Seminar in International Economics

advertisement

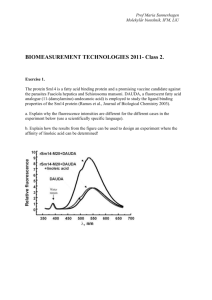

Seminar in International Economics/Finance MBA program, Inter-Continental University of the Caribbean Boulder, Colorado September 23- October 4, 2013 Leeds School of Business Room # S130 Sousan Urroz-Korori Website: http://spot.colorado.edu/~urrozkor E-mail: urrozkor@colorado.edu October 4, 2:30-4:30 pm. Final Exam This is an intensive seminar that requires not only your class participation but also extensive individual time to study outside classroom. Your participation in class is obligatory, and class discussion is part of your grade. You are required to read all the assigned material prior to class time. The Exam is scheduled for Friday October 7th 2:004:00 pm. you need to sign-up for one of the group presentation1 on the first day of class. Required Text book: Eun & Resnick, International Financial Management (IFM) 6th edition, McGraw-Hill/Irwin, New York, 2012, ISBN # 978-0-07-803465-7 September 24 9:00-12:00 am. Introduction to International Economics/Finance: The focus is in understanding the overall picture of International Economics and its relationship with development. We cover topics such as Financial and Economic Crisis, Capitalization and Development, Foreign Direct Investment, Trade, The Role of international organization such as World Trade Organization (WTO), and International Monetary Fund (IMF). Reading material: Professor’s notes on the website Globalization and the Multinational Firm, Chapter 1, IFM, pp. 4-24 Gain from Trade: The Theory of Comparative Advantage, IMF Appendix 1A, pp. 27 & 28 September 24 2:00-4:30 pm. International monetary systems, history of monetary arrangements, European monetary system, financial crisis, causes of financial crises, exchange regimes. 1 2 Professor’s notes online Prof. Becker2 notes on Foreign Exchange, on the website International Monetary System, Chapter 2, IFM, pp. 29-61 You either can sign up on line or during the first day of classes. Duke University 1 September 26 9:00-12:00 The current account, the capital account and the portfolio investment, reserve (surplus vs. deficit), The relationship between balance of payments and national income. Reading Material: Balance of Payments, Chapter 3, IFM pp. 64-79 Appendix 3A The relationship between balance of payments and national income accounting, page 82 Mini case, Mexico’s Balance of Payment Problem 1, page 80 Market and structure of foreign exchanges, spot market, cross exchange rates, arbitrage, forward rare, swap transactions. Reading Material: The Market for Foreign Exchange, chapter 5, IFM, pp. 112-135 Professor’s notes on Foreign Exchange Market Problems 1-9 page 136 October 1 2:00-4:30 pm. International Parity Relationships and Forecasting Foreign Exchange Rate, & Management of Transaction Exposure. Reading Material: Chapter 6, pp. 139-165 Problems 1-6 pp. 166 & 167 Chapter 8, pp. 198-216 Problems 1-5, pp 217 & 218 October 3 9:00-12:00 am. Management of Economic Exposure & Management of Transaction Exposure. Reading Material: Chapter 9 pp. 227-244 Chapter 10 pp. 248-262 October 3 2:00-4:00 pm. Problem solving period 2