STANDARD TWINNING FICHE

advertisement

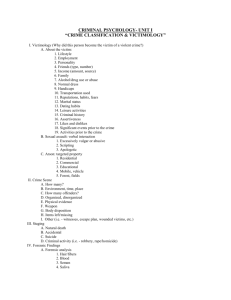

Support to Anti-Money laundering and financial investigation IPA 2009 TWINNING PROJECT FICHE 1. Basic Information 1.1 1.2 1.3 1.4 1.5 2. Programme: IPA 2009 (2009/021-642) Twinning Number: AL 09 IB JH 03 Title: Support to Anti-Money Laundering and Financial Crimes Investigations Structures Sector: 01.24 Beneficiary country: Albania Objectives 2.1 Overall Objective: Assisting relevant Albanian institutions in strengthening effectiveness, coordination and legality of the overall system tasked with the prevention, detection, investigation and prosecution of money laundering (ML), instrumental or otherwise related financial offences as well as the tracing, recovery (seizure and confiscation) and subsequent administration and destination of criminal proceeds and illegal assets. 2.2 Project purpose: Building long-term capacity at the strategic and operational levels within the General Prosecutor's Office (GPO) and its territorial articulations (Joint Investigative Units at seven district level: JIUs); the General Directorate of the Ministry of Finance for the Prevention of Money Laundering (Financial Intelligence Unit: FIU); the Albanian State Police – Directorate for Economic Crime and Corruption (ASP) and its articulations; and the Agency for the Administration of Seized and Confiscated Assets (AASCA); in view of implementation of the Albanian legal framework in the field of anti-ML, financial investigations, tracing and recovery of criminal proceeds and illegal assets and administration and destination of seized and confiscated assets1. Strengthening inter-institutional coordination between concerned bodies as well as inter-agency information sharing and common operational procedures. This will be achieved through continuous on-site, specialised, and coordinated technical assistance to the four key beneficiaries provided by European experts who will closely mentor and advise the project primary and secondary beneficiaries. Criminal Code; Criminal Procedure Code; Law Nr. 9917, dated May 19, 2008 “On the prevention of money laundering and financing of terrorism”; Law Nr. 10192 dated 3.12.2009 “On preventing and striking at organised crime and trafficking through preventive measures against assets”. 1 Support to Anti-Money laundering and financial investigation IPA 2009 2.3 Contribution to the National Development Plan/Cooperation Agreement /Association Agreement/Enlargement Report. 2.3.1 National Development Plan The National Development Plan makes reference to stepping up the fight against money laundering and financial crime and improving infrastructure and capacity in this regard. This project will contribute to this plan, specifically by: 1. 2. Increasing the capacity of institutions and the skills of officials involved in the prevention, detection, investigation and prosecution of ML and related financial offences as well as the tracing, seizure, confiscation and subsequent administration and destination of criminal proceeds and illegal assets; Providing for clearer distinction of responsibilities between institutions and improving operational standards and information flow; 2.3.2 Stabilisation and Association Agreement The Stabilisation and Association Agreement (SAA) was signed between Albania and the EU on 12th June 2006. Article 78 of the agreement places importance on the consolidation of the rule of law and the reinforcement of institutions at all levels and law enforcement and the administration of justice in particular. It stresses that co-operation should aim at improving the functioning of the police and other law enforcement bodies, providing adequate training and fighting corruption and organised crime. Article 85 specifically refers to the need to cooperate to prevent the use of financial systems for laundering the proceeds of crime and encourages administrative and technical assistance in this regard. 2.3.3 European Commission’s European (Accession) Partnership The European Commission’s European (Accession) Partnership document of 18 February 2008 sets out the following relevant priorities related to fight against criminality: Implement the 2007-2013 anti-corruption strategy and the recommendations made in the 2005 evaluation report by the Council of Europe Group of States Against Corruption and investigate and prosecute cases of corruption in the police and the judiciary with due vigour; Support to Anti-Money laundering and financial investigation IPA 2009 Improve coordination between prosecutors and police, in particular by means of the case management system; Strengthen the institutional capacity to investigate and prosecute corruption; Implement legislation on preventing bribery with due regard for inter-institutional coordination; Strengthen mechanisms to enforce the Law on declaration of assets; Conclude and implement agreements with neighbouring countries and ensure effective implementation, notably on cross border cooperation, the fight against organised crime, trafficking and smuggling, judicial cooperation, border management, readmission, the environment, transport and energy; Take the necessary measures to enforce anti-money laundering legislation better in terms of prevention, convictions, confiscations, seizures and freezing assets; the AML law is partially compliant with the 3d Directive and fully compliant with the Warsaw Convention and the FATF Recommendations Enhance the capacity of the financial intelligence unit, the prosecutor's offices and the police Economic Crimes Unit by ensuring appropriate financial and IT resources and improving working-level cooperation; Bring the Law on the prevention of money laundering into line with the acquis and with the Financial Action Task Force's and Council of Europe's Moneyval recommendations; see bullet point 1 above. Strengthen the capacity of the agency for the administration of seized and confiscated assets; Further improve cooperation with the authorities of other countries; Provide list of the authorities for the FIU in addition to the ones that we are cooperating already. Ensure proper enforcement of reporting obligations and examine transaction reporting thresholds; Take more effective measures to reduce use of cash in the economy; Take further measures to enhance cooperation between the various State bodies involved in the fight against organised crime and terrorism and, in particular, between the judicial authorities and the police; Take further measures to establish coherent and coordinated intelligence gathering and processing systems; Enhance use of special investigative means, interception of telecommunications and use of intelligence information; Step up the fight against economic and financial crime, including money-laundering and counterfeiting of currencies; Achieve tangible results in the fight against money-laundering, both within and outside the financial sector; Further increase international cooperation in the fight against organised crime and terrorism; Support to Anti-Money