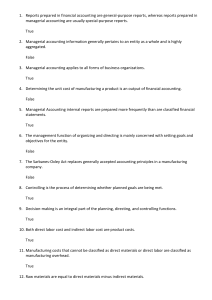

Chapter 1 – Managerial Accounting Concepts & Decision

advertisement

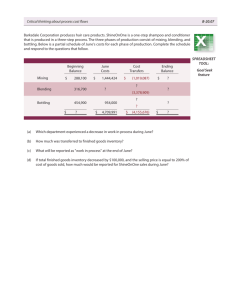

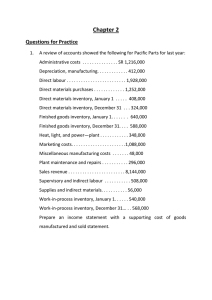

Chapter 1 – Managerial Accounting Concepts & Decision-Making Support A. The goal of managerial accounting. 1. To provide managers with the information they need for planning, control, and decision-making. 2. Budgets are the financial plans of a company (profit, cash-flow, production) 3. Control is achieved by evaluating the performance of managers and the operations that they run. a. Managers are evaluated to determine if their performance should be rewarded or punished. b. Operations are evaluated to determine if they should be changed. 4. Decision-making is a crucial part of the planning and control process. a. Decisions are made to reward or punish managers. b. Decisions are made to change operations or revise plans. B. Comparison of managerial and financial accounting C. The controller as the top management accountant. 1. The Controller prepares reports for planning and evaluating company activities. They also: a. Prepare financial accounting reports b. Tax reports c. Coordinate with the external auditors. 2. The Treasurer has custody of cash and funds invested in various marketable securities. They also prepare cash forecasts and obtaining financing from banks and other lenders. 3. The Chief Financial Officer (CFO) is the senior executive responsible for both accounting and financial operations. D. Cost terms used in planning, control, and decision-making. 1. Direct costs are costs that are directly and easily traceable to a specific cost object, i.e., a product, activity, or department. 2. Indirect costs are costs that cannot be directly or easily traceable to some cost object. 3. Variable costs increase or decrease, in total, with increases or decreases in the level of business activity. The variable cost per unit remains constant. a. Examples include: Direct materials, Direct Labor, Commissions 4. Fixed costs remain constant, in total, with changes in the level of business activity. Fixed cost per unit varies inversely with changes in the level of business activity. a. Examples include: Salaries, Depreciation, Rent 5. Opportunity costs are the benefits foregone from choosing one alternative over another. E. Cost classifications for manufacturing firms. 1. Manufacturing or Product costs. a. Direct materials: Materials directly and easily traceable to the end product. b. Direct labor: The hands on labor in the production process. c. Manufacturing overhead: All other manufacturing costs other than direct materials and direct labor. d. Inventoried until sold and then expensed through cost of goods sold. 2. Nonmanufacturing or period costs a. Selling, general, and administrative costs. b. Expensed as incurred. F. Balance sheet presentation of product cost 1. Raw materials inventory, Work-in-process inventory, Finished goods inventory G. Flow of product costs 1. Product costs flow into work in process inventory until the job is completed. 2. Product costs flow out of work in process inventory into finished goods inventory when the job is completed. 3. Product costs flow out of finished goods inventory into cost of goods sold when the job is sold. H. Income statement presentation of product costs. 1. Cost of goods manufactured = Beginning work in process + current manufactured costs – ending work in process. 2. Cost of goods sold = Beginning finished goods + cost of goods manufactured - ending finished goods. 3. Gross Profit / Gross Margin = Sales revenue – cost of goods sold 4. Operating Income / Net Income = Sales revenue – cost of goods sold – selling & administrative expenses I. Ethical considerations in Managerial Decision Making 1. Ethical behavior requires that managers recognize the difference between what’s right and what’s wrong and then make decisions consistent with what’s right. 2. Companies establish standards of conduct referred to as Company Codes of Conduct.