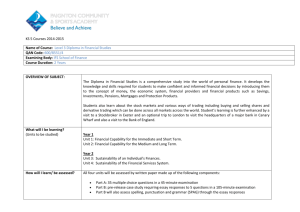

POSTGRADUATE DIPLOMA IN MARKETING AND MANAGEMENT

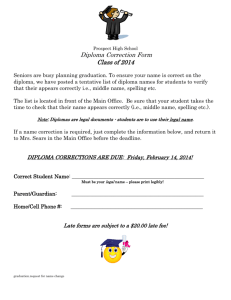

advertisement