laundering and financial investigation IPA 2009 Make major progress on the rate, number and quality of prosecutions in relation to offences connected with organised crime and trafficking and also in terms of seizure of the proceeds of crime; Fully incorporate into domestic legislation and implement the international conventions and protocols on prevention of terrorism to which Albania is party. The Government of Albania’s Action Plan for the Implementation of the European Partnership Priorities adopted in September 2007 makes the following commitments regarding Money Laundering and Financial Crime: The Albanian Government is fully involved in strengthening the fight against money laundering originating from illegal trafficking and terrorism and in decriminalising the country’s economic activity. Therefore, it aims to increase in-country economic and legal credibility levels. Strengthening this field’s capacities will be a huge focus for the Government, in order to achieve significant and concrete results. Therefore, the Albanian Government will increase regional cooperation, particularly on money laundering matters. In addition, it will cooperate with other countries so as to prevent the use of their financial systems for criminal proceeds in general and, in particular, their use to finance terrorism. This field’s cooperation will be based upon the implementation of the appropriate standards and mechanisms in the fight against money laundering and terrorism financing, focusing in particular on the European Union and other international institution standards. The 2008/2009 Enlargement Strategy Paper published by the European Commission states that" limited progress has been made in preventing money laundering. The legal framework and cooperation between banks and financial institutions on money laundering, have improved. However, enforcement capacity to confiscate assets remains low. Investigation resources, inter-agency cooperation and enforcement capacity need to be further improved". 2.3.4 Albania EU Enlargement 2009 Progress Report “Moderate progress can be reported in the fight against money laundering, which continues to be a major problem....(omissis)...The number and quality of the FIU inspections has increased. However the overall capacity of the FIU remains limited especially with regard to highlevel criminal groups and high-value suspicious transactions. Continuous high staff turnover hampers its efficiency and coordination with the Support to Anti-Money laundering and financial investigation IPA 2009 Prosecutor General's Office remains problematic although some progress can be reported in terms of the number of cases submitted by the FIU to the latter, particularly since lowering the reporting threshold for cash transactions.” “The capacity of the Agency for the Administration of Seized and Confiscated Assets requires further reinforcement. The effectiveness of national structure responsible for the confiscation of assets needs to be enhanced and a robust track record on confiscation and recovery of criminal assets established. The procedures concerning the seizure and confiscation of proceeds of crime need to be further clarified” .2. 3. Description 3.1 Background and justification: Money laundering is the conversion of criminal proceeds into assets that cannot be traced back to the underlying crime (predicate offence). Tackling money laundering and recovering criminal proceeds and unexplained assets (under the conditions set by the so called Anti-Mafia law) is vital both in view of preventing organised crime and acquisitive offences, by ensuring that crime does not pay3 and disrupting criminal organisations; and in order to protect the financial system, economic competition and eventually the security of the state as such. These two issues – preventing and fighting ML and recovering criminal proceeds – are therefore closely interconnected so do they require similar capabilities on the part of investigative and prosecutorial authorities. Money laundering and financial offences are a grave, systemic problem in Albania due to the widespread strength of organised crime, in the form of trafficking and other acquisitive offences; the weakness of the financial system, still largely based on cash transactions, and of the economic system, whose big part is still in the grey/informal economy; the extreme difficulties of financial investigations, due to limited expertise and considerable strain in gathering reliable information from concerned public offices and financial agencies. Encouraging improvements can be observed in the overall system and in concerned institutions, mainly due to the good inter-agency cooperation achieved by the JIUs and the increase in professionalism of investigators and analysts, but quality and quantity of current cases remain totally inadequate to successfully prevent and repress these phenomena. 2 Albania EU Enlargement Report 2009. - Para. 4.3.2. Communication from the Commission to the European Parliament and the Council - COM (2008) 766 of 20.11.2008, and references of the EU legal framework in the field therein 3 Support to Anti-Money laundering and financial investigation IPA 2009 Over the past three decades, the number and scope of laws and regulations aimed at combating money laundering have expanded dramatically worldwide. In Albania, in 2008 and in the first half of 2009, major changes have taken place and important reforms were accomplished by the General Directorate for the Prevention of Money Laundering and other Albanian institutions involved in the fight against money laundering and financing of terrorism. These reforms have aimed at enhancing the professional capacities of the Albanian Financial Intelligence Unit, as well as those of other agencies such as the Economic Crime and Economic Department at GPO and the (now 7) joint investigative units at district level for the investigation and prosecution of economic crimes and corruption (JIUs) and the Albanian State Police, which has formed a dedicated Economic Crime Directorate. Inter institutional cooperation and the exchange of information among relevant agencies has improved although better operating procedures are required. One first obstacle is that both the GPO and the ASP are not, by their own admission, regularly providing adequate feedbacks to the FIU over reports originated by this institution that have developed into criminal cases and other cases developed by initiative over individuals involved in serious acquisitive offences. This practice goes to the detriment of the effectiveness and strength of the overall prevention-repression system, as it does not allow the FIU to keep due track of developments for statistics and systemic analyses. Moreover, regular feedbacks and information would result in increased attention over individuals who are likely to be in need of using the financial system for laundering purpose. The forthcoming project will have to set agreed operating procedures to solve this problem. The second issue is the controversial