the concept of extraterritoriality in international competition law regime

advertisement

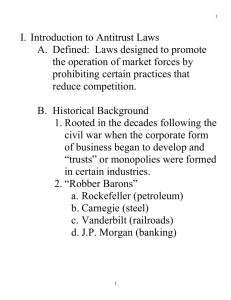

THE CONCEPT OF EXTRATERRITORIALITY IN INTERNATIONAL COMPETITION LAW REGIME By Daniel Bwala Introduction Extraterritoriality is a concept of enforcement of competition law beyond the territorial border of the state. Its implementation has created difficulties beyond states’ borders and the consequent interrelationships amongst states. This paper seeks to analyse the problems of extraterritoriality as well as the methods adopted as a model for global competition law so as to mitigate (if not eliminate) the difficulties created by concept of extraterritoriality. The paper further seeks critically to consider the pros and cons of each approach and suggest the approach considered as the preferred universally accepted idea for global competition law. The paper concludes by suggesting that the multilateral approach that is vigorously pursued by organisations such as OECD, UNCTAD, ICN, WTO and World Bank be the preferred idea for international competition law. Extraterritoriality is related to a States’ limit on its jurisdictional competence in relation to the application and enforcement of its laws abroad. 1 Jurisdictional competence relate to states ability to make laws and enforce them. It’s a matter of international. 2 Generally speaking, extraterritoriality within the purview of international law is considered as a states’ capacity to protect its national interests through the five principles, thus; Nationality; Protective Principles; Passive personality; and Universal jurisdiction. 3 There are three methods that have been adopted by states, regional blocs and trading partners, all of which are often been referred to as the model(s) or alternative(s) for achieving global competition law. The methods are thus categorised as Unilateral; Bi-lateral and Multi-lateral. Unilateral approach The unilateral approach has so far been adopted and applied by the United States of America in the cases of United States V Aluminium Co. of America (Alcoa)4 and Hartford Fire Insurance Co. V California5 on one hand, and the European Union in the cases of ICI V Commission6 (Dyestuffs case) and A Ahlstrom Oy V Commission7 (Wood Pulp case) on the other hand. The US approach is premised on section 1 of the Sherman Antitrust Act 8 which clearly prohibits any deal or deals that restrict interstate commerce, whether those deals are carried out horizontally by means of two or more rival companies operating within the same market with a view to gain or acquire greater market share thereby stifling smaller companies; or vertically by 1 Whish R., Bailey D., Competition Law (Oxford University Press), 7 th Ed, 2012, p.488 Brownlie., Principles of Public International Law (Clarendon Press), 7th Ed, 2008, p. 3 Carter B. E., Trimble P.R., International Law (Boston: Little, Brown) 1995, pp. 725-727 4 148 F 2d 416 (2nd Cir 1945) P.444 5 509 US 764 (1993) 6 (1972) ECR 619, (1972) CMLR 557 7 (1988) ECR 5193, (1988) 4 CMLR 901 8 1890 Ch. 647 2 means of producers colluding at different levels of the market thereby limiting competition at each of those levels of the market. However, the decision of the US Courts over time have produced two competing theories regarding extraterritorial application of US Antitrust Law, thus; vested rights and effects theory. 9 The US court in American Banana Co. V United Fruit Co10 applied the vested right theory and held to the effect that the Sherman Act could not, therefore, regulate the monopoly, because of the fact that the cause of action arose in Costa Rica and the injury suffered occurred outside the US territorial jurisdiction. It was a case involving American Banana Corporation located in Alabama and United Fruit Corporation situated in New Jersey. American Banana Corporation that had a banana plantation in Costa Rica, had its plantation confiscated and consequently its produce were damaged. It alleged that United Fruit was behind it and filed an action in the US court and sought for treble damages. Justice Holmes 11 stated in effect that in determining the legality or otherwise of the character of an action, the law of the forum of that action must be considered wholly. However, in United States V Aluminium Co. of America (Alcoa) as cited above, the US Court adopted and applied the effects or balance of interests theory and held to the effect that any state may impose liabilities on persons or companies whether within or outside its allegiance, for conducts outside its territory that creates an effect within its territory. It was a case involving the United States government and the Aluminium Corporation of America (Alcoa), a US corporation that had foreign investment in its stocks. Alcoa had a subsidiary company in Canada. The Canadian company together with other European companies formed a cartel called an ‘Alliance’ and although Alcoa technically was not a member of the alliance, however, forty nine percent of the stocks in Alcoa was owned by controlling members of the Canadian subsidiary company. The US government alleged that Alcoa monopolized interstate and foreign commerce through conspiracy with the Canadian subsidiary company. The court reasoned that any form of agreement by parties abroad that was either intended to, and did have some form of effect on foreign trade or commerce of the United States, would be caught up by the Sherman Act. In 1976, the US court applied the balance of interest theory in the case of Timberlane Lumber Co. V Bank of America12 and further stretched the principle in Alcoa to incorporate the concept of international comity. The court held in effect that the principle in Alcoa must be balanced against the interest of international comity. 