Tel Aviv University

advertisement

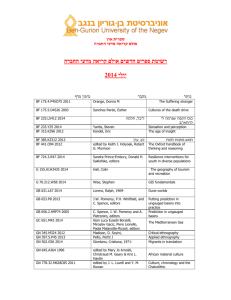

תואר שני – אופציות ומכשירים עתידיים2112.1133..1 Options and Futures ) תורת ההשקעות וניתוח ני"ע:(דרישות קדם סמסטר ב' – תשע"ו טלפון דואר אלקטרוני 20-6826044 kalay1@post.tau.ac.il מרצה תאריך בחינה אין בחינה פרופ' אבנר קלעי כיתה שעה קבוצה יום בשבוע 521 54.81-02.22 'ג 20 שעת קבלה – בתיאום מראש עוזר הוראה – יפורסם פירוט המטלות בקורס The course deals with the introduction and evaluation of options and future contracts. These financial instruments provide claims for future cash flows and are written on various underlying assets – from securities to bond portfolios. Financial theory has developed sophisticated evaluation tools for these instruments. The emphasis of the course will be on models based on elimination of arbitrage opportunities. We will present the various financial instruments, analyze the market structure in which they are traded and focus on some institutional considerations. Various investment strategies will be presented and the valuation of the different assets discussed. Innovative strategies such as the creation of a synthetic option by dynamic trading, portfolio insurance and index arbitrage are among the other course topics. Financial instruments traded in Israel and plans for creating new instruments will also be discussed. The relevant empirical evidence will be reviewed. This is an advanced course and as such it is assumed that the students will have taken an introductory options and futures course. דרישות הקורס A short empirical project, participation in five out of the six short tests (15 minutes each) that will be given throughout the course, and in a 25-minute examination that will test the student’s understanding of the Black and Scholes and the binomial option pricing model. מדיניות שמירה על טווח ציונים .החל משנה"ל תשס"ט מונהגת בפקולטה מדיניות שמירה על טווח ציונים בקורסי התואר השני ומדיניות השמירה על טווח הציונים תיושם לגבי הציון,עקרונות השיטה חלים על כל קורסי התואר השני . מידע נוסף בנושא זה מתפרסם בהרחבה באתר הפקולטה.הסופי בקורס זה http://recanati.tau.ac.il/masters/yedion/2015-16/mba-rules-tests 2 הערכת הקורס ע"י הסטודנטים בסיומו של הקורס הסטודנטים ישתתפו בסקר הוראה על מנת להסיק מסקנות לטובת צרכי הסטודנטים .והאוניברסיטה אתר הקורס , לפיכך מומלץ להתעדכן בו מדי שבוע,אתר הקורס יהווה המקום המרכזי בו ימסרו הודעות לסטודנטים .) (לצורך תיאום עינייני הבחינה למשל. ובכלל – גם בתום הסמסטר,לפני השיעור .שקפי הקורס יהיו באתר הקורס בכיתה ידונו גם נושאים (ובפרט דוגמאות) שאינם מופיעים בשקפים או מופיעים בכותרת- לתשומת לבכם . כל אלו הינם חלק בלתי נפרד מחומר הקורס.בלבד קריאת חובה The course is based primarily on the set of articles listed below. Almost all of the articles are available on the course site. The main course text is John C. Hull Options, Futures, and other Derivatives (henceforth OFOD) * תכנית הקורס I. A concise review of basic concepts The first lecture will cover a broad range of topics reviewing background material including: basic positions, complex strategies, early exercise considerations, put-call parity, the influence of the price of capital, division of the value of the option into its various components. Reading material: OFOD, ch.7-9; article by Merton [1]. II. The binomial model The single-period binomial model, investors’ preferences and the options model, cash and noncash options, the multi-period binomial model. Reading material: OFOD, ch.18; article by Cox, Ross and Rubinstein [2]. III. The Black and Scholes model The model’s assumptions, the continuous hedge concept, the relationship with the binomial model, sensitivity to various parameters and the economic intuition behind the formula. Reading material: Gibson, ch.4-5; article by Black and Scholes [3]. IV. The Black and Scholes model – the empirical evidence The explanatory and predictive power of the Black and Scholes model in the American market. Reading material: article by Macbeth and Merville. 