practice according to which the FIU reports some cases directly to the Prosecution, rather than the ASP, whenever they believe to have identified a possible predicate offence in relation to alleged ML. In the Albanian legal framework FIU officials do not hold the qualification of judicial police, while according to article 280 of the Criminal Procedure Code it is only to prosecution and judicial police to evaluate elements of a criminal offence. This procedure may also prevent the ASP from developing intelligence into elements of evidence and establishing vital connections with other ongoing investigations and confidential information, activity that is at the core of organised and serious crime investigations. The forthcoming project would have to settle the legitimate different views over this issue of involved institutions in view of establishing the most effective procedure. Although the financial sector and commercial banking have grown, greatly assisted by the expansion of the presence of foreign banks in the country, a large number of transactions are made outside the formal banking system. Albania also has created and developed a number of institutions with an impact on the financial systems. Amongst them there is a Supreme State Audit, an High Inspectorate for the Declaration and Audit of Assets (HIDAA) and the Financial Monitoring Authority and Gambling Commission. It is fair to say that the quality of these institutions varies greatly and none have yet achieved a fully satisfactory standard and - together with the rest of the public administration - they suffer from a high level of politicisation. According to widely agreed comments of Albanian officials and Support to Anti-Money laundering and financial investigation IPA 2009 international observers, positions within these institutions are awarded in many cases as a result of patronage rather than on the basis of expertise in the required field. The primary institution responsible for preventing money laundering is the Ministry of Finance’s General Directorate for the Prevention of Money Laundering - Financial Intelligence Unit. This was set up in 2001 when the law on Money Laundering was established. This law was further amended in 2004 and 2008. The FIU is operating at full potential and the number of cases it has referred to the Prosecution office between January and November 2009 have been 59. There have been 135 cases referred to the ASP in 2009, out of which 33 were reported to the Prosecutor’s Office following investigations. Staff in the FIU has two primary functions: inspection (ensuring adequate reporting by reporting bodies, compliance and preventive measures of AML/CFT) and analysis (gather, analyse and disseminate- analyse CTR & STRs to detect suspicious patterns and referrals for investigation). It has been reported that there have been sanctions as well as for banks, notaries, construction companies and other, for non compliance or non-reporting. The FIU has had an IT infrastructure upgrade in 2008 and has recently procured an analysis software. It has benefited of a EC Twinning Project that recently came to an end. In terms of investigation and prosecution, the key institutions are the Albanian State Police, the General Prosecutors Office and their territorial articulations. Due to a reorganisation in 2008 the Albanian State Police now has a Directorate for tackling Economic Crime and Money Laundering, with 22 investigators to deal with financial crime across the country. They still suffer from a lack of staff, training and procedures for tackling financial crime. Since autumn 2007 a Unit has existed within the Tirana District Prosecution Office called the Joint Investigation Unit. This is a multi agency unit staffed with investigators from Police, Customs & Tax and links with other agencies. It is split into a number of teams each of which is managed by a dedicated prosecutor. The Unit has a remit to tackle financial crime and Corruption within the Tirana District Prosecution Office area and the number of cases that are been referred to it is steadily increasing with more reports of corruption been made directly by the public. The Unit has access to two full time international experts (lawyers) from the US OPDAT project and has received financial assistance from OPDAT funds. US Millennium Challenge funds have been procured to spread the JIU concept to the main cities of Albania (Shkodra, Durres, Vlora, Korca, Gjirokaster). The final institution in the chain is the Agency for the Administration of Seized and confiscated Assets (AASCA), set up in 2005 after the passing of the anti organised crime package of laws. The Agency failed to achieve any of its goals until recently when, under a new administrator, it is making significant progress and managing a number of assets. It is however in need of specialised assistance to develop standard operating procedures in the administration and in the auctioning of assets. Support to Anti-Money laundering and financial investigation IPA 2009 Despite progress was achieved in all the below noticed areas, primary problems preventing the Albanian State in properly tackling money laundering and other financial crime and in recovering criminal proceeds and illegal assets remain: 1. Widespread penetration of organised crime, acquisitive offences, financial crime and phenomena associated to the informal/grey economy; 2. Limited expertise in financial analyses, criminal investigations and prosecutions, coupled with insufficient awareness of concerned institutions of the key relevance of the prevention and repression of these phenomena and the recovery of criminal assets. 3. Insufficient/inappropriate cooperation among concerned institutions, particularly as regards the lack of regular feedbacks to the FIU and the reporting system from FIU to Prosecution and ASP; 4. Inadequate technological support; insufficient availability of reliable information from relevant public agencies; poor quality of reports originated by banks and other relevant subjects; 5. Weakness of the current practise of investigations devoted to seizure/confiscation of criminal proceeds; unawareness of the need to implement routine financial investigations for all acquisitive offences 6. Limited expertise and lack of standard procedures in the management of seized and confiscated assets; lack of regulations for the auctioning of confiscated assets. From 2007 to the end of 2009 a twinning project to assist the Financial Intelligence Unit has been in place. This has provided training and technical assistance in the field of bank compliance, inter agency cooperation, analysis, regulatory issues and IT infrastructure amongst others. The project appears to have increased the professionalism of the Unit although the impact has been reduced by some staff changes during the lifetime of the project. 