Chap004

Chapter 04 - Planning Your Tax Strategy

4

PLANNING YOUR TAX STRATEGY

CHAPTER OVERVIEW

The basics of taxes and their relationship to financial planning are presented in this chapter. The material starts with a brief discussion of types of taxes. Next, the fundamental aspects of federal income taxes are presented including taxable income, deductions, exemptions, tax rates, and tax credits. The information on filing your federal income tax return covers filing status, types of tax forms, basic steps for completing Form 1040, tax assistance sources, and audit procedures. Finally, the chapter concludes with a discussion of tax planning strategies related to purchasing decisions, investment alternatives, and retirement plans.

LEARNING OBJECTIVES CHAPTER SUMMARY

After studying this chapter, students will be able to:

Obj. 1 Describe the importance of taxes for personal financial planning.

Tax planning can influence spending, saving, borrowing, and investing decisions. A knowledge of tax laws and maintenance of accurate tax records are necessary to take advantage of appropriate tax benefits. An awareness of income taxes, sales tax, excise tax, property tax, estate tax, inheritance tax, gift tax, and

Social Security is vital for successful financial planning.

Obj. 2 Calculate taxable income and the amount owed for federal income tax.

Taxable income is determined by subtracting adjustments to income, deductions, and allowances for exemptions from gross income. Your total tax liability is based on the published tax tables or tax schedules less any tax credits.

Obj. 3 Prepare a federal income tax return.

The major sections of Form 1040 require the determination or calculation of (1) your filing status, (2) your exemptions, (3) your income from all sources, (4) adjustments to your income, (5) your standard deduction or itemized deductions, (6) tax credits for which you qualify, (7) other taxes you owe, (8) amounts you have withheld or paid in advance, and (9) your refund or the additional amount you owe.

Obj. 4 Identify tax assistance sources.

The main sources of tax assistance are IRS services and publications, the Internet, other publications, computer software, and professional tax preparers such as commercial tax services, enrolled agents, accountants, and attorneys.

4-1

Chapter 04 - Planning Your Tax Strategy

Obj. 5 Select appropriate tax strategies for different financial and personal situations.

INTRODUCTORY ACTIVITIES

You may reduce your tax burden through careful planning and financial decisions related to consumer purchasing, the use of debt, investment decisions, and retirement planning.

Ask students to comment on their responses to the “My Life” chapter opening exercise (p. 105).

Point out the learning objectives (p. 105) in an effort to highlight the key points in the chapter.

Ask students to provide examples of common concerns associated with preparing a federal income tax return.

Point out methods of financial planning that can save money on taxes.

CHAPTER 4 OUTLINE

I.

II.

Taxes and Financial Planning

A. Taxes on Purchases

B. Taxes on Property

C. Taxes on Wealth

D. Taxes on Earnings

Income Tax Fundamentals

A. Step 1: Determining Adjusted Gross Income

1. Types of Income

2. Adjustments to Income

B. Step 2: Computing Taxable Income

1. Deductions

2. Exemptions

C. Step 3: Calculating Taxes Owed

1. Tax Rates

2. Tax Credits

D. Making Tax Payments

1. Withholding

2. Estimated Payments

E. Deadlines and Penalties

III. Filing Your Federal Income Tax Return

A. Who Must File?

B. Which Tax Form Should You Use?

C. Completing the Federal Income Tax Return

D. Filing State Income Tax Returns

4-2

Chapter 04 - Planning Your Tax Strategy

IV. Tax Assistance and the Audit Process

A. Tax Information Sources

1. IRS Services

2. Tax Publications

3. The Internet

B.

Tax Preparation Software

C. Tax Preparation Services

1. Types of Tax Services

V.

2. Evaluating Tax Services

3. Tax Service Warnings

D. What If Your Return Is Audited?

1. Who Gets Audited?

2. Types of Audits

3. Your Audit Rights

Tax Planning Strategies

A. Consumer Purchasing

1. Place of Residence

2. Consumer Debt

3. Job Related Expenses

4. Health Care Expenses

B. Investment Decisions

1. Tax Exempt Investments

2. Tax Deferred Investments

3. Self Employment

4. Children’s Investments

C. Retirement Plans

1. Traditional IRA

2. Roth IRA

3. Coverdell Education Savings Account

4. Keogh Plan

5. 401(K) Plan

D. Tax-Savings Strategies: A Summary

4-3

Chapter 04 - Planning Your Tax Strategy

CHAPTER 4 LECTURE OUTLINE

I. TAXES AND FINANCIAL PLANNING (p. 106)

Common goals related to tax planning include:

maintaining complete records

knowing current tax laws making financial decisions that can reduce your tax liability

The principal purpose of taxes is to finance government activities.

Taxes on Purchases (p. 106)

State and local sales taxes are added to the purchase price of products.

An excise tax is imposed on specific goods and services, such as gasoline, cigarettes, alcoholic beverages, tires, air travel, and telephone service.

Taxes on Property (p. 106)

The real estate property tax is based on the value of land and buildings.

Personal property taxes on the value of automobiles, boats, furniture, and farm equipment are imposed in some areas

Taxes on Wealth (p. 106)

An estate tax is imposed on the value of an individual’s property at the time of his or her death.

