NEW - MIT

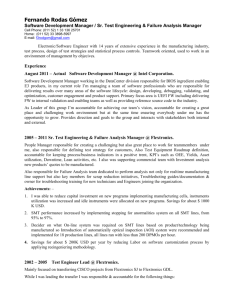

advertisement