Chapter 15: Multiple Deposit Creation

advertisement

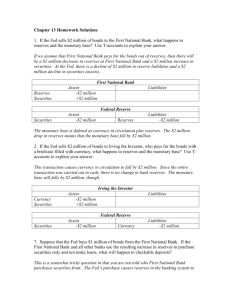

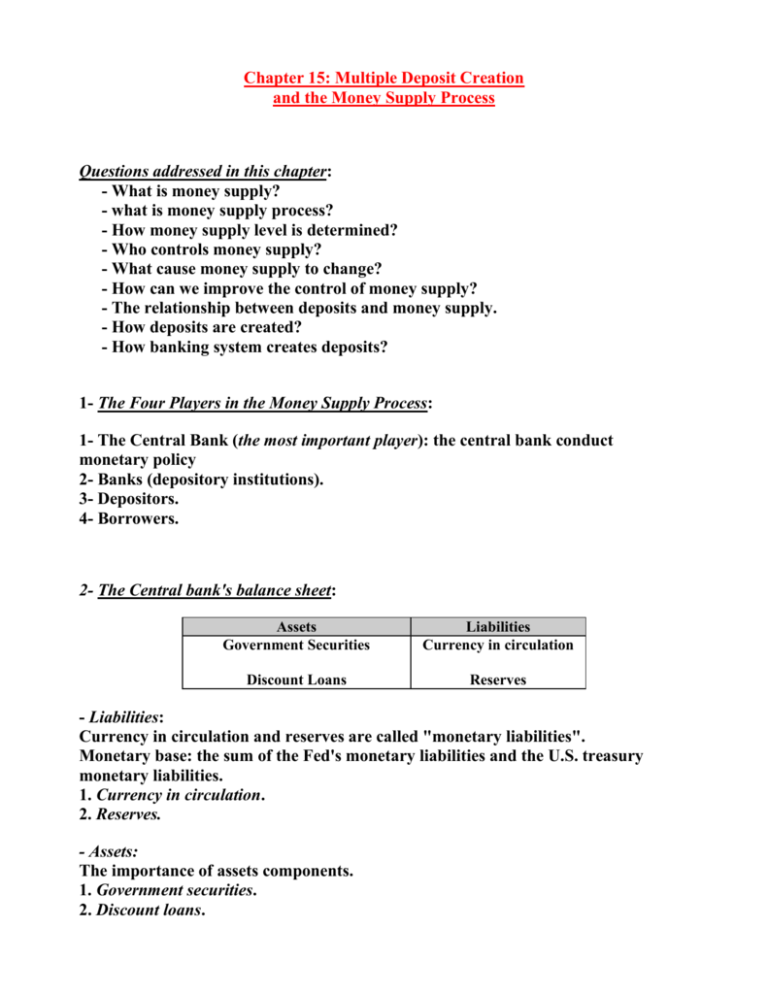

Chapter 15: Multiple Deposit Creation and the Money Supply Process Questions addressed in this chapter: - What is money supply? - what is money supply process? - How money supply level is determined? - Who controls money supply? - What cause money supply to change? - How can we improve the control of money supply? - The relationship between deposits and money supply. - How deposits are created? - How banking system creates deposits? 1- The Four Players in the Money Supply Process: 1- The Central Bank (the most important player): the central bank conduct monetary policy 2- Banks (depository institutions). 3- Depositors. 4- Borrowers. 2- The Central bank's balance sheet: Assets Government Securities Liabilities Currency in circulation Discount Loans Reserves - Liabilities: Currency in circulation and reserves are called "monetary liabilities". Monetary base: the sum of the Fed's monetary liabilities and the U.S. treasury monetary liabilities. 1. Currency in circulation. 2. Reserves. - Assets: The importance of assets components. 1. Government securities. 2. Discount loans. 3- Control of the Monetary Base: The monetary base or the "high-powered money" (MB) = Currency in circulation (C) + Total Reserves in banking system (R), or: MB = C + R The central bank controls monetary base through: 1. Open market Operations (OMO): A. Open market purchase from a bank: Example: The Fed purchase $100 of bonds from a bank and pays with check. The bank can deposit the $100 check in its account in the Fed, or the bank can cash in the $100 check for currency. The Banking System Assets Securities Reserves Liabilities Assets Securities Liabilities Reserves The Fed The net result of this open market purchase is that reserves have (increased / decreased) by ($100). While currency in circulations (changed/constant), monetary base has (increased/decreased) by ($100). B. Open market purchase from the Nonbank public: First: Assume that the other party (the nonbank) deposits the Fed's check in a local bank Nonbank public Assets Securities Checkable deposits Liabilities if the bank deposit the check in its account with the fed: Banking System Assets Reserves Liabilities Checkable deposits the effect of the Fad's balance sheet that it (gained\lost) ($100) of securities while it has an (increase\decrease) of ($100) of reserves in liabilities: The Fed Assets Securities Liabilities Reserves When the Fed's check is deposited in a bank, the net result of the Fed's open market purchase from the nonbank public is identical to the effect of its open market purchase from a bank: Reserves (increase\decrease) by the amount of the open market purchase, and the monetary base (increase\decrease) by the same amount. Second: assume now that the third party cashes the Fed's check for currency: Nonbank Public Assets Securities Currency Liabilities Fed Assets Securities Liabilities Currency in circulation The net effect: reserves are (unchanged\changed) while currency in circulation (increase\decreased) by the ($100) thus monetary base (increases\decreases) by the ($100)while reserves (changed\unchanged). The effect of an open market purchase on reserves depends on whether the seller of the bonds keeps the proceeds from the sale in currency or in deposits. The effect of an open market purchase on monetary base is always the same whether the seller of the bonds keeps the proceeds from the sale in currency or in deposits. 