Tutorial 3 sol

advertisement

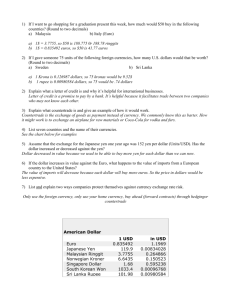

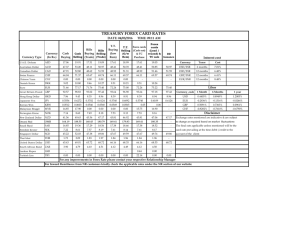

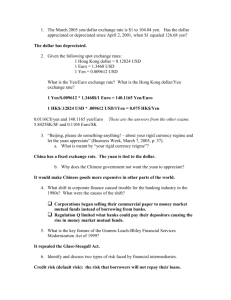

Tutorial 3 Answers [Note: answers in italics are my own comments – Loke] 1. Motives for Investing in Foreign Money Markets. Explain why an MNC may invest funds in a financial market outside its own country. ANSWER: The MNC may be able to earn a higher interest rate on funds invested in a financial market outside of its own country. In addition, the exchange rate of the currency involved may be expected to appreciate. 2. Motives for Providing Credit in Foreign Markets. Explain why some financial institutions prefer to provide credit in financial markets outside their own country. ANSWER: Financial institutions may believe that they can earn a higher return by providing credit in foreign financial markets if interest rate levels are higher and if the economic conditions are strong so that the risk of default on credit provided is low. The institutions may also want to diversity their credit so that they are not too exposed to the economic conditions in any single country. 3. Exchange Rate Effects on Investing. Explain how the appreciation of the Australian dollar against the U.S. dollar would affect the return to a U.S. firm that invested in an Australian money market security. ANSWER: If the Australian dollar appreciates over the investment period, this implies that the U.S. firm purchased the Australian dollars to make its investment at a lower exchange rate than the rate at which it will convert A$ to U.S. dollars when the investment period is over. Thus, it benefits from the appreciation. Its return will be higher as a result of this appreciation. 4. Exchange Rate Effects on Borrowing. Explain how the appreciation of the Japanese yen against the U.S. dollar would affect the return to a U.S. firm that borrowed Japanese yen and used the proceeds for a U.S. project. ANSWER: If the Japanese yen appreciates over the borrowing period, this implies that the U.S. firm converted yen to U.S. dollars at a lower exchange rate than the rate at which it paid for yen at the time it would repay the loan. Thus, it is adversely affected by the appreciation. Its cost of borrowing will be higher as a result of this appreciation. 5. Forward Contract. The Wolfpack Corporation is a U.S. exporter that invoices its exports to the United Kingdom in British pounds. If it expects that the pound will appreciate against the dollar in the future, should it hedge its exports with a forward contract? Explain. ANSWER: The forward contract can hedge future receivables or payables in foreign currencies to insulate the firm against exchange rate risk. Yet, in this case, the Wolfpack Corporation should not hedge because it would benefit from appreciation of the pound when it converts the pounds to dollars. 6. Effects of a Forward Contract. How can a forward contract backfire? ANSWER: If the spot rate of the foreign currency at the time of the transaction is worth less than the forward rate that was negotiated, or is worth more than the forward rate that was negotiated, the forward contract has backfired. [Comments: this worked solution is a bit confusing. Basically: I enter into forward contract to buy USD at a fixed forward rate, but in the future the spot USD has depreciated compared to the fixed forward rate, then I lose on the forward; or I enter into forward to sell USD at a fixed forward rate, but in the future the spot USD has appreciated compared to the fixed forward rate, then I also lose on the forward. ] 7. International Diversification. Explain how the Asian crisis would have affected the returns to a U.S. firm investing in the Asian stock markets as a means of international diversification. [See the chapter appendix.] ANSWER: The returns to the U.S. firm would have been reduced substantially as a result of the Asian crisis because of both declines in the Asian stock markets and because of currency depreciation. For example, the Indonesian stock market declined by about 27% from June 1997 to June 1998. Furthermore, the Indonesian rupiah declined again the U.S. dollar by 84%. 8. Suppose a currency increases in volatility. What is likely to happen to its bid-ask spread? Why? ANSWER. As a currency's volatility increases, it becomes riskier for traders to take positions in that currency. To compensate for the added risks, traders quote wider bid-ask spreads. 