3.2 Linked activities EU Projects in Albania Police Assistance Mission of the European Community to Albania, PAMECA III (IPA 2007); EURALIUS (European Assistance Mission to the Albanian Justice System, CARDS 2006) and future EU Justice Assistance Programs; Support to Anti-Money laundering and financial investigation IPA 2009 Twinning Project between Spain, Italy and Albania “Assistance to the GPO” (ongoing) Twinning Project on “Tackling ML and Financial Crime” between Albania and the Federal Republic of Germany (concluded in December 2009) Bilateral assistance projects in Albania United States Office of Overseas Prosecutorial Development, Assistance and Training Assistance to the JIU (OPDAT). Regional project in the Western Balkans The ongoing CARDS 2006 regional project "Support to the Prosecutors' Network" focuses on strengthening the legislation and institutional capacities of Prosecutors’ Offices (POs) of South-eastern Europe in view of a more effective co-operation against serious crime. The ongoing CARDS 2005 regional project “ILECUs" supports the creation of special international law enforcement coordination units in the beneficiaries with a view to supporting the exchange of information in international investigations and facilitating contacts on an operational level. These units will be integrated in national criminal intelligence models and supported by proper data protection and confidentiality regimes. IPA Multi-beneficiary Programme 2008 - Police Cooperation: Fight against organised crime, in particular illicit drug trafficking, and the prevention of terrorism. IPA Multi-beneficiary Programme 2008 - Police Cooperation: Regional support to strengthen the Southeast European Cooperative Initiative (SECI) Centre / SELEC for combating trans-border crime. 3.3 Results: (a) Cross- Cutting Results- All stakeholders 1. Detailed and realistic gap analyses of the overall system, assessing on the one hand the situation at the start of the project of serious, organised and acquisitive crime as well as the effective and potential capacity for response from concerned institutions tasked with prevention and repression; highlighting on the other hand the progress achieved at the end of the project, both in terms of reduction of crime levels and of operational capacity and coordination. Support to Anti-Money laundering and financial investigation IPA 2009 2. Improved effectiveness and legality of the action of the overall system of institutions dedicated to the prevention, detection, investigation and prosecution of ML and related financial offences as well as the tracing, recovery (seizure and confiscation) and subsequent administration and destination/devolution of criminal proceeds and illegal assets. 3. Improved inter-institutional operational coordination through the elaboration of formalized cooperation and information exchange protocols, in view of consolidating a fair and coherent preventive and repressive system. 4. National Strategy and Action Plan on Financial Crimes implemented across all beneficiary institutions; 5. Internal and Cross-cutting Training Strategies elaborated and implemented; 6. Improved International Cooperation mechanisms. (b) Economic Crime and Corruption Department at the GPO – Economic Crime and Corruption Joint Investigations Units at the Offices in Tirana, Durres, Vlora, Fier, Shkodra, Korca and Gjirokastra (JIUs) Through a process of full-time advice and close mentoring by a long term expert to the Economic Crime and Corruption Department at the GPO and the now seven Economic Crime and Corruption Joint Investigations Units at the Offices (Tirana, Durres, Vlora, Fier, Shkodra, Korca and Gjirokastra) the project is expected to contribute to: Improved coordination and oversight functions of the GPO in the concerned field Further developed ability of JIUs to conduct high quality joint investigations, both over ML and financial offences and over routine financial investigations aimed at recovering criminal assets related to acquisitive offences; improved cooperation with ASP, FIU and other relevant agencies, also through the implementation of investigative protocols/standard operating procedures (including the protocols on corruption and financial investigations developed by the current Twinning Project between the GPO, Spain and Italy). Improved ability of the Serious Crimes Court Prosecution Office to implement the preventive seizure and confiscation provided for by the anti-mafia law Support to Anti-Money laundering and financial investigation IPA 2009 Improved level of cooperation with concerned institutions and agencies (including customs and tax authorities, land and immoveable property registries), through the shared setting of inter-institutional operating procedures, including feedback and reporting mechanisms; Review and identification of possible gaps and legal blockages to financial criminal investigation and asset recovery, in view to delivering recommendations to relevant authorities; (c) Financial Intelligence Unit of the Ministry of Finance (FIU) Through a process of full-time advice and close mentoring by a long term expert to the Financial Intelligence Unit the project is expected to contribute to: Strategic development of the capacity to prevent, measure and identify cases that need appropriate investigations on the part of ASP; and to control illegal financial flows; Extended and adequate use of IT systems, especially EU funded equipment and software; Improved quality and quantity of intelligence packages submitted to investigative units; Further developing compliance and quality of the cooperation of relevant entities (notaries, banking institutions, etc) Increased international cooperation and information exchange, including in terms of exchange programmes and active participation in international, regional and sub-regional networks. Development and implementation of standard operating procedures agreed with the other actors of the system (d) Albanian State Police Directorate for Financial Crime and Money Laundering (ASP) Through a process of full-time advice and close mentoring by a long term expert to the ASP the project is expected to contribute to: Improved investigative skills on financial crime, including asset tracing/recovery as routine practise of any investigation on acquisitive offences; Increased understanding of money laundering techniques and investigative measures, including the use of proactive investigative techniques and routine financial investigations on cases of acquisitive offences; Support to Anti-Money laundering and financial investigation IPA 2009 Improved tasking and coordination processes in view of ensuring the effective use of available resources; Development of a training programme and human resources policy for financial investigators; Improved use of investigative technical means. (e) Agency for the Administration of Seized and Confiscated Assets (AASCA) Through a process of full-time advice and close mentoring by a long term expert to the AASCA, the project is expected to contribute to: Development of a strategic multi-annual management plan encompassing human resources, training and professional development; Establishment of clear, detailed rules