test one solutions - Villanova University

advertisement

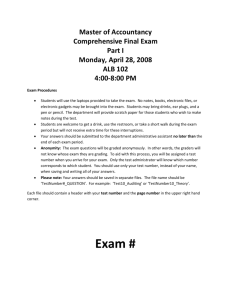

ACC 2480 Advanced Tax Villanova University Department of Accountancy Test One - KEY NAME ____________________________________________ Prof. Stiner Sep. 15, 2005 DATE ___________ INSTRUCTIONS: 1. Read and follow the additional instructions found at the start of each type of question or problem. Points may be lost for failure to follow instructions. 2. This is an open book, open notes, take home test. You may not consult any person, except Prof. Stiner, while you are taking the test. 3. Test structure: Problem/Question True/False Problems Total Questions Points Percent Your Points 26 39 43 5 52 57 31 91 100 4. Sign the Integrity Statement on page 2 after you read all instructions and after you complete the test. 5. Return this test to the instructor on or before the start of class on Tuesday, Sep 20. You may return the test by email or hard copy. (I prefer hard copy.) 1 ACC 2480 Advanced Tax Villanova University Department of Accountancy Test One - KEY Prof. Stiner Sep. 15, 2005 Integrity Statement I, ______________________________________________________(insert your name) have not had any unsanctioned prior access to this examination and will conduct myself in an honest manner in regard to all aspects of this examination. Unless authorized by the course professor, I will not discuss the contents of this examination, in general or specific terms, until the examination is administered to all students. 2 ACC 2480 Advanced Tax Villanova University Department of Accountancy Test One - KEY Prof. Stiner Sep. 15, 2005 TRUE/FALSE (39 points) On the blank line to the left of the number, write “T” if the statement is true. If the statement is false, write “F” on the line. Below the statement, indicate why the statement is false or correct the statement to make it true. True statements are worth one point. False statements are worth two points. ____ 1. Circular 230 is the only ethical standard that governs tax practitioners. (F— there are five standards altogether.) ____ 2. The realistic possibility of success is the standard for the AICPA Code of Professional Conduct. (F—The AICPA CPC standard is due care. The realistic possibility of success is the standard for Circ 230, the preparer penalties in the IRC and the SSTS.) ____ 3. The Statements on Standards for Tax Services is not a binding standard for tax accountants, even if they are members of the AICPA. (F—It is a binding standard for all CPAs licensed to practice in any state, because those standards are incorporated into the state ethics codes.) ____ 4. In current value terms, the ability to defer making a payment increases a taxpayer’s cost for that expenditure. (F--ch 1--p. 7--decreases) ____ 5. Tax planning is the structuring of a transaction to reduce tax costs or increase tax savings in order to maximize its net present value. (T--ch 1--p.77) ____ 6. If non-tax costs increase as the result of planning that reduces an entity’s tax rate, the planning may not maximize the entity’s after-tax return. (T--ch 1—p. 7) ____ 7. Deferring income into future tax years is not a good strategy if a business has expiring net operating losses. (T--ch 1& 3—by inference) ____ 8. A proposed regulation for an IRC (Internal Revenue Code) section is considered a primary authority for tax research purposes. (F—ch 2—p. 28—temporary and final regs are primary authorities. Proposed regs are not authoritative and should not be considered as primary authority.) 3 ACC 2480 Advanced Tax Villanova University Department of Accountancy Test One - KEY Prof. Stiner Sep. 15, 2005 ____ 9. Tax research is a strictly linear process in which the researcher proceeds from one step to the next without the need to repeat any previous step at any point in the research. (F—ch 2.—p. 35—tax research is an iterative process in the first four steps are repeated as often as necessary.) ____ 10. Est. of Hubert v. Com’r, 520 US 93, 117 S Ct 1124, 79 AFTR 2d 97-1394, 97-1 USTC ¶60261 (USSC, 1997) is the citation to the case heard by a federal district court. (F—ch 2.