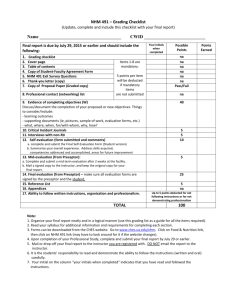

[2006] Vol

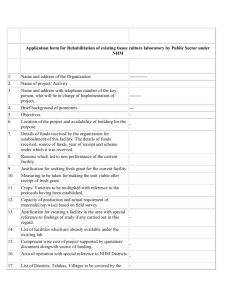

advertisement

![[2006] Vol](http://s3.studylib.net/store/data/008495660_1-04361327c6f18c158a0d75395704faa5-768x994.png)