Test 2, Fall 1998 - College of Business Administration

advertisement

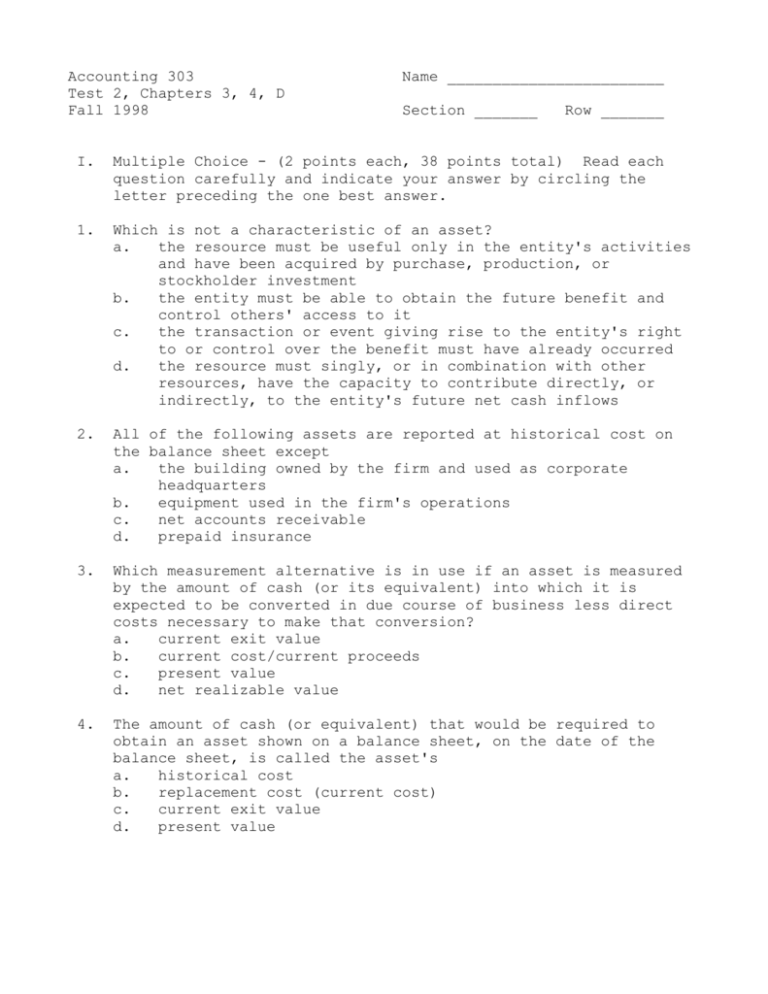

Accounting 303 Test 2, Chapters 3, 4, D Fall 1998 Name ________________________ Section _______ Row _______ I. Multiple Choice - (2 points each, 38 points total) Read each question carefully and indicate your answer by circling the letter preceding the one best answer. 1. Which is not a characteristic of an asset? a. the resource must be useful only in the entity's activities and have been acquired by purchase, production, or stockholder investment b. the entity must be able to obtain the future benefit and control others' access to it c. the transaction or event giving rise to the entity's right to or control over the benefit must have already occurred d. the resource must singly, or in combination with other resources, have the capacity to contribute directly, or indirectly, to the entity's future net cash inflows 2. All of the following assets are reported at historical cost on the balance sheet except a. the building owned by the firm and used as corporate headquarters b. equipment used in the firm's operations c. net accounts receivable d. prepaid insurance 3. Which measurement alternative is in use if an asset is measured by the amount of cash (or its equivalent) into which it is expected to be converted in due course of business less direct costs necessary to make that conversion? a. current exit value b. current cost/current proceeds c. present value d. net realizable value 4. The amount of cash (or equivalent) that would be required to obtain an asset shown on a balance sheet, on the date of the balance sheet, is called the asset's a. historical cost b. replacement cost (current cost) c. current exit value d. present value 2 5. Current assets are cash or other assets that are reasonably expected to be converted into cash, sold, or consumed within a. one year b. one normal operating cycle c. one year or normal operating cycle, whichever is shorter d. one year or normal operating cycle, whichever is longer 6. Activities between affiliated entities such as subsidiaries must be disclosed in the financial statements of a corporation as a. segment analysis b. significant relationships c. related party transactions d. contingent activities 7. In distinguishing between revenues and gains, which of the following statements is false? a. more gains than revenues are beyond the entity's control b. gains are associated more with peripheral, non-operating activities than are revenues c. revenues are associated more with the central, ongoing operations of an entity than are gains d. revenues are reported net (rather than gross) more often than gains 8. Which of the following statements regarding income reporting is true? a. current GAAP requires that both comprehensive income and net income be reported on the income statement b. distributions to owners do not appear on the income statement for both the current operating and all-inclusive concepts of income c. if the all-inclusive concept of income is used, dividends paid will appear on the income statement d. current GAAP follows the current operating concept of income to a greater extent than the all-inclusive concept 9. From the following information, compute cost of goods sold. Purchase returns.............................. $ 100 Inventory, December 31........................ 1,600 Freight-in.................................... 200 Inventory, January 1.......................... 1,200 Purchases..................................... 