and standard operating procedures binding the actions of appointed administrators in view of harmonising practises as well as preventing mismanagement and corruption; including the use of dedicated web- based software Establishment and implementation of proper auctioning procedures for the selling of confiscated assets, also in view of preventing mismanagement and corruption Improved cooperation mechanisms with concerned judicial and law-enforcement institutions; 3.4 Activities: (a) All stakeholders 1. Strategic assistance to the beneficiaries in the formulation of a long-term strategic operational cooperation policy and the establishment of intra-agency and agreed inter-agency standard operating procedures for continuous information exchange in view of the prevention, detection, investigation and prosecution of money laundering (ML), instrumental or otherwise related financial offences as well as the tracing, recovery (seizure and confiscation) and subsequent administration and destination of criminal proceeds and illegal assets, according to the specific duties of each concerned institution. This will include assistance in the drafting of a series of gap analyses, one assessing the situation at the start of the project of serious, organised and acquisitive crime and the capacity for response from concerned institutions tasked with prevention and repression; one highlighting on the other hand the progress achieved at the end of the project, both in terms of reduction of crime levels and of operational capacity and coordination of the overall state system. Activities will include targeted inter-agency training seminars comprising detailed case studies so to maximize efficiency and absorption. Support to Anti-Money laundering and financial investigation IPA 2009 2. Continuous assistance in the form close mentoring and on the job-training in the daily organisation and implementation of institutional activities, including appropriate inter-agency coordination on concrete cases 3. Assistance in the arrangement of targeted training courses, mainly in the form of periodical inter-agency seminars and elaboration of a Cross-Cutting training strategy 4. Provision of assistance in formulating, implementing, monitoring and assessing of, as well as reviewing progress towards, the objectives featured in the National Strategy on Financial Crimes and other governmental strategies; this should encompass the development of each institution's capacity to carry out the above tasks independently and in a sustainable manner. 5. Provision of assistance in developing periodical intra-agency and inter-agency capacity to self-assess performance, review internal and inter-agency processes and undertake corrective action in order to contribute to a sustainable system for the prevention, detection, investigation, prosecution and recovery of criminal proceeds and illegal assets. 6. Provision of assistance to develop international cooperation (b) Joint Investigations Unit of the General Prosecutor's Office (JIU) Support to the GPO and the JIUs’ in developing their respective supervisory/ operational (for GPO) and operational (for JIUs) duties, working procedures and investigative techniques for the detection, investigation and prosecution of money laundering, instrumental or otherwise related financial offences as well as the tracing and recovery (seizure and confiscation) of criminal assets Support to the GPO and JIUs in developing appropriate Case Management capacities to promote the effective prosecution of money laundering and financial crimes, as well as the provision of reliable statistical data in coordination with the overall criminal justice system; Support the GPO in fostering the capacity of the Serious Crimes Prosecution Office to implement and coordinate activities in the framework of the so-called "Anti- Mafia Law" Support to Anti-Money laundering and financial investigation IPA 2009 (c) Financial Intelligence Unit of the Ministry of Finance (FIU) Support to the FIU in developing improved procedures and techniques in the elaboration of analytical products based on the received Reports of Suspicious Operation; and in the proper dissemination of the analytical products towards the appropriate institutional clients. Assistance in the development of forms of information exchange with other national and international Agencies and bodies involved in the matter, including actors within the banking system, independent Albanian institutions as well as regional or sectorial organizations Assistance in the development of strategic analytical products and statistical tools which can improve the quality of publicly available statistics on Financial Crime, can assist in policy formulation, and can contribute to a transparent criminal justice system (d) Albanian State Police Directorate for Financial Crime and Money Laundering (ASP) Support to the ASP in developing improved procedures and investigative techniques for the detection and investigation of money laundering, instrumental or otherwise related financial offences as well as the tracing and recovery criminal assets. Support to the ASP in developing and fine tuning the use of parallel financial investigations as "routine" investigative practices Assistance in the development of forms of coordination and information exchange with other national and international Agencies and bodies involved in the matter. (e) Agency for the Administration of Seized and Confiscated Assets (AASCA) Support to the AASCA in developing procedures for the administration and the auctioning, where applicable, of seized and confiscated Assets Depending on policy developments decided by the Albanian Government, provide AASCA with support to develop an Asset Recovery Capacity4 or to closely cooperate with any such future entity Assistance in the development of internal management capacity encompassing training, human resources and continued professional development. 4 The creation of Asset Recovery Offices (AROs) is a Commission Priority (see preceeding footnote 3) and it is featured as a priority in the Government of Albania's recent strategic document on financial crimes. However it has not yet been decided whether an ARO will be created or whether AASCA or the General Prosecutor's Office will develop this function. Support to Anti-Money laundering and financial investigation IPA 2009 3.5 Means/ Input from the MS Partner Administration: 3.5.1 Profile and Tasks of the Project Leader- Member State (MS-based) Profile of Expert required: The MS Project Leader will be a representative of the leading MS Administration, who will continues to work in his/her MS administration but who devotes a portion of his/her time to conceiving, supervising and co-ordinating the overall thrust of the project. The MS Project Leader should be a high-ranking civil servant or equivalent staff commensurate with the requirement for an operational dialogue and backing at political level. Good level of written and spoken English is essential. Main Tasks: The MS Project Leader directs, at the strategic level, the implementation of the project and facilitates the implementation of project activities. In addition he/she will have the overall responsibility for the project's financial management. 