PAYE - Final Report

advertisement

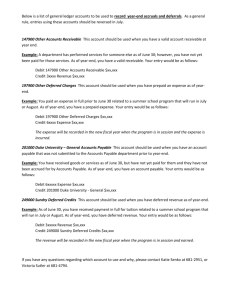

Audit of Payables at Year-End March 18, 2010 Final Report Audit of Payables at Year-End March 18, 2010 Final Report Audit Key Steps Planning completed Engagement start date Field work completed Exit conference Draft audit report completed Report sent for management response Management response received Final report completed Tabling of report to the External Audit Advisory Committee Approved by the Deputy Minister March 2009 April 2009 September 2009 November 2009 November 2009 November 2009 N/A January 2010 March 18, 2010 March 18, 2010 Acronyms EC DAO FAA PAYE TBS Environment Canada Departmental Accounting Office Financial Administration Act Payable at year end Treasury Board Secretariat Prepared by the Audit and Evaluation Team Acknowledgments The audit team responsible for this project, comprised of Nelson Jones, Audit Consultant, Lise Gravel, Auditor and Stella-Line Cousineau, Audit Manager under the direction of Jean Leclerc, would like to thank those individuals who contributed to this project and, particularly, employees who provided insights and comments as part of this audit. Original signed by __________________ Chief Audit Executive Table of Contents EXECUTIVE SUMMARY ................................................................................................. v 1 INTRODUCTION.......................................................................................................... 1 1.1 Background ..................................................................................................... 1 1.2 Project Significance ......................................................................................... 1 1.3 Objective(s) and Scope.................................................................................... 2 1.4 Methodology .................................................................................................... 2 1.5 Statement of Assurance .................................................................................. 4 2. FINDINGS ............................................................................................................... 4 2.1 Payable at Year-End Internal Control System .................................................. 4 2.2 Testing – Payable at Year-End Transactions ................................................... 5 2.3 Prepayment of Contracts ................................................................................. 7 3 CONCLUSION ........................................................................................................ 7 Annex 1 Audit Criteria Year-End Payable Transaction Testing ........................................ 8 Annex 2 List of Background Information and Supporting Documentation ........................ 9 Environment Canada iii Audit of Payables at Year-end EXECUTIVE SUMMARY This audit was included in Environment Canada’s Risk-Based Audit and Evaluation Plan 2008-2011, approved by the Deputy Minister. Environment Canada’s Corporate Accounting Division is responsible for establishing year-end timetable and procedures and assisting the Department to be in compliance with the Treasury Board Policy on Payables at Year-End. They are also responsible for summarizing year-end requirements that departmental accounting offices must comply with in order for the Department to meet its year-end obligations to central agencies; specifically, Public Works Government Services Canada, Receiver General for Canada1 and the Treasury Board of Canada Secretariat. The purpose of establishing payables at year-end is to ensure that liabilities existing at the fiscal year-end for work performed, goods received, and services rendered, transfer payment and other items are recorded in the accounts and financial statements of Canada in the correct fiscal year. Payables at year-end are set up when payments for old year goods/services cannot be made by the required cut off date. The audit objectives were to provide assurance that the Department is in compliance with the Treasury Board of Canada Secretariat Policy of Accounts Payable at Year-End by verifying that the liabilities existing at year-end are recorded accurately in the accounts; and that there are no material errors in the recording of contractual payments at year-end. A total of $60M in payable at year end was created for fiscal year 2008-09. This included payment to external suppliers ($32.6 M), interdepartmental settlements to other government departments ($10.7 M) and salary transactions ($17 M). The testing included 134 transactions specific to external suppliers and interdepartmental settlements for a total of $1,591 M. Statement of Assurance This audit has been conducted in accordance with the International Standards for the Professional Practice of Internal Auditing and the Policy on Internal Audit of the Treasury Board of Canada. In our professional judgement, sufficient and appropriate audit procedures have been conducted and evidence gathered to support the accuracy of the conclusions reached and contained in this report. The conclusions were based on a comparison of the situations, as they existed as the time, against the audit criteria. 