Do Politics Shape Buyout Performance?

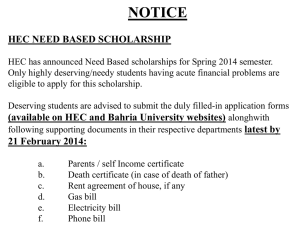

advertisement

Press release Published today in the HBR Do Politics Shape Buyout Performance? by Pr. Oliver Gottschalg and Pr. Aviad Pe’er Jouy-en-Josas, 24 October 2008 The paper “Do Politics Shape Buyout Performance? », published today in the Harvard Business Review, presents the conclusions of a study on 5,870 buyout investments between 1980 and 2003. Pr. Oliver Gottschalg, Assistant Professor of Strategy and Business Policy at HEC Paris and Pr. Aviad Pe’er, Assistant Professor of Management and Organizations at NewYork University’s Stern School of Business show that the activity and performance of Private Equity Firms is highly dependent on the political environment in which they operate. In the United States, a company headquartered in a right-wing ‘Republican’ (Red) state is 27% more likely to undergo a buyout than an otherwise identical company based in a left-wing ‘Democratic’ (Blue) state. Buyouts in Red states are also more successful – investors earn a 8% higher annual net return (IRR) from Red-State buyouts than from comparable Blue State investments. These findings are consistent with the assertion that a right-wing political leaning facilitates buyout value creation while a left-wing political leaning likely impedes it by increasing the costs associated with the mechanisms through which buyouts create value. These results are more relevant now than ever at this time of the presidential election in the United States and with the worldwide financial crisis which is likely to spur investment opportunities for buyout funds (e.g., Goldman Sachs Group, October 2008). The paper was presented at the Academy of Management annual conference, the Atlanta Competitive Advantage Conference and is also scheduled to be presented at the Strategic Management Society conference, and at the Israeli Strategy Conference. Professor Oliver Gottschalg is part of the Strategy Department at HEC Paris. He serves as Director of the Entrepreneurship Track in the HEC MBA program, co-directs the HEC-INSEAD Buyout Research Group and teaches courses on strategy, entrepreneurship, business plan design and management buyouts. His current research focuses on the strategic logic and the performance determinants of private equity investments. Press Contact, HEC Paris Elisabeth de Réals +33 1 39 67 94 23 +33 1 39 67 94 46 dereals@hec.fr www.hec.edu