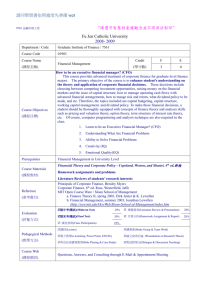

Fu Jen Catholic University

advertisement

”請遵守智慧財產權觀念並不得非法影印” 10001 碩士班 Please respect Intellectual Property Fu Jen Catholic University 2011- 2012 Department of Finance and International Business (Master’s Program in Finance) Department / Code Course Code Course Name 金融與國際企業學系 金融碩士班 研一 0F61 01983 Financial Management 財務管理 (課程名稱) Course Objectives (課程目標) Prerequisites Credit F S (學分數) 3 0 This course provides advanced treatment of corporate finance for graduate level finance majors. The primary objective of the course is to enhance student's understanding on the theory and application of corporate financial decisions. These decisions include choosing between competing investment opportunities, raising money on the financial markets and the issue of capital structure, how to manage operating cash flows with advanced financial arrangements, how to mange risk and return, what dividend policy to be made, and etc. Therefore, four major topics, namely capital budgeting, capital structure, working capital management and dividend policy will be emphasized in this course. Students enrolled the course are expected to familiar with the followings upon course completion. 1. The possible types and control mechanism of agency problems that originates from modern corporate structure separating management from shareholder’s ownership. 2. Valuation approaches, cash flow estimation, and risk aspect relating to capital budgeting. The concept of real option embedded in project investment is also emphasized. 3. The concept of weighted average cost of capital (WACC) is emphasized with special focus on possible approaches to estimate each cost element. 4. Possible arguments that dictate the optimal capital structure and dividend policy. Market frictions such as transaction cost or taxes are included into discussions step by step. 5. Students are asked to develop the ability to find and solve the financial problems like an Executive Financial Manager (CFO). Financial Management in University Level Financial Theory and Corporate Policy - Copeland, Weston, and Shastri, 4th ed,新陸 Course Materials (課程教材) Reference (參考書目) Evaluation Homework assignments and problems Literature Reviews of students’ research interests Principals of Corporate Finance, Brealey Myers Corporate Finance, 6th ed. Ross, Westerfield, Jaffe MIT Open Course Ware / Sloan School of Management a. Finance Theory II, spring 2003, Dirk Jenter & K. Lewellen b. Financial Management, summer 2003, Jonathan Lewellen (http://ocw.mit.edu/OcwWeb/Sloan-School-of-Management/index.htm ■期中考(筆試)(Midterm Test) 30% ■ 專題發表(Literature Review & Presentation) 20% ■期末考(筆試)(Final Test) 30% ■作業分析(Homework Assignment & Report) 20% ■ 課堂參與(Class Participation) 10% (評量方式) Pedagogical Methods (教學方法) ■講授(Lecture) ■競賽讀書會(Study Group) ■個案教學(Case Study) ■專題實作(Seminar on Field Research) ■電子教學(e-Learning) 產業實習(Internship) ■體驗教學(Project Adventure) 服務學習實作(Service Learning) ■角色扮演實境教學(Role Playing) ■自主學習(Independent Study) 企業競賽遊戲(Business Simulation Game) 對話教學法(Dialogue Teaching) 管理電影(Theater Learning) 其他 Course Web (課程網頁) Questions, Answers, and Consulting through E-Mail & Appointment Meeting Week Course Outline (課程大綱進度) Date Topic 1 09/16 2 09/23 3 09/30 4 10/07 5 10/14 6 10/21 7 10/28 Introduction to Class & Financial Management: Cash Flows, Principal of Valuation, & Financial Markets HWA1: Valuation Methods and Models? Preview Chapter 13. Ch. 13: The Role of the CFO, Performance Measurement, and Incentive Design