Exhibit 93 - Freddie Mac

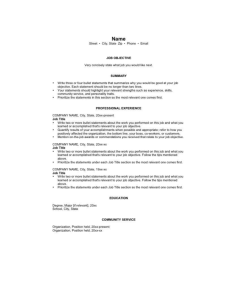

advertisement