13 The court further outlined the tests for determining extraterritoriality to include; some effect (actual or intended) on American foreign commerce; the effect should be sufficiently large to present cognizable injury; and the interest and link to the US must be sufficiently strong against those of other nations. 14 In 1993, the US Supreme Court again in Hartford Fire Insurance Co. V California15 was called upon to determine whether the comity principle precludes exercise of US extraterritorial jurisdiction over British reinsurance companies. The case involved an alleged violation of Section 1 of Sherman Antitrust Act through insurance coverage by US insurance companies and British reinsurance companies in the US market. The Court again applied the effect theory in interpreting the Sherman Act without regard to British foreign sovereignty. 9 Whish and Bailey cited supra pp. 489-492 213 US 347 (1909) 11 supra at p 356 12 549 F 2d 597 (9th Cir. 1976) 13 Jones A., Sufrin B., EU Competition Law: Text, Cases and Materials, (Oxford University Press) 4th Ed, 2011, pp. 1228-1230 14 ibid 15 supra 10 This extraterritoriality has its difficulties. Firstly, the US courts in Timberlane case adopted and modified the effects doctrine and in Hartford Fire Insurance’s case departed from it. It has created a judicial uncertainty as far as antitrust law is concern, especially in relation to balancing the interest of the comity principle. Secondly, because of the obvious disparity between the US antitrust law and the antitrust laws of other nations with less developed principles, application of US extraterritoriality will simply alienate those countries. Thirdly, even the concept of treble damages available in US antitrust laws are strange and will adversely prejudice the interest of US trading partners. In fact, the US extraterritoriality has sparked a series of legislation in other states, in fierce resistance to US attempt to enforce its competition laws abroad. Example, the UK, enacted the Protection of Trading Interests Act 1980 16 as a means of maintaining a resistance to US antitrust hegemony. Australia enacted the Foreign Antitrust Judgment (Restriction of Enforcement) Act 197917 and Canada enacted the Foreign Extraterritorial Measures Act 198518 respectively. In the ICI case cited supra, the US court even ordered ICI being a UK company from relying on its Patent Rights under the UK law. A commentator observed that US antitrust extraterritoriality amounts to judicial imperialism.19The difficulty with the decision of the US court in Hartford fire insurance’ case is that it is unclear in the decision of the court whether the direct, substantial, and reasonably foreseeable effects test of the Foreign Trade Antitrust Improvement Act (FTAIA) 1982 clearly amends or modifies the effects theory of the decision in Alcoa and also whether judges have authority to decline jurisdiction due to comity consideration and or whether the comity balancing test should be applied only after the jurisdiction has been established.20 The European Union approach is premised on Article 101 and 10221, which empowers the European court to exercise jurisdiction on grounds other than those grounds that constitute the effect theory under the US law. The grounds provided under the said articles are considered as single economic entity or theory doctrine, which connotes an agreement by undertaking entered outside the European Union, but implemented within the EU. The case of ICI v Commission (Dyestuffs case)22 paints the graphic picture of a single economic entity doctrine. It was a case involving Imperial Chemical Industrial Limited (ICI), a UK firm, but situated outside the EU. ICI was charged by the European Commission responsible for the imposition of fines for Dyestuffs cartel activities. The defence of ICI was that the jurisdiction of the Commission to impose fine on ICI, being a company outside the EU was not supported both by the EU Treaty as well as the international law principles of sovereignty. The Commission overruled ICI’s objection, consequently ICI filed an action against the commission in the European Court for annulment. ICI argued extraterritoriality as well as the effect doctrine, but the Court held that it was 16 Available at, http://www.legislation.gov.uk/ukpga/1980/11/contents (Last accessed on 29th March 2014) 17 Available at, http://www.comlaw.gov.au/Series/C2004A02023 (Last accessed on 29th March 2014) 18 Available at, http://laws-lois.justice.gc.ca/eng/acts/F-29/index.html (Last accessed on 29th March 2014) 19 Rhatican, J.P., Insurance Antitrust Defendants, Hartford Fire Insurance Co. v. California: A Mixed Blessing , 47 Rutgers L. Rev. 905, 955 (1995). 