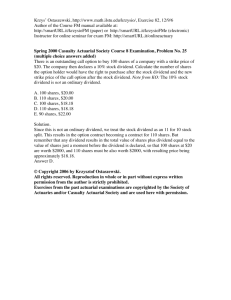

Dividend Policy - Mba Projects free on Hr, Marketing

advertisement