An inheritance tax is levied on the value of property bequeathed by a deceased individual.

Gift amounts greater than $12,000 are subject to federal tax.

Taxes on Earnings (p. 107)

Social Security taxes are used to finance the retirement, disability, and life insurance benefits of the federal government’s social security program.

Income tax is the major financial planning aspect of taxes for most individuals. In addition to federal income tax, all but seven states also have a state income tax.

Instructional Suggestions

Discussion Question: Why do many people avoid the topics of taxes more than other areas of personal financial planning?

Current Example: Thirty-five percent of Americans would support putting advertising on dollar bills if it would lower their taxes. Each year, 25 percent of all federal income tax forms are filed on April 15.

About half of Americans prepare their own tax returns.

Discussion Question: Are progressive taxes the most equitable for all people?

Use PPT slides 4-2 to 4-6.

Concept Check 4-1 (p. 107)

4-4

Chapter 04 - Planning Your Tax Strategy

CHAPTER 4 LECTURE OUTLINE

II. INCOME TAX FUNDAMENTALS (p. 107)

The process of determining your federal income tax involves computing taxable income, calculating the amount of tax owed, and comparing this amount with income tax payments withheld or made during the year.

Step 1: Determining Adjusted Gross Income (p. 108)

Taxable income is the net amount of income, after allowable deductions, on which tax is computed.

Earned income is money received by an individual for personal effort such as wages, salary, commission, fees, tips, or bonuses.

Investment income (also called portfolio income) is money received in the form of dividends or interest.

Passive income is the result of business activities in which you do not actively participate, such as a limited partnership.

An exclusion is an amount not included in gross income, such as foreign income when working in another country.

Tax-exempt income is income not subject to tax.

Tax-deferred income refers to income that will be taxed at a later date.

Adjusted gross income (AGI) is gross income after certain reductions have been made.

Step 2: Computing Taxable Income (p. 109)

A deduction is an amount subtracted from adjusted gross income to arrive at taxable income. Every taxpayer receives at least the standard deduction

—a set amount on which no tax is paid.

Many individuals qualify for more than the standard deduction.

Itemized deductions are expenses that a taxpayer is allowed to deduct from adjusted gross income; these include:

medical and dental expenses above a certain amount

certain state and local taxes

certain interest payments such as home mortgage

contributions

casualty and theft losses based on certain restrictions

moving expenses under certain conditions

certain job-related and miscellaneous expenses

4-5

Instructional Suggestions

Transparency Master 4-1 provides an overview of the process for computing taxable income and your tax liability.

Discussion Question: Should all types of income be taxed at the same rate?

Transparency Master 4-2

(Exhibit 4-2, p. 111) suggest a system for maintaining tax records.

Text Highlight: Pages 107-108 offer details regarding the various categories of itemized deductions.

Use PPT slides 4-7 to 4-18.

Text Highlight

: The “Financial

Planning in Action” feature on page 110 can be used as a class exercise to discuss items included in taxable income and common deductions.

Chapter 04 - Planning Your Tax Strategy

CHAPTER 4 LECTURE OUTLINE

An exemption is a deduction from adjusted gross income for yourself, your spouse, and qualified dependents.

Step 3: Calculating Taxes Owed (p. 112)

Taxable income is the basis for the amount of your income tax. The use of tax rates and the benefits of tax credits are the final phase of the tax computation process.

Use your taxable income in conjunction with the appropriate tax table or tax schedule.

The marginal tax rate refers to the rate used to calculate tax on your last (and next) dollar of taxable income.

The average tax rate is based on the total tax due divided by your taxable income.

A tax credit is an amount subtracted directly from the amount of taxes owed.

Making Tax Payments (p. 114)

The pay-as-you-go system, which was started in 1943, requires an employer to deduct an amount for federal income tax from your pay and send it to the government. The withheld amount is based on the number of exemptions and expected deductions.

The W-2 form reports your annual earnings and the amounts that have been deducted for federal income tax, social security, and, if applicable, state income tax.

Students and other low-income individuals may file for exemption from withholding if they paid no federal income tax last year and do not expect to pay any in the current year.

People with income from savings, investments, independent contracting, royalties, and lump-sum payments from pensions or retirement plans may be required to make tax payments during the year.

Deadlines and Penalties (p. 116)

Instructional Suggestions

Text Highlight: The “Financial

Planning Calculations” feature on page 111 demonstrates the difference between a tax credit and a tax deduction. PPT Slide

4-16.

Text Highlight: See pages 113-

115 for a list of recent tax credits available to various taxpayers.

Text Highlight: Exhibit 4-3 (p.

112 presents a sample W-2 form. (PPT ___4-14).

Discussion Question: Does wise financial planning include getting a large income tax refund each year?

Current Example: Mary

Stinson was billed for $54.94 by the IRS for a 10-cent underpayment. She was assessed a $24 late penalty and $30.84 in interest.

4-6

Chapter 04 - Planning Your Tax Strategy

Most people are required to file their federal income tax return each April 15. If you are not able to file on time, Form 4868 can be used to obtain an automatic four-month extension. This extension is for the 1040 form and other documents, but it does not delay your payment liability.

