i-ch5 - Haas School of Business

advertisement

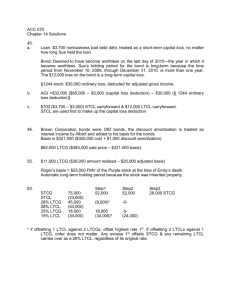

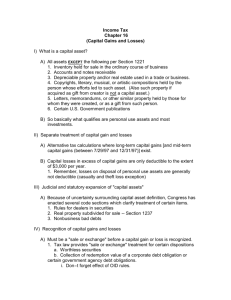

Chapter I5 Property Transactions - Capital Gains and Losses Discussion Questions I5-1 It may be difficult to determine the fair market value (FMV) of the used building received by the investor. The problem is likely to be resolved by using the FMV of the property given (the publicly-traded stock) to measure the amount realized. p. I5-3. I5-2 cost of the house cost of the room added to the house cost of built-in bookshelves basis for the house p. I5-4. $60,000 10,000 800 $70,800 I5-3 Yes, sales tax paid or accrued in connection with the acquisition of property is included as part of the property's cost. p. I5-5. I5-4 Amount realized Minus: basis (50 shares x $90)* LTCG $8,000 (4,500) $3,500 *FIFO method is used. pp. I5-5 and I5-6. I5-5 a. David's holding period starts on August 5 of the current year (the date of the gift) if David uses the FMV at the date of the gift to determine his basis. b. His holding period starts on January 15, 1987, if he uses his grandfather's basis. pp. I5-27 and I5-28. I5-6 a. The value of the taxable estate would be $80,000 less and the estate tax is reduced by electing to use the alternate valuation date. b. Jim's basis for the property would be $80,000 higher, and he might have a smaller gain or larger loss when he sells or exchanges the land. c. The savings in estate tax is $29,600 (37% x $80,000). If the property is subsequently sold at a gain, the tax savings will be $22,400 (28% x $80,000), thus the alternate valuation date should be elected. Another factor to consider is whether Jim plans to sell the property in the near future since the income tax savings would not occur until Jim sells or exchanges the property while the estate tax savings are realized currently. p. I5-8. I5-7 $150 ($82,500/550 shares). pp. I5-10 and I5-11. I5-1 I5-8 Basis of stock Total number of owned before shares owned after stock dividend stock dividend Basis for each = share owned after dividend $38,880 divided by X = $18 X = 2,160 shares Total number of shares after stock dividend Total number of shares before stock dividend Increase in shares due to stock dividend Percentage dividend distributed (160 divided by 2,000) = 2,160 2,000 160 8% pp. I5-10 and I5-11. I5-9 The interest must be capitalized. p. I5-5. I5-10 For Andy, the refrigerator is inventory and not a capital asset. Roger's refrigerator is a capital asset since it is not included in the list of properties that are not capital assets. pp. I5-12 and I5-13. I5-11 The purchase and sale of future contracts was an integral part of the company's business. p. I5-13. I5-12 The dealer must clearly identify that the security is held for investment. This act of identification must occur before the close of the day on which the security is acquired and the security must not be held primarily for sale to customers in the ordinary course of the dealer's trade or business at any time after the day of purchase. p. I5-14. I5-13 a. The gain is LTCG since the requirements of Sec. 1237 are satisfied. b. The cost of the 30 acres would be allocated among the lots on the basis of their relative FMVs. pp. I5-14 and I5-15. I5-14 The NSTCL is first offset against LTCG that is taxed at 28%, the highest rate for LTCG, then against LTCG taxed at 25%, and finally against the LTCG that is ANCG taxed at 20%. The NSTCL is used first to reduce gains taxed at the higher rates. p. I5-17. I5-15 The debt is a nonbusiness bad debt. The loss is treated as a STCL. p. I5-15. I5-16 The motive for purchasing the stock is not relevant in determining whether or not the stock is a capital asset. The stock is not within one of the classes of property excluded from capital-asset status. p. I5-13. I5-2 I5-17 Since the stock of the First Corporation is acquired to obtain a potential customer, the Top Corporation might use the Corn Products case to argue that the asset is not a capital asset since the stock is acquired as an integral part of Top's business. However, the stock is not likely to be a capital asset since