Key - Penn State University

advertisement

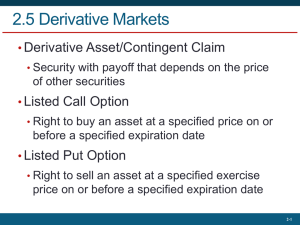

Exam #1 Econ 351 Spring 2015 Good Luck! Name ______________________________________ Last 4 PSU ID __________ Please put the first two letters of your last name on the top right hand corner of this cover sheet. Also, ONLY NON-PROGRAMMABLE CALCULATORS ARE ALLOWED - THERE ARE NO SUBSTITUTES. THANKS FOR YOUR COOPERATION! GOOD LUCK!!! 1 1. (30 points total) a) (10 points) The Table below is from January 31, 2015 so that these Jan 30 options have already expired. The ‘last’ column for all the 8 options is wrong. Please enter the correct last sale price to the left of the existing and wrong last sale price for all 8 options. b) (20 points total) We are going to evaluate two of the futures bets I made on Stock Trak using the boardofdart account.... I went short on Platinum and short on Feeder Cattle by selling March 2015 futures contracts. The pertinent information is below, please answer the following questions: (for full credit, please show all work). Prices in table were those that prevailed on Feb 3, when I made the bets. Contract # of Contracts Contract Size (each contract) Price Platinum Margin Requirement (each contract) $3,465 15 50 troy ounces Feeder cattle $2,025 10 50,000 lbs. $1,200 per troy ounce $ 2.00 per pound As of Friday, February 13, 2015, the (March) futures price of Platinum was $1,212 per troy ounce and the (March) futures price of feeder cattle was $2.04 per pound. I am closing both positions since my ‘fur is burning.’ (5 points) Considering the bet on Platinum, what is the $ value of each Platinum futures contract when I initially made the bet and what is the leverage ratio (please take the leverage ratio to three decimal spaces)? $ 60,000 (50 x $1,200) $60,000 / $3,465 = 17.315 b) (5 points) Calculate the rate of return when I close using the leverage ratio and the percent change in the price of platinum. What is my profit or loss? 17.315 x 1% = a minus 17.315 percent: a minus $8999.47 (LOSS) c) (5 points) Now consider the bet on feeder cattle. What is the $ value of each feeder cattle futures contract when I initially made the bet and what is the leverage ratio (please take the leverage ratio to three decimal spaces)? $100,000 $100,000 / $2,025 = 49.383 d) (5 points) Calculate the rate of return when I close using the leverage ratio and the percent change in the price of feeder cattle. What is my profit or loss? 2% x 49.383 = 98.766 2 2. Use the three tables below to answer the following questions Table 1 Table 2 3 Table 3 a) (5 points) Suppose we play a long straddle by purchasing one 535 call option and one 535 put option at Table 1 and close both positions on Table 2. Calculate the profit or loss AND rate of return. 1154 + 1198 = $ 2,352 close: 308 + 3017 = $3,325 profit = $973 return = 41.37% b) (5 points) Suppose instead that we waited and closed on Table 3, calculate the profit or loss and rate of return. How much money did we make (+) or lose (-) by waiting until Table 3 to close as compared to closing on Table 2. 1154 + 1198 = $ 2,352 close: 155 + 5 = $160 LOSS = $2,192 return = - 93.2% ......SAVED $3,165 c) (5 points) Suppose we play a strangle by buying a 545 call and a 525 put on Table 1 and close at Table 2. How much money did we make (+) or lose (-) by waiting until Table 3 to close as compared to closing on Table 2. 720 + 753 = $ 1,473 Close Table 2 $153 + $1,969 = $2,122 Profit = $649 Close Table 3 $3 + $1 = $4 Difference, I saved myself $2,118 d) (5 points) Name two reasons why each of the options (2 reasons for call and put) in the strangle above are so cheap on Table 3! Be very specific 1) both are way out of money - call $8.64 out of money, put is $11.36 out of money 2) very close to expiration, chances of getting in the money are extremely slim! e) (5 points) Suppose your friend plays a short straddle by writing one 535 call and writing one 535 put on Table 1 and closes on Table 3. How much does your friend make (+) or lose (-)? Does your answer relate to one of your answers above – why or why not? Explain. collects 1154 + 1198 = $2,352 closes: (buys back options) $155 + $5 = $160 Profit $2,192 Opposite of part b) above - this is a zero sum game. 4 f) (5 points) Suppose we gave your friend who played the short straddle a choice to close as above at Table 3 (choice 1) or to close at expiration assuming the spot price of Google remains as it is at Table 3 until expiration (choice 2). Compare the difference in losses or profits if they close at Table 3 vs. waiting until expiration (again, assume price is frozen until expiration as in Table 3). The call will expire $1.36 in money, put is out of money - collect the small term premium that is left ($155 - $136) = $19 from the call plus the $5 from the put = $24. Earn an extra $24 if I wait and collect the term premiums! g) (5 points) Considering your answer in part f), explain what would determine the magnitude of the difference between closing at Table 3 or waiting until expiration with the spot price frozen at Table 3. How close to expiration Table #3 is - the further from expiration, the more it pays to wait - collect larger term premiums. Also we have the volatility of the underlying stock - the more volatile, the higher the term premium, all else constant. 