3.5.2 Profile and tasks of the Resident Twinning Advisor- RTA (Advisor to the GPO) Profile of expert required: - She/He must be an experienced Prosecutor specialised in the investigation and prosecution of organised crime, financial crime and/or complex criminal cases involving large amounts of financial transactions; the RTA shall be experienced in leading multi-disciplinary teams of investigators including financial investigators. A minimum of 5 years of directly relevant professional experience in the above fields is required. Experience in trans-national, cross-border criminal investigations is highly desirable. Excellent interpersonal and good communication skills, reporting and analysis capacity and drive for results will be essential components of the RTA's profile. Project Management skills, or experience in comparable projects as Team Leader or Key Expert are also highly desirable though not essential. - Relevant proven experience in the investigation and prosecution of ML, other financial offences and in the tracing, detection and recovery of criminal proceeds and assets; experience with OC is desirable; Support to Anti-Money laundering and financial investigation IPA 2009 - Excellent knowledge of EU and international working practices in the field - Sound Managerial and Coordination skills - Very Good level of written and spoken English is essential - In possession of, or able to obtain, a National Security Clearance at EU Secret level or higher Duration of secondment: 24 months Main Tasks: - The RTA will act as Project Manager and will be responsible for managing project staff and other resources to achieve the agreed project objectives in an efficient and effective manner. S/he will keep close contacts with the beneficiaries and other international organisations with coterminous programmes and representatives of Member States. S/he will establish, together with the beneficiaries, a monitoring and evaluation system in order to assess the progress of the project. The RTA will ensure the closest coordination with the Contracting Authority and will be responsible for the liaison with and reporting to, the relevant Programme Manager at the European Union Delegation. The RTA will lead the project and ensure the achievement of the overarching project objectives. The RTA will also be responsible for leading the assistance to the GPO- JIU and specifically: - To provide direct advice and mentoring to the FIU and monitor progress on the project and ensure periodic thematic progress reports for the European Union Delegation, the beneficiaries and/or for the Steering Committee are prepared. - To develop and maintain close links and excellent working relations with representatives of Beneficiary institutions, to ensure the maximum coordination and dissemination of information. - To manage the JIU- related aspects of the project on a day-to-day basis - To coordinate JIU- related project activities and to ensure that the project is carried out within the planned time schedule. - To provide advisory support in policy formulation 3.5.3 Profile and tasks of the Resident Twinning Advisor for the Financial Intelligence Unit of the Ministry of Finance (FIU) Profile of Expert Required: - She/He must be an experienced Investigator o Financial Intelligence Officer specialised in the gathering, collection, analysis and dissemination of financial information, including internal processes and IT tools, applied to cases of Organised Crime, Financial Crime Support to Anti-Money laundering and financial investigation IPA 2009 and/or complex criminal cases involving large amounts of financial transactions. The Expert shall have a proven track record as a Financial Intelligence Officer, and must be suitable to work within a multi-disciplinary team. A minimum of 5 years directly relevant professional experience at the supervisory level is required; Excellent interpersonal and good communication skills, reporting and analysis capacity and drive for results will be essential components of the expert's profile. Good level of written and spoken English is essential. - In possession of, or able to obtain, a National Security Clearance at EU Secret level or higher Duration of secondment – twenty-four (24) months. Main Tasks: - To provide direct advice and mentoring to the FIU and monitor progress on the project and ensure periodic thematic progress reports for the European Union Delegation, the beneficiaries and/or for the Steering Committee are prepared. - To develop and maintain close links and excellent working relations with representatives of Beneficiary institutions, to ensure the maximum coordination and dissemination of information. - To manage the FIU- related aspects of the project on a day-to-day basis - To coordinate FIU- related project activities and to ensure that the project is carried out within the planned time schedule. - To provide advisory support in policy formulation The Expert is expected to ensure, together with the beneficiary administration, the achievement of the objectives listed in 2.1/ 2.2. In order to meet these purposes, and if fully justified, the Expert may propose alternative and/or complementary project activities and/or outputs to those identified in the section 3.4. 3.5.3.1 Profile and tasks of the short-term experts (Specific to FIU) The implementing partner must demonstrate access to Short Term Experts in the following fields. (this list is not exhaustive) 1. 2. 3. 4. IT networking and data transfer. Financial Analysis and Reporting. Financial tools. Banking operations. Support to Anti-Money laundering and financial investigation IPA 2009 5. Stock Markets 6. Tax Crime and aggressive Tax Planning. 7. International Cooperation in Tax Crime and Money Laundering. 3.5.4 Profile and tasks of the Resident Twinning Advisor for the Albanian State Police Directorate for Financial Crime and Money Laundering (ASP) Required Expert Profile: - She/He must be an experienced Investigator specialised in the investigation and criminal intelligence gathering on cases of Organised Crime, Financial Crime and/or complex criminal cases involving large amounts of financial transactions (including the tracking of illicit financial flows and high level investigations on Organized Crime); the Expert shall have a proven track record as an Investigator in parallel financial investigations, and must be suitable to work within a multi-disciplinary team. A minimum of 5 years of directly relevant professional experience at the supervisory level is highly desirable. Excellent interpersonal and good communication skills, reporting and analysis capacity and drive for results will be essential components of the expert's profile. S/he must be able to communicate solutions to problems in different legal environments, and provide advice on day-to-day questions