the Supreme Court in Arkansas Best stated that the motive for purchasing the stock is not relevant, and the stock is not within one of the classes of property excluded from capital-asset status. The Arkansas Best case is thought to be controlling because the application of Corn Products is limited to hedging transactions. Note, however, that this issue continues to be litigated and the Circle K Corporation case might also be used to support the taxpayer's position. pp. I5-13 and I5-14. I5-18 Capital gain. Gain on the sale of stock purchased with a substantial investment motive is capital gain. pp. I5-13 and I5-14. I5-19 Nancy held the bonds of the East Corporation as an investment. For Minor Corporation, the securities of the East Corporation are securities of an affiliated corporation. Thus, Minor's loss due to the worthless securities is an ordinary loss. p. I5-21. I5-20 There is no original issue discount since the discount of $20,000 is less than $25,000 (.0025 x $500,000 x 20). pp. I5-22 and I5-23. I5-21 Juanita purchased a market discount bond (i.e., her purchase price was less than the maturity value) and the accrued market discount must be recognized as ordinary income when she has a disposition of the bond unless the de minimus rule applies (i.e., market discount is zero if the discount is less than 1/4 of 1% of the stated redemption price of the bond at maturity multiplied by the number of years to maturity). If the bonds are sold after two years, up to 2/11 of the market discount may be treated as ordinary income if the realized gain is equal to or greater than this amount. p. I5-24. I5-22 She should transfer all substantial rights to the patent. p. I5-25. I5-23 The transferor of a franchise may not treat the transfer as a sale or an exchange of a capital asset if the transferor retains any significant power, right or continuing interest with respect to the subject matter of the franchise. pp. I5-26 and I5-27. I5-24 The lessor treats the payments as ordinary income. p. I5-27. I5-25 October 1, 1999. p. I5-29. I5-26 The gain on the sale of A is a LTCG of $12,000, the loss on the sale of B is a STCL of $3,000, and the gain on the sale of C is a LTCG of $7,400. Phil's NLTCG is $19,400 and his NSTCL is $3,000. The net capital gain is $16,400 ($19,400 - $3,000). Because both of the assets sold at a gain had a holding period of more than 18 months, all of the NCG is ANCG. p. I5-27. I5-3 I5-27 If the individual taxpayer does not have capital gains, only $3,000 of capital losses may be deducted annually. It may take many years before an investor with a large capital loss is allowed to deduct all of the losses. Possibly, a taxpayer could die with unused capital losses. The unfavorable treatment of capital losses may cause the investor to be less willing to take the risks associated with purchasing stock of a high-risk, start-up company. The instructor may want to refer to Sec. 1244 which is mentioned in Chapter I5 and discussed in Chapter I8. p. I5-18. I5-28 The taxpayer may not care if the loss is an ordinary loss or a STCL if the taxpayer has STCGs or has NLTCG that is mid-term gain but his marginal tax rate is 28% or less. The STCL could be used to offset STCG or NLTCG. p. I5-18. I5-29 The amount realized is increased by the amount of the liability assumed by Fred. Fred's basis is increased by the amount of the assumed liability. pp. I5-3 and I5-4. I5-30 When Calvin collects the first $10,000 interest payment on December 31, 19Y1, he must pay taxes of $4,000 and will have $6,000 to reinvest at a 6% after-tax rate of interest for four years. The after-tax payment received on December 31, 19Y2, will be reinvested at a 6% after-tax rate for three years, etc. At the end of the five years, he will have cash of $133,823 as shown below: $ 6,000 6,000 6,000 6,000 6,000 100,000 Total Cash Available x x x x 1.2625 = 1.1910 = 1.1236 = 1.06 = = = $ 7,575 7,146 6,742 6,360 6,000 100,000 $133,823 The value of the stock increases as follows: End of year one End of year two End of year three End of year four End of year five $108,000 116,640 125,971 136,049 146,933 Amount