@CH HD NO NUM = Appendix 4 Financial Measures used in Cost

advertisement

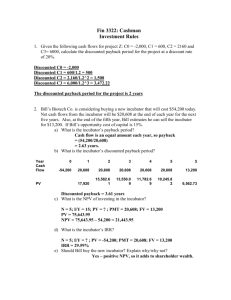

Appendix G Financial measures used in cost benefit analysis PAYBACK The payback may be defined as the amount of time, usually expressed in years and months, required for the original investment amount to be repaid by the cash-in flows. This measure is sometimes used with nominal cash-in flows and sometimes used with discounted cash-in flows. Nominal cash flows are the amounts unadjusted for the time value of money. The most popular form of payback used today is referred to as the exhaust method. The exhaust method of payback calculation involves the deduction of each year's cash-in flow from the original investment until the original amount is reduced to zero. This method should be contrasted with the average payback method which only gives a rough approximation of the period of time required to recover the investment amount when the cash-in flows are relatively constant. Exhaust method Payback in time (years, months, etc) = investment–cumulative benefit The calculation of the payback by the exhaust method is a reiterative process which requires the cumulative benefit to be subtracted from the investment until the result is zero. The time at which the result is zero represents the period which is required for the investment amount to be returned. Average method Payback in time = Investment Average annual benefit This average method is only useful if the annual benefits do not materially vary from the average. If there is any substantial variability in the annual benefits this method will produce meaningless results. Many 203 firms use the payback as the primary criterion for deciding whether an investment is suitable or not. It is generally considered that the cash flows used to calculate the payback should have first been discounted. This is referred to as a discounted payback. If this is done it will produce a time-value-based payback measure which will reflect the cost of capital. A discounted payback will always show a longer period than one based on nominal values. NET PRESENT VALUE (NPV) The net present value may be defined as the difference between the sum of the values of the cash-in flows, discounted at an appropriate cost of capital, and the present value of the original investment. Provided the NPV is greater than or equal to zero the investment will earn the firm's required rate of return. The size of the NPV may be considered as either a measure of the surplus which the investment makes over its required return, or as a margin of error in the size of the investment amount. Present value of benefit = Benefit (1+i)n Where i = rate of interest n = number of years NPV = Present value of benefit — Present value of investment The interpretation of the NPV should be based on the following rules: If NPV>=0 then invest If NPV <0 then do not invest The size of the NPV represents the margin of error which may be made in the estimate of the investment amount before the investment will be rejected. PROFITABILITY INDEX (PI) 204 The profitability index is defined as the sum of the present values of the cash-in flows divided by the present value of the investment. This shows a rate of return expressed as the number of discounted pounds and pence which the investment will earn for every pound originally invested. PI = Present value of benefits Present value of investment INTERNAL RATE OF RETURN (IRR) The internal rate of return is the rate of interest which will cause the NPV to be zero. It is the internally generated return which the investment will earn throughout its life. It is also frequently referred to as the yield of the investment. IRR = i such that NPV=0 RATE OF RETURN OR RETURN ON INVESTMENT (ROI) The rate of return or return on investment, which is sometimes referred to as the simple return on investment, is calculated by considering the annual benefit divided by the investment amount. Sometimes an average rate of return for the whole period of investment is calculated by averaging the annual benefits while on other occasions the rate of return is calculated on a year by year basis using individual benefit amounts. ROI = Annual benefit Investment amount 205