from the beneficiaries. Good level of written and spoken English is essential. - In possession of, or able to obtain, a National Security Clearance at EU Secret level or higher Main Tasks: - To provide direct advice and mentoring to the ASP's Unit for Financial and Economic Crimes and monitor progress on the project, and ensure periodic thematic progress reports for the European Union Delegation, the beneficiaries and/or for the Steering Committee are prepared. - To develop and maintain close links and excellent working relations with representatives of Beneficiary institutions, to ensure the maximum coordination and dissemination of information. - To manage the ASP- related aspects of the project on a day-to-day basis - To coordinate ASP- related project activities and to ensure that the project is carried out within the planned time schedule. Support to Anti-Money laundering and financial investigation IPA 2009 - To provide advisory support in policy formulation The Expert is expected to ensure, together with the beneficiary administration, the achievement of the objectives listed in 2.1/ 2.2. In order to meet these purposes, and if fully justified, the Expert may propose alternative and/or complementary project activities and/or outputs to those identified in the section 3.4. 3.5.4.1 Profile and tasks of the short-term experts (specific to Albanian State Police) The implementing partner must demonstrate access to Short Term Experts in the following fields. (this list is not exhaustive) 8. 9. 10. 11. 12. 13. 14. IT networking and data transfer. Financial investigations on complex transactions. Financial Analysis and Reporting. Financial tools. Stock Markets. Tax Crime and aggressive Tax Planning. International Cooperation in Tax Crime and Money Laundering. 3.5.5 Profile and tasks of the Resident Twinning Advisor for the Agency for the Administration of Seized and Confiscated Assets (AASCA) Required Expert Profile - She/he must be an experienced professional specialised in the administration of crime proceeds (funds as well as movable/immovable property), including sequestration processes, internal administrative procedures, and liaison/coordination with the Police and Judicial elements (particularly Prosecution) as well as Auctioning. The Expert shall have a proven track record and practical knowledge as an Administrator of seized and confiscated assets, and must be suitable to work within a multi-disciplinary team. A minimum of 5 years directly relevant professional experience at the supervisory level is required; Excellent interpersonal and good communication skills, reporting and analysis capacity and drive for results will be essential components of the expert's profile. Good level of written and spoken English is essential. Support to Anti-Money laundering and financial investigation IPA 2009 S/he must be able to communicate solutions to problems in different legal environments, and provide advice on day-to-day questions from the beneficiaries. - In possession of, or able to obtain, a National Security Clearance at EU Secret level or higher Main Tasks: - To provide direct advice and mentoring to the AASCA and monitor progress on the project, and ensure periodic thematic progress reports for the European Union Delegation, the beneficiaries and/or for the Steering Committee are prepared. - To develop and maintain close links and excellent working relations with representatives of Beneficiary institutions, to ensure the maximum coordination and dissemination of information. - To manage the AASCA- related aspects of the project on a day-to-day basis - To coordinate AASCA- related project activities and to ensure that the project is carried out within the planned time schedule. - To provide advisory support in policy formulation The Expert is expected to ensure, together with the beneficiary administration, the achievement of the objectives listed in 2.1/ 2.2. In order to meet these purposes, and if fully justified, the Expert may propose alternative and/or complementary project activities and/or outputs to those identified in the section 3.4. 3.5.5.1 Profile and tasks of the short-term experts specific to AASCA The implementing partner must demonstrate access to Short Term Experts in the following fields. (this list is not exhaustive) 15. 16. 17. 18. 19. IT networking and data transfer. Administration of Assets. Auctioning of Assets. International Cooperation in Credits recovery. Preparation of EU technical tender documents. 3.5.6 Profile and tasks of the Resident Twinning Advisor for the Joint Investigations Unit of the General Prosecutor's Office (JIU)* Support to Anti-Money laundering and financial investigation IPA 2009 This additional Expert (either long or medium term) will be tasked with assisting the RTA in the implementation and monitoring of activities outside of Tirana in particular by focusing on the provision of continuous assistance to the regional JIUs. Member States must be aware that the inclusion of a fifth expert into the Application will be considered a distinct advantage in the selection criteria, not an essential requirement. Profile of expert required: - She/He must be an experienced Prosecutor specialised in the investigation and prosecution of organised crime, financial crime and/or complex criminal cases involving large amounts of financial transactions; the Expert shall be experienced in leading multi-disciplinary teams of investigators including financial investigators. A minimum of 5 years of directly relevant professional experience in the above fields is required. Experience in trans-national, cross-border criminal investigations is highly desirable. Excellent interpersonal and good communication skills, reporting and analysis capacity and drive for results will be essential components of this Expert's profile. - Relevant proven experience in the investigation and prosecution of ML, other financial offences and in the tracing, detection and recovery of criminal proceeds and assets; experience with Organized Crime definitely an asset; - Excellent knowledge of EU and international working practices in the field - Sound Managerial and Coordination skills - Good level of written and spoken English is essential - In possession of, or able to obtain, a National Security Clearance at EU Secret level or higher Duration of secondment: 24 months Main Tasks: - The Expert will be responsible for implementing and monitoring project activities in an efficient and effective manner by ensuring project activities are implemented in a coherent manner across all regional JIUs. S/he will keep close contacts with the beneficiaries and the Tirana-based team. S/he will establish, together with the beneficiaries, a monitoring and evaluation system in order to assess the progress of the project. The Expert will assist the RTA in ensuring the achievement of the overarching project objectives in the regions, and in particular: Support to Anti-Money laundering and financial investigation IPA 2009 - To provide direct advice and mentoring to the regional JIUs, monitor project progress and ensure periodic thematic progress reports for the European Union Delegation, the beneficiaries and/or for the Steering Committee are prepared, under the overall supervision of the Resident Twinning Adviser. - To develop and maintain close links and excellent working relations with representatives of Beneficiary institutions, to ensure the maximum coordination and dissemination of information. - To manage the JIU- related aspects of the project on a day-to-day basis - To implement JIU- related project activities in the Regional Offices and to ensure that the project is carried out within the planned time schedule. The Expert is expected to ensure, together with the beneficiary administrations, the achievement of the objectives listed in 2.1/ 2.2. In order to meet these purposes, and if fully justified, the Expert may propose alternative and/or complementary project activities and/or outputs to those identified in the section 3.4. 