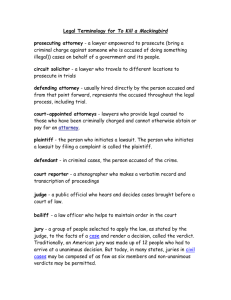

10 _main_argument

advertisement