—pp. 29-30—This is a citation to a case heard by the Supreme Court of the United States.) ____ 11. Textbooks, treatises, professional journals and commercial tax services are examples of secondary authorities for tax research. (T—ch. 2—p.30) ____ 12. If a contributor in a qualifying Sec 351 exchange receives cash, she will recognize at least some of the gain realized on the exchange. (T--ch 3—p. 58) ____ 13. Partners must have control (defined as 80% ownership) immediately after a contribution of property to a partnership in order to avoid gain or loss recognition on the transfer. (F--ch 3--pp. 56, 63 & 71--This is true for corporate shareholders in the aggregate. Partners have no control requirement.) ____ 14. Partners and S-corporation shareholders must pay income tax on their allocated share of the entity’s income, regardless of the amount of cash distributed by the entity during the year. (T--ch 4—p. 84) ____ 15. The nondiscrimination rules generally require a closely-held corporation to provide the benefit to all employees on substantially the same terms as the benefit is provided to the shareholder/employees. (T--ch 4—p. 85) ____ 16. The dividends-received deduction creates a temporary difference between book and taxable income. (F--ch 5—p. 119—permanent difference) 4 ACC 2480 Advanced Tax Villanova University Department of Accountancy Test One - KEY Prof. Stiner Sep. 15, 2005 ____ 17. The payment of nonqualified deferred compensation is an example of a permanent difference between book and tax incomes. (F--ch 5—p. 121— temporary) ____ 18. Economic performance occurs in the year or years in which the person actually provides the services, property, or use of property to the business. (T--ch 5— p.122) ____ 19. A deferred tax asset resembles an overpayment of tax that the corporation will recoup in a future year when a permanent difference reverses. (F--ch 5—p. 127--when temporary difference reverses) ____ 20. Tax incentives include exemptions of special types of income from taxation, increased or accelerated deductions, tax credits, and preferential tax rates. (T— ch 6—p.142) ____ 21. The value of the general business credit is increased when a corporation faces an alternative minimum tax. (F--ch 6—pp. 153 & 161--value of the credit is decreased) ____ 22. Substantial economic effect requires tax allocations to be consistent with the book allocations recorded in the partners’ capital accounts. (T--ch 7—p. 174) ____ 23. The built-in gain tax applicable to S corporations can be avoided if the property is held for the 10 years immediately following the conversion from a C corporation. (T--ch 7—p. 184) ____ 24. The term “earnings and profits” is comprehensively defined in the Internal Revenue Code and Treasury regulations. (F--ch 8—p. 204--is not defined well) ____ 25. The accumulated earnings tax equals 15 percent of the corporation’s accumulated taxable income for the years under examination. (T—ch 8—p. 212) 5 ACC 2480 Advanced Tax Villanova University Department of Accountancy Test One - KEY Prof. Stiner Sep. 15, 2005 ____ 26. Current year cash distributions to partners are a nontaxable return of investment which decreases the partners’ outside basis (but not below zero) in the partnership interest. (T—ch 8—p. 216) 6 ACC 2480 Advanced Tax Villanova University Department of Accountancy Test One - KEY Prof. Stiner Sep. 15, 2005 PROBLEM 1 - ORGANIZATIONAL STRATEGIES (10 POINTS) (ch 3 app. #28) Show your work in the space below each question. Part credit may be given for an incorrect answer if the work is shown. Mr. and Mrs. Smith, the sole shareholders of Triple S Corp (a C corporation), own real estate that they lease to Triple S Corp for use in the corporate business. The annual rental is $42,000. Triple S Corp pays tax at a 34 percent marginal rate, while the Smiths pay tax at a 35 percent marginal rate. a. Calculate Triple S Corp’s after-tax cost and the Smith’s after-tax cash flow from the rental arrangement. (5 points) Triple S’s after-tax cost of the rental arrangement is $27,720 ($42,000 rent payment $14,280 tax savings from ordinary deduction). The Smith’s after-tax cash flow is $27,300 ($42,000 rent revenue $14,700 tax cost). b. The Smiths pay tax at a higher tax rate than Triple S. Identify the possible tax reasons that the Smiths prefer to own the rental property rather than transferring ownership to their corporation. To answer this question, you may have to make assumptions as to other components of the Smith’s gross income or deductions. Please state your assumptions in your answer. (5 points) First, the rent payment is not subject to the double tax regime on dividends and is a tax-efficient way for the shareholders to get cash out of the corporation. Second, the rent income is passive activity income to the Smiths and may allow them to deduct losses generated by other passive activities. 