Understanding Chart of Accounts

advertisement

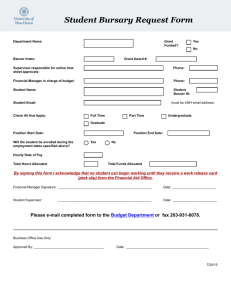

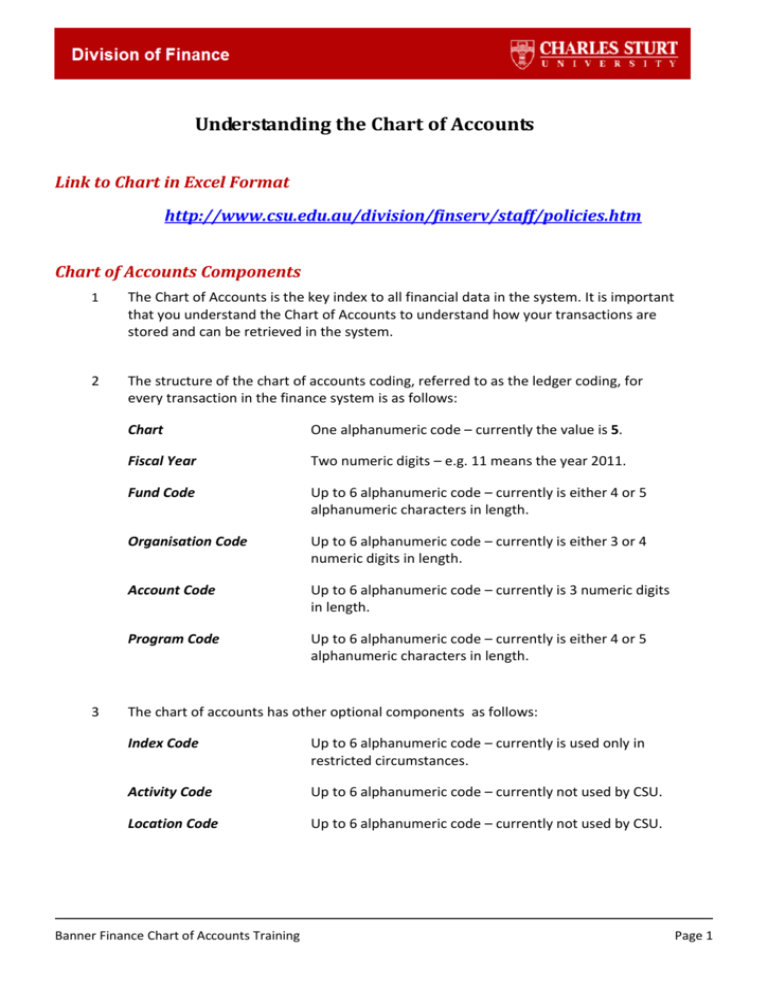

Understanding the Chart of Accounts Link to Chart in Excel Format http://www.csu.edu.au/division/finserv/staff/policies.htm Chart of Accounts Components 1 The Chart of Accounts is the key index to all financial data in the system. It is important that you understand the Chart of Accounts to understand how your transactions are stored and can be retrieved in the system. 2 The structure of the chart of accounts coding, referred to as the ledger coding, for every transaction in the finance system is as follows: 3 Chart One alphanumeric code – currently the value is 5. Fiscal Year Two numeric digits – e.g. 11 means the year 2011. Fund Code Up to 6 alphanumeric code – currently is either 4 or 5 alphanumeric characters in length. Organisation Code Up to 6 alphanumeric code – currently is either 3 or 4 numeric digits in length. Account Code Up to 6 alphanumeric code – currently is 3 numeric digits in length. Program Code Up to 6 alphanumeric code – currently is either 4 or 5 alphanumeric characters in length. The chart of accounts has other optional components as follows: Index Code Up to 6 alphanumeric code – currently is used only in restricted circumstances. Activity Code Up to 6 alphanumeric code – currently not used by CSU. Location Code Up to 6 alphanumeric code – currently not used by CSU. Banner Finance Chart of Accounts Training Page 1 Description of Components 4 The following describes how the individual components are used in the system for recording individual transactions: Chart This code is used primarily to denote separate legal entities for the purposes of producing financial statements. Currently CSU only has one chart of account but this may change in the future. It is a mandatory field. Fiscal Year All transactions in the system are recorded and reported by fiscal year. It is a mandatory field. Fund Code Fund codes provide the mechanism for the University to separately record funds from outside the university that come with legal conditions to separately record and report on those funds. The fund code is generally used to identify the external source of the funds but may also be used to define some internally allocated funds. It is a mandatory field. Organisation Code Organisation codes are the key component that holds budgets. When linked with a Fund code the combination of Fund/Orgn is what we call a Budget Centre or a Cost Centre. The Organisation code structure will generally be similar to the formal university organisation chart wherever that unit of the University holds budget responsibilities. It is a mandatory field. Account Code Account codes tell the system what type of accounting entry is being processed and identifies for us the type of accounting transaction, i.e. revenue, expense, asset, liability, or equity. It is a mandatory field. Program Code Program codes provide flexibility in reporting and managing budgets. It is used to manage budgets for projects, consultancies, cross organisation collaborative projects, multi funded projects, internally funded research projects etc. It is a mandatory field and used quite diversely by CSU. Activity Code Can be used for university-wide activities, such as professional development. It is an optional field and is currently not used by CSU. Location Code Location codes identify the physical location of buildings