9. Who are the principal users of the forward market? What are their motives? ANSWER. The principal users of the forward market are currency arbitrageurs, hedgers, importers and exporters, and speculators. Arbitrageurs wish to earn risk-free profits; hedgers, importers and exporters want to protect the home currency values of various foreign currency-denominated assets and liabilities; and speculators actively expose themselves to exchange risk to benefit from expected movements in exchange rates. [question – what is the difference between an arbitrageur and a speculator? The speculator takes directional market risk (bets on one direction of the market) while the arbitrageur is supposed to make market risk-free profits independent of market direction.] Problems 1. Bid/ask Spread. Utah Bank’s bid price for Canadian dollars is $.7938 and it’s ask price is $.81. What is the bid/ask percentage spread? ANSWER: ($.81 – $.7938)/$.81 = .02 or 2% [Note: as for all FX related calculation problems, make sure you are clear which is the base currency (the currency being bought/sold) versus the quotation currency (the currency quoted as the price to buy/sell the base currency). In this case the base currency is CAD, quote currency is USD. Hence the prices quoted above are prices in USD to buy or sell one unit of CAD. Be very clear on this! Secondly, note that the bid price is the price that the Bank is willing to buy (bid) for the base currency. The ask or offer price is the price that the Bank is willing to sell (offer or asking price) the base currency. In other words, bid and ask is from the perspective of the Bank quoting the rates to you, the customer.] 2. Indirect Exchange Rate. If the direct exchange rate of the euro is worth $1.25, what is the indirect rate of the euro? That is, what is the value of a dollar in euros? ANSWER: 1/1.25 = .8 euros. [Note: This question is likely from the point of view of an American-based (dollar) investor. Hence direct quotes are number of home currency (dollars) per one unit of the foreign currency (euro). That is, direct quotation means home currency is the quote currency, foreign currency is the base currency. Note also that this method of converting from direct to indirect and vice-versa by taking the reciprocal only applies if you assume no bid/ask spread. Once you have bid/ask spread then you cannot simply take the reciprocal to convert!] 3. Cross Exchange Rate. Assume Poland’s currency (the zloty) is worth $.17 and the Japanese yen is worth $.008. What is the cross rate of the zloty with respect to yen? That is, how many yen equal a zloty? ANSWER: $.17/$.008 = 21.25 1 zloty = 21.25 yen [Note: you can work this out algrebraically USD/Zloty x 1/(USD/Yen) = USD/Zloty x Yen/USD = Yen/Zloty] 4. Foreign Exchange. You just came back from Canada, where the Canadian dollar was worth $.70. You still have C$200 from your trip and could exchange them for dollars at the airport, but the airport foreign exchange desk will only buy them for $.60. Next week, you will be going to Mexico and will need pesos. The airport foreign exchange desk will sell you pesos for $.10 per peso. You met a tourist at the airport who is from Mexico and is on his way to Canada. He is willing to buy your C$200 for 1300 pesos. Should you accept the offer or cash the Canadian dollars in at the airport? Explain. ANSWER: Exchange with the tourist. If you exchange the C$ for Mexico pesos (MPs) at the foreign exchange desk, the cross-rate, MP/C$ = $.60/$.10 = 6 or C$1.00 = MP6.00. Thus, the C$200 would be exchanged for 1300 1200 pesos (computed as 200 × 6). If you exchange Canadian dollars for pesos with the tourist, you will receive 1300 pesos. [Note: USD/CAD x 1/(USD/MP) = MP/CAD = 6.0 MP/CAD Also, the tourist is offering an exchange rate = 1300/200 = 6.5 MP/CAD Hence you get more MP for each CAD you exchange with the tourist. Just as a note – you will most likely do better exchange with the tourist than with the foreign exchange counter. The money changer always charges a bid/ask spread to both you and the tourist. By exchanging directly with the tourist, you are both effectively ‘cutting out the middleman’, which benefits both sides.] 