Things Tax-Aide Volunteers Will NOT Do

advertisement

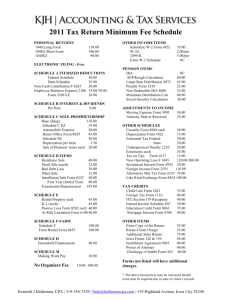

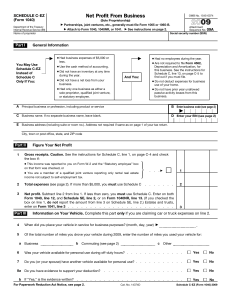

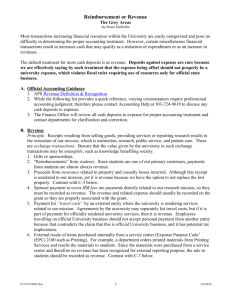

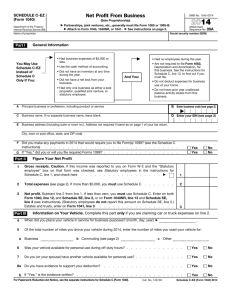

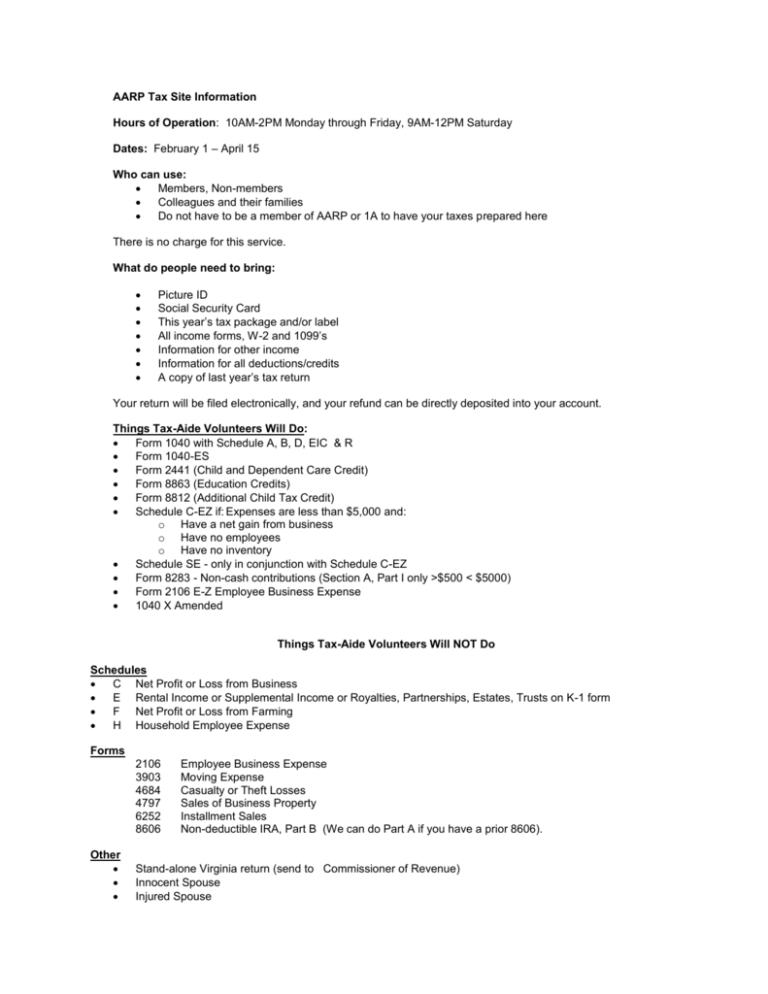

AARP Tax Site Information Hours of Operation: 10AM-2PM Monday through Friday, 9AM-12PM Saturday Dates: February 1 – April 15 Who can use: Members, Non-members Colleagues and their families Do not have to be a member of AARP or 1A to have your taxes prepared here There is no charge for this service. What do people need to bring: Picture ID Social Security Card This year’s tax package and/or label All income forms, W-2 and 1099’s Information for other income Information for all deductions/credits A copy of last year’s tax return Your return will be filed electronically, and your refund can be directly deposited into your account. Things Tax-Aide Volunteers Will Do: Form 1040 with Schedule A, B, D, EIC & R Form 1040-ES Form 2441 (Child and Dependent Care Credit) Form 8863 (Education Credits) Form 8812 (Additional Child Tax Credit) Schedule C-EZ if: Expenses are less than $5,000 and: o Have a net gain from business o Have no employees o Have no inventory Schedule SE - only in conjunction with Schedule C-EZ Form 8283 - Non-cash contributions (Section A, Part I only >$500 < $5000) Form 2106 E-Z Employee Business Expense 1040 X Amended Things Tax-Aide Volunteers Will NOT Do Schedules C Net Profit or Loss from Business E Rental Income or Supplemental Income or Royalties, Partnerships, Estates, Trusts on K-1 form F Net Profit or Loss from Farming H Household Employee Expense Forms 2106 3903 4684 4797 6252 8606 Other Employee Business Expense Moving Expense Casualty or Theft Losses Sales of Business Property Installment Sales Non-deductible IRA, Part B (We can do Part A if you have a prior 8606). Stand-alone Virginia return (send to Commissioner of Revenue) Innocent Spouse Injured Spouse Adoption Expenses Certain OID Situations Medical Savings Accounts Points not fully deductible in year paid Children under 18 with $1,700+ investment income (Form 8615) Foreign Tax Credit eligibility (Form 1116) Wash sales (stocks, etc.) Tax on early distribution from Employer’s Plan Limited IRA deduction Excluded US Savings Bond Interest Income from US possessions or foreign countries SS benefits for prior year Non-resident or Resident Alien (send to Williamsburg or CNU or HU) Any state return other than Virginia Active duty Military (refer to base/post VITA Site)