4,000 a. $3,500 b. $3,600 c. $3,700 d. $4,500 3 10. Which of the following material gains/losses would be disclosed as an extraordinary item on an entity's income statement? a. a loss arising from the write-off of a large uncollectible accounts receivable balance b. a loss arising from the early repayment of bonds classified as a long-term debt c. a gain from sale of a segment of the entity's business d. a gain from the sale of manufacturing equipment no longer needed by the entity 11. Which of the following items would not be reported on a net-oftax basis in an entity's financial statements? a. a revision in the remaining useful life of depreciable equipment, which is accounted for as a change in accounting estimate b. a gain arising from the disposal of a segment of the business c. an adjustment to the financial statements that is accounted for as a prior-period adjustment d. a loss that qualifies as an extraordinary item 12. A company that discontinues and disposes of an operation (segment) should include the gain or loss on disposal in the income statement as a. a prior period adjustment b. an extraordinary item c. an amount after continuing operations and before extraordinary items d. a bulk sale of fixed assets included in earnings from continuing operations 13. Under which of the following conditions would frost damage be considered an extraordinary item for income reporting purposes? a. only if frosts are normal in the geographical area but do not occur frequently b. only if frosts in the geographical area are unusual in nature and occur infrequently c. only if frosts occur frequently in the geographical area but can be covered by insurance policies d. under any circumstances frost damage should be classified as an extraordinary item 14. Jones & Jones will receive $100,000 at the end of four years as a result of a settlement against the city of Overisel. Assuming an interest rate of 8% compounded semiannually, the present value today is a. $ 73,069 b. $ 73,503 c. $ 85,480 d. $100,000 4 15. On January 2, 1997, Carrie Company adopted a corporate strategy to accumulate funds for future pension and postretirement benefits to employees. Carrie plans to make five equal annual deposits of $30,000 in a fund that will earn 8% compounded annually. The first deposit is made on January 2, 1997. How much will be on deposit on January 2, 2001, immediately after the last deposit? a. $150,000 b. $164,592 c. $175,998 d. $190,078 16. Using the table approach, the future amount of an annuity due may be calculated by finding the table factor for the future amount of an ordinary annuity of a. n+1 rents and then subtract 1 b. n+1 rents and then add 1 c. n-1 rents and then add 1 d. n-1 rents and then subtract 1 17. The future amount of an annuity due is determined one period a. before the next rent in the series b. after the last rent in the series c. before the last rent in the series d. after the first rent in the series 18. You would like to deposit a sum of money today that would enable you to withdraw $1,000 a year for five years. If the interest paid on the amount deposited is 10% compounded annually and if the first withdrawal is made one year from today, the formula you would use to determine the amount of the initial deposit is a. the present value of an ordinary annuity b. the present value of a deferred annuity c. the present value of an annuity due d. the future value of an ordinary annuity 19. The number .9423 is taken from the column marked 2% and the row marked three periods in a certain time value of money table. From what table is this number taken? a. Future value of 1 b. Present value of an ordinary annuity of 1 c. Present value of an annuity due of 1 d. Present value of 1 5 II. 1. Problems - Show your work as appropriate. (12 points) The balance sheet contains the following major sections: A. B. C. D. Current assets Long-term investments Fixed assets Intangible assets E. F. G. H. I. Current liabilities Long-term liabilities Contributed capital Unrealized capital Retained Earnings Using the letters A through I, indicate in which section of the balance sheet each of the following accounts would be classified. Put parentheses around the letter used if the account is a contra account. If the account does not appear on the balance sheet, use the letter X. ____ 1. Unexpired insurance ____ 2. Donated capital ____ 3. Land ____ 4. Fund to retire preferred stock ____ 5. Additional paid-in capital on common stock ____ 6. Deferred income tax liability - noncurrent ____ 7. Raw materials inventory ____ 8. Unearned ticket sales 6 2. (12 points) The December 31, 1998, liabilities and equity section of Caulk Company’s Balance Sheet is shown below. Liabilities Current Liabilities Accounts Payable........................... $200 Current Portion of Long-term Note.......... 50 $ 250 Long-term Liabilities Long-term Note Payable..................... 