2. Open market sale: If the Fed sells ($100) of bonds to a bank or a nonbank public, MB will decline by ($100). Example: The Fed sells ($100) bond to an individual who pays with currency. Nonbank Public A Securities L +100 Currency -100 The Fed A Securities -100 L Currency in circulation -100 The effect of an open market sale of ($100) bond is to reduce monetary base by ($100). Note that reserves are unchanged. (falls if pays with check). Conclusion: The effect of open market operations on MB is more certain than the effect on reserves*: Open market purchase: 1- If the proceeds are kept in currency, open market purchase has no effect on reserves. 2- If the proceeds are kept as deposits, open market purchase increases reserves by the same amount of open market purchase. 3- MB: the MB increases by same amount of the purchase. Open market sale: Sale of bonds reduces MB by same amount: 4- Reserves unchanged if pays by currency. 5- Reserves falls if pays by check. Therefore: the Fed can control MB with open market operations more effectively than it can control reserves. Shifts from Deposits into Currency: Even if the Fed doesn’t conduct open market operations, a shift from deposits to currency will affect reserves but no effect on MB: MB = R + C This is why the Fed has more control over MB than over reserves* Example: You close your account (100) in cash: Nonpublic Bank A Checkable Deposits -100 Currency +100 L The Banking System A Reserves -100 L Checkable deposits -100 The Fed A L Currency in circulation Reserves +100 -100 MB unaffected, but reserves are. MB is more stable than reserves. Control of Monetary Base: 1- Open market operations 2- Discount loans 3- Other Factors Discount loans: Example: The Fed makes ($100) discount loan to bank (A), bank (A) reserves increase by ($100): Bank (A) A Reserves +100 L Discount loans +100 The Fed A Discount loans +100 L Reserves +100 Monetary liabilities of the Fed (?) increased by ($100) MB increased by ($100). Now, when the bank pays off the loan: Bank (A) A Reserves -100 L Discount loans -100 The Fed A Discount loans L -100 Reserves -100 Net effect: When ($100) discount loan is made to a commercial bank, monetary liability of the Fed and thus MB is increased by the ($100). When ($100) discount loan is paid off, monetary liability of the Fed and thus MB is decreased by the ($100). 4- Other factors affecting MB: A. Float: Occurs from the Fed check-clearing process: when clearing a check, the Fed first credits the amount of the check to the bank that deposited the check (increases bank reserves), but later on, debits the bank on which the check is drawn (decreases bank reserves). This will result in a brief increase in total reserves of the banking system. B. Treasury deposits at the Fed: When the U.S. Treasury moves deposits from commercial banks to its account at the Fed, it causes a deposit outflows, thus reduces reserves and thus the MB. These are short-term fluctuations; the Fed can control MB very accurately. Multiple Deposit Creation: A Simple Model The question now is how deposits are created? When the Fed supplies the banking system with a ($1) of additional reserves (through what?), deposits increase by a multiple of this amount. This is called "Multiple deposit creation". Deposit Creation: a single bank: Assume that open market purchase of a ($100) was conducted with bank (A). The bank reserves increased by ($100). How bank (A) will use the ($100) now? The ($100) can be seen as an additional reserves to bank (A); but assume that bank (A) does not want to hold any excess reserves (since no interest is paid