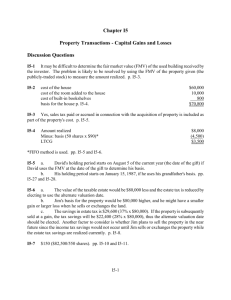

ACC 475

advertisement

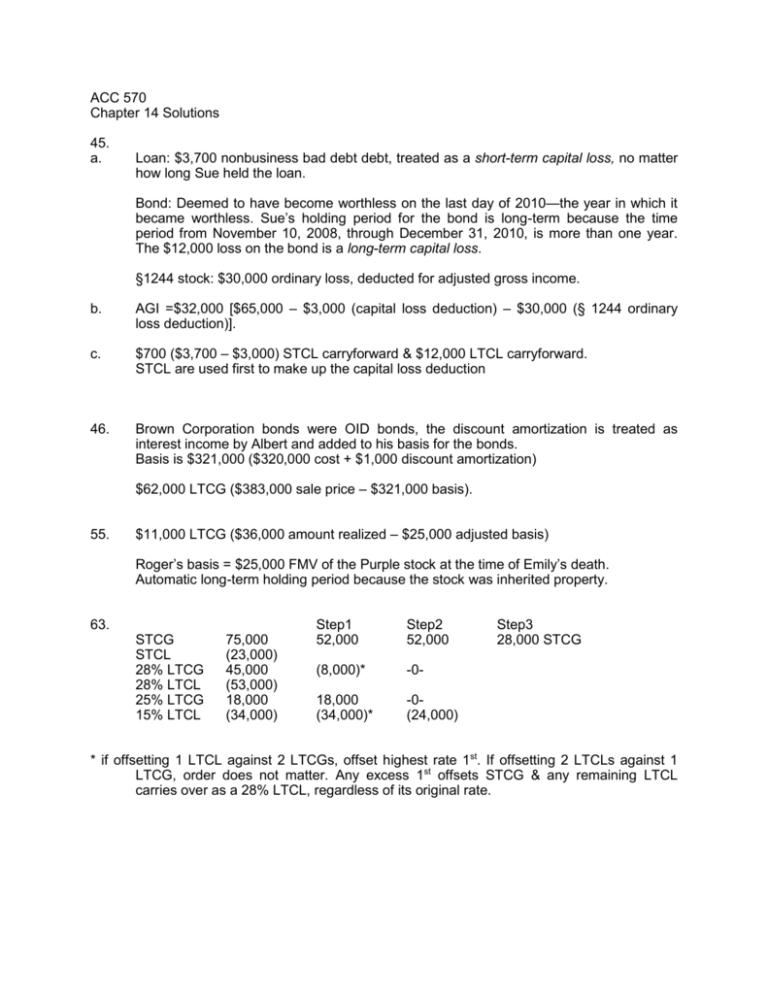

ACC 570 Chapter 14 Solutions 45. a. Loan: $3,700 nonbusiness bad debt debt, treated as a short-term capital loss, no matter how long Sue held the loan. Bond: Deemed to have become worthless on the last day of 2010—the year in which it became worthless. Sue’s holding period for the bond is long-term because the time period from November 10, 2008, through December 31, 2010, is more than one year. The $12,000 loss on the bond is a long-term capital loss. §1244 stock: $30,000 ordinary loss, deducted for adjusted gross income. b. AGI =$32,000 [$65,000 – $3,000 (capital loss deduction) – $30,000 (§ 1244 ordinary loss deduction)]. c. $700 ($3,700 – $3,000) STCL carryforward & $12,000 LTCL carryforward. STCL are used first to make up the capital loss deduction 46. Brown Corporation bonds were OID bonds, the discount amortization is treated as interest income by Albert and added to his basis for the bonds. Basis is $321,000 ($320,000 cost + $1,000 discount amortization) $62,000 LTCG ($383,000 sale price – $321,000 basis). 55. $11,000 LTCG ($36,000 amount realized – $25,000 adjusted basis) Roger’s basis = $25,000 FMV of the Purple stock at the time of Emily’s death. Automatic long-term holding period because the stock was inherited property. 63. STCG STCL 28% LTCG 28% LTCL 25% LTCG 15% LTCL 75,000 (23,000) 45,000 (53,000) 18,000 (34,000) Step1 52,000 Step2 52,000 (8,000)* -0- 18,000 (34,000)* -0(24,000) Step3 28,000 STCG * if offsetting 1 LTCL against 2 LTCGs, offset highest rate 1st. If offsetting 2 LTCLs against 1 LTCG, order does not matter. Any excess 1st offsets STCG & any remaining LTCL carries over as a 28% LTCL, regardless of its original rate. 65. 66. 67. Tax on $76,000 ordinary taxable income ($97,000 TI – $18,000 0%/15% gain – $3,000 qualified dividend) from married, filing jointly tax rate schedule 15% tax on $18,000 0%/15% gain and $3,000 qualified dividend Total tax using the alternative tax calculation Tax on $24,800 ordinary taxable income ($36,000 TI – $3,000 25% gain – $8,200 0%/15% gain) from head of household tax rate schedule 15% tax on $3,000 25% gain (regular tax rate is used since it is lower than the alternative tax rate) 0% tax on $8,200 0%/15% gain (alternative tax rate of 0% is lower than the regular tax rate of 15%) Total tax liability using the alternative tax calculation $11,363 3,150 $14,513 $3,123 450 –0– $3,573 Asok’s taxable income is $123,700 ($133,050 AGI – $5,700 standard deduction – $3,650 personal exemption) Tax on $65,700 ordinary taxable income ($123,700 TI – $45,000 25% gain – $13,000 0%/15% gain) from single tax rate schedule 25% tax on $16,700 of 25% gain (regular tax rate is the same as the alternative tax rate until taxable income exceeds $82,400) 25% tax on $28,300 of remaining 25% gain (alternative tax rate of 25% is lower than the regular tax rate of 28%) 15% tax on $13,000 0%/15% gain (alternative tax rate of 15% is lower than regular tax rate of 28%) Total tax liability using the alternative tax calculation $12,606 4,175 7,075 1,950 $25,806