Preview Chapter 14. Ch. 14: Valuation and Tax Policy Cost, Market, and Earning Approaches HWA2: Cash Flow Estimations? (Equity, debt, Asset) Preview Chapter 9 Ch. 9. Multi-period Capital Budgeting under Uncertainty: Real Options Analysis HWA3:Growth Rates Estimations? (perpetual vs n yr life) Ch. 9 (Continued) Preview Chapter 15 Ch. 15: Capital Structure and the Cost of Capital HWA4: Costs of Capital Estimates (Equity, Debt, Asset) Chapter 15 (Continued) : HWA discussion and Review 8 11/04 HWA5: Valuation Wrap-Ups (Equity, Debt, Asset, Stock) 9 11/11 10 11/18 11 11/25 12 12/02 13 12/09 14 12/16 Mid-Term Examination 期中考 (Ch. 9, 13, 14, 15) Preview Chapter 16 Ch. 8. The Term Structure of Interest Rates, Forward Contracts, and Futures Ch. 8. (Continued) HWA6: Risk Analysis – Sensitivity Study Research Interest 1-3: Literature Review Presentations Preview Chapter 17 Ch. 16: Dividend Policy: Theory and Empirical Evidence Research Interest 4-6: Literature Review Presentations Ch. 17: Applied Issues in Corporate Finance Research Interest 7-9: Literature Review Presentations Preview Chapter 18 Ch 17 (continued) Research Interest 9-12: Literature Review Presentations Preview Chapter 19 15 12/23 Ch. 18: Acquisitions, Divestitures, Restructuring, and Corporate Governance Research Interest 13-15: Literature Review Presentations Preview Chapter 20 16 Contribution to Mission (本課程與管理學院 使命之關係) 12/30 Ch. 19: International Financial Management (Optional) 17 01/06 Research Interest 16-20: Literature Review Presentations Ch. 20: Unsolved Issues, Undiscovered Territory, Future of Finance (Optional) 18 01/13 Final Examination 期末考 (Valuation & Ch. 8, 16-19) ■全人教育 ■做中學 (Holistic Education) (Learning by doing) ■人本價值 ■整合資源 ■創新知識 ■國際視野 (Human-centric values) (Resource integration) (Innovative knowledge) (International view) 以下資料 請勿更動 若有更動請用紅色標示或 通知所秘書 ■1.掌握專業知識內涵並培養獨立研究之能力。 Contribution to learning goals: management college (本課程能達成開課 單位的哪些目標-院) Each student should be able to capture the essence of professional knowledge and cultivate the ability to independent research. ■2.善用資訊科技,並培育資源統整之能力。 Each student should be able to capitalize on modern information technology in the integration and use of resources. 3.建立專業倫理與人本價值觀念,並應用於專業決策中。 Each student should be able to recognize professional ethics and human-centric values, and be able to apply them in professional decision-making. 4.拓展國際視野以提升國際化能力。 Each student should be able to expand his/her global perspective to adapt to internationalization. 以下資料 請勿更動 若有更動請用紅色標示或 通知所秘書 1.完備財務金融理論之訓練及提升對金融市場與商品之了解. To Provide solid training in financial theory and strengthen the knowledge of financial market and commodities. (問題分析與解決行為.Analysis and problem solving skills.) 2.提高對研究方法流程之熟稔度及各研究工具之操作能力. To enhance research skills. (問題分析與解決行為.Analysis and problem solving skills.) Contribution to 3.具理論與實務之整合能力. To integrate professional studies with financial theories and learning goals: practices. Graduate Institute of (整合與運用資源行為.To integrate and utilize the resources.) Finance (本課程能達成開課 4.拓展國際視野與具備專業倫理之素養. To develop international perspectives and 單位的哪些目標-所) professional ethics. (團隊合作行為.Team Work. ; 洞察環境變動(國際視野)行為.Globalized Vision.) 5.提昇邏輯分析與金融問題解決的能力. To enhance the ability of logistic analyses and financial problem solving skills. (問題分析與解決行為.Analysis and problems Analysis and problems solving skills.) Instructor (老師資料) Wei Pen Tsai 蔡偉澎 E-mail: mgcg1004@mail.fju.edu.tw Phone: 29053998 Office Hour: Wednesday, Thursday, Friday 15:30 -17:30pm Room: SL424