Explanations and Completed Tax Forms

advertisement

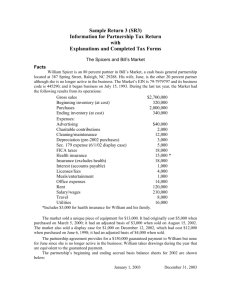

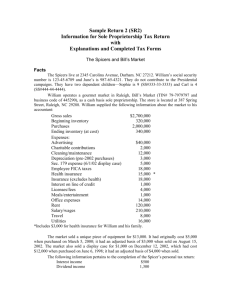

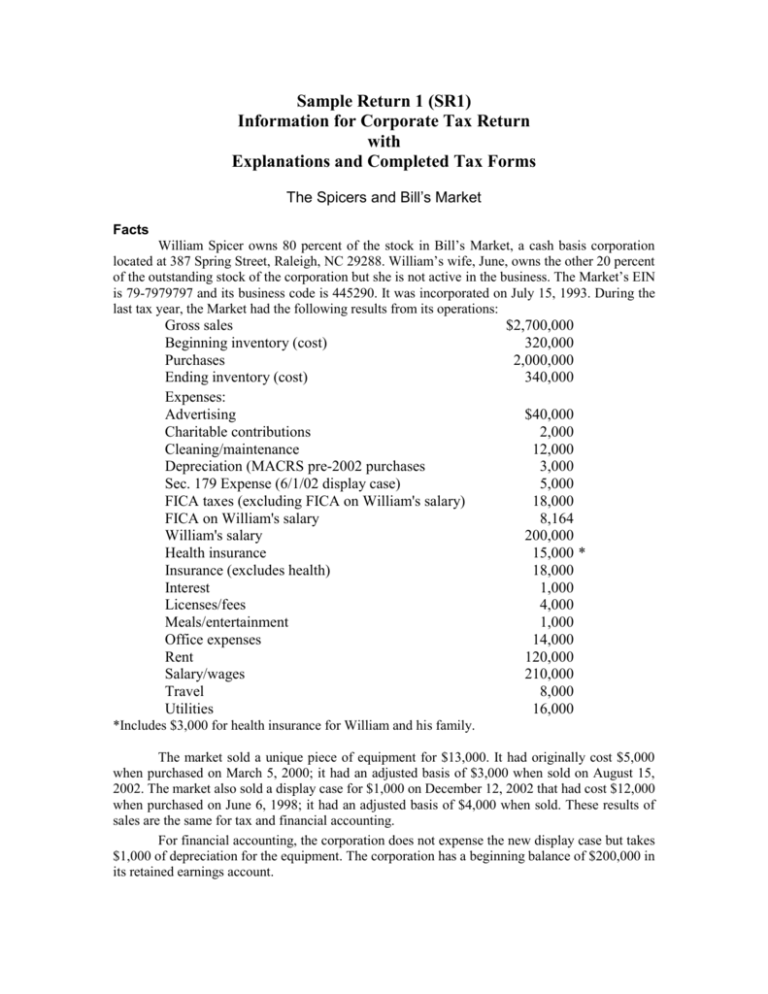

Sample Return 1 (SR1) Information for Corporate Tax Return with Explanations and Completed Tax Forms The Spicers and Bill’s Market Facts William Spicer owns 80 percent of the stock in Bill’s Market, a cash basis corporation located at 387 Spring Street, Raleigh, NC 29288. William’s wife, June, owns the other 20 percent of the outstanding stock of the corporation but she is not active in the business. The Market’s EIN is 79-7979797 and its business code is 445290. It was incorporated on July 15, 1993. During the last tax year, the Market had the following results from its operations: Gross sales Beginning inventory (cost) Purchases Ending inventory (cost) Expenses: Advertising Charitable contributions Cleaning/maintenance Depreciation (MACRS pre-2002 purchases Sec. 179 Expense (6/1/02 display case) FICA taxes (excluding FICA on William's salary) FICA on William's salary William's salary Health insurance Insurance (excludes health) Interest Licenses/fees Meals/entertainment Office expenses Rent Salary/wages Travel Utilities $2,700,000 320,000 2,000,000 340,000 $40,000 2,000 12,000 3,000 5,000 18,000 8,164 200,000 15,000 * 18,000 1,000 4,000 1,000 14,000 120,000 210,000 8,000 16,000 *Includes $3,000 for health insurance for William and his family. The market sold a unique piece of equipment for $13,000. It had originally cost $5,000 when purchased on March 5, 2000; it had an adjusted basis of $3,000 when sold on August 15, 2002. The market also sold a display case for $1,000 on December 12, 2002 that had cost $12,000 when purchased on June 6, 1998; it had an adjusted basis of $4,000 when sold. These results of sales are the same for tax and financial accounting. For financial accounting, the corporation does not expense the new display case but takes $1,000 of depreciation for the equipment. The corporation has a beginning balance of $200,000 in its retained earnings account. The corporation made estimated payments for its own taxes of $10,000 and withheld $45,000 from William’s salary for income taxes. The corporation makes a $25,000 dividend distribution to its shareholders on December 31 of the current tax year. The corporation’s beginning and ending accrual basis balance sheets for 2002 are shown below: January 1, 2002 December 31, 2002 Assets Cash $ 62,000 $ 51,836 Accounts Receivable 37,500 37,500 Inventory 320,000 340,000 Tax Refund 5,150 Plant, Prop. and Equipment $ 80,000 $68,000 Less: Accum. Depreciation 62,000 18,000 59,000 9,000 Total Assets $437,500 $443,486 Liabilities and Equities Deferred Tax Liability Note Payable Common Stock Retained Earnings Total Liabilities and Equities $ 12,500 225,000 200,000 $437,500 1,360 12,500 225,000 204,626 $443,486 The Spicers’ Individual Tax Return Information The Spicers live at 2345 Carolina Avenue, Durham, NC 27212. William’s Social Security number is 123-45-6789 and June’s is 987-65-4321. They do not contribute to the Presidential campaigns. They have two dependent children—Sophie is 9 (SS#333-33-3333) and Carl is 4 (SS#444-44-4444). The following information pertains to the completion of the Spicers’ personal tax return: Interest income $500 Dividend income 1,300 Loss on stock sale (long-term) (14,000) Unreimbursed doctor’s bills $8,000 Unreimbursed hospital bills 12,000 Dental bills 2,000 Mortgage interest 14,000 Real estate taxes 4,000 Contributions to their church 1,500 June is a volunteer at the children’s school but otherwise does not work outside the home. Her total mileage for her trips to and from the school was 1,200 miles. She also had unreimbursed out-of-pocket expenses for teaching materials of $232. Additionally, she spent $1,500 on childcare so that she could be there during after-school hours to tutor at-risk students. Bill’s Market does not have any pension plan for its employees, so Bill and June contribute $3,000 each to their IRAs. The completed Form 1120, Schedule D, and Forms 4562 and 4797 for the corporation and Form 1040, Schedules A, B, and D for the Spicers follow along with an explanation of various items. 