. It forces you to be precise in the words you chose to convey your message. It also maintains clarity and consistency when reading an ILM. Retains simplicity and forces the use of plain English. Retains simplicity and creates the need to prioritise what really matters. Acts as a tool to extract judgements on the relative importance of the identified problems, interventions and benefits. Forces decisions of relative importance. Each element and its connections add to the complexity. The aim is to capture those things that really matter and eliminate the rest. Ensures simplicity and priority KPIs are identified. Provides legitimacy and accountability to the investment. Tips and traps Problem Definition workshop 18 Appendix 5. Facilitator feedback form – Problem Definition workshop Critical to the success of the Investment Management Standard is the ability to have an intelligent facilitated discussion focused on the logic that is underpinning a potential investment. The capabilities of the facilitator are key to this discussion. You have just completed a Problem Definition workshop and we would like your feedback on how well the workshop was facilitated. How would you rate the truth contained within the following statements on a scale of 1 to 5? At the commencement all participants were given a clear understanding of the role of the facilitator and the outcomes sought by the discussion. The opinions of the key participants were obtained and properly considered. The difficult questions that were pivotal to the success of this investment were identified and properly addressed. Hard evidence was sought to validate each statement of the investment story. The discussion concluded with the agreement of participants that the investment story that was documented was consistent with the discussion. The workshop was completed within two hours. SCALE FALSE (1) – TRUE (5) Yes / No If no, for how long did it run? (__ hrs, __mins) Date of the workshop: Department / organisation: Size of investment: Less than $500k $500k – $10m Your name: Your position: Would you be happy to be contacted by other ‘investors’ seeking further information on the capability of this facilitator? Above $10m Yes / No Tips and traps Problem Definition workshop 19 Appendix 6. Quality assessment form – Investment Logic Map The purpose of an ILM is to clearly and honestly communicate the case for an investment. Whether the case for the investment is weak or strong then becomes a matter of judgement for the reader. There are five tests an ILM must pass to be considered of an acceptable standard: Test 1: Could a layperson read and easily comprehend the story of this investment to the point where they could have some opinion of it? Please explain why you have assessed it this way. Assessment: YES / NO / MAYBE Test 2: Is each problem a ‘call to action’ that conveys what is broken (both the cause and effect)? Please explain why you have assessed it this way. Assessment: YES / NO / MAYBE Test 3: Is there a logical connection between the effect of the problem and the benefits and their KPIs? Please explain why you have assessed it this way. Assessment: YES / NO / MAYBE Test 4: Is the strategic response one that: is likely to deliver the expected benefits and KPIs; allows for more than one project option; and seems to be a valid response to the problem(s). Please explain why you have assessed it this way. Assessment: YES / NO / MAYBE Test 5: Does the solution read as a set of logical and sensible business changes and assets that need to be undertaken to adequately deliver the strategic response? Please explain why you have assessed it this way. Assessment: YES / NO / MAYBE How would you rate this ILM? Assessment: SATISFACTORY/ UNSATISFACTORY Please explain why you have assessed it this way. Tips and traps Problem Definition workshop 20 Appendix 7. Sample agenda – Problem Definition workshop Problem Definition workshop for a low-complexity investment (single workshop) 5–10 minutes 10–15 minutes 45–50 minutes 15–20 minutes 10 minutes 10 minutes 5 minutes Introduction and outline of purpose and role Investor overview and venting Problem statements development Benefits and KPIs Strategic response Changes and assets Conclusion and next steps Problem Definition workshop for a higher complexity investment (two-four workshops) 5–10 minutes 10–15 minutes 50–55 minutes 20–30 minutes 5–10 minutes 5 minutes Introduction and outline of purpose and role Investor overview and venting Problem statements development Benefits and KPIs Strategic response Conclusion and next steps Tips and traps Problem Definition workshop 21 Appendix 8. Sample email – before the Problem Definition workshop Investor email outlining the purpose of the discussion to the participants. [Greetings] [something about the proposed investment] As a way to consolidate our thinking about this initiative we will be holding a Problem Definition workshop with the aim of properly understanding and articulating the need for this investment. You are invited to help define this problem. The first workshop will be held: Date: Time: Venue: The two-hour discussion has been designed to extract the compelling logic that underpins a potential investment or program and develop an Investment Logic Map. On a single page, an Investment Logic Map tells the story of an investment. An example is attached. The Investment Logic Map that is created evolves and forms the basis of all subsequent investment decision making and ultimately is used to measure the effectiveness of the investment. The discussion will be facilitated by [facilitator’s name], who is an accredited investment management facilitator. No preparation is required before this workshop as it is assumed that you are already a subject expert and understand the problem. The role of the facilitator is to extract the story of the potential investment from the group in the form of an Investment Logic Map. If you would like to read more about the benefits and practices of this approach you should refer to the DTF website at www.dtf.vic.gov.au/investmentmanagement. [Sign off] Tips and traps Problem Definition workshop 22 Appendix 9. Sample email – after the Problem Definition workshop [Greeting] Thanks for your participation at yesterday’s Problem Definition workshop for [investment name]. I have attached the Investment Logic Map that we produced and ask that you provide me with any suggested amendments by close of business (CoB) today. What happens over the next 48 hours is just the conclusion of our discussion. As such, there is no need to circulate this draft to people who were not present in our discussion as their comments would lack context – they will be free to make comment when we have completed this iteration of the Investment Logic Map. You should copy your responses to all other participants so we continue to understand each other’s perspectives. Based on your responses I will make any necessary changes and have version 1.0 to you by CoB tomorrow. … my observations To assist your input I make the following observations as to the relative strengths and weaknesses of the ILM we produced: [for example] Both the problem and the strategic intervention are generally strong – they speak well and there is strong evidence to support the drivers. While benefit one would be powerful I am not sure that it can be supported by a KPI that is attributable to this investment. It probably needs to change to ‘[rewording]’ and could then use ‘[name of KPIs]’. … about Investment Logic Maps An Investment Logic Map is never finalised. It is an evolving document that tells the story of an investment at any point in the investment lifecycle. Its strength is measured by its ability to be easily read by anyone who can then understand why an investment is being considered (or is underway). The reader should be able to suggest how it might be reshaped to deliver a better outcome. If you would like to read more about the benefits and practices of this approach you should refer to the DTF website at www.dtf.vic.gov.au/investmentmanagement. [Sign off] Tips and traps Problem Definition workshop 23 Tips and traps Problem Definition workshop 24