Chapter 01 Quiz A

advertisement

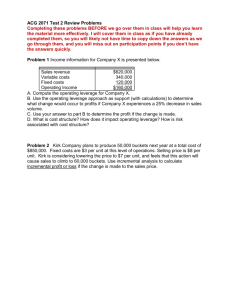

Chapter 9 Net Present Value and Other Investment Criteria Chapter 09 Quiz A Student Name _________________________ Student ID ____________ Use the following information to answer questions 1 through 5. You are analyzing a proposed project and have compiled the following information: Year Cash flow 0 -$145,000 1 $ 33,400 2 $ 70,500 3 $ 82,100 Required payback period 3 years Required return 9.50 percent ________ 1. ________ 2. What is the net present value of the proposed project? a. $6,239.12 b. $6,831.84 c. $8,221.29 d. $8,376.91 What is the discounted payback period? a. 2.68 years b. 2.79 years d. 2.95 years c. 2.89 years ________ 3. Should the project be accepted based on the internal rate of return (IRR)? Why or why not? a. no; The project IRR is greater than the required return. b. no; The project IRR is greater than zero. c. yes; The project IRR is greater than the required return. d. yes; The project IRR is equal to zero. ________ 4. Should the proposed project be accepted based on the profitability index (PI)? Why or why not? a. no; The PI is less than 1.0. b. no; The PI is greater than 1.0. c. yes; The PI is less than 1.0. d. yes; The PI is greater than 1.0. ________ 5. Should the proposed project be accepted based on the payback period? Why or why not? a. yes; The payback period is greater than the required payback period. b. yes; The payback period is less than the required payback period. c. no; The payback period is greater than the required payback period. d. no; The payback period is less than the required payback period. ________ 6. Dew Little Co. is considering opening a new plant to produce lawn mowers. The initial cost of the project is $6 million. This cost will be depreciated straight-line to a zero book value over the 15-year life of the project. The net income of the project is expected to be $137,000 a year for the first four years and $538,000 for years 5 through 15, respectively. What is the average accounting return on this project? a. 12.47 percent b. 13.17 percent c. 14.37 percent d. 15.87 percent ________ 7. Which one of the following indicates a project should be accepted? a. NPV = -$281 b. PI = 1.02 c. IRR = 13.8 percent; Required return = 14.2 percent d. Payback = 3.31 years; Required payback = 3.25 years ________ 8. The point where the net present values of two mutually exclusive projects are equal is referred to as the: a. internal rate of return. b. point of profitability. c. crossover point. d. payback point of equivalency. 9-1 Chapter 9 Net Present Value and Other Investment Criteria ________ 9. Which one of the following statements is correct? a. Multiple MIRR’s exist when cash flows are unconventional. b. MIRR’s are independent of an external discount rate. c. The value of a project depends on how the cash flows from the project are used. d. A project’s cash flows are modified prior to computing the MIRR. _______ 10. For an independent project, NPV: a. is the difference between the project’s cost and its market value. b. generally conflicts with the IRR accept / reject decision. c. is the least favored method of project analysis from a finance point of view. d. indicates an accept decision when it is negative. 9-2 Chapter 9 Net Present Value and Other Investment Criteria Chapter 09 Quiz A 1. b Answers NPV $145 ,000 $33,400 (1 .095 ) 1 $70 ,500 (1 .095 ) 2 $82 ,100 (1 .095 ) 3 ; NPV = $6,831.84 CF0 -$145,000 C01 $33,400 F01 1 C02 $70,500 F02 1 C03 $82,100 F03 1 I = 9.5 NPV CPT $6,831.84 2. c Year Cash flow 1 $33,400 2 $70,500 3 $82,100 Discounted cash flow $30,502.28 $58,797.77 $62,531.78 Discounted payback 2 $145 ,000 $58,797 .77 $30 ,502 .28 = 2.89 years $62 ,531 .78 3. c CF0 -$145,000 C01 $33,400 F01 1 C02 $70,500 F02 1 C03 $82,100 F03 1 I = 9.5 IRR CPT 11.81 percent The project should be accepted because the IRR of 11.81 percent is greater than the required return of 9.5 percent. 4. d CF0 $0 C01 $33,400 F01 1 C02 $70,500 F02 1 C03 $82,100 F03 1 I = 9.5 NPV CPT $151,831.84 PI $151,831 .84 1.05 $145 ,000 The project should be accepted because the PI of 1.05 is greater than 1.0. 9-3 Chapter 9 Net Present Value and Other Investment Criteria 5. b Year Cash flow 1 $33,400 2 $70,500 3 $82,100 Payback 2 $145,000 $70,500 $33,400 2.50 years $82,100 The project should be accepted because the payback period of 2.50 years is less than the required payback of 3 years. ($137 ,000 4) $538 ,000 11) AAR 6. c 15 $6,000 ,000 $0 .14369 14 .37 percent 2 7. 8. 9. 10. b c d a A PI greater than 1.0 indicates acceptance. 