1 Receiver General Manual, Chapter 14 Environment Canada v Audit of Payables at Year-end Summary of Findings and Conclusions The audit concluded that overall, the Department is compliant with the requirements of the Treasury Board Secretariat of Canada Policy on Payables at Year-End and Environment Canada procedures. The audit also revealed that Environment Canada’s internal control system to set up payable at year end is documented and communicated. It should be noted that results were not sufficient to support an audit opinion of payables at year-end for the purposes of audited financial statements. In addition, the testing did not reveal material errors in the recording of contractual payments at year-end. No recommendations are included in this audit report. Environment Canada vi Audit of Payables at Year-end 1. INTRODUCTION This audit was included in Environment Canada’s Risk-Based Audit and Evaluation Plan 2008-2011, approved by the Deputy Minister. 1.1 Background Section 37 of the Financial Administration Act (FAA) requires all departments and agencies to record as a charge against the appropriation to which it relates, work performed, goods received or services rendered before the end of a fiscal year. The Treasury Board Policy on Payables at Year-End requires that all expenditures be recorded in the fiscal year during which the goods or services have been received but for which payment has not been made. In some cases, an exact liability will not be known since an invoice from the supplier will not have been received; the policy permits the use of estimates in those circumstances. Old year goods and services paid for in the new fiscal year must be charged against specific payables at year-end coding supplied by Finance Corporate Services Branch and not recorded as a charge against the new-year’s appropriation. Environment Canada’s Corporate Accounting Division is responsible for establishing year-end timetable and procedures and assisting the Department to be in compliance with the Treasury Board Policy on Payables at Year-End. They are also responsible for summarizing year-end requirements that departmental accounting offices must comply with in order for the Department to meet its year-end obligations to central agencies; specifically, Public Works Government Services Canada, Receiver General for Canada2 and the Treasury Board of Canada Secretariat. A total of $60M in payable at year end was created for fiscal year 2008-09. This included payment to external suppliers ($32.6 M), interdepartmental settlements to other government departments ($10.7 M) and salary transactions ($17 M). 1.2 Project Significance In 2004, Treasury Board of Canada Secretariat required departments and agencies to conduct assessments of their readiness to completely adopt full accrual accounting practices and be ready to withstand the rigor of an audit of their financial statements. In November 2007, Environment Canada hired Ernst & Young to conduct the assessment on the Department’s behalf. The assessment found that there were deficiencies in a number of areas which included the financial statement preparation and 2 Receiver General Manual, Chapter 14 Environment Canada 1 Audit of Payables at Year-end transactional processes3. More specifically, control deficiencies in the procurement and accounts payable processes primarily in the year-end accrual estimation and related cutoff procedures were identified. Through internal consultation, as part of the Annual Risk-Based Audit and Evaluation Plan, additional elements that could possibly impact the level of risk associated with year-end expenditures were highlighted, as follows: the process for establishing payables at year-end is not automated; there is a high level of transactions in a short period of time; there is a risk that payables at year-end are not adequately supported by documentation. In 2003/2004 and in 2004/2005, Internal Audit completed two audits of the accounts payable process in use at Environment Canada. The results of these audits found that there were no control deficiencies, however a number of recommendations dealing with internal procedures were made and have been fully implemented. Notwithstanding those two audits, there has been no audit in the last ten years that assessed and reported on the Department’s payable at year-end process. Therefore, this audit focused on the establishment of payables at year end only for fiscal year 2008-2009. 1.3 Objective(s) and Scope The audit objectives were to provide assurance that the Department is in compliance with the Treasury Board Secretariat Policy on Payables at Year-End by verifying that the liabilities existing at the fiscal year-end are recorded accurately in the accounts; and that there are no material errors in the recording of contractual payments at year-end. In Scope The audit included payable at year end transactions relating to regular payments to external suppliers ($32.6 M) and interdepartmental settlements to other government departments ($10.7 M). Payable at year end transactions from all regions were covered in the scope of the audit. The testing included a total of 134 transactions for a value of $1.591 M (3.7%). Out of Scope Salary Management System transactions ($17 M) were scoped-out because the system to establish payables at year-end is completely automated and leaves very little room for error. Receivable transactions were also excluded because these were covered in the Audit of Accounts Receivable conducted by Internal Audit in fiscal year 2008-2009. 