Explanations and Completed Tax Forms

advertisement

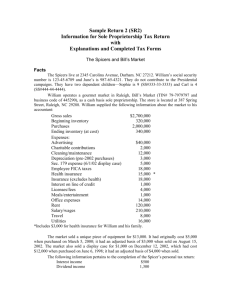

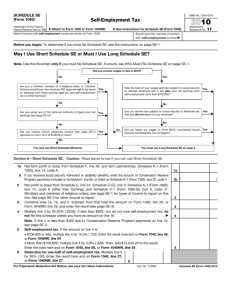

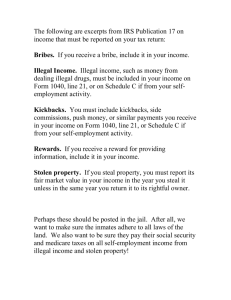

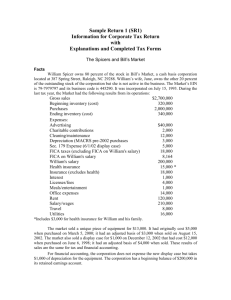

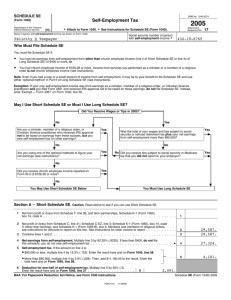

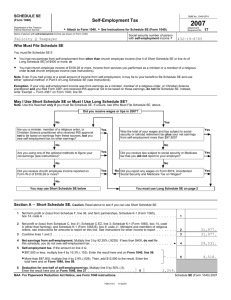

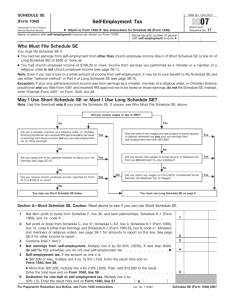

Sample Return 3 (SR3) Information for Partnership Tax Return with Explanations and Completed Tax Forms The Spicers and Bill’s Market Facts William Spicer is an 80 percent partner in Bill’s Market, a cash basis general partnership located at 387 Spring Street, Raleigh, NC 29288. His wife, June, is the other 20 percent partner although she is no longer active in the business. The Market’s EIN is 79-7979797 and its business code is 445290, and it began business on July 15, 1993. During the last tax year, the Market had the following results from its operations: Gross sales Beginning inventory (at cost) Purchases Ending inventory (at cost) Expenses: Advertising Charitable contributions Cleaning/maintenance Depreciation (pre-2002 purchases) Sec. 179 expense (6/1/02 display case) FICA taxes Health insurance Insurance (excludes health) Interest (accounts payable) Licenses/fees Meals/entertainment Office expenses Rent Salary/wages Travel Utilities $2,700,000 320,000 2,000,000 340,000 $40,000 2,000 12,000 3,000 5,000 18,000 15,000 * 18,000 1,000 4,000 1,000 14,000 120,000 210,000 8,000 16,000 *Includes $3,000 for health insurance for William and his family. The market sold a unique piece of equipment for $13,000. It had originally cost $5,000 when purchased on March 5, 2000; it had an adjusted basis of $3,000 when sold on August 15, 2002. The market also sold a display case for $1,000 on December 12, 2002, which had cost $12,000 when purchased on June 6, 1998; it had an adjusted basis of $4,000 when sold. The partnership agreement provides for a $150,000 guaranteed payment to William but none for June since she is no longer active in the business; William takes drawings during the year that are equivalent to the guaranteed payment. The partnership’s beginning and ending accrual basis balance sheets for 2002 are shown below: January 1, 2003 December 31, 2003 Assets Cash Accounts Receivable Inventory Plant, Prop. and Equipment Less: Accum. Depreciation Total Assets $ 62,000 37,500 320,000 $80,000 62,000 Liabilities and Equities Note Payable Capital--William Capital--June Total Liabilities and Equities 18,000 $437,500 $ 12,500 340,000 85,000 $437,500 $145,000 37,500 340,000 $68,000 63,000 5,000 $527,500 12,500 412,000 103,000 $527,500 The Spicers’ Income Tax Information The Spicers live at 2345 Carolina Avenue, Durham, NC 27212. William’s Social Security number is 123-45-6789 and June’s is 987-65-4321. They do not contribute to the Presidential campaigns. They have two dependent children—Sophie is 9 (SS#333-33-3333) and Carl is 4 (SS#444-44-4444). The following information pertains to the completion of the Spicers’ personal tax return: Interest income $500 Dividend income 1,300 Loss on stock sale (long-term) (14,000) Unreimbursed doctor’s bills $8,000 Unreimbursed hospital bills 12,000 Dental bills 2,000 Mortgage interest 14,000 Real estate taxes 4,000 Contributions to their church 1,500 June is a volunteer at the children’s school but otherwise does not work outside the home. Her total mileage for her trips to and from the school was 1,200 miles. She also had unreimbursed out-of-pocket expenses for teaching materials of $232. Additionally, she spent $1,500 on childcare so that she could be there during after-school hours to tutor at-risk students. The Spicers contribute $3,000 each to regular IRSs. The Spicers made quarterly estimated tax payments of $65,000. All payments were made when due. The completed Form 1065 (pp. 1 and 2), Schedule D, Forms 4562 and 4797 for the partnership and the K-1s for partners, William and June, and Form 1040, Schedules A, B, D, E, and SE for the Spicers follow along with an explanation of various items. Explanation Two complete sets of tax returns must be prepared—one for the partnership, Form 1065, and the other for the Spicers, Form 1040. Form 1065 should be prepared first. Separately stated items of income and expense of the partnership must be segregated from the balance of the income and expense items that will constitute ordinary or “bottom line” income. The separately stated expense items are the charitable contributions and the Section 179 expense. The health insurance premium paid by the partnership for William and his family is considered a guaranteed payment to William. The net Section 1231 gain is also a separately stated item. Note, however, that the Section 1245 recapture 2 is an element of ordinary income for the partnership. It does not require separate reporting for partnership purposes and is included in partnership ordinary income. To complete the partnership tax return, the Section 1231 gain and loss and the Section 1245 recapture are both entered on Form 4797; only the Section 1231 net gain is separately reported on Schedule K (Form 1065), line 6. The $2,000 depreciation recapture is reported as other income on line 7, Form 1065. Form 4562 is completed for the partnership to report both the Section 179 expense and depreciation expense. The Section 179 expense is reported as a separate item on line 9 of the Schedule K, however. The annual limitation on the Section 179 expense