9-4 Chapter 9 Net Present Value and Other Investment Criteria Chapter 09 Quiz B Student Name _________________________ Student ID ____________ Use the following information to answer questions 1 through 5. You are analyzing a proposed project and have compiled the following information: Year Cash flow 0 -$228,000 1 $ 56,500 2 $ 99,700 3 $115,000 Required payback period 3 years Required return 9 percent ________ 1. ________ 2. What is the net present value of the proposed project? a. -$3,448.54 b. -$3,163.80 c. $6,163.80 d. $15,377.15 What is the discounted payback period? a. never b. 2.37 years d. 3.37 years c. 3.04 years ________ 3. Should the project be accepted based on the internal rate of return (IRR)? Why or why not? a. no; The project IRR is greater than the required return. b. no; The project IRR is less than the required return. c. yes; The project IRR is greater than the required return. d. yes; The project IRR is equal to zero. ________ 4. Should the proposed project be accepted based on the profitability index (PI)? Why or why not? a. no; The PI is less than 1.0. b. no; The PI is greater than 1.0. c. yes; The PI is less than 1.0. d. yes; The PI is greater than 1.0. ________ 5. Should the proposed project be accepted based on the payback period? Why or why not? a. yes; The payback period is greater than the required payback period. b. yes; The payback period is less than the required payback period. c. no; The payback period is greater than the required payback period. d. no; The payback period is less than the required payback period. ________ 6. Drexfel Co. is considering opening a new plant to produce lawn mowers. The initial cost of the project is $2 million. This cost will be depreciated straight-line to a zero book value over the 10-year life of the project. The net income of the project is expected to be $86,000 a year for the first three years and $95,000 for years 4 through 10, respectively. What is the average accounting return on this project? a. 4.62 percent b. 6.71 percent c. 8.28 percent d. 9.23 percent ________ 7. Which one of the following statements is correct concerning the profitability index (PI)? a. PI should be used to determine which one of two mutually exclusive projects should be accepted. b. PI is the discount rate that makes the net present value equal to zero. c. There can be multiple PIs if the cash flows are unconventional. d. PI is used to rank positive NPV projects when the available funds are limited. ________ 8. You should accept a project when the: a. net present value is positive. b. profitability index is less than 1 but greater than zero. c. discounted payback period is greater than the required period. d. modified internal rate of return is less than the required return. 9-5 Chapter 9 Net Present Value and Other Investment Criteria ________ 9. The crossover point: a. is used to determine which one of two internal rates of return for a project should be used when determining if a project should be accepted. b. is the point where the net present value of a project is equal to zero. c. equates the net present values of two separate projects. d. is the time at which a project pays back on a discounted basis. ________ 10. Which one of the following statements is correct? a. The discounted payback period is longer than the payback period. b. The internal rate of return is used to determine which one of two mutually exclusive projects should be accepted. c. The modified internal rate of return is used to evaluate different sized projects. d. The payback period is considered the best method of project analysis from a financial point of view. 9-6 Chapter 9 Net Present Value and Other Investment Criteria Chapter 09 Quiz B 1. a Answers NPV $228 ,000 $56 ,500 (1 .09 ) 1 $99 ,700 (1 .09 ) 2 $115 ,000 (1 .09 ) 3 ; NPV = -$3,448.54 CF0 -$228,000 C01 $56,500 F01 1 C02 $99,700 F02 1 C03 $115,000 F03 1 I=9 NPV CPT -$3,448.54 2. a Year Cash flow 1 $ 56,500 2 $ 99,700 3 $115,000 Total Discounted cash flow $ 51,834.86 $ 83,915.50 $ 88,801.10 $224,551.46 On a discounted basis, this project never pays back. 3. b CF0 -$228,000 C01 $56,500 F01 1 C02 $99,700 F02 1 C03 $115,000 F03 1 I=9 IRR CPT 8.24 percent The project should not be accepted because the IRR of 8.24 percent is less than the required return of 9 percent. 4. a CF0 $0 C01 $56,500 F01 1 C02 $99,700 F02 1 C03 $115,000 F03 1 I=9 NPV CPT $224,551.46 PI $224 ,551 .46 .98 $228 ,000 The project should be rejected because the PI of .98 is less than 1.0. 9-7 Chapter 9 Net Present Value and Other Investment Criteria 5. b Year Cash flow 1 $ 56,500 2 $ 99,700 3 $115,000 Payback 2 $228,000 $99,700 $56,500 2.62 $115,000 The project should be accepted because the payback period of 2.62 years is less than the required payback of 3 years. ($86 ,000 3) $95 ,000 7) 6. d 7. 