2 Explanation Two returns are filed—one for the corporation (Form 1120) and a second one for the Spicers (Form 1040). The Spicers do not have to wait until the corporation completes it tax return to complete theirs. Because Bill is an employee, he will receive a Form W-2 from the corporation and as shareholders, they will receive a Form 1099-DIV by the end of January showing their $25,000 dividend distribution. The completion of the Form 1120 for the corporation is straightforward. The income and expense items are reported on Form 1120 except for the following items. Form 4797 is used to report the asset sales including the depreciation recapture, which is included directly in corporate income on line 9, Form 1120. The $5,000 Sec. 1231 net gain is entered on line 7, Schedule D, and also becomes part of the corporate taxable income on line 8. Form 4562 includes the depreciation expense and the Sec. 179 expense. These items are combined and deducted from corporate income. The FICA taxes on William’s salary of $200,000 is determined ($8,164) and deducted from taxable income along with the other deductible corporate expenses. (The schedule of other deductions appears below.) The corporation deducts the health insurance paid for William and his family as he is an employee. The deduction for the charitable contribution is not limited as it does not exceed 10 percent of corporate net income. The corporation pays an income tax of $4,850 on its taxable income of $32,336. The overpayment of $5,150 is refunded to the corporation. Form 1120 and Related Schedules and Forms File Name SR1f1120return.pdf Forms Included Form 1120: U.S. Corporate Income Tax Return Schedule D: Capital Gains and Losses Form 4562: Depreciation and Amortization Form 4797: Sales of Business Property Schedule of Other Deductions: Bill's Market EIN: 79-7979797 Form 1120 Page 1, Line 26, Other deductions: Meals/entertainment@ 50% Office expense Travel Insurance Utilities $ 500 14,000 8,000 18,000 16,000 $56,500 Schedule of Other Assets: Form 1120, Page 4, Line 6 Tax refund due = $5,150 Schedule of Other Liabilities: Form 1120, Page 4, Line 21 Deferred taxes = $1,360 Determining Book Income and the Tax Provision: Taxable income: $32,336 Subtract nondeductible portion of meals (permanent difference) 500 3 Book income before temporary differences Add depreciation difference Book income before tax: $31,836 4,000 $35,836 Tax Provision: Tax liability: $32,336 x .15 = $4,850. Permanent difference: $500 nondeductible meals Temporary differences: $4,000 depreciation Deferred tax liability: $4,000 x .34 = $1,360 Book tax expense: $4,850 current tax liability + $1,360 deferred tax liability = $6,210 Adjusting entry to books for book tax expense and tax provision: Tax Expense $6,210 Deferred Tax Liability Taxes Payable $1,360 4,850 Book income after tax: $35,836 - $6,210 = $29,626 $10,000 estimated payments - $4,850 taxes payable = $5,150 refund due Form 1040 and Related Schedules The Spicer’s Form 1040 is also straightforward. William’s Form W-2 prepared by the corporation reports his salary of $200,000 and withholding income taxes of $45,000 (and FICA withholding). Thus, William’s salary income of $200,000 is reported on line 7, Form 1040. They include the $25,000 dividend on Schedule B with their other dividends and their interest income. They have neither self-employment taxes nor any deduction for the health insurance premium paid by the company. They report their $14,000 capital loss on their Schedule D. They are allowed to deduct only $3,000 currently and they have an $11,000 capital loss carryforward. Including these items, the Spicers have AGI of $217,800. They can now complete their Schedule A. June is allowed to deduct 14 cents per mile for the 1,200 driven ($168) for her volunteer work along with her out-of-pocket expenses of $232. She cannot, however, claim any child care credit for the babysitting expenses incurred doing the volunteer work. Completing the rest of Schedule A is straightforward except that they have to reduce their itemized deductions (by 3 percent of AGI in excess of $137,300). After completing Schedule A, the Spicers can calculate their taxable income by deducting their allowable itemized deductions of $23,150 and exemptions of $10,800 ($3,000 x 3 x 90%) from their AGI. Their taxable income is $183,850 on which they have a tax liability of $46,161. They are not able to benefit from the child tax credit as their AGI is too high. After deducting William’s withholding, they owe $1,161. There is no penalty for under withholding as their underpayment is less than 10 percent of their tax due. Form 1040 and Related Schedules File Name SR1f1040return.pdf Forms Included Form 1040: U.S. Individual Income Tax Return Schedule A: Itemized Deductions Schedule B: Interest and Dividends Schedule D: Capital Gains and Losses 4