realized on sale Less taxes Cash Available 9,387 $146,933 (20% x $46,933) $137,546 Despite the different before-tax returns (10% and 8%), Calvin should purchase the stock since $137,546 exceeds $133,823 by $3,723. I5-4 Note to Instructor: This problem illustrates the value of deferring the tax and the implications of preferential tax treatment for net capital gains. To further illustrate the value of the deferral, ask the students what alternative should be selected if the time period was six years instead of five years. Without computing the numbers, students should be able to respond that the stock would be the better investment by a larger margin, $5,097. With the bond, Calvin would have another $8,030 ($6,000 x 1.3383), thus increasing the total to $141,853. The value of the stock at the end of the sixth year would be $158,688 (1.08 x $146,933). After paying taxes of $11,738, he would have cash of $146,950 ($158,688 - $11,738). Issue Identification Questions I5-31 The primary tax issue is whether the gain or loss on the sale of the seed is ordinary income or capital gain or loss. If the gain or loss is capital, secondary issues deal with the netting of other capital gain and losses, whether the gain or loss is long or short-term, capital loss limitations etc. In this situation it appears that the gain or loss should be capital because Acorn is in the business of selling barley and not in the business of buying and selling seed. The facts in this question are similar to Hufford v. U.S., 17 AFTR 2d 760, 66-1 USTC ¶ 9357 (D.C. Wash., 1966). p. I5-13. I5-32 1. Are the breeding beavers capital assets for Lisa and John? No, they are depreciable property used in a trade or business. 2. What is the basis of the beavers? The contract is unusual in that the taxpayers may pay the debt with beavers instead of cash. There may be an issue of whether or not the $30,000 paid for the beavers is an inflated cost which could be used to increase depreciation deductions. Is this an arm's length transaction? If the cash price for a pair of breeding beavers is significantly less than $30,000, the basis should not be $30,000. In Bryant v. Comm [86-1 USTC 9456 (9th Cir., 1986)] beavers were sold under similar contracts as above to investors for $1,750 when others could purchase beavers for $250. There were tax related reasons for inflating the cost, and the court reduced the basis to FMV. 3. When John and Lisa pay the debt with the beavers, will a gain or loss be recognized? Yes, the gain or loss is ordinary. The payment of the debt by delivering the beavers is equal to a sale of the beavers. The sales price is the amount of the debt which is satisfied. Gain or loss is measured by the difference between the sales price and the adjusted basis (cost). p. I5-13. I5-5 I5-33 The primary tax issue is whether the gain or loss on the sale of the farm is capital or ordinary. To determine the amount of gain or loss, the basis rules for inherited property need to be addressed. If the gain or loss is capital, the holding period rules for inherited property need to be applied. The basis of the property is $500,000 and the $20,000 gain should be LTCG because Mike is holding the property for investment (assuming that he keeps the inherited property separate from his real estate business). pp. I5-8 and I5-9. I5-34 The primary tax issue is whether the $75,000 gain on the sale of the house is capital or ordinary. A secondary issue is whether the gain (if capital) is LTCG or STCG. It appears that the gain is capital because Sylvia is not in the business of home construction. Since she started construction of the house more than one year ago, she may be deemed to have a split holding period whereby the portion of the gain attributable to construction on or before July 29, 1997 would be LTCG. Any LTCG is mid-term gain taxed at a maximum rate of 28%. pp. I5-12 through I5-14. Problems I5-35 Amount realized Minus: Adjusted basis LTCG $159,000* (150,000) $ 9,000 *($74,000 + $40,000 + $45,000) p. I5-3. I5-36 a. b. c. $30,000 [($40,000/$120,000) x $90,000] $60,000 [($80,000/$120,000) x $90,000] Yes, since the