1.9 Business Income - Schedule C

advertisement

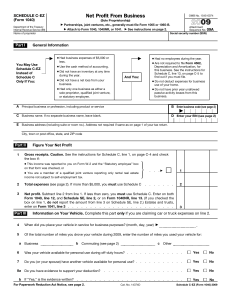

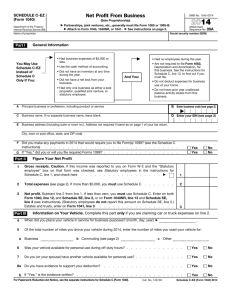

Module NJ 1.9 Business Income Schedule C-EZ Pub 4012, Tab 2 4/6/2015 NJ Training TY 2008 1 Taxpayer Business Income Schedule C-EZ Operate a Business (regular and on-going for purpose of sales and profit) Or Sole proprietor Must Report sales, expenses and net profit (loss not permitted) on Schedule C-EZ Out of Scope - If TP does not qualify for Schedule C-EZ and Schedule C is required 4/6/2015 NJ Training TY 2008 2 Definitions Employee: Employer controls when, where, and how the employee works (W-2 issued). Independent Contractor: Performs services for others. Self-Employed for Tax Purposes (No W-2 issued) Note: Household employees (baby sitters, cleaning help, home health aides etc) income is taxable to employee – Out Of Scope To Payer 4/6/2015 NJ Training TY 2008 3 Schedule C-EZ Requirements Business expenses of $5,000 or less Cash method of accounting No inventory No net loss from business Sole proprietor, no employees Form 4562, Depreciation/Amortization, not required No deduction for business use of home 4/6/2015 NJ Training TY 2008 4 Schedule C-EZ Information Only one C-EZ per person on return “Business Code” Source Press F-1 Help Button in Tax Wise or Refer to 1040 Instruction Booklet Employer ID Number (EIN) If TP does not have an EIN, leave space blank. Do not enter SSN If TP has 1099-Misc, use TaxWise Link from C-EZ line 1 Gross Receipts, to enter 1099 data 4/6/2015 NJ Training TY 2008 5 Schedule C-EZ F1 for List USE SCRATCH PAD FOR EXPENSES F9 to 1099-MISC OR SCRATCH PAD FOR INCOME 4/6/2015 NJ Training TY 2008 6 Allowable Business Expenses Repairs and Advertising Vehicle expenses Mileage or actual expenses – see below Commissions Insurance Interest Office & rent expense maintenance Supplies Taxes Travel Utilities 50% of business meals/entertainment Professional fees Mileage expense calculated by TW must be manually entered on scratch pad with other expenses – it does not automatically transfer 4/6/2015 NJ Training TY 2008 7 Taxes On Self-Employment Income Social Security and Medicare tax for persons who work for themselves is 15.3% Similar to SS tax and Medicare tax withheld from employees’ wages Computed on Schedule SE and is automatically transferred to Form 1040 In TaxWise, entry on line 1 of C-EZ will automatically generate Schedule SE 4/6/2015 NJ Training TY 2008 8