PRICING DECISIONS

advertisement

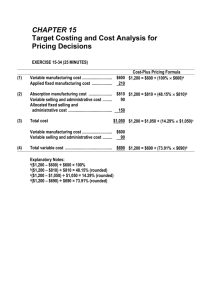

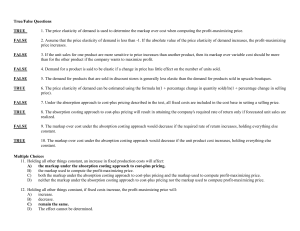

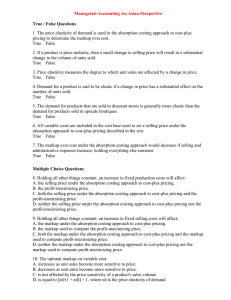

A-1 PRICING DECISIONS BACKGROUND • The price of a product or service should exceed its out-of-pocket costs, but by how much? • The dilemma is that price and unit sales move in opposite directions— the higher the price, the lower unit sales. • In most situations, the price should largely be a marketing decision that takes into account cost and the delicate balance between price and unit sales. • The cost-plus pricing formula is commonly used as a starting point in the pricing decision. COST-PLUS PRICING FORMULA Selling price = Cost + (Markup% × Cost) • What cost should be used? • What markup percentage should be used? A-2 THE ECONOMISTS’ APPROACH • The economists’ approach to cost-plus pricing is based on the price elasticity of demand. • A product whose unit sales volume is very sensitive to price is a product with elastic demand. • A product whose unit sales volume is not very sensitive to price is a product with inelastic demand. • The price elasticity of demand, d, for a product can be estimated with the following formula: d = ln(1+ % change in quantity sold) ln(1+ % change in price) EXAMPLE: The management of Roxy Entertainment International, a chain of theaters, is wondering how to price popcorn. Management experimented with the price of popcorn over the last two days with the following results: Price Unit Sales Day 1 ............................................................................ $1.19 24,000 tubs Day 2 ............................................................................ $1.29 21,600 tubs æ æ21,600-24,000 öö ÷ ÷ ÷ ln çç1+ çç ÷ ÷ ÷ ÷ ln (1+ (-0.1000 )) çè çè 24,000 øø d = = æ æ1.29-1.19 ö÷ ö ln (1+ (+0.0840 )) ÷ ln çç1+ çç ÷ ÷ ÷ çè çè 1.19 ÷ ø÷ ø = ln(0.9000) -0.10536 = = -1.306 0.08066 ln(1.0840) A-3 THE ECONOMISTS’ APPROACH (cont’d) • Assuming that all costs are either strictly variable or strictly fixed and that the price elasticity of demand is constant, the profit-maximizing price is given by the following formula: öVariable cost Profit-maximizing = æ çç ε d ÷ ÷ price çè1+ε d ÷ ø per unit EXAMPLE: The price elasticity of demand for popcorn, according to the computations above, is –1.306. Suppose the variable cost of a tub of popcorn is just $0.35. Then the profit-maximizing price for a tub of popcorn, according to this formula, is: æ -1.306 ö ÷ ÷ Profit maximizing price = ççç $0.35 = 4.268 × $0.35 = $1.49 ÷ ÷ èç1+(-1.306)ø This is equivalent to a 326.8% markup on variable cost. A-4 THE ECONOMISTS’ APPROACH (cont’d) • Summary of economists’ approach to cost-plus pricing: • The cost base is variable cost. • The markup depends only on the price elasticity of demand. The more elastic the demand (the more sensitive consumers are to price), the lower the markup. • The formula for the profit-maximizing price works if all costs are strictly variable or strictly fixed and the price elasticity of demand is constant for a given product. • Fixed costs play no role in pricing. Prices affect volume, which affect variable costs—not fixed costs. Therefore, fixed costs are irrelevant. A-5 THE ABSORPTION APPROACH • The absorption approach to cost-plus pricing: • The cost base consists of the product’s absorption costing unit product cost. • The markup must be high enough to cover selling, general, and administrative expenses and to provide for a profit. EXAMPLE: Aspen Company hopes to sell 20,000 units next year. Cost data concerning this product follow: Per Unit Total Direct materials.............................................................. $6 Direct labor.................................................................... $4 Variable manufacturing overhead .................................... $1 Fixed manufacturing overhead ........................................ $380,000 Variable SG&A expense .................................................. $4 Fixed SG&A expense ...................................................... $100,000 Assume that target selling prices are determined by adding a 40% markup to unit product cost. Compute the target selling price. Direct materials.............................................................. $ 6 Direct labor.................................................................... 4 Variable manufacturing overhead .................................... 1 Fixed manufacturing overhead* ...................................... 19 Unit product cost ........................................................... 30 Markup at 40% .............................................................. 12 Target selling price ......................................................... $42 * ($380,000 ÷ 20,000 unit) = $19 per unit A-6 THE MARKUP ON AN ABSORPTION BASIS • Why is the markup 40%? It could be: • an industry practice. • a time-honored rule of thumb in the company. • managers’ judgment of how much markup the market will bear. • the result of a markup computation. MARKUP COMPUTATION The markup on absorption costs, given the assumed unit sales volume, can be computed using the following formula. Markup % on absorption cost Required ROI + SG&A expenses ( × Investment ) = Unit sales × Unit product cost EXAMPLE: Suppose Aspen Company requires a 15% return on investment (ROI) and has invested $400,000 in the product. SG&A expenses are $180,000 ($4 per unit × 20,000 units + $100,000). Compute the markup %. Markup % on = (15% × $400,000) + $180,000 absorption cost 20,000 units × $30 per unit = $60,000 + $180,000 $600,000 = 40% A-7 VERIFICATION OF THE MARKUP Suppose 20,000 units are sold as planned at the price of $42 per unit. Income Statement Aspen Company Revenue ($42 per unit × 20,000 units) ........................... $840,000 COGS ($30 per unit × 20,000 units) ................................ 