FMV on the date of the gift is greater than the donor's basis. p. I5-7. I5-37 a. Amount realized $ 784,000 Minus: Basis* ( 118,000) Gain Realized ($666,000) *$110,000 + ($200,000/$300,000 x $12,000) b. Amount realized Minus: Basis Gain realized $784,000 (110,000) $674,000 pp. I5-6 and I5-7. I5-6 ($800,000 - $16,000) I5-38 Adjusted gross income: a. $42,500; b. $22,500; c. $36,500. a. Selling price Minus: Basis LTCG Increase in AGI $48,000 (30,500) ($30,000 + $15,000/$45,000 x $1,500) $17,500 $17,500 b. Selling price Minus: Basis STCL Reduction in AGI $28,000 (30,500) $(2,500) $(2,500) c. Selling price Minus: Basis LTCG Increase in AGI $42,000 (30,500) $11,500 $11,500 Holding period starts on April 12, 1992. pp. I5-6 and I5-7. I5-39 a. b. $9,600 $600 realized loss [$5,000 - ($9,600 - $4,000)]. pp. I5-9 and I5-10. I5-40 a. b. The basis allocated to the rights is $500 [($1,000/$8,000) x $4,000]. Amount realized Minus: Basis LTCG $1,080 (500) $ 580 The holding period for the stock rights starts on July 25, 1986. c. The basis of the 100 shares purchased by exercising the stock rights is $7,300 ($6,800 + $500). The holding period starts on May 14 of the current year. d. $1,080 LTCG. pp. I5-11 and I5-12. I5-41 Since Sec. 1237 applies and less than five lots have been sold, none of the gain recognized last year will be ordinary income. A LTCG of $7,520 is recognized. Selling price $12,000 Minus: Selling expenses ( 480) Amount realized $11,520 I5-7 Minus: Basis Gain (LTCG) ( 4,000) $ 7,520 This year, ordinary income of $3,000 (0.05 x $60,000) is recognized, and a deduction for selling expenses of $1,900 is allowed. A LTCG of $37,000 is recognized Amount realized Minus: Basis Gain $58,100 ($60,000 - $1,900) (20,000) $38,100 Ordinary income LTCG $ 1,100 ([0.05 x $60,000] - $1,900) $37,000 pp. I5-14 and I5-15. I5-42 CASE A - 28% - gain is STCG CASE B - 28% - collectibles gain CASE C - 20% - gain is ANCG CASE D - 28% - mid-term gain pp. I5-17 and I5-18. I5-43 a. b. c. $1,960 $1,960 $1,800 [($2,000 x 28%) + ($7,000 x 20%)]. same as (a) because the NSTCL is first offset against 28% rate class. All of the $9,000 NCG is ANCG taxed at 20%. pp. I5-17 and I5-18. I5-44 a. b. Tax on $70,000 + 20% ($20,000) = $19,187. $20,142.50 + 31% ($90,000 - $87,700) = $20,856. p. I5-19. I5-45 a. b. $21,058. $23,444 [$13,896.50 + 31% x ($84,500 - $61,400)] [$13,896.50 + 31% x ($85,100* - $61,400) + (20% x $11,000)] p. I5-19. *The $11,000 addition to his AGI results in a $330 (3% x $11,000) reduction of itemized deductions and a $270 (2% x 5 x $2,700) reduction in the personal exemption deduction, thus his taxable income is increased by $11,600 [$11,000 + ($330 + $270)] and his tax liability is increased by $2,386. Note to instructor: This problem illustrates how adjusted net capital gain may be subject to I5-8 a tax rate greater than 20%. The marginal tax rate on the $11,000 net capital gain amounts to 21.69% ($2,386 $11,000). I5-46 Find the selling price (SP) such that the selling price less the tax on the LTCG is $90,000. SP - [.2 x (SP - $60,000)] = $90,000 SP - .2SP + $12,000 = $90,000 .8SP = $78,000 SP = $97,500 p. I5-19. I5-47 Situation 1 AGI after considering capital gains and losses NSTCG (NSTCL) NLTCG (NLTCL) Situation 2 Situation 3 Situation 4 $45,000 4,000 1,000 $58,000 ( 3,000) 11,000 $59,000 1,000 ( 2,000) $67,000* ( 9,000) 5,000 1995 1996 1997 1998 *$1,000 STCL is a carryforward. pp. I5-16 through I5-18. I5-48 AGI STCL to be carried forward LTCL to be carried forward $37,000 $47,000 1,000 -- -- 7,000 pp. I5-16 through I5-18. I5-9 $57,000 $67,000 800 3,300 I5-49 The loss due to Wolverine stock at one time would have been an ordinary loss since the security probably would not have been a capital asset due to the Corn Products doctrine. However, the Supreme Court's decision in 1988 in the Arkansas Best Corporation case severely limits the use of the ordinary loss exception in the case of stock or other assets that fall within the definition of a capital assets. As a result, the loss on the Wolverine stock is probably a capital loss. The loss due to the Spartan stock is a LTCL. The loss