5 3) (40 points total) a) (20 points) We are now going to graph the profit functions for the long and short straddle as above where we opened up the positions at Table 1. We are only going to plot the profit / loss for both players for one point, let's call it point B, with the spot at expiration as it is in Table 2: spot = $510.66 (there are two points B's, one for player of short straddle and one for player of long straddle). Be sure to include the math as to how you calculated the payoffs for each player and prove that this is indeed a zero sum game! Be sure to label the break even points (there are two of them!). The math for Points B: player of long straddle buys both options....cost = $2,352. The '535' put is $24.34 in the money...exercises: buys low at spot (100 x 510.66 = $51,066) and sells high at STRIKE = $53,500......$ 2,434 - profit = ($2,434 $2,352) = $82. Player of short straddle collects $2,352 but has to honor the put they wrote...has to buy high at spot = (100 x 535) $53,500 and sell low at spot (100 x $510.66) = $51,066 - loses $2,434 - difference: Revenue = $2,352 minus $2,434 = - $82 (loss!) 6 b) (20 points) We are now going to graph the profit functions for the strangle for both the buyer and writer of the strangle above where both players opened up the positions at Table 1. We are only going to plot the profit / loss for both players for one point, let's call them points B, with the spot at expiration as it is in Table 2: spot = $510.66 (there are two points B's, one for buyer of the strangle and one for the writer of the strangle). Be sure to include the math as to how you calculated the payoffs for each player and prove that this is indeed a zero sum game! Be sure to label the break even points (there are two of them!). Math for point B: Buyer of strangle spends $1,473 on the options: the '525' Put is in money $ 14.34 - exercise = $1,434 - Buyer of strangle loses $39 ($1,434 - $1,473). Writer of strangle collects $1,473 - has to honor put buy buying 100 shares at $525 = $52,500 SELLS BACK AT SPOT = $51,066 , loses $1,434 on the put bet but collected $1,473 - profit = $39. 4. (25 points total) a) (5 points) Suppose you purchased the 540 put at Table 1 and close the position on Table 2. Calculate the profit/loss and rate of return (please show work). Buy = $1,410, Sell = $3,235 Profit = $1,825 Return $1,825/$1,410 = 129.4% b) (5 points) Plot the evolution of the premium of the 540 put that you purchased on Table 1 assuming that the spot price of Google is frozen as it is in Table 1. 7 c) (15 points) In the space below, graph the profit function of the 540 put that you purchased on Table 1 given the following three scenarios: Scenario 1): the option expires with the spot price of GOOG as it is on Table 1 and your position is closed. Locate this point on your diagram as point A, clear labeling the profit or loss associated with this scenario. Scenario 2): the option expires with the spot price of GOOG as it is on Table 2 and your position is closed. Locate the specific profit or loss on your diagram and label as point B. Scenario 3): the option expires with the spot price of GOOG as it is on Table 3 and your position is closed. Locate the specific profit or loss on your diagram and label as point C. 8 5. (30 points) Let’s pretend that you graduated in December of 2014 and you scored a job as chief financial officer for a golf resort in New York. Your ‘season’ ended in the fall and the person that you replaced 'parked' all the cash made during the 2014 golf season in ten year Government securities. In particular, they purchased 10 ten year Treasury contracts during the fall of 2014. The CEO, let's call her Betty, tells you that you need to use those 10 ten year Treasury contracts to pay taxes in April of this year (2014). a) (5 points) So Betty comes to you and tells you that she can't sleep because of this stress and asks you to buy insurance (make a hedge) against bad things happening (in terms of paying the tax bill). What are the bad things happening and how can you make the hedge? I am looking for 3 different hedges. Bad things would be low Treasury prices in March/April so that you wouldn't be able to pay tax bill! The three different hedges are below!! Sell futures, buy FO puts, write FO calls. So here we are in the January of 2015 and you are considering three different hedges: Scenario #1: You sell 10 March futures contracts for 132 and the price at expiration is 135. Scenario #2: You buy 10 March futures option puts with a strike price at 132 for a price of $3,000 per put and the price at expiration is 135. Scenario #3: You write 10 March futures option calls with a strike price of 132 for a price of $3,000 per call and the price at expiration is 135. b) (10 points) Compare the revenue obtained to pay the tax bill under each scenario and rank them accordingly from highest to lowest. Please show all work. #1 Revenue: $1.32 million TIED FOR SECOND #2 Cost: $30K – RIP UP PUT…SELL AT SPOT = $1.35 million – Revenue = $ 1.32 million TIED FOR SECOND #3 Collect Premium = $30 K….. SELL AT STRIKE TO OWNER OF CALL = $1.32 million.. Revenue = $1.35 million BEST c) (15 points) Given that these March futures contracts expire at 135, please draw your profit functions for each of the three scenarios above. In particular, draw the futures profit function, the futures option puts profit function and the profit function for writing the calls all on the same diagram. Be sure to label each profit function and label as points 1, 2, and 3 to coincide with each scenario. Be sure to label all the break even points. 