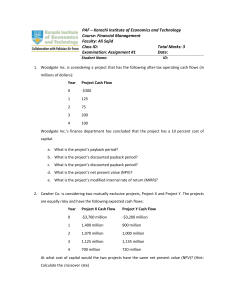

CAVENDISH UNIVERSITY DEPARTMENT: MODULE: BUSINESS AND MANAGEMENT MANAGERIAL ACCOUNTING – MR. MAHLANGU LEE MAHLANGU 0978877736 Mahl48@yahoo.com 2,500 – 3,000 WORDS IN LENGTH HARVARD REFERENCING SYSTEM IS RECOMMENDED (MINIMUM REFENCES 5 QUOTATIONS) FORMAT: INTRODUCTION, ANSWER QUESTIONS, RECOMMENDATIONS AND CONCLUSIONS. Date Due: As per calendar ASSIGNMENT: ONE & TWO Nchanga Demolishers Limited Nchanga Demolishers Limited intends purchasing a new demolishing machine. The following information relating to the machine is available. Cost of machine Expected useful life Scrap value Method of depreciation Cost of Capital Year 1 2 3 4 5 Cash flow 20,000,000 24,000,000 56,000,000 40,000,000 60,000,000 K120, 000,000 6 years K80, 000,000 Straight line 14% Profit 2,000,000 6,000,000 38,000,000 22,000,000 42,000,000 Q.1. a) What are relevant costs in investment appraisal decision making? b) Contrast between payback period and accounting rate of return (ARR . c) Using the information in the case study above calculate the following : i) Payback period for the new machine in months . ii) Net present value (NPV) for the new machine and advise if Nchanga Demolishers Limited should invest in this machine. Total 20 marks Q.2. a) Outline the main differences between NPV and IRR b) Using the information in the case study above, calculate the ARR for the new machine. Is this return favourable to Nchanga Demolishers Limited? Give reasons for your answer. c) Using the information in the case study above, calculate the IRR for the new machine. Discuss your conclusion from your calculations. Total 20 marks