Fixed Income Arbitrage

advertisement

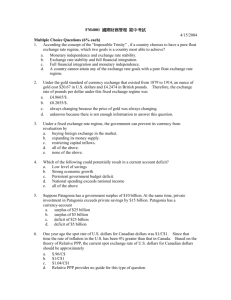

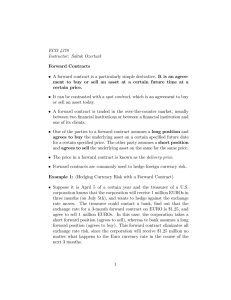

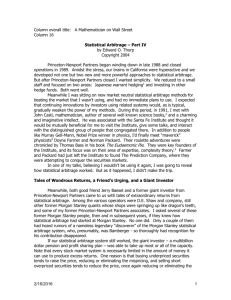

FIXED INCOME ARBITRAGE Jake Caldwell – Colgate Finance Club Fall 2010 Part I: Fixed Incomes An investment that provides a return in the form of fixed periodic payments and the eventual return of principal at maturity - Investopedia Fixed Incomes – What are they? “Fixed” – they offer returns at regular intervals – monthly, quarterly, annually, etc. Generally, they have “fixed” returns – predictable return on investment (not always the case) “Income” – they provide a source of income to an investor Created as a product that an investor can rely on to produce returns Who might be extremely interested in this? Retired Investor Often referred to as a “Fixed-Income Security” The Bond 1. 2. 3. 4. The most common Fixed-Income Security Debt-Instrument – Sell the Debt to an Investor Investor gives the entity capital and is paid interest on the debt he/she takes on – Interest rate of the Bond Government Corporate Municipal Institutional Terminology of FI or Bond Issuer – Company Issuing the Debt-Instrument Coupon – Interest the investor receives Bond Principal – The Cost of the Bond Maturity Date – Expiration of the Bond – Investor receives the principal back Interest Rate or Coupon The Payoff Determined by the quality of the debt/credit and the duration of the product Quality – Determined by a Rating Agency Duration – Differs by product The Coupon is generally paid out semi-annually, but is referred to as a annual rate Interesting FIs Structured Note Adjusts to favorable increases for investor – increases returns/ coupon rate, medium-term Commercial Paper Short-term (less than 270 days) debt note to investors backed by no hard assets – can only be used for variable assets (inventories) not fixed assets (plant) Bank Obligations CDs – Certificate of Deposit – pays out interest to owner Part II: Arbitrage The simultaneous purchase and sale of an asset in order to profit from a difference in the price - Investopedia How It Works An investor/trader sits on his desk in NY. He is trading a commodity – Oil. Oil is traded on Mercantile Exchanges globally This trader is looking at Crude Oil Future prices on the NYMEX and the CME He sees that Crude Oil is trading at $100 a barrel on the NYMEX and $100.05 on the CME He shorts 1,000 Futures on the NYMEX and buys 1,000 Futures on the CME He profits from the price discrepancy and makes 1,000 x $.05 – (.01x1,000) = $40 This example is on a small scale, but it costs the trader nothing to do this Is this practical? Although this may seem like an easy way to make money, you will not find a price discrepancy of .05 on any futures Arbitrage relies on market imperfections This acts as a system of “checks & balances” These price discrepancies may occur in the shortterm, but not in the long-term (we are talking about the difference between seconds and minutes) The Role of Technology The ability to exploit price differences is a result/bi-product of the revolution in technology on trading floors The emergence of trading floors/market places for assets (NYSE Euronext) allows traders to find this price differential Ultimately, the trader with the fastest technology and the most market information is the winner Perfect Market Information is an imperfection of the markets – it does not exist http://www.youtube.com/watch?v=wuq54vDFeqU Fixed Income Arbitrage Muni. Bond Arbitrage Case This is one example of Fixed Income Arbitrage Deals with Municipal Bonds and Interest Rate Swaps Underlying Assumptions/Facts: Municipal Bonds are tax-exempt Municipal Bonds are correlated with Interest Rate Swaps Interest Rate Swaps (remember “fixed-to-floating”) are a type of Corporate Bonds – involves the swap by two companies to decrease costs and obtain the best rates IRS/CB are not tax-exempt Looking for these to share same maturity date (duration) Muni. Arbitrage Case cont. Trader is long NJ/NY Municipal Bonds for the new Giants Stadium In order to protect himself, he wants to hedge his risk – specifically, the duration risk He chooses to short corporate bonds – i.e., Interest Rate Swaps with the same maturity When these reach maturity, he pays the interest/tax on the corporate bonds, but receives the taxexempt interest on the Muni. Bonds – the difference between these two is his profit Mathematically Long 1,000 2-year Muni. Bonds at $200 1,000 x $200 = $200,000 of risk (unhedged) They payout 6% annually interest rate – or 3% semi. Duration is 2 years, after 2 years I receive the principal After my first year, how much have I made assuming I choose to reinvest the interest in a different asset? $200,000 x .03 = $6,000 x 2 = $12,000 After 2 years, I will have made $24,000 But I am at risk the entire time of the municipal bond not being paid back or not receiving my interest – I want to hedge this duration risk Mathematically cont. The trader shorts Interest Rate Swaps for two companies that pays out 6% annual interest rate (3% semi-annually) and is taxed at 5%. $200,000 x .03 =$6,000 x 2 = $12,000 x (0.95) = $11,400 x 2 = 22,800 Now if this is what the trader pays out, then we must subtract this from the interest made on the Municipal Bond: $24,000-$22,800 = $1,200 Conclusion As you see, arbitrage takes advantage of the imperfections of the markets and acts as a safety net to keep prices close together Each asset class/product can be traded differently to take advantage of these In our example of Fixed Income Arbitrage, the trader focuses on hedging his duration and uses differences in interest rates (based on taxes)