Concept Check 4-2 (p. 116)

4-7

Chapter 04 - Planning Your Tax Strategy

CHAPTER 4 LECTURE OUTLINE

III. FILING YOUR FEDERAL INCOME TAX

RETURN (p. 116)

The annual submission of your federal income tax requires several decisions and activities.

Who Must File? (p. 116)

Every citizen or resident of the United States and every U.S. citizen who is a resident of Puerto Rico is required to file a federal income tax return if his or her income is above a certain amount.

The five filing status categories are:

single

married filing joint return

head of household

married filing separate return qualifying widow or widower

Which Tax Form Should You Use? (p. 117)

You may use Form 1040EZ if you are single and claim only your own exemption; if your income consisted only of wages, salaries, and tips and not more than $400 of interest; if your taxable income is less than $50,000; and if you do not itemize deductions or claim any adjustments to income or any tax credits.

The Form 1040A would be used by individuals who have less than $50,000 in taxable income from wages, salaries, tips, unemployment compensation, interest, or dividends; on this form you can report a deduction for individual retirement account (IRA) contributions and a tax credit for child care and dependent care expenses.

Form 1040 is an expanded version of Form 1040A that includes sections for all types of income and makes it possible to itemize your deductions.

Form 1040X is used to amend a previously filed tax return.

Completing the Federal Income Tax Return (p. 117)

The major sections of Form 1040 are:

1.

filing status and exemptions

2.

income

3.

adjustments to income

4.

tax computation

5.

tax credits

6.

other taxes

7.

payments

4-8

Instructional Suggestions

Supplementary Resource: For federal income tax instructional materials, contact the Internal

Revenue Service, ATT:

Taxpayer Education, 1111

Constitution Ave., SW,

Washington, DC 20224

(202-566-4904). Website: http://www.irs.gov

Use PPT slide 4-19.

Assignment: Have students obtain current tax forms and instructions from a local IRS office, bank, library, or post office.

Exercise: Have class members discuss their experiences when preparing their federal tax returns.

Text Highlight: Exhibit 4-4

(pp. 118) presents an overview of the various types of 1040 forms. (PPT slides 4-20, 4-21)

Transparency Master 4-3 presents the first page of the

Form 1040.

Transparency Master 4-4 presents the back of Form 1040.

Transparency Master 4-5 presents the main categories of itemized deductions reported on

Schedule A Form 1040.

Chapter 04 - Planning Your Tax Strategy

CHAPTER 4 LECTURE OUTLINE

8.

refund or amount owed

9.

your signature

Filing State Income Tax Returns (p. 119)

All but seven states have a state income tax. States usually require income tax returns to be filed when your federal tax return is due.

Instructional Suggestions

Use PPT slides 4-22 and 4-23.

Transparency Master 4-6 presents an example of current tax tables and tax rate schedules.

Concept Check 4-3 (p. 120)

4-9

Chapter 04 - Planning Your Tax Strategy

CHAPTER 4 LECTURE OUTLINE

IV. TAX ASSISTANCE AND THE AUDIT PROCESS

(p. 121)

Tax Information Sources (p. 121)

The Internal Revenue Service assists taxpayers through books and other publications, recorded phone messages with tax information, a toll-free hotline to answer questions, and a walk-in tax assistance service.

Other tax guides available from various organizations are published each year.

The Internet provides many information sources related to tax planning and tax form preparation.

Tax Preparation Software (p. 124)

A spreadsheet program can be very helpful for maintaining and updating tax data on various income and expense categories.

Specialized programs for preparing your federal income tax return are also available.

Instructional Suggestions

Discussion Question: Should individuals do their own taxes or make use of the services of a professional tax preparer?

Use PPT slide 4-24 to 4-26 .

Current Example: Filing early can extend the three-year-period of limitation for an audit. For example, if you file February 1,

2012, the IRS still has until

April 15, 2015 (instead of Feb.

1, 2015) to notify you of an examination of that return.

Text Highlight: Point out factors to consider when selecting tax software (p. 124).

Text Highlight: The ”How

To…” feature (p. 125) discusses the process for filing your taxes online.

4-10

Chapter 04 - Planning Your Tax Strategy

CHAPTER 4 LECTURE OUTLINE

Tax Preparation Services (p. 124)

The sources available for professional tax assistance include:

tax services

enrolled agents, who are government-approved tax experts

accountants

attorneys

When planning to use a tax preparation service, consider these factors:

What training and experience does the tax professional possess?

How will the fee be determined? (Avoid preparers who earn a percentage of your refund.)

Does the preparer suggest you report various deductions that might be questioned?

Will the preparer represent you if your return is audited?

Is tax preparation the main business activity, or does it serve as a front for selling other financial products and services?

Instructional Suggestions

4-11

Chapter 04 - Planning Your Tax Strategy

CHAPTER 4 LECTURE OUTLINE

What If Your Return Is Audited? (p. 127)

The IRS reviews all returns to make sure that they have been properly completed. If you made an error, your tax is automatically refigured and you will receive a bill or a refund.

A tax audit is a detailed examination of your tax return by the IRS.