500 Bonds Payable.............................. 300 800 Total Liabilities........................ 1,050 Stockholders’ Equity Preferred Stock, $10 Par..................... 50 Common Stock, $5 Par......................... 150 Additional Paid-in Capital – Common Stock.... 375 Additional Paid-in Capital – Preferred Stock. 50 625 Retained Earnings............................ 465 Total Stockholders’ Equity................. 1,090 Total Liabilities and Stockholders’ Equity..... $2,140 Additional Information: December 31, 1997, accounts payable was $175. The Long-term Note Payable requires a $50 payment every June 30. The Bonds Payable were issued in 1988 and mature in 2008. During 1998 10 shares of Common Stock were issued at $18 per share, and 1 share of Preferred Stock was issued at $20 per share. Net Income for 1998 was $85. Dividends were paid in 1998 in the amount of $15. Using all the above information, reconstruct the Liabilities and Stockholders’ Equity section of Caulk’s December 31, 1997, Balance Sheet by showing your numbers in the following form. Liabilities Current Liabilities Accounts Payable........................... $_____ Current Portion of Long-term Note.......... _____ Long-term Liabilities Long-term Note Payable..................... _____ Bonds Payable.............................. _____ Total Liabilities........................ $_____ _____ _____ Stockholders’ Equity Preferred Stock, $10 Par..................... _____ Common Stock, $5 Par......................... _____ Additional Paid-in Capital – Common Stock.... _____ Additional Paid-in Capital – Preferred Stock. _____ _____ Retained Earnings............................ _____ Total Stockholders’ Equity................. _____ Total Liabilities and Stockholders’ Equity..... $ _____ 7 3. (9 points) Income statement information for KGC Company is as follows: Beginning inventory..................... Ending inventory........................ General and administrative expenses..... Gross profit............................ Net income.............................. Net sales............................... Purchases............................... Purchases returns and allowances........ Sales................................... Sales returns and allowances............ Selling expenses........................ Transportation-in....................... Required: $ 70,000 50,000 (c) 310,000 20,000 (b) 490,000 20,000 (a) 20,000 60,000 10,000 Find the missing amounts labeled (a) through (c) above. Show your work in the space provided. a. Sales b. Net Sales c. General and Administrative Expenses 8 4. (13 points) On May 1, 1998, Wardle Company decided to dispose of its entire European Division (considered a major segment). The segment was sold on November 24, 1998, for $820,000. The book value of the Division on the date of the sale was $906,000. The Division’s operations from January 1, 1998, until the date of disposal was a $260,000 profit, with 75% of that amount earned in the period from January 1, 1998, to May 1, 1998. During June 1998, Wardle Company decided to change their depreciation method from the declining balance method to the straight-line method. Under the straight-line method, depreciation would have been $78,000 less than with the declining balance method. Wardle’s pretax income from continuing operations for 1998 was $238,000. Wardle Company is subject to a 30% income tax rate. Prepare Wardle Company's income statement for 1998 from Pretax Income From Continuing Operations through net income. Omit the heading and earnings per share amounts. 