Practice Final 1 - The University of Texas at Dallas

1.

A firm has 800,000 shares outstanding at a market price of $120 a share. It wants to raise $10 million via a rights offering. The subscription price is $100 per share.

(10 points) a.

How many new shares will they issue? $10million/$100 = 100,000 b.

How many rights will be required to buy one share?

800,000 rights/100,000 new shares = 8 rights/share c.

At what price will the stock sell when it goes ex-rights?

New value = 800,000*$120+$10,000,000 = $106,000,000/900,000shares = $117.78 d.

What is the value of 1 right? $120-$117.78=$2.22

2.

A project has equipment cost of $210. It will have a life of 3 years. The cost will be depreciated straight-line to zero. The salvage value at the end of 3 years is $50.

Cash sales will be $200 per year and cash costs will run $120 per year. The firm will also need to invest $70 in net working capital at time 0. The appropriate discount rate is 8% (use for all flows), and the corporate tax rate is 40%. (15 points) a.

What is the value of the tax shield in each period from the investment in the project? T(D=.4*70=$28 b.

What are the operating cash flows in years 1, 2, and 3?

OCF=(200-120)(.6)+.4*70=$76 c.

What is the NPV? CF0=-210, CF1=76, CF2=76, CF3=76+30+70=176,

NPV=-$4.7574 d.

What is the IRR? (Estimate if you do not have a financial calculator.)

7.18%

3.

Oakdale Furniture Inc. has a beta coefficient of 0.7 and a required rate of return of

15 percent. The market risk premium is currently 5 percent. If Oakdale acquires new assets that increase its beta by 50 percent, what will be Oakdale’s new required rate of return? (5 points)

15%=Rf+0.7(5), Rf=11.5%, Rs = 11.5%+1.05(5) = 16.75%

4.

You are trying to assess the value of a small retail store that is up for sale. The store generated a cash flow to its owner of $100,000 last year and is expected to have growth of about 5% a year in perpetuity. (5 points) a.

If the rate of return required on this store is 10%, what would your assessment be of the value of the store?

PV=100,000(1.05)/(.1-.05)=$2,100,000

b.

What would the growth rate need to be to justify a price of $2.5 million for this store? $2,500,000=100,000(1+g)/(.10-g), g=5.77%

5.

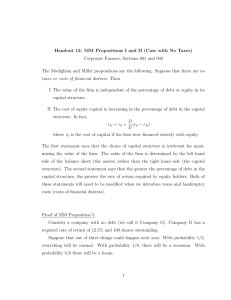

The Dinkins Corporation has an expected EBIT of $300,000 and a corporate tax rate of 40 percent. Dinkins uses $1 million of debt financing, and the cost of equity to an unlevered firm is 15%. The personal tax rates of Dinkins’ investors are 30% on debt and 20% on income from stocks. (15 points) a.

What is the value of the firm according to MM in a world with corporate taxes? (No personal taxes)?

Vu=300,000(1-.4)/.15=1,200,000; VL=1,200,000+.4(1,000,000)=1,600,000 b.

What is the firm's cost of equity if its debt cost is 10%? V=S+B, S=600,000

Rs=15%+1,000,000/600,000(15-10)(1-.4)=20% c. What is the firm's value in the Miller model (both corporate and personal taxes)?

VL=1,200,000+(1-(.6*.8)/.7)*1,000,000=1,514,285.71

6.

The current market rate of return is 12% and the risk-free rate is 4%. You have been given the job of determining your firm's cost of capital components. The company has 10 million shares outstanding with a current value of $25.00 per share. The debt represents 30% of the capital structure and the yield to maturity is

10%. The

of the equity is 1.4 and the tax rate is 30%. (15 points) a.

What is the firm's market value of the equity? 10 million*$25=$250,000 b.

What is the market value of the firm? .7V=250,000, V=357,142,857.14 c.

What is the market value of the debt? V=S+B, B=107,142,857.14 d.

What is the required rate of return on equity? Rs=4+1.4(12.4)=15.2% e.

What is the after tax cost of debt to the firm ? 10%(1-.3)=7% f.

What is the firm's WACC? RWACC=.3(7)+.7(15.2)=12.74%

7.

Trading Post has 220,000 shares outstanding with a par value of $1 per share and a market price of $12.00 per share. On the balance sheet, additional paid-in capital is $540,000, while retained earnings is $275,000. There is no treasury stock and there are no transactions costs. (15 points) a.

What is total owners’ equity for Trading Post?

220,000 + 540,000 + 275,000 = 1,035,000 b.

Suppose Trading Post declares a 10% stock dividend. What happens to the common stock (par value) account on the balance sheet?

There are now 242,000 shares at par value $1. Therefore the common stock account = $242,000. It went up by $22,000.

c.

Suppose Trading Post declares a 2-for-1 stock split. What happens to the common stock account on the balance sheet? Nothing d.

Suppose Trading Post declares a 10% stock dividend. What is the stock’s new price per share after the dividend?

Value of the firm = $12*220,000=2,640,000. There are 242,000 shares. Price per share

= 2,640,000/242,000 = $10.91. e.

Suppose Trading Post declares a 3-for-1 stock split. If you owned 750 shares before the split, how many do you own after the split?

750*3= 2,250 f.

Suppose Trading Post declares a 3-for-1 stock split. What is the market price of a share of the company’s stock after the split?

$12/3= $4.

8.

You are an investment advisor who has been approached by a client for help on his financial strategy. He has $250,000 in savings in the bank. He is 55 years old and expects to work for 10 more years, making $100,000 a year (end of year payments). (He expects to make a return of 7% on his investments for the foreseeable future. You can ignore taxes.) (10 points) a.

When he retires 10 years from now, he would like to be able to withdraw

$80,000 a year for the following 25 years. (The first withdrawal would be in 11 years.) How much would he need in the bank 10 years from now to be able to do this? PMT=$80,000, n=25, I=7%, PV = 932,286.65 b.

How much of his income would he need to save each year for the next 10 years to be able to afford these planned withdrawals ($80,000 a year) after the tenth year? FV 0f $250,000 = $491,787.84.

Need to save $932,286.65-$491,787.84 = $440,498.81 more.

FV = 440498.81, n=10, I=7%, PMT=? = 31,882.20

9.

You are interested in creating a portfolio of two stocks – Coca-Cola and Texas

Utilities. Over the last decade, an investment in Coca-Cola Stock would have earned an average annual return of 25%, with a standard deviation in returns of

36%. An investment in Texas Utilities stock would have earned an average annual return of 12%, with a standard deviation of 22%. The correlation in returns across the two stocks is 0.28. Assuming that the average and standard deviation, estimated using past returns, will continue to hold in the future, estimate the average returns and standard deviation of a portfolio composed 60% of Coca-Cola and 40% of Texas Utilities stock. (10 points)

.6(25)+.4(12) = 19.8% = E(R)

Use formula for the variance of a portfolio on page 262. Variance = 0.065,

Standard Deviation = 25.5%