The types of audits are:

the correspondence audit to clarify or document minor questions

the office audit in which you must visit an IRS office to clarify some aspect of your return

the field audit involves an IRS agent visiting your home or place of business

When you receive an audit notice, you have the right to have more time to prepare. Also, ask the IRS for clarification of items being questioned. When being audited, the following suggestions can be helpful:

decide if you will bring your tax preparer, accountant, or lawyer

be on time to your appointment; bring only relevant documents

answer the IRS agent’s questions clearly and completely

present substantiating records and receipts in a logical, calm, and confident manner, and maintain a positive attitude that avoids hostility

make sure the information you present is consistent with the tax law

keep your answers aimed at the auditor’s questions.

Be as brief as possible; you can never tell an auditor too little.

4-12

Instructional Suggestions

Use PPT slide 4-27.

Concept Check 4-4 (p. 128)

Chapter 04 - Planning Your Tax Strategy

CHAPTER 4 LECTURE OUTLINE

V. TAX PLANNING STRATEGIES (p. 128)

Tax avoidance is the use of legitimate methods to reduce one’s taxes.

Tax evasion is the use of illegal actions to reduce one’s taxes.

Consumer Purchasing (p. 129)

Owning a home is one of the best tax shelters available to most individuals. Real estate property taxes and mortgage interest are deductible as itemized deductions.

The interest on home equity loans is deductible, when these loans are used to buy a car, consolidate credit card debts, or finance other personal expenses.

A variety of work expenses, such as union dues, certain travel and education costs, and business tools, may be included as itemized deductions.

Flexible spending accounts (FSA) , also called health savings accounts and expense reimbursement accounts, reduce taxable income when paying for medical expenses or child-care costs.

Workers are allowed to put pre-tax dollars into these employer-sponsored programs. These “deposits” result in a lower taxable income. Then, the funds in the FSA may be used to pay for various medical expenses and dependent-care costs.

A drawback of the FSA is that any account funds must be used to pay for expenses incurred before year's end or the money is lost.

Investment Decisions (p. 130)

Interest income from municipal bonds, which are issued by state and local governments and other taxexempt investments, is not subject to federal income taxes.

Tax-deferred investments include:

tax-deferred annuities

Section 529 savings plans to set aside money for a child’s education

retirement plans such as IRA, Keogh, or 401(k) plans

Instructional Suggestions

Use PPT slides 4-28 and 4-29.

Use PPT slide 4-30.

PPT Slides 4-31 to 4-33.

4-13

Chapter 04 - Planning Your Tax Strategy

CHAPTER 4 LECTURE OUTLINE

Capital gains , profits from the sale of a capital asset such as stocks, bonds, or real estate, are also tax deferred; you do not have to pay the tax on these profits until the asset is sold. Long-term capital gains

(on investments held more than a year) are taxed at a lower rate. Certain assets, however, such as art, antiques, stamps, and other collectibles, are still taxed at the pre-1997 capital gains rate—28 percent.

Short-term capital gains (on investments held for less than 12 months) are taxed as ordinary income (See

Financial Planning Calculations box on page 129).

Instructional Suggestions

4-14

Chapter 04 - Planning Your Tax Strategy

CHAPTER 4 LECTURE OUTLINE

The sale of an investment for less than its purchase price is, of course, a capital loss . Capital losses can be used to offset capital gains and up to $3,000 of ordinary income. Unused capital losses may be carried forward into future years to offset capital gains or ordinary income up to $3,000 per year.

Retirement Plans (p. 131)

A major tax strategy of benefit to working people is the use of tax-deferred retirement plans such as individual retirement accounts (IRAs), Keogh plans, and 401(k) plans.

A traditional IRA allows contributions up to $2,000 per year with earnings from the plans not taxed until they are withdrawn. Today, a regular IRA deduction is available only to people who do not participate in employer-sponsored retirement plans and have an adjusted gross income under a certain amount.

In general, amounts withdrawn from deductible IRAs are included in gross income. An additional 10 percent penalty is usually imposed on withdrawals made before age 59½ unless the withdrawn funds are on account of death or disability, for medical expenses, or for qualified higher education expenses.

The Roth IRA allows a $5,000 annual contribution, which is not tax deductible; however, the earnings on the account are tax free after five years. The funds from the Roth IRA may be withdrawn before age 59½ if the account owner is disabled, or for the purchase of a first home ($10,000 maximum). Withdrawals from the Roth IRA are exempt from federal and state taxes..

If you are a self-employed person and own your own business, you can establish a Keogh plan. This retirement plan, also called an HR10 plan, may combine a profit-sharing plan and a money purchase pension plan of other investments.

Instructional Suggestions

4-15

Chapter 04 - Planning Your Tax Strategy

CHAPTER 4 LECTURE OUTLINE

The part of the tax code called 401(k) authorizes a tax-deferred retirement plan sponsored by an employer. This plan allows you to contribute a greater tax-deferred amount (a maximum of $16,500 in 2010) than you can contribute to an IRA. However, most companies set a limit on your contribution, such as 15 percent of your salary. Many employers provide a matching contribution in their 401(k) plans.

Tax-Savings Strategies: A Summary (p. 133)

Each year, the IRS changes the tax form and filing procedures. In addition, Congress frequently passes legislation that changes the tax code. These changes require that you regularly determine how to best take advantage of the tax laws for your personal financial planning.