1.4 Methodology The audit was conducted in accordance with Generally Accepted Accounting Principles (GAAP), the International Standards for the Professional Practice of Internal Auditing 3 Ernst & Young, Environment Canada, Audit Readiness Assessment-Phase One, Section II, Financial Statement Processes and Transactional Controls. Environment Canada 2 Audit of Payables at Year-end and the Treasury Board Policy on Internal Audit. The audit involved an examination of background information, interviews and year-end transaction testing. The audit methodology included: Examination of Documentation Treasury Board and departmental policies, procedures and guidelines were reviewed to determine what tools are available and/or used to manage year-end transactions. A list of documents examined during the audit is attached in Annex 2. Sampling & Testing The testing of the transactions was conducted in three parts: 1) A judgmental sample of twenty (20) payable at year-end transactions totaling $321,372.00 was selected from the department’s financial system’s data base. The selection was based on high risk transaction types as identified in the Department's Statistical Payment Sampling Policy. This test was conducted to determine whether the payments were properly supported and recorded as payable-at year-end expenses, and to determine if the goods were received and/or services rendered prior to fiscal year-end. 2) A random sample of fifty-three (53) contracts totaling $502,519.00 was selected from the financial system’s data base. The sample only included contracts issued during the months of February and March with an end-date of no later than March 31, 2009. This test was conducted to ensure that goods and services were in fact received prior to March 31. 3) A judgmental sample of sixty-one (61) contracts totaling $767,846.21 was selected from the financial system’s data base. The sample was filtered to include contracts with a value of over $5K4 and a contract end date in the new fiscal year. This test was conducted to determine if any contracts ending in the new fiscal year were being paid out of the old fiscal year budget. Evidence gathered to support the testing included but was not limited to documentation such as, contract deliverable information, purchase orders, invoices, proof of delivery, payable at year-end spreadsheets, etc. The evidence obtained was provided by departmental accounting officers and program managers. Annex 1 provides detailed audit criteria for each phase of testing. Interviews The audit team interviewed employees in the Corporate Accounting office to obtain a better understanding of their business processes. In addition, departmental accounting officers provided information regarding their internal processes. 4Liabilities to be charged to an appropriation must be accrued if they exceed the lesser of $5,000 or one-half of one percent of the appropriation authority. Lesser amounts may be accrued at the discretion of each department. (reference Treasury Board Secretariat of Canada Payable at year-end Policy) Environment Canada 3 Audit of Payables at Year-end Data Source The payable at year-end data was obtained from the National Payable at Year-End Report created from the departmental financial reporting system (Discoverer) as at April 24th, 2009. 1.5 Statement of Assurance This audit has been conducted in accordance with the International Standards for the Professional Practice of Internal Auditing and the Policy on Internal Audit of the Treasury Board of Canada. In our professional judgement, sufficient and appropriate audit procedures have been conducted and evidence gathered to support the accuracy of the conclusions reached and contained in this report. The conclusions were based on a comparison of the situations, as they existed at the time, against the audit criteria. 2. FINDINGS Recently introduced changes to legislation governing the Proactive Disclosure of Contracts to include the disclosure of amendments effective as of April 1st, 2009, has led to a review of the Department’s Payable at Year-end (PAYE) procedures. As a result, significant changes occurred this year in the way of creating payables at year-end, such as the requirement to create them from the accounts payable module instead of the general ledger module. As well, tighter timelines to provide payable at year-end information were implemented. This approach was developed in consultation with other departments to determine the most effective means of processing PAYEs which relate to procurement contracts. In addition to ensuring Proactive Disclosure compliance, the new approach will have numerous benefits including: reduced requirement for year end decommitment of contracts related to PAYE's, purchase orders matching to appropriate financial code, better tracking and accounting of assets, and better internal controls for accrual balances. 