Transfer pricing (Ch.20)

advertisement

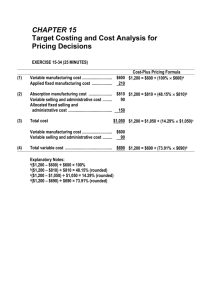

Transfer Pricing Intercompany fund flow mechanisms: costs and benefits. A multinational corporation unbundles its total flow of funds between each pair of subsidiaries into separate components associated with resources transferred as: i) products ii) capital iii) services iv) technology E.g. Dividends, interest and loan repayments capital invested as equity or debt Fees loyalties or corporate overhead corporate services, trademarks or licences. Different channels (for moving money and profits internationally). i) transfer pricing ii) fee and royalty adjustments iii) leading and lagging iv) intercompany loans v) Dividend-adjustment and investing in the form of debt vs equity. Tax factors: total tax payments on intercompany fund transfers depend on the tax regulation of both the host and recipient nations. Transfer Pricing Home and host country governments’ policing mechanisms to review transfer pricing policies (arm’s length pricing) Sec 482, US Revenue code. Each government normally presumes that MNCs use transfer pricing to the country’s detriment. Uses: 1) reducing taxes 2) reducing tariffs 3) avoiding exchange controls. 1) Reducing taxes: affiliates A & B A 100,000 CBs at $10/unit Transfer price B Sells them at $22/unit Unrelated customer (TP=$15) Low markup A Rev 1500 COGS 1000 Gross pft 500 Other exp 100 Inc. bef. tax 400 Tax (30%/50%) 420/360 Net Income 280 ($000) B 2200 1500 700 100 600 120 (TP= $18) High markup A 1800 1000 800 100 700 300 300 B 2200 2200 400 100 300 210 490 A+B 2200 1000 1200 200 1000 150 150 580/640 In effect, profits are being shifted from a higher to a lower tax jurisdiction. Objective : Minimize taxes. Basic thumb rule: 2) AB, tA, tB : marginal tax rates respectively. If tA tB set as low transfer price as possible. If tA tB set as high tranfer prices as possible. Reducing tariffs Tariffs complicate the decision rule. E.g. B pays ad valorem tariffs of 10% (import duties). (TP=$15) Low markup A Rev 1500 COGS 1000 Imp dty(10%) --Gross pft 500 Other exp 100 Inc. bef. tax 400 Tx(30%/50%) 120 Net Income 280 ($000) B 2200 1500 150 550 100 450 225 225 (TP= $18) High markup A 1800 1000 ---800 100 700 210 490 B 2200 2200 180 220 100 120 60 60 A+B 2200 1000 150 1050/1020 200 850/820 345/270 505/550 In general, the higher the ad valorem tariffs relative to the income tax differential, the more likely it is that a low transfer price is desirable. Costs (legal fess, executive times and penalties). If the transfer price is too high: tax authorities in B see revenues foregone. If the transfer price is too low: both governments may intervene. A’s government sees tax evasion; B’s government sees dumping. Arm’s length prices—3 principal methods 1) Comparable uncontrolled price method. 2) Resale price method 3) Cost-plus method 3 principal methods for establishing an arm’s length prices in order of their general acceptability to tax authorities are: 1. Comparable uncontrolled price method: --- prices used in comparable bona-fide transactions between enterprises that are independent of each other, or --- between the MNE groupand other unrelated parties. In principle, this method is the most appropriate to use; in theory it is the easiest. In practice, however, it may be difficult or impractical to apply. Comparability: adjustments can be made easily for freight and insurance but cannot be made accurate for trademarks. 2. Resale price method: --- reduce the price at which it is resold to an independent purchases by an appropriate markup (ie, an amount that covers the resellers’ costs and profit). This method is probably applicable to marketing operations. However, determining an appropriate markup can be difficult, esp when the reseller adds substantially to the value of the product. A B(reseller) third party 3. Cost-plus method: adds an app. Profit markup to the sellers’ cost to arrive an an arms-length price. Ths method is useful in specific situations, as when semifinished products are sold between related parties or one entity is essentially acting as a subcontractor for a related entity. Semifinished AB product (subcontractor) Practice by MNCs In light of section 482, and similar authority by most other nations, current practice by MNCs appears to be setting standard prices for standardized products. However, innovative nature of MNCs, trade between related parties in high-tech custommade components and subassemblies no comparable sales to unrelated buyers. As trade in intangible services becomes more important, monitoring transer pricing to shift their overall taxable income from one jurisdiction to another. One means of dealing with the US government’s crackdown on alleged transfer pricing abuses is greater reliance on advance pricing agreements (APAs). These agreements allow the MNC, the IRS and the foreign tax authority to work out, in advance, a method to calculate transfer prices. These agreements are expensive, they can take quite a long time to negotiate, and they involve a great deal of disclosure on the part of the MNC; but if a company wants assurance that its transfer pricing is in order, the APA is a useful tool. NOTE: 1. 2. Transfer pricing can be used to avoid currency controls. MNCs can use transfer pricing to increase their share of profits from joint ventures.