Some guidelines to consider when selecting effective personal tax strategies include the following:

• Time the receipt of income and payment of taxable expenses in relation to your current and future tax rate.

• Take advantage of tax credit for which you qualify.

• Maximize contributions to tax-deferred retirement programs.

• Consider tax-exempt investments, such as municipal bonds.

• Defer capital gains and accelerate capital losses.

• Take advantage of the tax benefits of owning your own business.

• Plan purchases, such as a house or health care, with tax implications in mind.

• Search out all possible itemized deductions.

Instructional Suggestions

Concept Check 4-5 (p. 133)

4-16

Chapter 04 - Planning Your Tax Strategy

CONCLUDING ACTIVITIES

Point out the chapter summary (p. 134) and key terms in the text margin.

Use the “My Life Stage” feature (p. 134) to highlight the main financial planning activities from the chapter for various ages and life situations.

Discuss selected end-of-chapter Financial Planning Problems, Financial Planning Activities, Life

Situation Case, and Digital Case.

Use Chapter Quiz in the Instructor’s Manual .

Refer students to activities and readings in the Student Resource Manual for Chapter 4.

WORKSHEETS FROM PERSONAL FINANCIAL PLANNER FOR USE WITH

CHAPTER 4

Use the “Your Personal Financial Planner in Action” (p. 134) activities to encourage students to plan and implement various personal financial decisions.

Sheet 20 Current Income Tax Estimate

Sheet 21 Income Tax Preparer Comparison

Sheet 22 Tax Planning Activities

CHAPTER 4 QUIZ ANSWERS

True-False

1. F (p. 106)

2. F (p. 108)

3. F (p. 109)

4. F (pp. 114-115)

5. F (p. 124)

Multiple Choice

6. A (p. 110)

7. C (p. 109)

8. C (p. 111)

9. B (p. 127)

10. D (p. 130-131)

4-17

Chapter 04 - Planning Your Tax Strategy

Name ________________________________________ Date____________________________

CHAPTER 4 QUIZ

TRUE-FALSE

_____1. A general sales tax is also referred to as an excise tax.

_____2. Taxable income refers to the amount deducted from a person’s pay.

_____3. A tax deduction directly reduces the amount of taxes owed.

_____4. Most people mail the full amount owed in federal income tax each April.

_____5. Enrolled agents are IRS auditors who visit people’s homes to verify deductions.

MULTIPLE CHOICE

_____6. __________ is deductible as an itemized deduction. a.

Mortgage interest b.

Credit card interest c.

An IRA contribution d.

An automobile expense

_____7. An example of an adjustment to income is a.

passive income. b.

child care expenses. c.

IRA contributions. d.

commission and bonuses.

_____8. An exemption refers to a.

taxable income. b.

deductible expenses. c.

a reduction from adjusted gross income. d.

amounts not subject to an IRS audit.

4-18

Chapter 04 - Planning Your Tax Strategy

_____9. When an IRS agent visits your home or office to verify tax records, this is referred to as a(n) a.

office audit. b.

field audit. c.

correspondence audit. d.

research audit.

_____10. An example of tax-exempt income is a.

gambling winnings. b.

pension funds. c.

rental income. d.

interest from municipal bonds.

SUPPLEMENTARY LECTURE

Does a Fair Tax Exist?

Would you rather pay a tax directly or indirectly? Is a progressive tax better than a proportional tax?

These are difficult questions since taxes affect people in different household situations in different ways.

Three criteria used in assessing the fairness of taxes are benefits received, ability to pay, and the payment burden.

Benefits Received

The fairness criterion states that people should pay taxes in proportion to the benefits they receive from the government.

An example is the use of gasoline taxes and driver’s license fees for road construction and repairs.

Equitable as the benefits-received criterion may seem, it is very difficult to implement.

Ability to Pay

A commonly accepted criterion of tax fairness is that individuals with different amounts of wealth or income should pay different amounts of taxes.

Supporters of ability to pay usually argue that high tax bills hurt the rich less than the poor. This argument is the basis for the progressive tax, in which tax rates increase as the level of taxable income increases. The federal income tax is a progressive tax.

In a proportional tax, or flat tax, a constant tax rate is applied to all levels of the tax base. Many state and local income taxes are examples proportional taxes.

Some proportional taxes may seem fair, but in fact they penalize people in low income groups. For example, when all individuals are charged sales tax on food, low income people who use a larger portion of their incomes for necessities, pay a greater percentage of their total income for sales tax than people with higher incomes pay A regressive tax of this kind involves taxes that decrease, as a portion of income, as the tax base increases and tend to place a heavier burden on the poor. For this reason, many states do not tax sales of food and medications.

4-19

Chapter 04 - Planning Your Tax Strategy

Payment Burden

Many people believe only individuals pay taxes. Although businesses pay property and income taxes, some observers contend that these taxes are passed on to consumers in the form of higher prices.

We pay many indirect taxes of this kind. In addition to those just mentioned, a portion of building owners’ real estate taxes are paid by tenants as part of their rent.

In contrast, direct taxes cannot be passed on to someone else. Property taxes paid by homeowners and income taxes paid by individuals are examples of direct taxes.