8. 9. 10. d a c a AAR 10 $2,000 ,000 $0 .0923 9.23 percent 2 9-8 Chapter 9 Net Present Value and Other Investment Criteria Chapter 09 Quiz C Student Name _________________________ Student ID ____________ Use the following information to answer questions 1 through 5. You are analyzing a proposed project and have compiled the following information: Year Cash flow 0 -$164,700 1 $ 24,300 2 $108,600 3 $ 85,100 Required payback period 3 years Required return 11 percent ________ 1. ________ 2. What is the net present value of the proposed project? a. $5,610.29 b. $6,809.44 c. $7,558.47 d. $8,012.73 What is the discounted payback period? a. 2.09 years b. 2.37 years d. 2.88 years c. 2.62 years ________ 3. Should the project be accepted based on the internal rate of return (IRR)? Why or why not? a. yes; The project IRR is greater than the required return. b. yes; The project IRR is equal to zero. c. no; The project IRR is greater than the required return. d. no; The project IRR is greater than zero. ________ 4. Should the proposed project be accepted based on the profitability index (PI)? Why or why not? a. yes; The PI is less than 1.0. b. yes; The PI is greater than 1.0. c. no; The PI is less than 1.0. d. no; The PI is greater than 1.0. ________ 5. Should the proposed project be accepted based on the payback period? Why or why not? a. no; The payback period is greater than the required payback period. b. no; The payback period is less than the required payback period. c. yes; The payback period is greater than the required payback period. d. yes; The payback period is less than the required payback period. ________ 6. Bluefield Energy is considering opening a new plant to produce small windmills. The initial cost of the project is $770,000. This cost will be depreciated straight-line to a zero book value over the 8-year life of the project. The net income of the project is expected to be $67,000 a year for the first two years and $79,000 for years 3 through 8, respectively. What is the average accounting return on this project? a. 17.18 percent b. 18.49 percent c. 19.74 percent d. 20.80 percent ________ 7. Which one of the following statements is correct concerning the discounted payback method (DPB) of analysis? a. DPB is useful because it considers all of the cash inflows as well as the cash outflows. b. DPB favors long-term projects. c. DPB is preferred over payback; but in practice, DPB is used less frequently than payback. d. You should accept a project when the DPB is greater than the required period. ________ 8. You should accept a project when the: a. net present value is negative. b. profitability index is greater than 1.0. c. payback period is greater than the required period. d. modified internal rate of return is less than the required return. 9-9 Chapter 9 Net Present Value and Other Investment Criteria ________ 9. Which one of the following methods of project analysis is most biased towards short-term returns? a. internal rate of return b. profitability ratio c. payback period d. net present value ________ 10. Which one of the following methods of analysis requires adjusting the cash flows of a project? a. profitability index b. payback period c. modified internal rate of return d. accounting rate of return 9-10 Chapter 9 Net Present Value and Other Investment Criteria Chapter 09 Quiz C 1. c Answers NPV $164 ,700 $24 ,300 (1 .11) 1 $108 ,600 (1 .11) 2 $85,100 (1 .11) 3 ; NPV = $7,558.47 CF0 -$164,700 C01 $24,300 F01 1 C02 $108,600 F02 1 C03 $85,100 F03 1 I = 11 NPV CPT $7,558.47 2. d Year Cash flow 1 $ 24,300 2 $108,600 3 $ 85,100 Discounted cash flow $21,891.89 $88,142.20 $62,224.39 Discounted payback 2 $164 ,700 $21,898 .89 $88,142 .20 = 2.88 years $62 ,224 .39 3. a CF0 -$164,700 C01 $24,300 F01 1 C02 $108,600 F02 1 C03 $85,100 F03 1 I = 11 IRR CPT 13.26 percent The project should be accepted because the IRR of 13.26 percent is greater than the required return of 11 percent. 4. b CF0 $0 C01 $24,300 F01 1 C02 $108,600 F02 1 C03 $85,100 F03 1 I = 11 NPV CPT $172,258.47 PI $172 ,258 .47 1.05 $164 ,700 The project should be accepted because the PI of 1.05 is greater than 1.0. 9-11 Chapter 9 Net Present Value and Other Investment Criteria 5. d Year Cash flow 1 $24,300 2 $108,600 3 $85,100 Payback 2 $164,700 $24,300 $108,600 2.37 years $85,100 The project should be accepted because the payback period of 2.37 years is less than the required payback of 3 years. ($ 67 ,000 2) $79 ,000 6) AAR 6. c 8 $770 ,000 $0 .19740 19 .74 percent 2 7. 8. 9. 10. c b c c 9-12