Assign_2_Argentina

advertisement

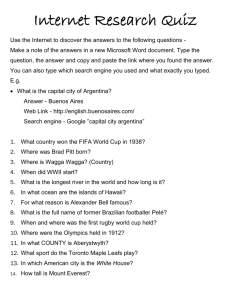

Assignment 2 Write a 1600-1900 word paper (with a much more strictly enforced word limit this time!), due electronically by 12:00 PM Friday the 14th, responding to the following statement: “Of the IMF, the international financial market, and the Argentine government, the Argentine government was least responsible for its default, and should not offer bondholders more than 30 cents on the dollar.” When responding to this remark, notice that it has two components: 1) it says that Argentina was not to blame for its economic crisis, and 2) it says that it should not offer more than 30 cents on the dollar. You have the benefit of hindsight, but I’d still like you to analyze both components of this comment. Keep in mind that when assessing who is to blame, I want you to focus on the economics that caused the default, not moral culpability or anything like that. For example, you might focus on the government’s dollar peg, the deficit spending, the continued loans by the IMF, the speculation of the bond market, the type of reforms pushed by the IMF, etc. You may also wish to consider whether a large haircut is in Argentina’s best long-term interest, and if a country cannot have exchange rate stability, monetary autonomy, and capital mobility simultaneously, which two they should prioritize. Once again, include an abstract (which will not count against your word limit), and focus on making your arguments as clear and concise as possible, because I anticipate that the word limit will be a real cap. Finally, focus on improving the errors that I commented on in your first paper, because that is where I will be focusing most of my attention when grading this paper. Good luck! The following articles recount the debt-restructuring plan that was recently accepted by the majority of Argentine bondholders and give an update on how Argentina is doing now. Short haircuts all round Nov 2nd 2004 From The Economist Global Agenda Argentina has unveiled a new offer to the creditors it stopped paying almost three years ago. Will this end the largest sovereign default in history? A HAIRCUT or a scalping? That is what Argentina’s disgruntled creditors are asking themselves after the country’s economy minister, Roberto Lavagna, unveiled his latest plan, on Monday November 1st, to restructure the $100 billion of sovereign bonds it no longer honours. Without an army to back them up, private lenders can never hope to make a sovereign defaulter repay in full. But the proportion of debt write-off, or “haircut”, they will grudgingly accept varies widely. Whether Argentina’s bondholders settle for Mr Lavagna’s latest scissor work may depend on who they are. Some are hardened Wall Street moneymovers who professed to know what they were doing when they bought in to Argentina’s supposed economic miracle in the 1990s. Others are Argentine pension funds trapped in the subsequent financial meltdown. Still others are retail investors— little guys in Japan, Germany and especially Italy—who believed what unscrupulous banks and brokers told them about where to put their nest-eggs. Mr Lavagna is hoping to divide and conquer his country’s assorted creditors by offering to swap their bonds for not one but three different types of securities. Small investors, whose plight attracts the most sympathy in Rome, Berlin and Tokyo, will be offered “par” bonds. Denominated in dollars, these will carry the same face value as the bad debts they replace, but will not mature until 2038, paying a miserable rate of interest in the meantime. Domestic pension funds and their ilk will swap their defunct dollar IOUs for a limited number of peso bonds, worth 30.1% less at face value, paying 3.31% interest, and maturing four decades hence. And Argentina’s biggest foreign creditors, for whom no one cries, will get so-called “discount” bonds. Discount is the operative word here: they will knock a whopping 66.3% off the face value of the bonds they replace, and will not mature for almost 30 years. To sweeten the deal, Mr Lavagna will acknowledge the $2.1 billion in interest that went unpaid before December 2001—but not the more than $20 billion of interest that has accumulated since. He will also backdate the new bonds to December 31st 2003, so that an interest payment of about $475m will fall due immediately. Mr Lavagna will also set aside extra money for bondholders if Argentina grows faster than 3% per year from now on. The true extent of the haircut may not be clear until the new bonds first come on the market. But they are unlikely to be worth much more than 30% of the original value of the bonds they replace. By comparison, Ecuador offered creditors between 33% and 62% after its default in October 1999. Even Russia offered 35% after its 1998 default. Could Argentina afford to pay more? J.P. Morgan, an investment bank, predicts that its economy will grow by 8% this year. The federal budget surplus, excluding interest payments, is likely to be 4.6% of GDP, and the central bank has accumulated more than $18 billion of foreign reserves. But almost half the population remains beneath the poverty line. The Global Committee of Argentina Bondholders, which claims to represent holders of a large chunk of Argentina’s outstanding debt, is convinced it could pay more. The deal is “far below the general consensus of what Argentina has the capacity to pay,” said Hans Humes, the committee's co-chairman. Disappointing these creditors remains politically popular in Argentina. But it is losing Argentina sympathy in the International Monetary Fund. Argentina owes the IMF $14.4 billion and is expected to repay it $5.5 billion (including interest) next year. In the past, the Fund has rolled over this debt, coming up with fresh loans with which Argentina can repay older ones. But, by its own rules, it can only lend to a country in default to other creditors if that country is renegotiating its debts in “good faith”. The Fund has refused to define what constitutes good faith. But Argentina has stretched the concept about as far as it can. In August, the Fund felt unable to approve a further loan to the country until it made