20 Torremans, Paul., Extraterritorial Application of Competition Law; European Law Review, August 1996, Vol. 21(4), pp 280-293 21 Treaty on the Functioning of European Union (TFEU): Available at; http://eur-lex.europa.eu/legalcontent/EN/TXT/?uri=CELEX:12008E101 (Last accessed on 29th March 2014) 22 supra unnecessary to consider the issue of effect doctrine when grounds other than that existed under Article 101 and 102. In its judgment, the court reasoned that ICI, Sandoz and Geigy participated in price-fixing. Moreover that, although they were all non-European undertakings, located outside the EU, however, were still guilty of price-fixing through their respective subsidiaries located within the EU. The court held that both the parent company and its subsidiary formed a single economic entity. Again in A Ahlstrom Oy V Commission (Wood Pulp case)23 , the question of the effects doctrine favoured by the US courts was raised and argued in extensio. It was a case involving non-European undertakings were charged for violating Article 101 by their price-fixing activities of wood pulp to buyers within the EU. The court held in effect in its judgment at page 5232 thus "The consequence of the agreements and practices of the undertakings on prices and/or charges to customers as well as on resale of wood pulp within the EU was therefore, substantial and intended, and was primary and direct result of the agreements and practices." Interestingly also, the court analysis its reasoning in considering extraterritoriality and its application. The court interpreted Article 101 in relation to the case in hand, to include the formation of an agreement, or conclusion of a decision or concerted practice on one hand and the implementation of the agreement, decision or concerted practice on the other hand. The court held that since the implementation of the agreement or concerted practice was within the common market of which buyers within the EU were affected, it was irrelevant whether they used subsidiaries, or agents within the EU. It may well seem that again the EU court avoided making a statement regarding its position in relation to the US effect doctrine. The tacit avoidance by the EU court to make a pronouncement regarding its position in relation to the effects doctrine is largely criticized, because had the court decided on that, it would be clear whether the EU adopt the US approach and concede to its application in the EU. Secondly, the EU court in Wood pulp’s case, the court was called upon to interpret the Treaty in relation to comity principle. The court tacitly avoided making any pronouncement on that as it held that it was unnecessary to determine the question of international comity as it would amount to the court determining its jurisdiction in relation to matters not within its purview. As it stands, while each of the jurisdictions adopted its principle, it is clear there is no consensus on extraterritoriality by both the US and the EU. Bilateral approach The Bilateral approach was adopted as an alternative to the unilateral approach, which has caused lots of frictions between the US and the EU. The first of such agreement was the EU/US Cooperation Agreement24 signed in 1991 regarding the application of their competition laws and exchange of interpretative letters. The idea behind the agreement was to promote cooperation and coordination of competition between counterparts and to reduce any differences, problems, e.t.c that has existed or may arise in the application of competition law of respective parties. Key elements of the agreement included cooperation, confidentiality of information, information exchange as well as the concept of comity. The agreement recognized positive and negative comity on both matters of enforcement and disclosure where disclosure will prejudice regional laws. The EU/US in 1998 also signed the second cooperation agreement 23 supra Available at http://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX:21995A0427(01) (Last accessed on 30th March 2014) 24 called the EU/US Positive Comity Agreement 199825 which was aimed at promoting positive comity application of competition laws between the pairs, especially where the former can show a prima facie anticompetitive practices of undertaking in the latter’s jurisdiction as adversely affecting the market of the former. This agreement was developed owing to the friction caused by the respective laws of the counterparts regarding comity principle and how enforcement of those laws suffered setbacks. There is other bilateral agreement between the EU and other regional blocs and states, e.g., Canada, Japan, Korea, China and Russia.26 The cooperation agreement has been held to be largely successful and preferred than the unilateral approach by US and EU.27 An example of cooperative efforts in competition law between US and Canada can be seen in Panasonic/sanyo28 where the respective competition authorities and parties co-operated in arriving at a positive outcome and Thompson Corporation/Reuters Group29 where negotiations of and investigations in paralleled and included joint meetings with the parties by