on reserves): Bank (A) A Securities Reserves L -100 +100 there is no increase in checkable deposits, therefore; required reserve remain the same. Bank (A) finds its excess reserves increased by the ($100). The bank can now make a loan equal in amount to the increase in excess reserves ($100). Assuming that the borrower opens a checking account at bank (A) -recall that this is a case of a single bank; Bank (A) A Securities Reserves Loans L -100 +100 +100 Checkable Deposits +100 Therefore, the bank created a checkable deposit by lending the ($100). Since Checkable deposits are part of money supply, this action of lending the ($100) created money! The borrower will spend the ($100) loan and the ($100) of reserves will leave bank (A). Result: A bank cannot safely make loans > its excess reserves it has before it make the loan. in our example, this is equal to ($100) since the amount of excess reserves the bank hold before the loan is equal to ($100): Bank (A) A Securities Loans L -100 +100 Deposit Creation: the banking system: Example: Deposit at bank (A) of ($100), all Banks hold no excess reserves: Bank A A Reserves L Checkable Deposits +100 +100 If the “r” = 10%, Bank A A Required reserve +10 Excess reserve +90 L Checkable Deposits +100 Since banks don’t want to hold excess reserves: Bank A A Reserves +10 Loans +90 L Checkable Deposits +100 Two cases: 1- increase in loans and checkable deposits by ($90) 2- The borrower can spend the ($90): loans, checkable deposits, and reserves fall by ($90). If the borrower deposited the ($90) into bank (B): Bank B A Reserves +90 L Checkable Deposits +90 The total increase in banking deposits = $190 Applying the (%10) “r” to bank B: Bank B A Reserves +9 Excess reserves +81 L Checkable Deposits +90 Bank (B) will hold no excess reserves: Bank B A Reserves Loans +9 +81 L Checkable Deposits +90 The ($81) loan may be spent and then deposited in bank (A), (B), or another bank: Bank C A Reserves Excess reserves +8.1 +72.9 L Checkable Deposits +81 Total increase in of checkable deposits = 100 + 90 + 81 = $271 If banks lend full amount of excess reserves, Increase in deposits = $10,000, increase in Loans = $10,000, increase in reserves = $100 Creation of Deposits (10%) RR and $100 in reserves Bank Increase Increase Increase in in in loans reserves deposits A 0.00 100 0.00 B 100 90 10.00 C 90 81 9.00 D 81 72.90 8.10 E 72 65.61 7.29 F 65.61 59.05 6.56 … 59.05 53.14 5.91 … … … … … … … … … … … … Total 1,000.00 1,000.00 100.00 all banks The same result will apply if the bank purchased securities. Result: the usage of excess reserves to make loans or purchase securities leads to the same effect on deposit expansion Remember: The single bank case: Can create deposits equal only to the amount of its excess reserves: cannot by itself generate multiple deposit expansion because when the bank loses its excess reserves, the reserves may leave the bank to another. Single bank cannot make loans greater than its excess reserves. The banking system: Can generate multiple deposit expansion because when the bank loses its excess reserves, the reserves do not leave the banking system (move from one bank to another). This process continues until the initial increase in reserves results in multiple increases in deposits: Simple Deposit Multiplier: the multiple increase in the banking system reserves. Multiple expansion of deposits: ∆D=(1/r)(∆R) ∆D: change in total checkable deposits in the banking system. r: required reserve ratio. ∆R: change in reserves for the banking system. In our example: ∆D = (1/0.10)(100) = 1,000.00