ANSWERS TO CONCEPT QUESTIONS, PROBLEMS,

FINANCIAL PLANNING ACTIVITIES, FINANCIAL PLANNING CASE,

AND CONTINUING CASE

CONCEPT QUESTIONS

Concept Check 4-1 (p. 107)

1. How should you consider taxes for your financial planning?

Tax planning should include knowing current tax laws, maintaining complete tax records, and making financial decisions that reduce your tax liability. (p. 106)

2. What types of taxes do individuals frequently overlook when making financial decisions?

While most people are aware of the impact of federal income taxes on their financial situation, a wide variety of other taxes also affect financial planning. These include sales, excise, property, estate, inheritance, gift, and state and local income taxes. (p. 106-107)

Action Application : Encourage students to gather information using a web search and personal interviews.

Concept Check 4-2 (p. 116)

1. How does tax-exempt income differ from tax-deferred income?

Tax-exempt income is not subject to taxation. Tax-deferred income is income that will be taxed at a later date. (p. 109)

2. What information is needed to compute taxable income?

Taxable income is the result of subtracting adjustments to income, deductions, and exemptions from gross income. (See Exhibit 4-1, p. 108 and text pp. 107-112)

3. When would a person use the standard deduction instead of itemized deductions?

The standard deduction would be used when a person does not have at least that amount in itemized deductions. A taxpayer with no or few itemized deductions still receives the standard deduction—an amount on which no taxes are paid. (pp. 109-110)

4-20

Chapter 04 - Planning Your Tax Strategy

4. What is the difference between your marginal tax rate and your average tax rate?

The marginal tax rate refers to the rate used to calculate the last (and next) dollar of taxable income.

The average tax rate is based on the total tax due divided by taxable income. (p. 112)

5. How does a tax credit affect the amount owed for federal income tax?

A tax credit is a direct (dollar-for-dollar) reduction in the amount owed in taxes. One example of a tax credit is child and dependent care expenses. (p. 113-114)

Action Application : Student findings should reveal current examples of tax-exempt income and how

Social Security benefits and other income sources are taxed for people with different life situations.

Concept Check 4-3 (p. 120)

1. In what ways does your filing status affect preparation of your federal income tax return?

A person’s filing status, which is determined by marital status and dependents, will affect the amount of the standard deduction and the tax schedules that are used. (pp. 116-117)

2. What factors affect a taxpayer’s choice of a 1040 form?

Whether a taxpayer will use the 1040, the 1040A, or 1040EZ will depend on type of income, amount of income, number of deductions, and complexity of tax situation. (pp. 117-118)

Action Application : This activity will not only improve student awareness about taxes but can also enhance their communication skills.

Concept Check 4-4 (p. 128)

1. What are the main types of sources available to help people do their taxes?

The main sources of tax assistance are IRS publications and services, other tax publications, the

Internet, computer software, and tax preparers. (pp. 121-124)

2. What actions can help a person reduce the chances of an IRS audit?

By correctly reporting all income and properly taking advantage of deductions and tax credits, a person can reduce the chances of an audit. When unusual income or expense occurs, you may want to include an explanation of the item with the tax return.

3. What appeal process do taxpayers have if they disagree with an audit decision of the Internal

Revenue Service?

If you disagree with the results of the audit, you may request a conference at the Regional Appeals

Office. After this, a person may go to a U.S. tax court, the U.S. claims court, the U.S. district court, and even as far as the U.S. Supreme Court. (p. 128)

Action Application : Encourage students to point out some of the best online sources with information about e-filing.

4-21

Chapter 04 - Planning Your Tax Strategy

Concept Check 4-5 (p. 133)

1. How does tax avoidance differ from tax evasion?

Tax avoidance refers to the use of legitimate methods to reduce one’s taxes. Tax evasion is the use of illegal actions to reduce taxes. (p. 129)

2. What common tax-saving efforts are available to most individuals and households?

Common tax-savings efforts include owning a home with a mortgage (property taxes and mortgage interest are deductible), making purchases that may be deducted as job-related expenses, selecting tax-deferred and tax-exempt investments, owning your own business, and participating in a taxdeferred retirement plan.

Action Application : This exercise can help students better understand the reasons some people desire a refund while others try to avoid that situation.

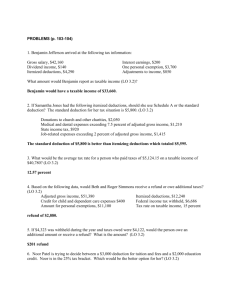

PROBLEMS (p. 135)

1. Thomas Franklin arrived at the following tax information:

Gross salary, $46,910

Interest earnings, $225

Dividend income, $80

One personal exemption, $3,650

Itemized deductions, $7,820

Adjustments to income, $1,150

What amount would Thomas report as taxable income?

Solution: Thomas would have a taxable income of $34,595 resulting from $46,910 + $80 + $225 -

$1,150 - $7,820 - $3,650.

LO: 2

Topic: Computing Taxable Income

LOD: Medium

Bloom tag: Application

2. If Lola Harper had the following itemized deductions, should she use Schedule A or the standard deduction? The standard deduction for her tax situation is $5,450.

Donations to church and other charities, $1,980

Medical and dental expenses that exceed 7.5 percent of adjusted gross income, $430

State income tax, $690

Job-related expenses that exceed 2 percent of adjusted gross income, $1,610

Solution: The standard deduction of $5,450 is better than itemizing deductions which totaled $4,710

($1,980 + $430 + $690 + $1,610).