respective competition authorities from the forum of the companies. However successful bilateral agreements have been, it has its own fair share of criticism and failures. Firstly, Hartford Fire Insurance Co. V California was decided in 1993, after the EU/US Cooperation Agreement was signed in which parties agreed to cooperate on the understanding of the principles of comity. The decision also sparked a reactionary response in the EU when France in France v Commission30 challenged the validity or otherwise of the agreement on the grounds of procedural irregularity. The EU Treaties, which required that the agreement be reached by the council in consultation with the EU parliament. The Court ruled that procedure was not followed and voided the agreement.31Secondly, in Boeing/McDonnell Douglas,32 while the USs’ FTC was willing to allow merger arrangement the European Commission was reluctant to allow the merger. Also in GE/Honeywell33 was the case of a merger permitted in the US but prohibited by the European Commission. Multilateral approach Multilateral approach appears to be the preferred alternative to internationalization of competition law as a means of avoiding the difficulties of extraterritoriality. The effort commenced with the post-war Havana Charter for an International Trade 34 , where a provision was made for antitrust rules. However when the General Agreement on Tariffs and Trade was entered into in 1947, the antitrust rules were not incorporated into the agreement. So by the time the World Trade Organisation (WTO) was established in 1995, emphasis was laid on trade related activities rather than on 25 Available at, http://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX:21998A0618(01) (Last accessed on 30th March 2014) 26 Details of EU agreements with regional blocs and states are available at, http://ec.europa.eu/competition/international/bilateral/index.html (Last accessed on 30th March 2014) 27 Whish R., Bailey D., Competition Law (Oxford University Press), 7 th Ed, 2012, p.511. 28 Case M 5421, 09, 2009. Also referred to in Whish and Bailey ibid at p.511 29 Case M 4726, 09, 2007. Also referred to in Whish and Bailey ibid at p.511 30 Case C-327/91 (1994) ECR 1-3641 31 Note that the position was rectified by joint decision of the council and commission in Oj (1995) L 95/45 corrected by Oj (1995) L 131/38 32 Case M 877Oj (1997) L 336/16 33 Case COM/M. 2220. 34 The Charter is set out in Wilcox, A Charter for World Trade (The Macmillan Company) 1949, pp. 231-327. competition law policies and principles.35 Because of the inherent defect associated with the agreement, it has become difficult for the organisation to impose an obligation on undertakings. It is also challenging to decipher the distinction between trade and competition policy, consequently, it became even more difficult to incorporate competition law within its dispute resolution mechanism. Even with its efforts through the Singapore group36 in 1996 and the Cancun declaration37 in 2003, there is still no clear outline on competition policy rules and its application amongst member states. The WTO’s multilateral approach has been considered as the least successful in a global effort to internationalize competition law. Unlike WTO, the Organisation for Economic Co-Operation and Development (OECD) takes competition policy seriously and has been constructively engaged to its progress and development. It first made a recommendation in 1986 concerning cooperation with regards to restrictive business practices in relation to international trade and further developed on that through its revised version in 1995 38 . The key features of the documents are cooperation, consultation and notification of matters relating the interests of a foreign government in relation to competition law. In 2012, it published its Recommendation on Fighting Bid Rigging in Public Procurement 39 amongst member states. The recommendation further reinforces the earlier released 2009 Guidelines for Fighting Bid Rigging in Public Procurement40. However, the problem with OECD in relation to internationalising competition law is that it is considered to be narrow in its scope, because it relates to its member states whose membership is about forty countries, thirty four of which come from most industrialised economies. Secondly, because the organisation consists of largely developed states, the model is considered as too difficult approach to be adopted by developing states. It has also not provided a clearly defined and unified enforcement mechanism. The United Nations Conference on Trade and Development (UNCTAD) on the other hand seeks to develop competition law policies through The Set of Mutually Agreed Equitable Principles and Rules for the Control of Restrictive Business Practices41. In 1980, the UN General Assembly adopted a Voluntary, non-binding code. The most recent document of the organisation is its 2010 model law on competition,42 which sets out core principles of competition law with a view that member states would adopt or incorporate them into their national competition law. The model law has been widely regarded as successful and states have hitherto embraced those principles and have