3 Test No. 1: on the Macbeth and Merville [4] article. V. Warrants Warrants, capital structure and options, loans and options. Reading material: article by Emanuel [5]; article by Galai and Schneller [6]. Test No. 2: on the Galai and Schneller article. VI. The ex day of options This section covers a sophisticated trading strategy built around the behavior of options’ prices around the ex-dividend date. Reading material: articles by Kalay and Subrahmanyam [7], Jia, Kalay, and Mayhew [8]. Test No. 3: on the Jia, Kalay, and Mayhew article. VII. The Market Value of the right to vote Reading Material: Kalay, Karakas, and Punt article [16] Test No. 4: on the Kalay, Karakas, and Punt article VIII. Bonds and the option-pricing model The discussion will cover bonds, convertible bonds and the forced conversion strategy. Reading material: article by Ingersol [9]; article by Griener, Kalay and Kato [10]. Test No. 5: on the Griener, Kalay, and Kato paper. VIII. The options imbedded in future contracts The discussion will cover the relations between a future price and a future spot price, and the quality option implicit in the future contract. Reading material: article by Fisher Black [11]; article by Gay and Manaster [12]; article by Jarrow and Oldfield [13]. Test No.6: on the article of Gay and Manaster. Test No 7: The Black Scholes – binomial Test: testing the level of knowledge and understanding of the binomial model and the Black Scholes for determining option prices IX. Exotic Options Non-standard options of various forms are presented and analyzed. Among the financial instruments covered are: A range forward contract, Deferred payment option, Bermudan option, Chooser options, Barrier Options, Binary options, Lookback options, Shout options, and Asian option. Reading material: OFOD ch. 19. 4 List of Articles 1. MERTON, ROBERT C., 1973. “Theory of Rational Option Pricing,” The Bell Journal of Economics and Management Science, 4, pp. 141-83. 2. COX, ROSS AND RUBINSTEIN, 1979. “Option Pricing: A Simplified Approach,” Journal of Financial Economics. 3. BLACK FISHER AND MYRON SCHOLES, 1973. “The Pricing of Options and Corporate Liabilities,” Journal of Financial Economics, 81, pp. 637-54. 4. MACBETH AND MERVILLE, 1979. “An Empirical Investigation of the Black Scholes Call Option Pricing Model,” Journal of Finance, 34, pp. 1173-86. 5. EMANUEL D., 1983. Economics. “Warrant Valuation and Exercise Strategy,” Journal of Financial 6. GALAI AND SCHNELLER, 1978. “Pricing of Warrants and the Value of the Firm,” Journal of Finance. 7. KALAY AND SUBRAHMANYAM, 1984. “The Ex-Dividend Day Behavior of Option Prices,” Journal of Business. 8. JIA, KALAY, AND MAYHEW, 2010, “Ex-Dividend Arbitrage in the Option Markets” Review of Financial Studies 9. INGERSOL, 1977. Financial Economics. “A Contingent Claim Valuation of Convertible Securities,” Journal of 10. GRIENER D., KALAY A., and K. KATO, 2000. “The Market for Callable-Convertible Bonds.” Facific Basin Finance Journal. 11. BLACK FISHER, 1976. “The Pricing of Commodity Contracts,” Journal of Financial Economics, pp. 167-79. 12. GAY AND MANASTER, 1984. “The Quality Option Implicit in Future Contracts,” Journal of Financial Economics, 13, pp. 353. 13. JARROW A. and G. OLDFIELD, 1981, “Forward Contracts and Futures,” Journal of Financial Economics. 14. M. RUBINSTEIN, 1985. “Nonparametric Tests of Alternative Option Pricing Models Using all Reported Trades and Quotes on the 30 most active CBOE Options,” Journal of Finance. 15. SMITH, 1976. “Option Pricing: A Review”, Journal of Financial Economics, 3 pp. 3-51. 16. Kalay, A., Karakas, O., and Shagun Punt, 2014, “The Market Value of Corporate Votes: Theory and Evidence from Option Prices, Journal of Finance "