600,000 Gross margin ................................................................. 240,000 SG&A expenses ($4 × 20,000 + $100,000) ..................... 180,000 Net operating income ..................................................... $ 60,000 WEAKNESSES OF THE ABSORPTION APPROACH • Some sales volume must be assumed to compute the selling price and markup percentage, but in reality the sales volume depends on the selling price. • If the actual sales volume is less than assumed, the profit will be less than desired and a loss could occur. The protection provided by the markup is more illusory than real. • As unit sales volume drops, the unit production cost increases. Applying a preset markup to this higher unit production cost results in higher selling prices. This further depresses unit sales volume, which leads to an increase in selling prices, and so on. A-8 TARGET COSTING Some companies approach the pricing problem from an entirely different perspective when they develop new products. They use target costing. TRADITIONAL APPROACH The absorption costing approach to cost-plus pricing takes cost as given and marks it up. The company hopes consumers will be willing to pay the resulting price. TARGET COSTING APPROACH In the target costing approach, the selling price is taken as a given and the company strives to design and manufacture the product so that its cost is low enough to yield a satisfactory profit. Target costing is a market-driven approach that puts the emphasis on managing processes inside the company, rather than hoping that consumers will accept a price high enough to cover all of the costs the company has incurred. A-9 EXAMPLE: Kiromoto Ltd. is planning to launch a new CD-ROM player with advanced features. a) The marketing department believes that such a product should sell for about $95 and would have total annual sales of about 400,000 units. b) In order to design, develop, and produce this CD-ROM player, an investment of $10 million would be required. c) Due to the very short product lives of such products, the company requires a return on investment (ROI) of 40%. Compute the average target cost per player. Projected sales (400,000 players × $95 per player) ......... Less desired profit (40% × $10,000,000) ........................ Target cost for 400,000 players ...................................... Average target cost per player ($34,000,000 ÷ 400,000 players) ................................. $38,000,000 4,000,000 $34,000,000 $85 A-10 TIME AND MATERIAL PRICING Service organizations (repair shops, printing shops, attorneys, etc.) often use time and material pricing. Two pricing rates are established—one based on labor time and the other based on materials used. EXAMPLE: Speedy Appliance Repair incurs the following costs in a typical year: Service Parts Service employee wages ................................................ $260,000 Parts employee wages ................................................... $ 40,000 Shop supervision ........................................................... 36,000 Parts supervision ........................................................... 38,000 Fringe benefits............................................................... 59,000 15,000 Supplies ........................................................................ 6,000 2,000 Utilities .......................................................................... 12,000 5,000 Rent.............................................................................. 30,000 15,000 Depreciation .................................................................. 40,000 5,000 Other ............................................................................ 7,000 2,000 Total ............................................................................. $450,000 $122,000 The costs of parts used in repairs are billed directly to customers and are not included in the above table. A-11 Time Component The service personnel work a total of 15,000 billable hours in a typical year. Based on these data and a desired margin of $5 per billable hour, the labor time rate would be computed as follows: Service costs per billable hour ($450,000 ÷ 15,000 hours) .......................................... $30 Desired margin per billable hour ...................................... 5 Time component charge ................................................. $35 Thus, customers will be charged $35 per hour for service personnel time. Material Component The $122,000 cost of the parts department is recovered by marking up the invoice cost of parts ($305,000 per year). In addition, the company adds a 20% profit margin to the invoice cost. Charge for ordering, handling, and carrying parts ($122,000 ÷ $305,000) ....................................... 40% of invoice cost Desired profit margin on parts ........................................ 20% of invoice cost Material loading charge .................................................. 60% of invoice cost Thus, the amount charged for parts on a job will consist of the invoice cost of the parts plus a material loading charge equal to 60% of this cost. A-12 BILLING A JOB In billing a job, the time and material components are added together. Example: To complete the Speedy Appliance Repair example, assume that a repair job is completed that required 3 hours of labor time and $40 in parts. Time charge (3 hours × $35 per hour) ............................ $105 Materials charge: Invoice cost of parts .................................................... $40 Material loading charge ($40 × 60%) ........................... 24 64 Total price of the job ...................................................... $169 A-13 Other Pricing Procedures Not Covered in Text Breakeven Approach: Breakeven + Desired Profit Cost-Plus using variable costing Variable cost plus desired return