even incorporated them in their modified form into their respective competition law. However, one of the challenges of the model law is that it failed to harmonize competition law because of the simple fact that states have uneven standards of economic development and mechanism for enforcement. Secondly, in one of their 35 Whish and Bailey supra, p.507 Working Group on the Interaction between Trade and Competition, available at, http://www.wto.org/index.htm (Last accessed on 30th March 2014) 37 South Asian Council for Food Security and Fair Trade Declaration, available at http://www.seacouncil.org/seacon/index.php?option=com_content&view=article&id=55&Itemid=69 (Last accessed on 30th March 2014) 38 Available at, http://acts.oecd.org/Instruments/ShowInstrumentView.aspx?InstrumentID=192&InstrumentPID=188& Lang=en&Book=False (Last accessed on 30th March 2014) 39 ibid 40 ibid 41 Resolution 35/63 of 5 December 1980. Available at, http://unctad.org/es/Docs/tdrbpconf7d8_en.pdf (Last accessed on 30th March 2014) 36 42 Available at, http://unctad.org/es/Docs/tdrbpconf7d8_en.pdf (Last accessed on 30th March 2014) round table meetings, member states from developing countries decried that, since the global financial crisis, enforcement of competition law has been difficult. 43 Thirdly, since the global economic meltdown, some member states reverted to protectionist rules of applying industrial policies instead of competition laws. When it comes to enforcement, it appears bilateral and international cooperation has been most effective than observing principles as contained in the model law. Because of the disparity in trade and development between member states and the fact that the model law has taking into account more of competition policies of developed states than of the developing states, it has become difficult for developing states to full appreciate and apply the principles as encouraged by the model law. On the other hand, the International Competition Network (ICN) is the most successful of the multilateral approaches, not only because it has123 agency members from over 108 jurisdiction as at 201244, but also because it promotes substantive and procedural convergence of competition laws. The idea for the harmonization of international competition laws by this network was conceived and articulated through a document titled Final Report of the International Competition Policy Advisory Committee to the US Attorney General for Antitrust (IPAC Report 2000) 45 The Report consist of over 300 pages and contained recommendation such as multijurisdictional merger review, interface of trade and competition policy and anti-cartel enforcement. In its reasoning for the report, the Co- Chair of the Committee, James F. Rill, stated thus "... The Report draws a blueprint to use in the short and medium term to increase transparency, deepen cooperation, and encourage compatibility among the proliferating competition systems that exist in the U.S. and abroad.” 46 The report led to the birth of International Competition Network, as an international network whose aim is to advocate the adoption of superior standards and procedures, formulate proposal for procedures, facilitate effective international cooperation in respect of competition laws for the benefit of members, consumers, agencies and economies globally.47 The ICN approach has been particularly successful because it again engaged the US and provoked transparency amongst member states. The US unilateral extraterritoriality has been the problems, and to have the US leading and constructively engaged in promoting multilateral approach of ICN is one of the major achievements of this approach. The Network also has working groups comprising of highly regarded and effective resource persons and organizations. For example, the Advocacy Working Group, whose mission is to develop practical tools and guidance to improve the effectiveness of the network, has from 2003-2013 through its various programs created awareness, provoked conversations and influence and improved outreaches. The Agency Effectiveness Working Group, which was formed in 2009, has as at 2012 achieved most of its objectives from effective project delivery, knowledge management and ex-post valuation to strategic planning and prioritization. The Cartel Working Group has been considered to be the most successful of the groups, in that through its numerous conferences and engagements from 1999-2011 as at 2011 43 Reports on the Intergovernmental Group of Experts on Competition Law and Policy on its Tenth Session, Geneva, July 2009, pp. 4-6. Available at, http://unctad.org/en/docs/ciclpd6_en.pdf (Last accessed on 30th March 2014) 44 ICN Statement of Achievements 2001-2012, Available at, http://www.internationalcompetitionnetwork.org/uploads/20112012/2012%20icn%20statement%20of%20achievements.pdf (Last accessed on 30th March 2014) 45 Available at, http://www.justice.gov/atr/icpac/4272.htm (Last accessed on 30th March 2014) 46 ibid p. 2 47 ICN’s Mission statement, available at, http://www.internationalcompetitionnetwork.org (Last accessed on 30th March 2014) approximately 150 participants from more than 70 jurisdictions have joined the group, including