9 10 6. (30 points) So the next day, Betty comes to you and tells you that she plans to do some renovations to the resort next winter (in December 2015) and wants to do some more hedging since she really trusts you and your excellent education at Penn State University. The resort makes some serious cash beginning in May and ending in early September. She wants you to 'park' half of the seasons money in Treasuries by buying 10 June Treasury contracts and then wants you to sell these Treasuries in December to pay for the renovations. So it is Jan 2015 and you need to do some more hedging by playing the futures market. a) (5 points) What is your natural position in June and how could you hedge against bad things happening? Name the three hedges and make sure you explain what we mean by 'bad things happening.' Natural position is short, hedge against high prices by buying futures, buying FO calls, or writing FO puts. Bad things happening means that our cash will buy less Treasuries (high Treasury prices) not more as in lower Treasury prices. The June hedge - consider the following 3 scenarios So it is still in January of 2015 and there are futures options, both calls and puts available with a strike price of 123 for $3,000 each. Consider the following 3 scenarios. Scenario #1: You buy 10 June futures contracts for 123 and the price at expiration is 127. Scenario #2: You buy 10 June futures option calls with a strike price at 123 for a price of $3,000 per call and the price at expiration is 127. Scenario #3: You write 10 June futures option puts with a strike price of 123 for a price of $3,000 per put and the price at expiration is 127. b) (10 points) Compare the costs of acquiring the 10 Treasury contracts in June for each scenario and rank them accordingly from lowest cost to highest cost. Please show all work. #1: Cost: $1.23 million BEST #2: Cost: $30K EXERCISE CALL BUY @ STRIKE $1.23 million… TOTAL COST = $1.26 million #3: Collect premium = $30K … BUY HIGH AT SPOT (PUT IS OUT OF MONEY) $1.27 million - $30K = $1.24 million 11 c) (15 points) Given that these June futures contracts expire at 127, please draw your profit functions for each of the three scenarios above. In particular, draw the futures profit function, the futures option calls profit function and the profit function for writing the puts all on the same diagram. Be sure to label each profit function and label as points 1, 2, and 3 to coincide with each scenario. Be sure to label all the break even points. 12 7. (50 points total) Now on to the December Hedges: a) (5 points) What is your natural position in December and how could you hedge against bad things happening? Name the three hedges and make sure you explain what we mean by 'bad things happening.' Natural position is long, hedge short....sell futures, buy FO puts, write FO calls - bad things are low Treasury prices, can't buy equipment that we want and no Holiday bonus! :( Scenario #1: You sell 10 December futures contracts for 125 and the price at expiration is 128. Scenario #2: You buy 10 December futures option puts with a strike price at 125 for a price of $3,000 per put and the price at expiration is 128. Scenario #3: You write 10 December futures option calls with a strike price of 125 for a price of $3,000 per call and the price at expiration is 128. b) (10 points) Compare the revenue obtained to pay for the new equipment under each scenario and rank them accordingly from highest to lowest. Please show all work. #1: $1.25 Million #2: - $30 K PUT IS OUT OF MONEY – SELL HIGH AT SPOT = $1.28 million Total Revenue = $1.25 milliom #3: Collect $30K - CALL IS IN MONEY – SELL LOW AT STRIKE = $125 K TOTAL REVENUE = $1.28 million BEST c) (15 points) Given that these December futures contracts expire at 128, please draw your profit functions for each of the three scenarios above. In particular, draw the futures profit function, the futures option puts profit function and the profit function for writing the calls all on the same diagram. Be sure to label each profit function and label as points 1, 2, and 3 to coincide with each scenario. Be sure to label all the break even points. 13 d) (10 points) So let us pretend your are at the paving company's Holiday party in December of 2015 and the CEO, Lee, wants to give you a Holiday bonus. Lee gives you an envelope and tells you that he decided to give you 20% of the money you saved the paving company given all the hedging. We assume, importantly, that you had a crystal ball the whole time and played the best hedge for each of the three hedges (March, June and December). Compare the total revenue left for buying the equipment assuming you played the best hedge to the total revenue that you would have left for the new equipment if you went naked and didn't hedge at all. How much is the check for or is the envelope empty? Please show all work. BEST HEDGES MARCH: 1.35 million (revenue) JUNE: 1.23 million (costs) MARCH: 1.28 million (revenue) TOTAL TO BUY EQUIPMENT: $1.4 million NAKED MARCH: 1.35 million (revenue) JUNE: 1.27 million (costs) MARCH: 1.28 million (revenue) TOTAL TO BUY EQUIPMENT: $1.36 million SAVED FIRM $40,000.......20% OF $40K = CHECK FOR $8,000 14