better progress with its creditors. Any offer that remains unacceptable to more than, say, 30% of bondholders would surely also be unacceptable to the IMF. Thus Mr Lavagna will hope to win over as many creditors as he can, as cheaply as he can. He has found some canny ways to tempt them to settle. The more who accept, the more new securities he will issue, he says. In addition, he has cunningly blunted the incentive to hold out for a better deal in the courts, whether in the United States (where the new bonds will be issued), Italy (where seven lawsuits are currently underway), Germany (where 100 are) or Argentina itself. If a recalcitrant creditor wins a better deal in the courts, he says, Argentina will also offer a better deal to the bondholders who agree to his swap. This “favoured creditor clause”, as he calls it, creates a monumental free-rider problem for the bondholders. Those who accept Mr Lavagna’s debt swap will be spared the costs and risks of a court case, while still reaping the benefits of any successful legal challenge. But given that this is true, why should any bondholder bother to mount one? Could Mr Lavagna’s toughness and trickery set a precedent for other countries tempted to default on their debts? The markets thus far seem to be discounting the possibility, demanding only the narrowest of “spreads” (interest-rate premiums compared with the return on American Treasuries) on the bonds they buy from Argentina’s neighbours and peers. As commodity prices peak and interest rates rise, their complacency may be tested. Until then, Argentina’s example does not seem to have deterred new fools from rushing in. Besides, Argentina is a past master at bilking its creditors. In a recent IMF study, Kenneth Rogoff, Carmen Reinhart and Miguel Savastano estimate that it has spent more than a quarter of its history since 1824 either defaulting on its debt or restructuring it. The default at the end of 2001 followed those of 1989, 1982, 1890 and 1828. Each time investors returned, albeit at a price. Mr Lavagna will hope they display a similarly short memory this time. The world’s capital markets can be bitten more than once, it seems, before they turn shy. S&P raises debt rating as economy rebounds Strong economic growth and the elimination of international debt in Argentina prompted S&P to raise the nation's credit rating to five levels below investment grade. BY DANIEL HELFT AND ELIANA RASZEWSKI Bloomberg News Argentina's credit rating was raised for the second time in a year by Standard & Poor's, which cited falling debt levels and increased investment. New York-based S&P lifted the nation's long-term foreign currency debt rating to B, the same level as Uruguay and one step above Bolivia, from B- with a stable outlook. The rating is five levels below investment grade. The upgrade reinforces many investors' view that the economy has recovered in Argentina five years after the government defaulted on $95 billion of bonds, said Vitali Meschoulam, a fixed-income strategist at HSBC Securities USA in New York. On Wednesday Argentina sold dollar-denominated bonds to international banks for the second time since the default. The rating change is ''further confirmation that Argentina's economy is on the right track,'' Meschoulam said. Higher ratings in Argentina are emblematic of improved credit quality across Latin America as interest rates fall and international reserves climb on the back of record exports of such commodities as oil, copper and soybeans. Moody's Investors Service said this week it may lift the credit rating for Chile, ranked along with Mexico the highest in the region at Baa1. Last month, S&P raised Brazil's credit rating to BB, two levels below investment grade, from BB-. ''We have been watching a very positive economic cycle in the past two years and LatinAmerican countries have benefited from it,'' said Rafael Guedes, managing director of Fitch Ratings' Brazilian unit, in an interview in Sao Paulo. ``The countries took advantage of the increase in international trade with very adequate economic and fiscal policies.'' Brazil, where the inflation rate was as high as 4,900 percent in June 1994, may achieve investment grade by the middle of next year, Nelson Rocha Augusto, president of Rio de Janeiro-based BB DTVM, Latin America's largest asset manager, said in an interview. Brazil's annual inflation rate was 5.5 percent in February. Other investors and economists including Cristina Panait, an emerging-markets analyst at Los Angeles-based Payden & Rygel, say an investment grade rating for Brazil in the next two years is likely. Guedes said such predictions are optimistic. ''Brazil needs to grow and learn how to spend in a better way,'' he said. ``It's a dream to think about an investment grade without that.'' Argentina's credit ratings have climbed since the government completed a restructuring of defaulted debt in June last year. The country, whose 2001 debt default was the biggest ever by a sovereign borrower, recorded 9.1 percent economic growth last year. The economy has expanded more than 25 percent in the past three years. The country in December used about one third of its central bank reserves to pay off its entire debt with the International Monetary Fund, reducing its need to tap international credit markets. The extra yield investors demand to hold Argentina's dollar-denominated bond due 2033 instead of a comparable maturity U.S. Treasury has fallen to about 3.7 percentage points from 5.3 percentage points in December last year. Argentina on Wednesday priced $500 million of bonds to yield 8.36 percent, or 3.7 percentage points more than a U.S. Treasury of similar maturity. Brazil's 10 percent bond due 2011 yields 1.49 percentage points more than a U.S. Treasury of comparable maturity. S&P lifted Argentina's credit rating from selective default in June last year, when the government persuaded creditors holding $62.3 billion of defaulted bonds, or 76 percent of the country's $81.8 billion of defaulted principal, to accept new securities worth about 30 cents on the dollar. S&P said its decision to raise the rating was a result of the economic expansion and a reduction in government debt.