2.1 Payable at Year-End Internal Control System The Treasury Board Policy on Internal Controls requires the Department to ensure the establishment, maintenance, monitoring and reviewing of internal controls to mitigate risks relating to the reliability of financial reporting. Proper recording of financial transactions permits the preparation of internal and external financial information, reports and statements in accordance with policies, directives and standards. Environment Canada 4 Audit of Payables at Year-end The Department’s Finance and Corporate Services Branch is centralized and has Departmental Accounting Offices located in each region, herein after referred to as DAOs. Finance Corporate Accounting Division is responsible for producing, publishing and interpreting year-end timetable and procedures, as well as assisting departmental accounting offices (DAOs) in all requests pertaining to year-end. Corporate Accounting is also responsible for ensuring that the Department meets all requirements indicated in Chapter 14 of the Receiver General Manual. These instructions are posted on the Finance Intranet web page and updated as required. Departmental accounting offices are responsible for implementing the payable at yearend procedures in their respective regions and services. While, instructions sent to program managers are slightly different from one region to the other; the principles and timelines are very similar across the Department and respect the Treasury Board Policy on Payables at Year-End requirements and the instructions from the Corporate Accounting Division. Treasury Board Policy on Payable at year end stipulates that “Section 33 (FAA) certification of requisitioning authority is required when the debt is charged against the appropriation and again when the debt is settled. This permits financial officers to review the legality of the transaction and to exercise the appropriate controls in both instances”. Furthermore, the policy stipulates that “Section 34 (FAA) certification for performance or compliance with contract is required at the time the appropriation is charged” At Environment Canada, program managers are required to record and identify year end liabilities on a “Payable at Year-End Form” or listing. In order to validate the accuracy and integrity of PAYE, all forms require Section 34 certification by the program managers along with back up information. These are then submitted to the responsible departmental accounting office for processing where section 33 is performed. While there are no formal procedures that provide specific monitoring instructions for the departmental accounting officers, all have implemented some type of monitoring such as, following-up with program managers, reviewing and updating outstanding payable at year-end transactions either on a monthly basis and/or as transactions are received. Furthermore, Corporate Accounting Division holds a formal follow-up exercise on all outstanding payables at year end in the fall, as departments are required to submit to the Receiver General preliminary representations by Period 9. 2.2 Testing – Payable at Year-End Transactions Payable at year-end transactions are created for expenses that are incurred prior to year-end, but the payment cannot be processed. In some instances it may not be possible to receive the invoice in time from the vendor or there could be a dispute with the vendor. In these instances, a payable at year-end is created for the amount owing and it is paid in the following year. This portion of the testing involved the examination of a judgmental sample of twenty payable at year-end transactions created for fiscal year 2008-2009 totaling $321,372.00. Environment Canada 5 Audit of Payables at Year-end The selection was based on high risk transaction types as identified in the Departmental Statistical Sampling Policy. The following table represents the type of expenses covered by this testing. Table 1 Number of PAYE Type of expenses Total Training Hospitality Expenses Miscellaneous Electronic Equipment Materials Stationary & Office Supplies Computer Supplies (Including, cables, diskettes) Informatics Hardware/Parts-Non Capital 1 1 1 1 1 1 2 1 $7,800.00 716.45 11,750.00 672.00 23,690.64 2,139.60 9,958.80 1,000.00 TRACKED ASSETS-Measuring, Controlling, Laboratory 1 18,232.00 TRACKED ASSETS-Video conferencing - equipment TRACKED ASSETS-Laptops-Non Capital 1 1 381.54 1,540.00 Tracked Assets - Telecommunications Equipment Furniture & Furnishings & Appliances Informatics Software-Non Scientific-Non Cap Ships & Boats (excluding parts)-Non Capital Off-Road Vehicles Work in Progress (WIP) Laboratories - Capital Totals 1 3 1 1 1 1 20 43,656.32 35,051.83 350.42 6,980.00 11,220.00 146,232.61 $321,372.00 The testing looked at whether the liability existed and that it was properly recorded, that section 34 was performed and that the goods have been received and/or that the services have been rendered, by obtaining and reviewing supporting documentation. When payable at year-end transactions are created, evidence such as a final report; purchase order; packing slip or other types of documentation should exist to prove that the work has been performed, good received and/or services