Report by the Secretariat

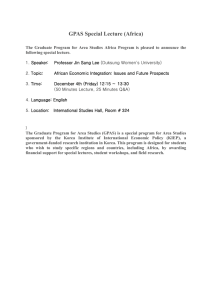

advertisement