LO: 2

Topic: Determining Tax Deductions

LOD: Medium

4-22

Chapter 04 - Planning Your Tax Strategy

Bloom tag: Application

3. What would be the average tax rate for a person who paid taxes of $4,864.14 on a taxable income of

$39,870?

Solution: The average tax rate would be 12.2 percent. ($4,864.14 ÷ $39,870)

LO: 2

Topic: Calculating Average Tax Rate.

LOD: Easy

Bloom tag: Application

4. Based on the following data, would Ann and Carl Wilton receive a refund or owe additional taxes?

Adjusted gross income, $46,686

Itemized deductions, $11,420

Child care tax credit, $80

Federal income tax withheld, $4,784

Amount for personal exemptions, $7,300

Tax rate on taxable income, 15 percent

Solution: Taxable income would be $27,966 ($46,686 - $11,420 - $7,300) times the average tax rate of 15 percent equals $4,195 less a tax credit of $80 gives a tax liability of $4,115. When compared to federal tax withheld ($4,784), the result is a refund of $669.

LO: 2

Topic: Determining a Refund or Taxes Owed.

LOD: Hard

Bloom tag: Application

5. Each year, the Internal Revenue Service adjusts the value of an exemption based on inflation (and rounded to the nearest $50). In a recent year, if the exemption was worth $3,100 and inflation was 4.7 percent, what would be the amount of the exemption for the upcoming tax year?

Solution: $3,100 X 1.047 = $3,245.70 rounded to $3,250

LO: 2

Topic: Indexing Exemptions for Inflation.

LOD: Medium

Bloom tag: Application

6. If $3,432 was withheld during the year and taxes owed were $3,316, would the person owe an additional amount or receive a refund? What is the amount?

Solution: $3,432 - $3,316 = $116 refund

LO: 2

Topic: Determining a Tax Refund.

LOD: Medium

Bloom tag: Application, analysis

4-23

Chapter 04 - Planning Your Tax Strategy

7. If 400,000 people each receive an average refund of $2,300, based on an interest rate of

4 percent, what would be the lost annual income from savings on those refunds?

Solution: 400,000 X $2,300 X .04 = $36,800,000

LO: 2

Topic: Opportunity Cost of Tax Refunds

LOD: Easy

Bloom tag: Application

8. Which 1040 form should each of the following individuals use? a. A high school student with an after-school job and interest earnings of $480 from savings accounts. b. A college student who, due to ownership of property, is able to itemize deductions rather than take the standard deduction. c. A young, entry-level worker with no dependents and income only from salary.

Solution: a. Form 1040A b. Form 1040 c. Form 1040EZ

LO: 3

Topic: Selecting Federal Tax Forms

LOD: Easy

Bloom tag: Application

9. Using the tax table in Exhibit 4-7, determine the amount of taxes for the following situations: a. A head of household with taxable income of $26,210. b. A single person with taxable income of $26,888. c. A married person filing a separate return with taxable income of $26,272.

Solution: a. $3,336 b. $3,614 c. $3,524

LO: 3

Topic: Using Federal Tax Tables

LOD: Easy

Bloom tag: Application

4-24

Chapter 04 - Planning Your Tax Strategy

10. Would you prefer a fully taxable investment earning 10.2 percent or a tax-exempt investment earning

7.9 percent? Why? (Assume a 28 percent tax rate.)

Solution: With a 28 percent tax rate, 10.2 percent times 0.72 equals 7.344 percent; a 7.9 percent taxexempt return would be preferred.

LO: 5

Topic: Comparing Taxes on Investments

LOD: Hard

Bloom tag: Application, analysis

11. On December 30, you decide to make a $1,000 charitable donation. If you are in the 28 percent tax bracket, how much will you save in taxes for the current year? If you deposit that tax savings in a savings account for the next five years at 4 percent, what will be the future value of that account?

Solution: 0.28

$1,000 = $280 tax savings; $280

1.217 = $340.76

LO: 3

Topic: Future Value of a Tax Savings

LOD: Medium

Bloom tag: Application

12. If a person with a 28 percent tax bracket makes a deposit of $4,000 to a tax deferred retirement account, what amount would be saved on current taxes?

Solution: $4,000 x 0.28 = $1,120

LO: 5

Topic: Tax Deferred Retirement Benefits

LOD: Easy

Bloom tag: Application

FINANCIAL PLANNING ACTIVITIES (p. 136)

1. Using the web sites such as http://www.quicken.com

, Kiplinger’s Personal Finance Magazine at http://www.kiplinger.com

, or Money Magazine at http://www.money.com

, or library resources, obtain information about the tax implications of various financial planning decisions.

This activity can help students start to understand the extent to which taxes influence financial decisions. In addition, students should obtain some examples of wise tax planning from some various sources.

2. Survey several people about whether they get a federal tax refund each year. Obtain information from several individuals about the following: (a) Do they usually get a refund or have to pay when they file their federal tax return? (b) Is their situation (refund or payment) planned? (c) What are the reasons why they want to get a refund each year? (d) Are there reasons why getting a refund may not be a wise financial decision?