and rooms to the system. It is an optional field and is Banner Finance Chart of Accounts Training Page 2 currently not used by CSU for transactions processing. But it is used in a restricted way by the Division of finance only for the Banner Fixed Assets master file to record where fixed assets are physically located. Index Code Indexes can be established to facilitate data entry and represent a default Fund-Orgn-Acct-Prog-Actv-Locn combination – currently is used only minimally at CSU. Hierarchy of Components 5 The following describes the hierarchy established for the components to facilitate flexible reporting levels within the system. Typically transactions are only able to be entered at the lowest level of the hierarchy, i.e. at the data enterable code. The higher level codes are used for ‘roll up’ reporting. In the Fund code example below, querying or running a report on Fund code RB57 (not data enterable) will provide a summarised view of all transactions for the data enterable funds RD04 + RD30 + RD38. Fund Code R001 Hierarchy structure to five levels. For example: Research Grants R002 Commonwealth Research Grants R589 Cooperative Research Centres RB57 CRC National Plant Biosecurity RD04 CRC NPB - 3880 - J Spinner/G Gurr RD30 CRC NPB - 3897 - J Kent RD38 CRC NPB - 4125 - G Gurr Organisation Code 400 Division of Facilities Management 410 Facilities Management - Operations 6701 Operations - Directorate 413 Operations – Director 6702 Operations – Sustainability Management Account Code 33 Hierarchy structure to eight levels. For example: Hierarchy structure to four levels. For example: Fees for Services Rendered 335 Conference/meeting Services 342 Conference/Seminar Fees 362 Catering – Meetings/Conferences Banner Finance Chart of Accounts Training Page 3 Program Code 5627 Hierarchy structure to five levels. For example: Office of Corporate Affairs Programs 9003 Alumni Office Programs 6110 Alumni – WACOBU Programs 6111 WACOBU White membership 6112 WACOBU Gold membership E154 Mitchell Old Boys Rugby Nomenclature 6 Ledger Coding or FOAP is the correct terminology to use with Finance to be understood correctly when referring to the F-O-A-P : F(und)-O(rgn)-A(cct)-P(rog). Please refrain form using Account codes to refer to the full FOAP as that is misleading since the Account code is only one component part of the ledger coding. Ledgers 7 The Finance system incorporates four main ledgers: General Ledger (for assets & liabilities – mainly used by Division of Finance) Operating Ledger (for revenue & expenses – used by everyone) o Includes the Budget Ledger (for budgets) Encumbrance Ledger (for Requisitions and Purchase Orders) Grant Ledger (for Research Grants for multi-year reporting) Finance System Overview 8 The Banner Finance system includes several different modules that are integrated into one system. It also integrates with other Banner systems such as Human Resources, Student Administration, Advancement and Financial Aid. CSU only operates the Banner Finance and Banner Student systems. A relationship diagram below shows the integration of the modules. General Ledger module Finance Operations module Purchasing module Accounts Payable module Stores Inventory module Fixed Assets module Banner Finance Chart of Accounts Training Page 4 Research Grant Accounting module Accounts Receivable module Endowment Management module Cost Accounting Budget & Position Control Banner Finance Chart of Accounts Training Page 5