Coca-Cola mini-case

(Equity Method Investments)

The Coca-Cola Company (Coke) is the largest producer of bottled beverages in the

world, yet it does not own its bottling companies. Coca-Cola Enterprises (CCE) bottles,

distributes and markets the product it receives from Coke. It is owned 40% by Coke and

the remainder by outside parties. Since Coke is a minority active investor in CCE, it

accounts for this investment using the equity method.

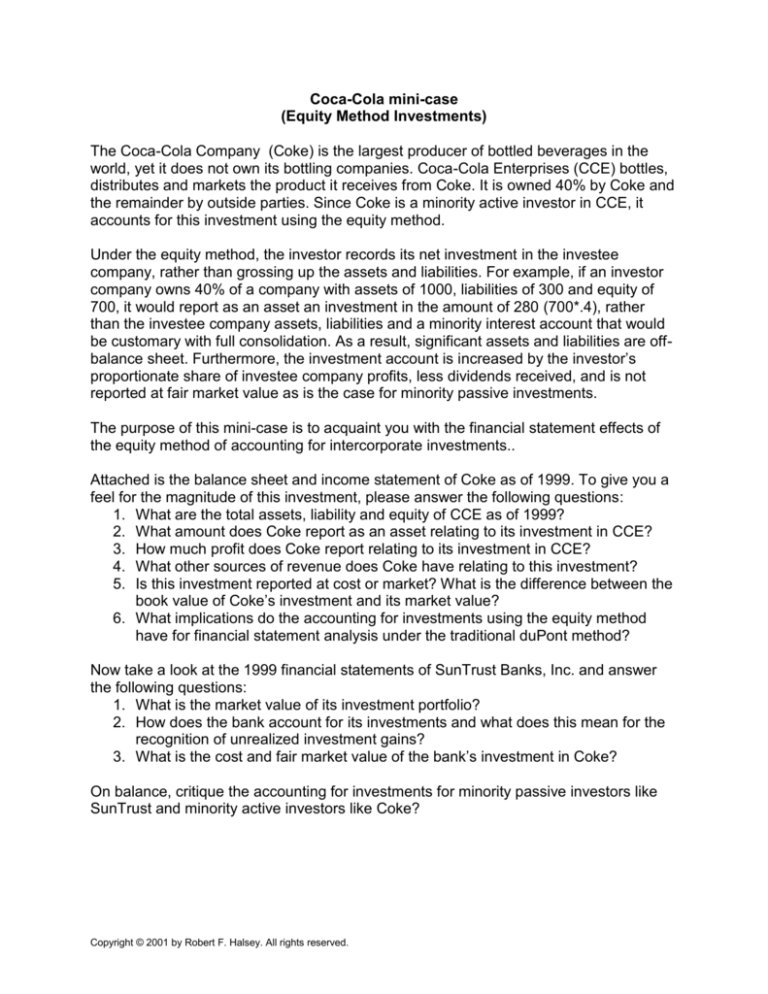

Under the equity method, the investor records its net investment in the investee

company, rather than grossing up the assets and liabilities. For example, if an investor

company owns 40% of a company with assets of 1000, liabilities of 300 and equity of

700, it would report as an asset an investment in the amount of 280 (700*.4), rather

than the investee company assets, liabilities and a minority interest account that would

be customary with full consolidation. As a result, significant assets and liabilities are offbalance sheet. Furthermore, the investment account is increased by the investor’s

proportionate share of investee company profits, less dividends received, and is not

reported at fair market value as is the case for minority passive investments.

The purpose of this mini-case is to acquaint you with the financial statement effects of

the equity method of accounting for intercorporate investments..

Attached is the balance sheet and income statement of Coke as of 1999. To give you a

feel for the magnitude of this investment, please answer the following questions:

1. What are the total assets, liability and equity of CCE as of 1999?

2. What amount does Coke report as an asset relating to its investment in CCE?

3. How much profit does Coke report relating to its investment in CCE?

4. What other sources of revenue does Coke have relating to this investment?

5. Is this investment reported at cost or market? What is the difference between the

book value of Coke’s investment and its market value?

6. What implications do the accounting for investments using the equity method

have for financial statement analysis under the traditional duPont method?

Now take a look at the 1999 financial statements of SunTrust Banks, Inc. and answer

the following questions:

1. What is the market value of its investment portfolio?

2. How does the bank account for its investments and what does this mean for the

recognition of unrealized investment gains?

3. What is the cost and fair market value of the bank’s investment in Coke?

On balance, critique the accounting for investments for minority passive investors like

SunTrust and minority active investors like Coke?

Copyright © 2001 by Robert F. Halsey. All rights reserved.

Coca-Cola 1999 Annual Report

Copyright © 2001 by Robert F. Halsey. All rights reserved.

Copyright © 2001 by Robert F. Halsey. All rights reserved.

Copyright © 2001 by Robert F. Halsey. All rights reserved.

Copyright © 2001 by Robert F. Halsey. All rights reserved.