Causes of aggregate economic growth

advertisement

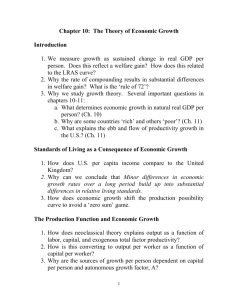

2a: Economic growth: theory and data 0 Growth: big questions, theoretical tools What does economic growth involve? Factor accumulation & productivity growth Changing structure of production, consumption & trade What makes economies richer? What sustains their growth? Growth theory What determines the mix of goods produced, consumed and traded? Trade theory models for small open economies 1 Southeast Asian experience (1) East Asia and Pacific region: generally high and consistent growth since 1980s Especially if we ignore the failures! (Gill & Kharas Table 1.2) Progress of leading economies from low to middle income status Poverty alleviation record is strong (G&K Table 1.7) Inequality rising, but what does this signify? From high or low base? Changing structure of production, and urbanization Relative scarcity of some productive factors – esp. human capital and entrepreneurial abilities Political economy, and development policy settings 2 3 4 5 The “mechanics” of growth Why do countries grow at different rates? Why do rates of growth change over time? Is there anything that policy makers can do to influence the rate of growth? Aggregate production functions: “parables” or “toys” for understanding aggregate economic growth 6 The aggregate production function Y = F(K,L) Qty of output (Y) A: Linear production function B: Diminishing returns production function YB YA 0 L0 Qty of Variable Input (L) 7 A basic growth model Relate agg. production (Y, measured in $) to capital stock (K), labor force (L), pop. growth (n), savings (S), savings rate (s = S/Y), consumption (C), investment (I), and capital depreciation rate (d) Two-factor production function: (Disposition of income) Savings out of income: Savings = investment: Change (Δ) in K stock: Change in labor force: Y = F(K, L) (Y = C + S) S = s*Y S=I ΔK = I – d*K ΔL = n*L (1) (2) (3) (4) (5) Eq. (1)-(6) can be solved for Y, K, L, I, S, C in terms of s, d and n. Combining (3)-(5) gives: ΔK = s*Y – d*K (6) Using (5) and (6), aggregate output growth depends on net investment & growth of labor force. 8 The Solow growth model • Expressed in intensive form (output per worker, y = Y/L, and capital per worker, k = K/L) • Diminishing returns to k y y = ƒ(k) k • From (6), growth of capital stock per worker : Δk = sy – (n + d)k i.e. Δk rises with savings/worker, declines with pop growth & physical deprctn. 9 y (n+d)k = depreciation y = ƒ(k) = output/worker yH y0 yL sy = savings/worker kL k0 kH k Δk = sy – (n + d)k, so Δk is vertical diffnce sy curve and (n+d)k. • At kL, Δk > 0 and “capital deepening”. Compare kH. • At k0, Δk = 0 with “steady-state” output per worker y0. • “Steady state” implies constant per capita income • Convergence: poorer countries (lower k) will grow faster. 10 Higher savings rate increases per capita income y (n+d)k y = ƒ(k) y1 y0 (s+a)y sy k0 k1 k • Experiment: Increase savings per worker from sy to (s+a)y : At k0, Δk now > 0. New steady state income is y1. Lower population growth raises per capita income y (n+d)k y = ƒ(k) ((n–b)+d)k y1 y0 sy k0 k1 k • How do we represent a reduction in population growth rate? What happens to capital accumulation and steady-state income per worker? More on Solow growth model Solow: Empirically, technical progress accounts for most economic growth Think about investments in human capital (education, training) as a form of technical progress that increases the effective labor endowment. What about natural resources? Link between Δk and the return on capital Higher Δk implies higher return on new investment (capital scarcity implies high returns) Then capital should flow to poorest countries! Can Solow model explain comparative growth experiences? 13 Convergence • Standard Solow model: all countries share same technology, savings rates, etc • Diminishing returns implies lower growth rate of capital per worker at higher levels of k • Implication: absolute convergence Poorer economies will grow more quickly than richer Over time, per capita income levels among similar economies will become equal, regardless of initial differences. Formally: GDP growth = a*(Base GDP) + b*(K/L growth); a < 0, b > 0 14 Southeast Asian experience (2) Sources of economic growth in SE Asia What factors have contributed most to growth? Labor force growth (“demographic dividend”) Capital investment (domestic and foreign) Improvements in effective labor through education, nutrition, etc Efficiency gains – from trade and specialization; domestic market activation, etc…. Productivity spillovers and externalities; increasing returns World Bank: East Asian Miracle (1993), decomposes contribution of some of these to total GDP growth 15 Contributions to growth Variable (per cent/year) Indonesia Malaysia Singapore Thailand 1.1 1.64 1.69 0.87 Population growth 0.22 0.26 0.18 0.26 Primary enrollments 1.77 2.53 2.93 2.19 Secondary enrollments 0.16 0.5 0.84 0.31 Initial income -1.02 -1.47 -1.74 -1.12 Estimated growth rate 2.23 3.46 3.9 2.51 Actual growth rate 3.72 4 6.03 3.82 60 87 65 66 Investment Percentage explained Source: East Asian Miracle, 1993 What accounts for the unexplained 13-40%? 16 Is this convergence? 17 Divergent paths in 3 countries 1954-58a 1978 1985 2005 Philippines 380 Rps 510 600 3170 Burma 300 150 186 1020 Thailand 400 490 752 6420 Ratio, Th/Ph 1.05 0.96 1.25 2.02 Ratio, Th/Bu 1.33 3.27 4.04 6.29 Sources: (1950s: Myrdal, Asian Drama; other years: World Bank. Units: 1950s: Indian Rupees; 1978-85: current $US; 2005: PPP$ 18 What accounts for divergence within SE Asia? 19 Abstraction vs complexity in economic analysis Obviously the world does not work exactly as described in Solow’s “parable” Does this invalidate the use of models? Economic models abstract from the complexities of real world situations in order to understand underlying mechanisms that are thought (or asserted) to be general What use is a road map drawn on a 1:1 scale? Models yield testable implications and their use helps us to define research agendas Solow model identifies the central mechanism of growth: accumulation of capital per worker 20