Financial Planning Problems: Stock Investments

advertisement

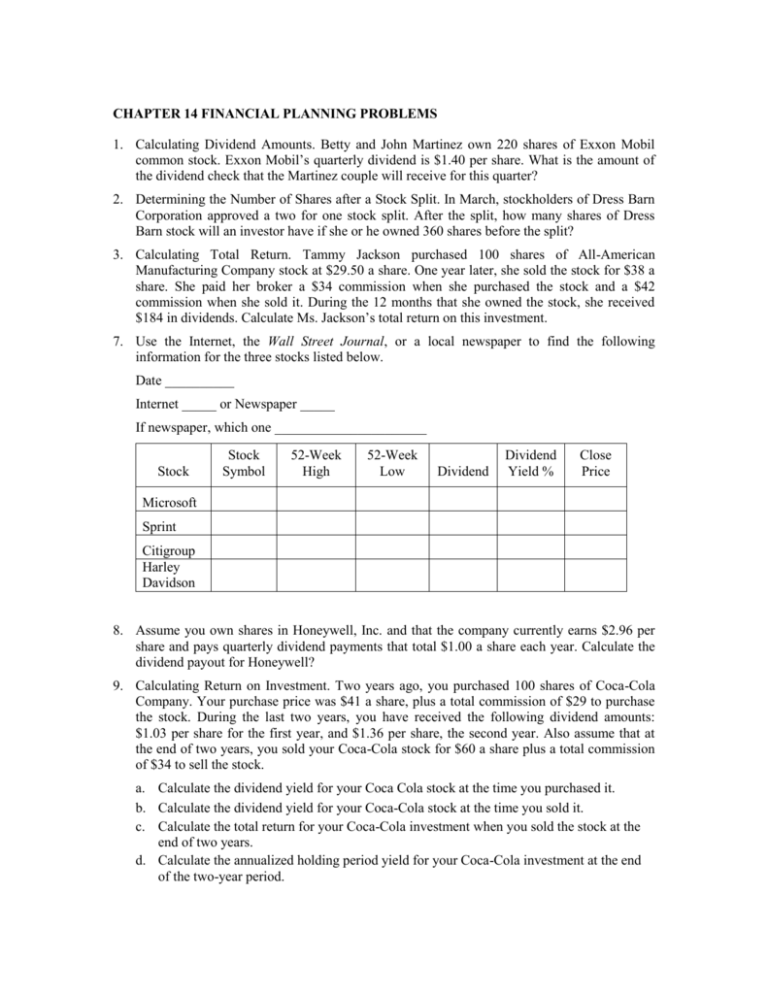

CHAPTER 14 FINANCIAL PLANNING PROBLEMS 1. Calculating Dividend Amounts. Betty and John Martinez own 220 shares of Exxon Mobil common stock. Exxon Mobil’s quarterly dividend is $1.40 per share. What is the amount of the dividend check that the Martinez couple will receive for this quarter? 2. Determining the Number of Shares after a Stock Split. In March, stockholders of Dress Barn Corporation approved a two for one stock split. After the split, how many shares of Dress Barn stock will an investor have if she or he owned 360 shares before the split? 3. Calculating Total Return. Tammy Jackson purchased 100 shares of All-American Manufacturing Company stock at $29.50 a share. One year later, she sold the stock for $38 a share. She paid her broker a $34 commission when she purchased the stock and a $42 commission when she sold it. During the 12 months that she owned the stock, she received $184 in dividends. Calculate Ms. Jackson’s total return on this investment. 7. Use the Internet, the Wall Street Journal, or a local newspaper to find the following information for the three stocks listed below. Date __________ Internet _____ or Newspaper _____ If newspaper, which one ______________________ Stock Stock Symbol 52-Week High 52-Week Low Dividend Dividend Yield % Close Price Microsoft Sprint Citigroup Harley Davidson 8. Assume you own shares in Honeywell, Inc. and that the company currently earns $2.96 per share and pays quarterly dividend payments that total $1.00 a share each year. Calculate the dividend payout for Honeywell? 9. Calculating Return on Investment. Two years ago, you purchased 100 shares of Coca-Cola Company. Your purchase price was $41 a share, plus a total commission of $29 to purchase the stock. During the last two years, you have received the following dividend amounts: $1.03 per share for the first year, and $1.36 per share, the second year. Also assume that at the end of two years, you sold your Coca-Cola stock for $60 a share plus a total commission of $34 to sell the stock. a. Calculate the dividend yield for your Coca Cola stock at the time you purchased it. b. Calculate the dividend yield for your Coca-Cola stock at the time you sold it. c. Calculate the total return for your Coca-Cola investment when you sold the stock at the end of two years. d. Calculate the annualized holding period yield for your Coca-Cola investment at the end of the two-year period. 10. Calculating Earnings Per Share, Price-Earnings Ratio, and Book Value. As a stockholder in Bozo Oil Company, you receive its annual report. In the financial statements, the firm has reported assets of $9 million, liabilities of $5 million, after-tax earnings of $2 million, and 750,000 outstanding shares of common stock. a. Calculate the earnings per share of Bozo Oil’s common stock. b. Assuming that a share of Bozo Oil’s common stock has a market value of $40, what is the firm’s price-earnings ratio? c. Calculate the book value of a share of Bozo Oil’s common stock. (p. 461) 12. Using Dollar Cost Averaging. For four years, Mary Nations invested $3,000 each year in America Bank stock. In 2004, the stock was selling for $34. In 2005, the stock was selling for $48. In 2006, the stock was selling for $37. In 2007, the stock was selling for $52. a. What is Ms. Nations’s total investment in America Bank? b. After four years, how many shares does Ms. Nations own? . 2004 2005 2006 2007 Total Shares c. What is the average cost per share of Ms. Nations’s investment?