Zach Broderick

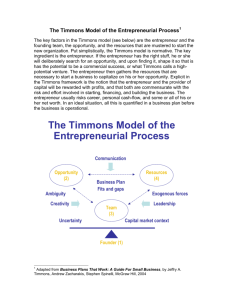

advertisement

Zach Broderick Bus 30a – Final The Bauers’ entrepreneurial venture in the SOI case is a fine example of a well balanced Timmons model with excellent fit. On the opportunity side of the scale, they are currently entering a market in the midst of two sea-changes: the privatization of Eastern Europe after decades of a closed economy, and the technological revolution of the Internet. They are creating immense value by providing a much needed service that barely exists in a market that is growing at near full capacity. They have numerous competitive advantages, such as being the first to market and proprietary technology. Their financial statements predict break-even in 2 years with about 40% growth in profits after that, and they have a solid 3-5 year harvesting strategy. Finally, they have low fixed costs and low asset intensity, which as the case mentions translates into rapidly growing profits as income increases. Equally impressive is their team, whose expertise covers all important bases. Both Kurt and Rafal have considerable knowledge of the Polish and Eastern European business climate; John, Jae and Mike are on the cutting edge of computer and Internet technologies, and Robert ties the two together with his 16 years of experience in online financial systems. They also have a top-tier advisor in the form of Jeffrey Timmons, who adds wisdom to the already impressive business skills of Kurt. Especially important is that their minds seem to be in the right place. Most of them are giving up cushy, well-paid jobs and instead opting for months of no salary for their hard labor. As the case seems to suggest, the problem with resources might not be a lack of them but rather an abundance, leading to sloppy entrepreneurship and collapse such as seen in the dot-com era. The Bauers appear to have raised sufficient equity on their own and do not seem strapped for cash, and prospects for capital seem almost guaranteed—they should have no problem feeding their cash burn rate, which is considerable at $34,000/month. So long as they act before they are out of cash, they should be able to negotiate highly favorable terms from VC firms looking to ride the high risk/reward wave of the Internet and Eastern European booms. The key to this case is not in the Timmons model, but rather in the harvest strategy and the risk associated with it. Harvesting quickly (3-5 years) is certainly a good strategy, as they are riding two bubbles that are likely to burst, and thus their company’s value is likely to peak early on. The risk they face is not being purchased by one of the major players and instead being crushed. In order to reduce this risk, they must make their acquisition costsaving or even necessary for the giants. The primary cause of this risk is that their service is easily imitable, making their purchase unnecessary, and in order to mitigate this they must distinguish themselves using their competitive advantages to remain an attractive buyout target. Their business plan acknowledges this and lists some strategies that are spot-on, but I will not reprint them here, though I would advise them to take their own advice. Rather, I would like to suggest one critical measure of my own that they left out that would significantly reduce their risk, and that is to patent their idea. As it is today, the patenting of abstract software ideas such as “A system and method for transmitting and viewing financial information over the Internet” was very much legal, easy, and incredibly effective in ‘94, and would necessitate a buyout if any other firm wanted to imitate their technology. In summary, they have an excellent opportunity, and if I were them, I would patent my idea and aggressively follow the risk reduction plan they outlined, forcing a buyout from a major player early when our valuation has reached its peak.