5. Forward Premium. Compute the forward discount or premium for the Mexican peso whose 90-day forward rate is $.102 and spot rate is $.10. State whether your answer is a discount or premium. ANSWER: Annualized forward discount/premium for Mexican peso = (F - S) / S =($.102 - $.10) / $.10 × (360/90) = 0.08, or 8%, which reflects a 8% premium 6. Suppose Dow Chemical receives quotes of $0.009369-71 for the yen and $0.03675-6 for the Taiwan dollar (NT$). a. How many U.S. dollars will Dow Chemical receive from the sale of ¥50 million? ANSWER. Dow must sell yen at the bid rate, meaning it will receive from this sale $468,450 (50,000,000 x 0.009369). [Note: the reasoning process is : The rate quoted by the Bank is USD quote currency, Yen is base currency. Since I am the customer, the bid rate is the side that pays me less USD per one Yen.] b. What is the U.S. dollar cost to Dow Chemical of buying ¥1 billion? ANSWER. Dow must buy at the ask rate, meaning it will cost Dow $9,371,000 (1,000,000,000 x 0.009371) to buy ¥1 billion. c. How many NT$ will Dow Chemical receive for U.S.$500,000? ANSWER. Dow must sell at the bid rate for U.S. dollars (which is the reciprocal of the ask rate for NT$, or 1/0.03676), meaning it will receive from this sale of U.S. dollars NT$13,601,741 (500,000/0.03676). [Note: another way to think of this is, you are selling USD means you are buying NT$. Hence you need to buy NT$ at the ask side, which is more expensive.] d. How many yen will Dow Chemical receive for NT$200 million? ANSWER. To buy yen, Dow must first sell the NT$200 million for U.S. dollars at the bid rate and then use these dollars to buy yen at the ask rate. The net result from these transactions is ¥784,334,649.45 (200,000,000 x 0.03675/0.009371). [Note: You can’t simply reciprocal the rates as in problems (3) and (4) since now you have bid/ask spreads. Safest way is to work it out step-by-step as in the worked solution above. Just don’t be careless! I start with NT$, which I need to sell at the bid (cheaper) rate to get USD: # of USD received = 200,000,000 x 0.03675 I now use the USD to buy JPY at the ask (more expensive rate). # of Yen received = # of USD received / ask rate = 200,000,000 x 0.03675/0.009371 ] e. What is the yen cost to Dow Chemical of buying NT$80 million? ANSWER. Dow must sell the yen for dollars at the bid rate and then buy NT$ at the ask rate with the U.S. dollars. The net yen cost to Dow from carrying out these transactions is ¥313,886,220.51 (80,000,000 x 0.03676/0.009369) [Note: In the first step, how many USD do you need to buy NT$80 mio? # of USD that you need to buy NT$ = 80,000,000 x ask = 80,000,000 x 0.03676 In the second step, you need to sell Yen to buy USD, which you do at the Yen bid: # of Yen that you need to buy USD = # of USD / bid = 80,000,000 x 0.03676 / 0.009369 For these kinds of questions, work it out step-by-step. Just be very careful about which side (bid/ask) you take, as well as whether you multiply or divide. ] 7. Speculation. Diamond Bank expects that the Singapore dollar will depreciate against the dollar from its spot rate of $.43 to $.42 in 60 days. The following interbank lending and borrowing rates exist: Lending Rate U.S. dollar Singapore dollar 7.0% 22.0% Borrowing Rate 7.2% 24.0% Diamond Bank considers borrowing 10 million Singapore dollars in the interbank market and investing the funds in dollars for 60 days. Estimate the profits (or losses) that could be earned from this strategy. Should Diamond Bank pursue this strategy? ANSWER: Borrow S$10,000,000 and convert to U.S. $: S$10,000,000 × $.43 = $4,300,000 Invest funds for 60 days. The rate earned in the U.S. for 60 days is: 7% × (60/360) = 1.17% Total amount accumulated in 60 days: $4,300,000 × (1 + .0117) = $4,350,310 Convert U.S. $ back to S$ in 60 days: $4,350,310/$.42 = S$10,357,881 The rate to be paid on loan is: .24 × (60/360) = .04 Amount owed on S$ loan is: S$10,000,000 × (1 + .04) = S$10,400,000 This strategy results in a loss: S$10,357,881 – S$10,400,000 = –S$42,119 Diamond Bank should not pursue this strategy. [Note: this diagram represents this kind of uncovered interest arbitrage : Deposit US$ Interest earned in US$ @ 7% p.a. US$ Deposit matures -> receive P+I 60 days Convert spot to USD at $0.43/S$ Convert to SGD at $0.42/S$ 60 days Borrow S$10 mio Interest payable in S$ @ 24% p.a. S$ Loan matures -> pay P+I Note that the FX rates in this question are quoted without bid/ask spread, whereas the borrowing/lending rates are quoted with bid/ask spreads. In the exam, be prepared that both might have bid/ask spreads. Just remember, as the customer you always receive the worse rate: FX quote Interest rate quote ] Buy at the more expensive (offer) rate for the base currency Borrow at the higher interest rate Sell at the cheaper (bid) rate for the base currency Lend at the lower interest rate