7 ACC 2480 Advanced Tax Villanova University Department of Accountancy Test One - KEY Prof. Stiner Sep. 15, 2005 PROBLEM 2 – EMPLOYEE COMPENSATION STRATEGIES (10 POINTS) (ch 4 app #14 and example on p. 96) Three years ago, The Pines Inc. granted 500 SARs to Ms. Severn as a year-end bonus. The Pines’ stock was worth $55 per share on the date of grant. Ms. Severn exercised her SARs this year when The Pine’ stock was worth $88 per share. Her marginal tax rate in both years was 33%. a. How much compensation income did Ms. Severn recognize in the year she received the SARs? (2 points) Ms. Severn did not recognize any compensation income in the year she received the SARs. (p. 96) b. How much compensation income did Ms. Severn recognize in the year she exercised the SARs? (2 points) Ms. Severn recognized $16,500 compensation income ($33 appreciation in per share value 500 SARs) in the year of exercise. (p. 96) c. Compute Ms. Severn’s after-tax cash flow from the exercise of her SARs. (3 points) Cash inflow upon exercise Cash outflow at exercise (tax cost) After-tax cash flow $16,500 5,445 $11,055 ($33/SAR * 500 SARs) (16,500 * 33%) d. How much compensation expense does The Pines recognize and in which tax year is it recognized? (3 points) The Pines recognizes $16,500 as compensation expense in the tax year during which the date of exercise occurs. This year and 2005 are acceptable answers for the year. 8 ACC 2480 Advanced Tax Villanova University Department of Accountancy Test One - KEY Prof. Stiner Sep. 15, 2005 PROBLEM 3 – BUSINESS INCENTIVE PROVISIONS (10 points) (ch 6 app #15) Assume the following tentative minimum tax and regular tax amounts calculate for Ace Corp. Tentative minimum tax Regular tax Year 1 $250,000 $210,000 Year 2 $230,000 250,000 Year 3 $210,000 250,000 Year 4 $250,000 230,000 Complete the following table by calculating the items requested for each year. Year 1 40,000 (250K-210K) Year 2 Year 3 -0- -0- Year 4 20,000 (250K-230K) -0- 20,000 20,000 -0- Total tax liability 250,000 40,000 230,000 -0(20K-20K) 250,000 Minimum tax credit carryforward 230,000 20,000 (40K-20K) Minimum tax credit generated Minimum tax credit used 20,000 See ch 6, p. 159 for the proposition that AMT is paid if it is higher than regular tax (Years 1 & 4) See. Ch 6, p. 160 and the example on p. 161 to determine that AMT credit is generated in the years in which tentative minimum tax is greater than regular tax and for the proposition that the credit is used in the future (years 2, 3 & 5) not in the year in which it is generated. 9 ACC 2480 Advanced Tax Villanova University Department of Accountancy Test One - KEY Prof. Stiner Sep. 15, 2005 PROBLEM 4 – INCOME AND LOSS ALLOCATIONS BY PASSTHROUGH ENTITIES (10 POINTS) (CH 7 app #14) John Running Cloud’s outside basis in his Denali Partnership interest is $200,000. This basis includes a $20,000 share of recourse liabilities, a $50,000 share of nonrecourse liabilities and a $100,000 share of qualified nonrecourse financing. Required: Compute Mr. Running Cloud’s at-risk amount in Denali Partnership. Outside basis Less: nonqualified nonrecourse liabilities At-risk amount $200,000 (50,000) $150,000 See p. 188 for the propositions that (1) at-risk amount includes the partner’s share of recourse liabilities ($20K) and qualified nonrecourse financing ($100K) and (2) other nonrecourse financing ($50K) is included in outside basis but is not included in the atrisk amount. 10 ACC 2480 Advanced Tax Villanova University Department of Accountancy Test One - KEY Prof. Stiner Sep. 15, 2005 PROBLEM 5 – DISTRIBUTIONS TO BUSINESS OWNERS (10 points) (ch 8 app #7) For each of the following independent situations, all of which are C-corporation transactions, complete the table by computing the dividend payment and accumulated E&P at the beginning of Year 2. Scenario 1 2 3 4 5 6 Accumulated E&P Jan 1 Year 1 $190,000 55,000 (50,000) (18,000) 160,000 -0- Cash Distribution Current E&P Dividend Payment $100,000 100,000 100,000 100,000 100,000 100,000 $150,000 80,000 133,700 (48,000) (22,900) (72,500) 100,000 100,000 100,000 0 100,000 0 Accumulated E&P Jan 1 Year 2 240,000 35,000 (16,300) (66,000) 37,100 (72,500) See p. 204 for the proposition that a distribution is a dividend to the extent of the current E&P. Then see p. 205 for the proposition that, if current E&P is exceeded, a distribution is a dividend to the extent of accumulated E&P. In both instances, E&P is reduced by the amount of the distribution that is a dividend. (p. 204) See p. 206 for the proposition that a distribution is a return of paid-in capital when E&P have been reduced to zero or lower, and that the return of capital has no effect on the amount of E&P. Returns of capital reduce the recipient shareholder’s basis in his or her stock, but not below zero. If the distribution exceeds the shareholder’s basis, the excess is capital gain. ProfS’s Note: the character of the capital gain depends on how long the shareholder has held the stock. 11