Chp. End Questions

advertisement

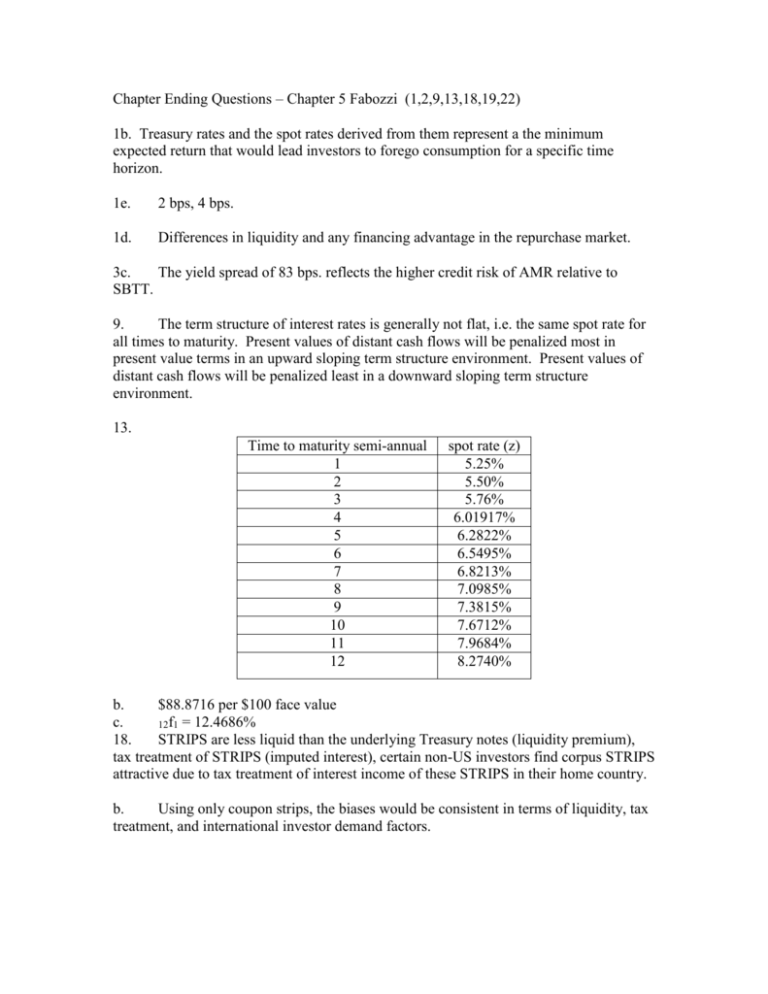

Chapter Ending Questions – Chapter 5 Fabozzi (1,2,9,13,18,19,22) 1b. Treasury rates and the spot rates derived from them represent a the minimum expected return that would lead investors to forego consumption for a specific time horizon. 1e. 2 bps, 4 bps. 1d. Differences in liquidity and any financing advantage in the repurchase market. 3c. The yield spread of 83 bps. reflects the higher credit risk of AMR relative to SBTT. 9. The term structure of interest rates is generally not flat, i.e. the same spot rate for all times to maturity. Present values of distant cash flows will be penalized most in present value terms in an upward sloping term structure environment. Present values of distant cash flows will be penalized least in a downward sloping term structure environment. 13. Time to maturity semi-annual 1 2 3 4 5 6 7 8 9 10 11 12 spot rate (z) 5.25% 5.50% 5.76% 6.01917% 6.2822% 6.5495% 6.8213% 7.0985% 7.3815% 7.6712% 7.9684% 8.2740% b. $88.8716 per $100 face value c. 12f1 = 12.4686% 18. STRIPS are less liquid than the underlying Treasury notes (liquidity premium), tax treatment of STRIPS (imputed interest), certain non-US investors find corpus STRIPS attractive due to tax treatment of interest income of these STRIPS in their home country. b. Using only coupon strips, the biases would be consistent in terms of liquidity, tax treatment, and international investor demand factors. 19. Arbitrage forces. A Treasury note that is under priced may be purchase – stripped and the parts sold for more than the investment. A Treasury note that is over priced my be sold and STRIPS purchased for less than the revenue received from the sale. 22. See question #2 on Quiz #4. Chapter 6 (2,6,10,11,12,13) 2. The real rate is the rate earned above the inflation rate. b. Coupon payments are inflation adjusted (index ratio) and return of principal on the maturity date is also adjusted by the index ratio. c. coupon payment = ½ * 3% * 10,000*1.01 =$151.50 inflation adjusted principal = $10,000 * 1.01 = $10,100 coupon payment = ½ * 3% * 10,000 * 1.01 * 1.01 = $153.015 inflation adjusted principal = $10,000 * 1.01 * 1.01 = $10,201 d. With deflation, the inflation adjusted principal would fall. However the Treasury has structured TIPS so that they are redeemed (maturity date) at the greater of the inflation adjusted principal or the initial par value. e. The adjustments to principal each year are taxed as a mini-capital gain. This reduces the attractiveness of TIP investments in non-tax sheltered accounts. 6. 100-day T-bill Bid Price = $89,358.33 100-day T-bill Ask Price = $89,363.89 10. All Treasury auctions are now single price auctions. In a single price auction all bidders receiving allotments through the auction receive their bills at the stop-out yield. 11. The day count convention for Treasury securities is actual/actual. 12. Trademark Treasury zero-coupon securities are offered by investment banks who hold the underlying Treasury notes in a bank custody account. There is a small risk that the custodian bank may go bankrupt exposing the owner of a Trademark security to some default risk. Primary Treasury security dealers make a market for Generic receipts (Treasury receipts ) these were offered to improve the liquidity of the Trademark Treasury products. Both of these security types require physical delivery of supporting documentation. 13. STRIPS created through the process operated by the New York Federal Reserve Bank are the only source of newly created securities stripped from US Treasury notes.