9 5. (16 points) Solve each of the following unrelated questions. a. Tom Turner deposited $10,000 in a fund that earns 8% interest compounded annually. How many years will it take for the fund to grow to $21,589.25? b. Ted Banks wants to borrow some money from the bank to start a small business. Ted can afford to pay off the loan in 15 annual installments of $9,500. The bank charges an annual interest rate of 12%. If Ted makes the first payment one year from the date of the loan, how much can Ted borrow? c. Susan’s grandmother has agreed to deposit a lump sum into an account that pays 10% interest compounded annually in order to pay for Susan’s college education. Susan estimated that she will need to withdraw $10,000 at the beginning of each year for four years to pay for room, board, tuition, and books. Susan’s grandmother will deposit the lump sum on September 1, 1997, and Susan will make the first withdrawal on September 1, 2001. Determine the amount that Susan’s grandmother must deposit. Clearly label all work. 10 ANSWERS TO MULTIPLE CHOICE QUESTIONS 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. a c d b d c d b c b 11. 12. 13. 14. 15. 16. 17. 18. 19. a c b a c a b a d ANSWERS TO PROBLEM QUESTIONS: 1. 1. 2. 3. 4. A H C B 5. 6. 7. 8. G F A E 2. Liabilities Current Liabilities Accounts Payable........................... Current Portion of Long-term Note.......... Long-term Liabilities Long-term Note Payable..................... Bonds Payable.............................. Total Liabilities........................ Stockholders’ Equity Preferred Stock, $25 Par..................... Common Stock, $5 Par......................... Additional Paid-in Capital – Common Stock.... Additional Paid-in Capital – Preferred Stock. Retained Earnings............................ Total Stockholders’ Equity................. Total Liabilities and Stockholders’ Equity..... 500 + 50 150 - 50 = 550 10 = 40 50 = 100 375 - 130 = 245 50 - 10 = 40 465 - 85 + 15 = 395 $175 50 550 300 40 100 245 40 $ 225 850 1,075 425 395 820 $1,895 11 3. Sales.................................. 830,000(a) Less Sales Returns & Allowances........ 20,000 Net Sales.............................. (b)810,000 Cost of Goods Sold..................... Beginning Inventory.................. 70,000 Purchases............................ 490,000 Less: Purchases Ret & Allow......... <20,000> Add: Transportation-In.............. 10,000 Cost of Goods Available for Sale..... 550,000 Ending Inventory..................... 50,000 Cost of Goods Sood................. 500,000 Gross Profit........................... 310,000 General and Admin Expenses.............(c)230,000 Selling Expenses....................... 60,000 290,000 Net Income............................. 20,000 4. Pretax income for continuing operations.... Income tax expense......................... Income before discontinued operations...... Results of discontinued operation: Income from operations of discontinued segment(net of $58,500 income taxes)... $136,500 Loss on disposal of segment (net of $6,300 income tax credit)............... <14,700> Income before accounting change............ Cumulative effect of change in depreciation method (net of $23,400 income taxes)........................... Net Income.. ............................. 260,000 x 75% = 195,000; 195,000 x .7 = 136,500 260,000 – 195,000 = 65,000 820,000 – 906,000 = <86,000> <21,000> <21,000> x .3 = <6,300> 78,000 x .7 = 54,600 $238,000 71,400 $166,600 121,800 288,400 54,600 $343,000 12 5. a. Future value of a single sum, i = 8%, n = ? $21,589.25 ---------- = 2.158925 $10,000.00 = 10 years b. (i = 8%, n = ?) Present value of an ordinary annuity when the annual payments are known: P = R x PVIF n = 15, i = 12% = $9,500 x 6.810864 = $64,703 c. Defferred annuity problem - three ways to work the problem are shown (1) Deferred annuity = R x (converted table factor) Table factor for n + k = 7, i = 10% Less table factor for k = 3, i = 10% Converted table factor 4.868419 2.486852 2.381567 deferred annuity = $10,000 x (2.381567) = $23,816 (2) Deferred annuity = R x (converted table factor) Table factor for PV of ordinary annuity, n = 4, i = 10% Times table factor for PV of single sum, n = 3, i = 10% Converted factor 3.169865 x .751315 2.381567 deferred annuity = $10,000 x (2.381567) = $23,816 (3) Find PV as of September 1, 2000: PV of ordinary annuity, r = 10,000, i = 10%, n = 4 PV = 10,000 x 3.169865 = 31,698.65 Find PV as of September 1, 1997: PV of single sum, FV = 31,698.65, i = 10%, n = 3 PV = 31,698.65 x .751315 = $23,816 13