4. Institutional Framework 4.1 Lead Beneficiary Institution General Prosecution Office – Department for Economic Crime and Corruption and Joint Investigative Units in Tirana, Durres, Vlora, Fier, Korca, Gjirokaster and Shkodra Contact: Mr Arben KRAJA, Prosecutor, GPO, akraja@pp.gov.al; Telephone: +355 69 2023396 4.2 Other Beneficiary Institutions 1. Financial Intelligence Unit - Ministry of Finance, Directorate for the Prevention of Money Laundering - Rruga “Dora D’Istria” No. 2, Tirana, Abania Contact: Mr. Arben DOCI, Director General Email: adoci@fint.gov.al Support to Anti-Money laundering and financial investigation IPA 2009 Telephone: +355 4 2257156 2. Albanian State Police - Directorate for Economic Crime and Money Laundering Albanian State Police Headquarters, Bld Bajram Curi, Tirana, Albania Contact: Mr. Shpetim MUCOLLARI, Director. Telephone: +355 69 4102316 3. Agency for the Administration of Sequestered and Confiscated Assets (AASCA) Ministry of Finance, Blv Deshmoret e Kombit Qendra e Biznesit, 2 Kullet Kulla II, Kati 12, Tirana, Albania Contact: Mr. Hekuran VLADI, Email: hvladi@gmail.com Telephone: +355 67 2084375 Support to Anti-Money laundering and financial investigation IPA 2009 5. Budget The maximum EU support to this project is € 1,500,000 to cover the financing of the Twinning. Indicative Budget (amounts in EUR) Programme Investment Support (I) Twinning Total Support Institution Total Building (IB) Programm e(=I+IB) 1,500,000 1,500,000 1,500,000 National Cofinancing IFI TOTAL 0,000 0 1,500,000 0,000 Support to Anti-Money laundering and financial investigation IPA 2009 6. Implementation Arrangements 6.1. Implementing Agency The European Union Delegation in Tirana will be responsible for tendering, contracting, payments and financial reporting, and will work in close cooperation with the beneficiary. The Programme Manager at the EU Delegation, OPS I, will be Mr Stefano FAILLA, Rr. Papa Gjon Pali II Tirana, Albania Tel: + 355 42 228320 Fax: +355 42 270678 e-mail: stefano.failla@ec.europa.eu 6.2. Main counterpart in the Beneficiary Country General Prosecution Office Joint Investigation Unit, Tirana District Prosecution Office Contact: Mr Arben KRAJA, Prosecutor, GPO, akraja@pp.gov.al; TELEPHONE: +355 69 2023396 6.3. Contracts: The project will be implemented through one twinning agreement. Contract Contract Value ( € ) Project: Support to Anti-Money laundering and Financial Crimes Investigations Structures Contract = Twinning €1.500.000 Total € 1.500.000 7. Implementation Schedule (indicative) 7.1 Launching of the call for proposals 7.2 Start of project activities 7.3 Project completion 7.4 Duration of the execution period months for closure of project. 8. – March. 2010. – January 2011. – March 2012. - Twenty-four (24) months plus three Sustainability The results of this project are designed in such a way as to provide sustainable benefits for the beneficiaries and achieve the overall project purpose. Support to Anti-Money laundering and financial investigation IPA 2009 9. Crosscutting issues (equal opportunity, environment, etc…) 9.1. Equal Opportunity The principle of equal opportunity will be integrated into all stages of the project implementation, which it is also in conformity with the Albanian Constitution which provides for equal opportunity for men and women be treated equally despite of their race, nationality, gender, origin, religious and political beliefs. 9.2. Environment N/A 10. Conditionality and sequencing The implementation of the project requires the full commitment and participation of the senior management of the Beneficiary Institutions. The Beneficiaries shall: a) Ensure that appropriate staff and resources are made available to work with the EU twinning partner(s). Counterparts for each of the Beneficiary Institutions will be appointed to facilitate the implementation of the respective activities of the twinning project; b) Be responsible for the selection of trainees where relevant - in consultation with the EU experts - as well as for providing the EU experts with legislation and any other documents necessary for the implementation of the project; c) Ensure that appropriate staff for training are made available, that trainees are released from their duties during their training and that once trained they are retained in post; d) Ensure that staff mentored and trained under this project are permitted to remain in post and not subject to arbitrary and frequent transfer into posts where their newly acquired skills are of no use or dismissed without due cause/process. To address this, a detailed database of what training was provided to which person should be maintained by the implementing partner(s) to allow for monitoring of the investment in future to ensure those trained have not been transferred; e) Provide all possible assistance to solve any unforeseen problem that the EU twinning partner(s) may face; f) Fully support the RTA and Resident Experts with accommodation, training rooms and logistical assistance within Beneficiary premises; Support to Anti-Money laundering and financial investigation IPA 2009 g) Where feisable, appoint an English- speaking officer per each beneficiary institution in order to facilitate day-to- day activities; Equally, the Twinning team, as led by the Twinning Resident Adviser must ensure full collaboration with the counterparts at the institution. Communications should be open and consistent. The Twinning team must carry out activities in the interest of the beneficiary institutions, and maintain beneficiary involvement at all stages of activities. 11. Investment criteria 10.1 Co-financing: Co-financing will come from the beneficiary in the form of provision of accommodation, training rooms, electricity and telephone, etc. 10.2 Measures to mitigate risks: Discussions with Albanian authorities to reconfirm officially the agreement to the above conditionalities prior to the signing of the contract. ANNEXES TO PROJECT FICHE 1. Logical framework matrix in standard format (compulsory) 2. Implementation Chart