4-25

Chapter 04 - Planning Your Tax Strategy

While getting a refund can be viewed as a method of “forced savings” and does prevent a person from having to come up with the money to pay taxes on April 15, some people view this action as giving the government an interest-free loan since it has the use of the money until a refund is issued.

The opportunity cost is the lost interest that would be earned if it were in savings.

3. Use IRS publications and other reference materials to answer a specific tax question. Contact an IRS office to obtain an answer for the same question. What differences, if any, exist between the information sources?

This activity can help students better understand the federal income tax return preparation process. In addition, they should realize that certain tax matters regarding income and deductions may be open to interpretation.

4. Using Sheet 21 in the Personal Financial Planner , obtain information from two different tax preparation companies about the services they offer and the costs of their services.

Refer students to the list of tax preparers on pages 124-125 of the textbook. Differences in fees may be probably related to the expertise of the preparer; accountants, for example, charge a higher rate than employees at a tax service who do not have as extensive training.

5. Survey friends and relatives about the tax-planning strategies. Sheet 22 from the Personal Financial

Planner may be used for asking questions in your survey.

This exercise can provide students with examples of specific tax planning activities that can benefit them now or in the future.

FINANCIAL PLANNING CASE

A Single Father’s Tax Situation (p. 137)

1. What are Eric’s major financial concerns in his current situation?

Eric’s major financial concerns include providing for the current and future financial needs of his daughters, weak tax-planning activities, and limited use of investments with tax benefits.

2. In what ways might Eric be able to improve his tax-planning efforts?

Eric could take advantage of child care tax benefits, change his withholding amount to avoid owing a large amount in April, and investigate tax-exempt or tax-deferred investments.

3. Is Eric typical of many people in our society with regard to tax planning? Why?

While student answers will vary depending on their awareness of tax planning efforts, most individuals tend to avoid this aspect of personal finance. Many believe the topic is too complex, but the content offered in this chapter is designed to provide a basic understanding of this vital area.

4. What additional actions might Eric investigate with regard to taxes and personal financial planning?

Other areas Eric might consider include the purchase of a home to take advantage of its tax benefits and expanded use of tax-deferred retirement plans.

4-26

Chapter 04 - Planning Your Tax Strategy

5. Calculate the following: a. What is Eric’s taxable income? (Refer to Exhibit 4-1, p. 108)

Taxable income is $26,780 ____

($48,340 + $125 + $65 - $2,800 - $8,000 - ___$10,200) b. What is his total tax liability? (Use Exhibit 4-7, p. 122) What is his average tax rate?

Tax liability is______ $3,056 ($3,456 from tax table less $400 tax credit). His average tax rate is

11.41 percent ($3,056 divided by $26,780). c. Based on his withholding, will Eric receive a refund or owe additional tax? What is the amount?

Eric receives a refund of $122. ($3,178 withheld less $3,056 liability.)

CONTINUING CASE

Taxes (p. 138)

Questions

1.

Given her current situation, list some suggestions on what Shelby should do with a tax refund of

$800.

Shelby previously calculated that she needed an emergency fund of 3 to 6 months of living expenses ($3,630 to $7,260), so she could use the refund to work to accumulate this amount.

Also, she could use the refund to begin to pay off her credit card debt, begin paying off the

2.

Based on her current and future life situation, what tax planning strategies should she consider? student loan debt, or start an investment program. Most of all, she should avoid the temptation to spend the money on an unnecessary shopping spree.

Although student responses may vary, some good answers to this question are:

Identify any job-related expenses that may be deducted on her tax return

Set up a flexible spending account (FSA) for medical expenses to reduce her tax liability

Consider a tax-exempt investment or a tax-deferred retirement program such as a 401k

Compare her tax rate for the current year and the next and decide if she needs to accelerate or delay the receipt of income in order to minimize her tax liability

3.

Describe how Shelby might use the Personal Financial Planner sheet entitled “Tax Planning

Activities” to help her tax situation.

Although student responses may vary, some good answers to this question are:

Shelby can use this form to consider actions that can prevent tax penalties and may result in tax savings.

DAILY SPENDING DAIRY (p. 138)

This activity can provide students with increased understanding of their spending and the role of taxes in their personal financial decisions.

4-27

Chapter 04 - Planning Your Tax Strategy

TM 4-1 Computing Taxable Income and Your Tax Liability (Exhibit 4-1)

4-28

Chapter 04 - Planning Your Tax Strategy

TM 4-2 A Tax Recordkeeping System (Exhibit 4-2, p. 111)

4-29

Chapter 04 - Planning Your Tax Strategy

TM 4-3 Federal Income Tax Return —Form 1040 (Exhibit 4-5, p. 119)

4-30

Chapter 04 - Planning Your Tax Strategy

TM 4-4 Federal Income Tax Return —Form 1040

(Exhibit 45 cont’d, p.120)

4-31

Chapter 04 - Planning Your Tax Strategy

TM 4-5 Schedule for Itemized Deductions —Form 1040

(Exhibit 4-6, p. 121)

4-32

Chapter 04 - Planning Your Tax Strategy

TM 4-6 Tax Tables and Tax Rate Schedules (Exhibit 4-7, p. 122)

4-33