about 40 non-governmental advisors. The Merger Working Group was founded in 2001and continue to organize a large body of work product and conferences. In 2010, the group carried out a survey of the use and impact of its models amongst members and non-governmental advisors, and 90% of responses indicated the success of the working group’s body of work product. The Network adopted the working group’s recommended practices for merger analysis on market definition, the legal framework for competition merger analysis, the use of market shares, thresholds and presumptions, competitive effects analysis in horizontal merger review, coordinated effects, unilateral effects, entry and expansion, and failing firm / existing assets. According to the 2011 group’s comprehensive assessment report, over 90% of responding agencies were familiar with the Recommended Practices for Merger Analysis, and 85% of responding agencies reported using the Recommended Practices.48 Conclusion No doubt the world is increasingly becoming globalized, so is free trade amongst businesses, companies and countries of the world. Therefore, while the US through the decision in Hartford Fire Insurance by the ‘effect doctrine’ seeks to enforce its antitrust law extraterritorially as a model for the rest of the world, The EU through Dyestuffs and Wood Pulp’ by the ‘single economic entity doctrine’ seeks to establish their model, while the rest of the world grapple in the dark as they face global competition law hegemony. The question becomes then which model is desirable and adaptable. Enforcement of competition law by unilateral approach has created lots of problems from resistance to blocking laws. The Bilateral approach has achieved some degree of successes but leaves much to be desired especially in the light of alienation of non-members of the agreement in parallel. Efforts to achieve an international competition law as a means of lessening the controversial nature of extraterritoriality have been alternatively or simultaneously sought and discussed. Multilateral approach has become more useful and result oriented model and so far the effort through the International Competition Network has been the most successful one, even though with its problems of a non-binding nature of its agreement and the challenges faced by developing countries in implementing the recommendations of the network. No doubt the debate will continue especially on the extraterritoriality of competition law and how it can be solved via a more harmonized approach. At least at the moment, a multilateral approach has provided so much comfort and possibilities and has reduced rancor and trading wars amongst the international comity. Whether a better solution lies ahead remain to be seen. Daniel H Bwala, Esq, MCIArb (UK) Legal Practitioner and Arbitrator Principal, Bwala & Co (Crystal Chambers) Adjunct Lecturer, Nigerian Law School, Abuja National Representative, International Negotiation Competition (INC) Mobile Nos. (Nig) +234-8035231530 (UK) +44-7424732953 www.bwalaandco.com 48 ibid Bibliography Primary sources International Conventions/Agreements/Charters/Statutes/Rules/Model Laws UK Protection of Trading Interests Act 1980 US Sherman Antitrust Act 1890 Australia Foreign Antitrust Judgment (Restriction of Enforcement) Act 1979 Canada Foreign Extraterritorial Measures Act 1985 EU Treaty on the Functioning of European Union (TFEU) EU/US Cooperation Agreement 1991 EU/US Positive Comity Agreement 1998 UN Havana Charter for an International Trade 1947 South Asian Council for Food Security and Fair Trade Declaration 2003 UNCTAD Mutually Agreed Equitable Principles and Rules for the Control of Restrictive Business Practices, Resolution 35/63 of 5 December 1980 UN Model Law on Competition 2010 Final Report of the International Competition Policy Advisory Committee to the US Attorney General for Antitrust (IPAC Report 2000 Case Law United States V Aluminium Co. of America (Alcoa) 148 F 2d 416 (2nd Cir 1945) P.444 Hartford Fire Insurance Co. V California 509 US 764 (1993) ICI V Commission (1972) ECR 619, (1972) CMLR 557 A Ahlstrom Oy V Commission (1988) ECR 5193, (1988) 4 CMLR 901 American Banana Co. V United Fruit Co 213 US 347 (1909) Timberlane Lumber Co. V Bank of America 549 F 2d 597 (9th Cir. 1976) Panasonic/Sanyo. Case M 5421, 09, 2009 Thompson Corporation/Reuters Group. Case M 4726, 09, 2007 France V Commission. Case C-327/91 (1994) ECR 1-3641 Boeing/McDonnell Douglas Case M 877Oj (1997) L 336/16 GE/Honeywell Secondary sources Textbooks Whish R., Bailey D., Competition Law (Oxford University Press), 7th Ed, 2012. Brownlie., Principles of Public International Law (Clarendon Press), 7th Ed, 2008. Carter B. E., Trimble P.R., International Law (Boston: Little, Brown) 1995. Jones A., Sufrin B., EU Competition Law: Text, Cases and Materials, (Oxford University Press) 4th Ed, 2011. Wilcox., A Charter for World Trade (The Macmillan Company) 1949. Journals/Articles Rhatican, J.P., Insurance Antitrust Defendants, Hartford Fire Insurance Co. v. California: A Mixed Blessing, 47 Rutgers L. Rev. 905, 955 (1995). Torremans, Paul, Extraterritorial Application of Competition Law; European Law Review, August 1996, Vol. 21(4)