rendered. The following table presents the results of testing. Table 2 Test Liability existed and properly recorded Section 34 Certification by program managers Pertinent back-up (Invoice, packing slip, copy of deliverable) PAYE Transactions (20) All All 14 As indicated above, all payable at year end transactions were supported by Section 34 certification of the FAA as required by Treasury Board Policy on Payables at Year-End. Environment Canada 6 Audit of Payables at Year-end In addition, fourteen of the transactions tested were also supported by some of type of evidence as a proof that they were in fact a bona fide payable at year end along with the Section 34 of the FAA. The remaining six transactions were for service contracts. The review of the control system revealed that the DAOs in four regions are clearly requesting program managers to provide pertinent back-up documentation when creating a payable at year end, while two other DAOs were silent on this requirement. Although this is not a Treasury Board requirement, it can be considered as a best practice from a control perspective, as this may ensure the integrity of the payable at year-end process and decrease the risk of lapsing funds. However, given that there are limited resources within Finance with already full workloads, this is not being considered in the department at this time. The audit also looked at year end contracts. Specifically, the analysis was conducted to verify whether the work performed for service contracts was in fact fulfilled on or prior to fiscal year-end and paid against the appropriate budget. This was done by examining the evidence obtained from the program areas. Fifty-three contracts awarded towards the end of the fiscal year totalling $502,519.55 were reviewed. Of the fifty-three contracts examined, there was one contract in the amount $5K where the audit team was unable to obtain evidence that the service was in fact rendered. The testing also revealed that there was one other contract for which a PAYE was set-up for the whole amount ($24,500) although it was only partially completed (90%). 2.3 Prepayment of Contracts This portion of the testing involved an examination of sixty-one contracts (61) with an end date in the new year totaling $767,846.21. The testing was conducted to validate that the payment of all or part of a contract, with deliverables in the new fiscal year, was not paid prior to its due date. The results of the analysis confirmed that the payments were recorded in the proper fiscal year. 3. CONCLUSION The audit concluded that overall, the Department is compliant with the requirements of the Treasury Board Secretariat of Canada Policy on Payables at Year-End and Environment Canada procedures. The audit also revealed that Environment Canada’s internal control system to set up payable at year end is documented and communicated. It should be noted that results were not sufficient to support an audit opinion of payables at year-end for the purposes of audited financial statements. In addition, the testing did not reveal material errors in the recording of contractual payments at year-end. No recommendations are included in this audit report. Environment Canada 7 Audit of Payables at Year-end Annex 1 Audit Criteria Year-End Payable Transaction Testing AUDIT CRITERIA Criteria 1: The payable transaction is a bona-fide payable at year-end and is appropriately recorded in the accounts. The transaction is a proper charge to the 2008-2009 appropriation authority The goods and services have been received? The supporting documentation has been reviewed and is dated prior to year-end? In general, the Department is in compliance with Treasury Board Policy on Payables at Year-End? Criteria 2: The payments represent contracted goods and services received or performed prior to year-end cut-off and are properly recorded in the accounts. The payments are a proper charge to the 2008-2009 appropriation authority The commitment is properly recorded? The goods have been received or services have been performed prior to year-end? The supporting documentation (invoices, delivery or packing slips, etc.) confirms a contract deliverable? Environment Canada 8 Audit of Payables at Year-end Annex 2 List of Background Information and Supporting Documentation Treasury Board of Canada Secretariat, Policy on Payables at Year-End (PAYE) Treasury Board of Canada Secretariat, Account Verification Policy Treasury Board of Canada Secretariat, Internal Control Policy Environment Canada, Corporate Accounting, Year-End Timetable and Procedures for 2008-2009, March 11, 2009 Environment Canada, Section 33 – Statistical Payment Sampling Policy Environment Canada, Audit and Evaluation Directorate, Audit of Accounts Payable – NCR, March 2005 Environment Canada, Audit and Evaluation Directorate, Audit of Accounts Payable, July 16, 2003 Environment Canada, Three Year Risk Based Audit and Evaluation Plan 2009-2012 Environment Canada Financial Statement 2007-2008 Ernst and Young, Environment Canada Audit Readiness Assessment – Phase One and two, November 2007, Justice, Financial Administration Act PWGSC, Receiver General Manual Environment Canada 9 Audit of Payables at Year-end Environment Canada 10