applies at both the partnership and partner level. The charitable contribution is subject to limitation at the partner level and is separately reported on line 8, Schedule K. The $3,000 payment for health insurance by the partnership for William is reported as part of the guaranteed payment ($153,000) on line 10, p. 1, Form 1065. The guaranteed payment is also reported on line 5, Schedule K. To complete Schedule K, the earnings from self-employment are reported on line 15(a). These earnings include ordinary income plus guaranteed payments reduced for the Section 179 expense and the $2,000 Section 1245 income. William’s guaranteed payments and share of ordinary income (as adjusted) are subject to self-employment taxes. Because this is a general partnership, June’s income is also subject to self-employment taxes even though she no longer works actively in the business. If she were a limited partner, she would not be subject to selfemployment taxes on this income. Finally, the $500 of nondeductible meals/entertainment expense is reported on line 21, Schedule K. This item is must be reported because it reduces the partners’ outside bases in their partnership interests. (Note: the interest expense is not reported separately as it is from accounts payable rather than interest incurred for investment purposes.) The partnership then completes Schedule K-1s for William and June that include their share of each of the items reported on Schedule K. These forms tie directly to the items reported on Schedule K. Thus, William’s 80 percent and June’s 20 percent shares of net ordinary income is reported on line 1, the Section 1231 gain on line 6, the charitable contribution is on line 8, the Section 179 expense on line 9, and the nondeductible expense is on line 21. The guaranteed payment (including the health insurance premium) is reported only on William’s line 5 and the appropriate self-employment income is included line 15(a). William’s self-employment income includes not only his share of the partnership ordinary income but includes the guaranteed payment. Form 1065 and Related Schedules and Forms File Name Forms Included SR3f1065return.pdf Form 1065: U.S. Return of Partnership Income Schedule K-1: Partner’s Share of Income (June) Schedule K-1: Partner’s Share of Income (William) Form 4562: Depreciation and Amortization Form 4797: Sales of Business Property Schedule of Other Deductions: Bill's Market EIN: 79-7979797 Form 1065 Page 1, Line 20, Other deductions: Advertising Interest Meals/entertainment@ 50% Office expense Travel $40,000 1,000 500 14,000 8,000 3 Insurance Utilities 18,000 16,000 $97,500 Form 1040 Once the partnership return is complete, the Spicers’ personal tax return can be completed. To complete their personal tax return, the Spicers’ must determine their AGI. They report their interest and dividend income on Schedule B and enter these amounts on lines 8(a) and 9, respectively, on Form 1040. The items listed on their K-1s are accounted for as follows: On page 2 of Schedule E they report their combined ordinary income from the partnership and William’s guaranteed payment in Part II, column (k) and the Section 179 expense in column (j). Although June is no longer active in the business, her income is still considered active income because of William’s participation. The net amount from line 40 is entered on line 17, Form 1040. Because the guaranteed payment for William’s health insurance is included in William’s income, it is treated as paid by him. He is allowed to deduct 70 percent ($2,100) of the premium on line 28, Form 1040. The remaining premium is included with their other medical expenses. They must complete Schedule 4797 to report the net Section 1231 gain (entered on line 2 column (g) with the notation that it is from Schedule K-1) and the Section 179 expense (entered on line 17). Because there are no other Section 1231 gains or losses, this net gain is entered on line 11, Schedule D and combined with the Spicers’ long-term capital gain and loss entered on line 8 for a net $9,000 loss. They are permitted to deduct $3,000 of this loss and they have a $6,000 loss carryover. The charitable contributions are included on Schedule A with their other charitable contributions. The applicable net income from self-employment is entered on their respective Schedule SEs to determine self-employment taxes and the allowable deduction for one-half this amount on line 27, Form 1040. Their AGI of $221,763 is the sum of these items. The Spicers can now complete their Schedule A and page 2 of Form 1040. Again, their itemized deductions are reduced for 3 percent of their AGI in excess of $137,300. They deduct their personal exemptions of $10,080 and the taxable income is $189,282. Their income tax is $46,846 and they must add the self-employment taxes of $18,873, a total tax of 65,719. They have no allowable credits. After deducting their estimated payments of $65,000, they owe $719 in taxes. They do not owe any penalty on this underpayment as the amount owed is less than 10 percent of their tax total liability. Form 1040 and Related Schedules File Name Forms Included SR3f1040return.pdf Form 1040: U.S. Individual Income Tax Return Schedule A: Itemized Deductions and Schedule B: Interest and Dividends Schedule D: Capital Gains and Losses Schedule E: Income or Loss from Partnerships Schedule SE: Self-Employment Tax (June) Schedule SE: Self-Employment Tax (William) 4