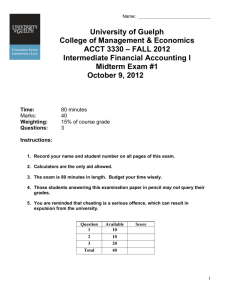

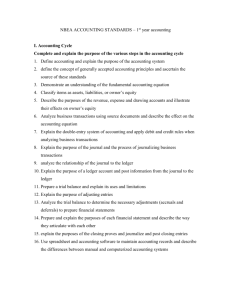

Chapter 10

advertisement