Internal Control - Food Security and Nutrition Network

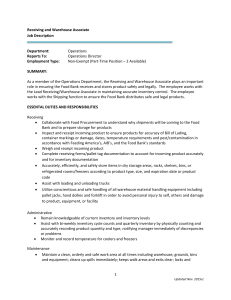

advertisement