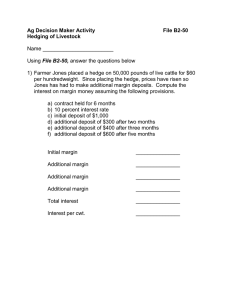

Ag Decision Maker Activity File B2-50

advertisement

KEY Ag Decision Maker Activity Hedging of Livestock File B2-50 Using File B2-50 answer the questions below. 1) Farmer Jones placed a hedge on 50,000 pounds of live cattle for $60 per hundredweight. Since placing the hedge, prices have risen so Jones has had to make additional margin deposits. Compute the interest on margin money assuming the following provisions. a) b) c) d) e) f) contract held for 6 months 10 percent interest rate initial deposit of $1,000 additional deposit of $300 after two months additional deposit of $400 after three months additional deposit of $600 after five months Initial margin $1,000 x 10% x (6/12) year = $50.00 Additional margin $300 x 10% x (4/12) = 10.00 Additional margin $400 x 10% x (3/12) = 10.00 Additional margin $600 x 10% x (1/12) = 5.00 Total interest Interest per cwt. $75/500 cwt. = $75.00 $.15 2) It if February and Farmer Jones has 270 hogs that will be marketed in June. Jones has decided to hedge one contract on the CME (40,000 pounds or about 220 hogs). Assume June futures Expected June basis Brokerage fee Interest on margin Cost of production $80.00 3.50 .20 .15 68.00 a) What is the expected net hedge price? June futures Expected June basis Brokerage fee Interest on margin Expected net hedge price $80.00 3.50 .20 .15 $76.15 b) What is the expected net profit per cwt? Expected net hedge price Cost of production Net profit $76.15 68.00 $8.15 c) What is the net profit per cwt. from the hedge if the actual futures price in June is $90.00, basis is $4.00, and interest on margin is $.30? Futures price in February Futures price in June Futures loss $80.00 90.00 $10.00 Futures price in June Basis Cash price in June $90.00 - 4.00 $86.00 Cash price in June $86.00 Futures loss Brokerage fee Interest on margin Cost of production Net profit - 10.00 - .20 - .30 -68.00 $7.50 d) Why is the actual net profit different than the expected net profit? The interest on margin is 15 cents larger than expected and the basis is 50 cents larger than expected. e) What is the net profit per cwt. in "c" above from the unhedged hogs? Cash price in June Cost of production Net profit $86.00 -68.00 $18.00 f) How much of the production is hedged and how much is unhedged? Hedged production Unhedged production 270 hogs - 220 hogs = 50 hogs x 180 lbs. = 40,000 pounds 50 hogs 9,000 pounds g) What is the net profit in "c" above from all of the hogs? 40,000 / 100 x $7.50 = 9,000 / 100 $18.00 = Total $3,000 1,620 $4,620 h) What is the net profit in "c" above if the hedge is not placed and all of the hogs are sold on the cash market in June? 49,000 / 100 x $18.00 = $8,820 i) What is the net profit per cwt. from the hedge if the actual futures price in June is $70.00, basis is $3.00, interest on margin is $.10? Futures price in February Futures price in June Futures gain $80.00 70.00 $10.00 Futures price in June Basis Cash price in June $70.00 - 3.00 $67.00 Cash price in June Futures gain Brokerage fee Interest on margin Cost of production Net profit $67.00 10.00 - .20 - .10 -68.00 $8.70 j) What is the net profit per cwt. in "i" above from the unhedged hogs? Cash price in June Cost of production Net profit $67.00 -68.00 $- 1.00 k) What is the net profit in "i" above from all of the hogs? 40,000 / 100 x $8.70 = 9,000 / 100 $- 1.00 = Total $3,480 900 $5,380 l) What is the net profit in "i" above if the hedge is not placed and all of the hogs are sold on the cash market in June? 49,000 / 100 x $ -1.00 = $ -490 . . . and justice for all The U.S. Department of Agriculture (USDA) prohibits discrimination in all its programs and activities on the basis of race, color, national origin, gender, religion, age, disability, political beliefs, sexual orientation, and marital or family status. (Not all prohibited bases apply to all programs.) Many materials can be made available in alternative formats for ADA clients. To file a complaint of discrimination, write USDA, Office of Civil Rights, Room 326-W, Whitten Building, 14th and Independence Avenue, SW, Washington, DC 20250-9410 or call 202-720-5964. Issued in furtherance of Cooperative Extension work, Acts of May 8 and June 30, 1914, in cooperation with the U.S. Department of Agriculture. Jack M. Payne, director, Cooperative Extension Service, Iowa State University of Science and Technology, Ames, Iowa.