Reimbursement or Revenue - University of Colorado Denver

advertisement

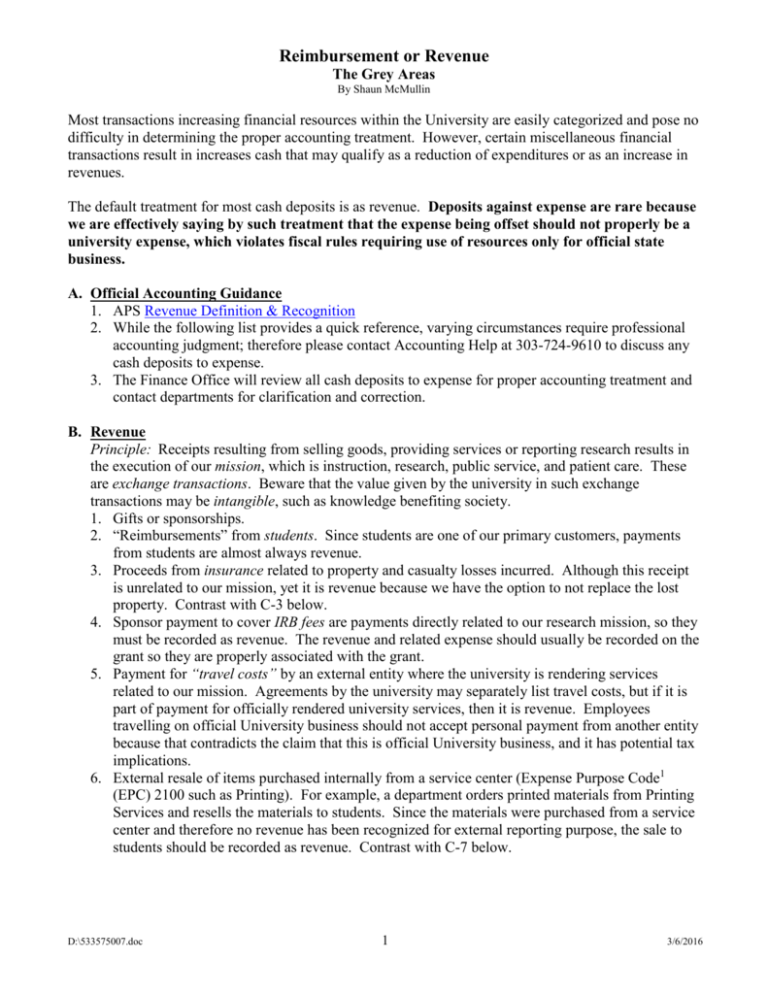

Reimbursement or Revenue The Grey Areas By Shaun McMullin Most transactions increasing financial resources within the University are easily categorized and pose no difficulty in determining the proper accounting treatment. However, certain miscellaneous financial transactions result in increases cash that may qualify as a reduction of expenditures or as an increase in revenues. The default treatment for most cash deposits is as revenue. Deposits against expense are rare because we are effectively saying by such treatment that the expense being offset should not properly be a university expense, which violates fiscal rules requiring use of resources only for official state business. A. Official Accounting Guidance 1. APS Revenue Definition & Recognition 2. While the following list provides a quick reference, varying circumstances require professional accounting judgment; therefore please contact Accounting Help at 303-724-9610 to discuss any cash deposits to expense. 3. The Finance Office will review all cash deposits to expense for proper accounting treatment and contact departments for clarification and correction. B. Revenue Principle: Receipts resulting from selling goods, providing services or reporting research results in the execution of our mission, which is instruction, research, public service, and patient care. These are exchange transactions. Beware that the value given by the university in such exchange transactions may be intangible, such as knowledge benefiting society. 1. Gifts or sponsorships. 2. “Reimbursements” from students. Since students are one of our primary customers, payments from students are almost always revenue. 3. Proceeds from insurance related to property and casualty losses incurred. Although this receipt is unrelated to our mission, yet it is revenue because we have the option to not replace the lost property. Contrast with C-3 below. 4. Sponsor payment to cover IRB fees are payments directly related to our research mission, so they must be recorded as revenue. The revenue and related expense should usually be recorded on the grant so they are properly associated with the grant. 5. Payment for “travel costs” by an external entity where the university is rendering services related to our mission. Agreements by the university may separately list travel costs, but if it is part of payment for officially rendered university services, then it is revenue. Employees travelling on official University business should not accept personal payment from another entity because that contradicts the claim that this is official University business, and it has potential tax implications. 6. External resale of items purchased internally from a service center (Expense Purpose Code1 (EPC) 2100 such as Printing). For example, a department orders printed materials from Printing Services and resells the materials to students. Since the materials were purchased from a service center and therefore no revenue has been recognized for external reporting purpose, the sale to students should be recorded as revenue. Contrast with C-7 below. D:\533575007.doc 1 3/6/2016 C. Expense Reduction Principle: A receipt treated as an expense reduction effectively says that the expense being reduced was not for official university business. This is not normally allowed, but in the cases below, it may happen. 1. Refunds or rebates from a vendor for goods or services purchased from the vendor. 2. Reimbursement of personal usage of university resources, such as a photocopier, by employees when the resources involved are typically not used to provide services on a fee for service basis. Such usage is normally not allowed, but may happen for insignificant and incidental items. 3. Payment of worker’s compensation claims from an insurance company. In this case this is an expense reduction because it reduces the cost of lost productivity. 4. Cost-sharing agreements with external entities whereby the university and the external entity agree to share the expenses of a particular activity that is not related to any mission-related service provided by the university. 5. Payment by an employee to help defray part of a travel cost. This may be reimbursement of inadvertently claimed travel expenses or cost sharing by the employee. This treatment is an admission that University resources were improperly used to arrange and pay for travel. 6. Resale of items purchased internally from a true auxiliary (EPC1 2000 such as Bookstore or Parking). For example, a department purchases one-day parking passes to resell to patients. Since Parking is a true auxiliary and therefore revenue has already been recognized for external reporting, the sale by the department should be credited to expense. Contrast with B-6 above. 7. Reimbursements from employees or students for lost university property. 1 To find the expense purpose code (EPC), go to People Soft Finance > General Ledger > Chart Fields > Program and click on the tab “Program CU Attributes”. Anyone having Finance System access may look this up for programs in any department. D:\533575007.doc 2 3/6/2016