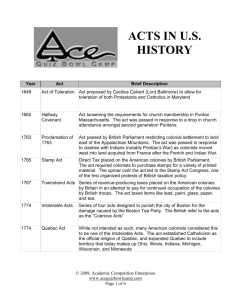

at_hammer

advertisement