Investment Rules: NPV, IRR, Payback Period Calculations

advertisement

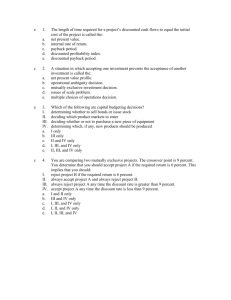

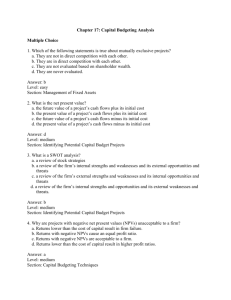

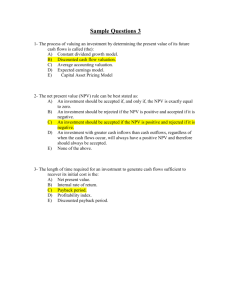

Fin 3322: Cashman Investment Rules 1. Given the following cash flows for project Z: C0 = -2,000, C1 = 600, C2 = 2160 and C3= 6000, calculate the discounted payback period for the project at a discount rate of 20%. Discounted C0 = -2,000 Discounted C1 = 600/1.2 = 500 Discounted C2 = 2,160/1.2^2 = 1,500 Discounted C3 = 6,000/1.2^3 = 3,472.22 The discounted payback period for the project is 2 years 2. Bill’s Biotech Co. is considering buying a new incubator that will cost $54,200 today. Net cash flows from the incubator will be $20,608 at the end of each year for the next five years. Also, at the end of the fifth year, Bill estimates he can sell the incubator for $13,200. If Bill’s opportunity cost of capital is 15%. a) What is the incubator’s payback period? Cash flow is an equal amount each year, so payback = (54,200/20,608) = 2.63 years. b) What is the incubator’s discounted payback period? Year Cash Flow PV 0 1 2 3 4 5 5 -54,200 20,608 20,608 20,608 20,608 20,608 13,200 17,920 15,582.6 1 13,550.0 9 11,782.6 9 10,245.8 2 6,562.73 Discounted payback = 3.61 years c) What is the NPV of investing in the incubator? N = 5; I/Y = 15; PV = ? ; PMT = 20,608; FV = 13,200 PV = 75,643.95 NPV = 75,643.95 – 54,200 = 21,443.95 d) What is the incubator’s IRR? N = 5; I/Y = ? ; PV = -54,200; PMT = 20,608; FV = 13,200 IRR = 29.59% e) Should Bill buy the new incubator? Explain why/why not? Yes – positive NPV, so it adds to shareholder wealth. 3. A project has net income of $1,800, $2,000, $2,200, and $2,400 a year over its 4-year life. The initial cost of the project is $65,000, which will be depreciated using straight-line depreciation to a book value of zero over the life of the project. The firm wants to earn a minimal average accounting return of 8.5%. The firm should _____ the project based on the AAR of _____. 0 NI 1 2 3 1800 2000 2200 4 Average AAR 2400 2,100 =2100/32,500 =0.064615 BV 65,000 48,750 32,500 16,250 0 32,500 Reject the project based on the AAR 6.46% < 8.5% 4. What is the profitability index for an investment with the following cash flows given a 9% required return? Cost $21,500, then yearly revenue of $7,400, $9,800, and $8,900. Year 0 1 2 3 Cash Flow -21,500.00 7,400.00 9,800.00 8,900.00 PI = 21,909.89/21,500 PV 6,788.99 8,248.46 6,872.43 21,909.89 1.02