due to the Huron stock is ordinary since the stock is that of an affiliated corporation. p. I5-21. I5-50 a. b. $3,432 ($20,000 - $16,568) $94 Cash Received 12-31-96 6-30-97 12-31-97 6-30-98 12-31-98 6-30-99 Amortization of Discount $900 900 900 900 900 Interest Income $ 94 100 106 112 119 $ 994 1,000 1,006 1,012 1,019 Basis of Bond $16,568 16,662 16,762 16,868 16,980 17,099 For the first semiannual period, Phil must recognize $94 of original issue discount as ordinary income. c. d. $1,994 ($994 + $1,000) $16,762 ($16,568 + $94 + $100). p. I5-23. I5-51 (a.) Amount Realized Adjusted Basis Realized and Recognized Gain or (Loss) Ordinary Gain Capital Gain or (Loss) (b.) (c.) $191,000 (184,000) $185,750 (184,000) $183,000 (184,000) $ 7,000 2,000* $ 5,000 $ 1,750 1,750 $ 0 $ 1,000 ($ 1,000) *The market discount of $16,000 accrued for the two years that Swen held the bond is $2,000 ($16,000 x 2 years/16 years). pp. I5-23 and I5-24. I5-10 I5-52 The $3,800 loss on the sale of the automobile is not deductible. Gary has a $11,700 STCG that is offset by $2,000 ($5,000 - $3,000 deduction in 1997) STCL carried forward from 1997. Thus, Gary has a $9,700 NSTCG. Gary's AGI is $59,700 ($50,000 + $9,700). pp. I5-16 and I5-17. I5-53 a. Amount realized Minus: Basis STCG b. $5,000 (20 X $250) STCL c. $11,000 LTCG Amount realized Minus: Basis LTCG $ 6,200 ( 5,000) $ 1,200 (20 x $310) $100,000 ( 89,000) $ 11,000 (2,000 x $50) [(2,000 x $42) + $5,000] pp. I5-24 and I5-25. I5-54 a. b. $23,550 LTCG Amount realized Minus: Basis LTCG $38,550 (15,000) $23,550 ($37,500 + $1,050) (500 x $30) $1,050 STCG is recognized in 1999. pp. I5-24 and I5-25. I5-55 The painting is not a capital asset. She has ordinary income of $1,950. The basis for the stock is $30,000, thus a LTCL of $1,500 ($28,500 - $30,000) is recognized. The holding period for inherited property is always considered to be more than one year (i.e., long-term). Since the land is sold at a loss, her basis is $30,000. Since her basis is the property's FMV on the date of the gift, the holding period starts on the date of the gift, April 8, 1997. She has a STCL of $5,000. a. NSTCL of $5,000 b. NLTCL of $1,500 c. Betty's AGI is reduced by $3,000. d. Betty has a STCL carryforward of $2,000 ($5,000 - $3,000) and a LTCL carryforward of $1,500. pp. I5-6 through I5-9, I5-16 and I5-18. I5-56 Case A: taxable income is $184,000. Case B: taxable income is $115,000. Case C: taxable income is $80,000. Net corporate capital losses are not deductible. I5-11 Case D: taxable income is $90,000. Net corporate capital losses are not deductible. pp. I5-20 and I5-21. I5-57 a. b. c. $9,259 ($4,614 + $4,645) $4,677 $1,736 [$95,949 - ($92,277 + $614 + $645 + $677)]. p. I5-22. I5-58 a. If Dale sells the stock, his LTCG is $5,500 and the tax is $1,100 ($5,500 x 0.2). He will have $5,400 ($6,500 - $1,100) to give to Tammy. b. If Dale gives the stock to Tammy and she sells it, her LTCG is $5,500 since her basis for the stock is $1,000. Her tax is $550 ($5,500 x 10%). Tammy will have $5,950 ($6,500 - $550) available for college. pp. I5-6 and I5-7. I5-59 a. $40,000 ( 3,000) 14,000 $51,000 AGI without considering the gains and losses Capital loss Ordinary gain AGI b. $40,000 4,000 $44,000 AGI without considering the gains and losses Net capital gain ($14,000 - $10,000) AGI c. The answer in part (a) is the same. The AGI in part (b) is reduced by $2,500 to $41,500 since the net capital gain is $1,500 ($14,000 - $12,500). pp. I5-16 through I5-18. I5-60 a. NSTCG is $13,000 since the capital loss incurred in 1992 is carried forward as a $40,000 STCL. b. $263,000 ($250,000 + $13,000). c. $303,000 ($250,000 + $53,000). The $40,000 capital loss may not be carried forward to 1997 since the carryforward period is only five years. pp. I5-20 and I5-21. Tax Form/Return Preparation Problems I5-61 (See Instructor's Guide) I5-62 (See Instructor's Guide) Case Study Problems I5-63 (See Instructor's Guide) I5-64 (See Instructor's Guide) I5-12 Tax Research Problems I5-65 (See Instructor's Guide) I5-66 (See Instructor's Guide) I5-67 (See Instructor's Guide) I5-68 (See Instructor's Guide) I5-13