Perfectly Competitive Markets

advertisement

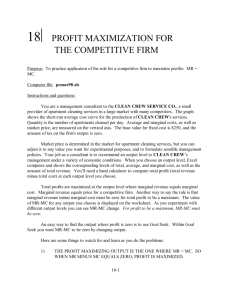

Lecture 2: Perfectly Competitive Markets Required Text: Chapter 2 Market Models Market Structures Four different types of market structure make up the basis of most economic modeling: Perfect Competition Monopoly Monopolistic Competition, and Oligopoly The last three types of markets are said to be imperfectly competitive markets. Perfect Competition A market is said to be perfectly competitive if There are many buyers and sellers, each with roughly the same market share. Thus, all buyers are sellers are price takers in the market All sellers sell identical (homogenous) goods Information about how to produce and use the good is freely available – all firms have access to technology One can become the seller or buyer with relative ease (free entry and exit) In a perfectly competitive market, firms compete with each other on production/procurement costs. In a perfectly competitive market, a firm’s marketing strategy focuses on the level and timing of sales Perfect Competition A perfectly competitive faces a horizontal demand curve, because as a price taker, it faces “a going price” for whatever amount it sells. A perfectly competitive firm has U-shaped average cost (AC) and marginal cost (MC) curves in the short-run The going price is determined by levels of market demand and supply. Short run is the time period within which the fixed factor of production (i.e., plant size) cannot be adjusted. There is no fixed factor in the long run As a profit-making firm, it adjusts its output to equate its marginal cost (MC) to the going price Equilibrium condition: MC = P = MR Revenue of a Perfectly Competitive Firm Total Revenue: The amount of money received when the firm sells the product, i.e., Since the firm is a price taker under perfect competition, it sells each additional unit of the product for the same price. Average Revenue = Total Revenue/Quantity sold AR = TR/Q = P Marginal Revenue = Additional revenue earned from selling an additional unit of the product. Total Revenue = Price of the product × Quantity of the product sold TR = P × Q MR = ∂TR/∂Q = P Thus, for a competitive firm AR = P = MR Total Revenue: P×Q TP = Q P TR AR MR 0 3 0 0 0 Total Revenue 350.00 10 3 30 3 3 300.00 3 75 3 3 250.00 50 3 150 3 3 200.00 70 3 210 3 3 85 3 255 3 3 95 3 285 3 3 100 3 300 3 3 101 3 303 3 3 Dollars 25 150.00 100.00 50.00 0.00 0.00 20.00 40.00 60.00 Output TR 95 3 285 3 3 85 3 255 3 3 80.00 100.00 120.00 Average Revenue: TR/Q = P TP = Q P TR AR MR 0 3 0 0 0 10 3 30 3 3 25 3 75 3 3 AR 3.50 3.00 50 3 150 3 3 70 3 210 3 3 85 3 255 3 3 $/Unit 2.50 2.00 1.50 1.00 0.50 0.00 0.00 20.00 40.00 60.00 Output 95 3 285 3 3 100 3 300 3 3 101 3 303 3 3 95 3 285 3 3 85 3 255 3 3 AR 80.00 100.00 120.00 Marginal Revenue: ∂TR/∂Q = P TP = Q P TR AR MR 0 3 0 0 0 10 3 30 3 3 25 3 75 3 3 50 3 150 3 3 MR 3.50 3.00 70 3 210 3 3 85 3 255 3 3 95 3 285 3 3 100 3 300 3 3 101 3 303 3 3 $/Unit 2.50 2.00 1.50 1.00 0.50 0.00 0.00 20.00 40.00 60.00 3 285 3 3 85 3 255 3 3 100.00 Output MR 95 80.00 120.00 Profit Maximization by the Competitive Firm: Approach I: Total Profit = TR – TC L TP = Q TR TC Profit 0 0 0 80 -80 1 10 30 105 -75 2 25 75 130 -55 TC, TR, & Profit 350.00 300.00 250.00 50 150 155 -5 4 70 210 180 30 5 85 255 205 50 100.00 6 95 285 235 50 50.00 7 100 300 255 45 8 101 303 280 23 9 95 285 305 -20 10 85 255 330 -75 Dollars 3 200.00 150.00 0.00 0.00 20.00 40.00 60.00 80.00 100.00 Output TC TR On the Diagram, the profit maximizing level of output is the level where the vertical difference between the TR and TC is the largest. With P = $3/unit, profits are maximized by producing 95 units of output. 120.00 Profit Maximization by the Competitive Firm: Approach I: Total Profit = TR – TC Stage III Stage II Stage I Input (L) TP (Q) AP (Q/L) MP TC TR Profit 80 0 -80 0 0 0.00 1 10 10.00 10 105 30 -75 2 25 12.50 15 130 75 -55 3 50 16.67 25 155 150 -5 4 70 17.50 20 180 210 30 5 85 17.00 15 205 255 50 6 95 15.83 10 235 285 50 7 100 14.29 5 255 300 45 8 101 12.63 1 280 303 23 9 95 10.55 -6 305 285 -20 10 85 8.50 -10 330 255 -75 Max Profi Max Output Profit Maximization by the Competitive Firm: Approach II: MR = MC Most managers do not make decisions looking at TR and TC. Most decisions are made at the “margin.” The output level that will maximize profit is determined by comparing the amount that each additional unit of output adds to TR and TC. Recall, Marginal Cost (MC) represents additional cost from producing an additional unit of output; and Marginal Revenue (MR) represents addition to TR from selling (producing) an additional (one more) unit of output, which is equal to the price of that output. Thus, MC and MR can be used to determine profit maximizing level of output. Profit maximizing Condition: MR = MC Profit Maximization by the Competitive Firm: Approach II: MR = MC L Q TR MR TC MC Profit 0 0 0 1 10 30 3 105 2.50 -75 2 25 75 3 130 1.67 -55 3 50 150 3 155 1.00 -5 4 70 210 3 180 1.25 30 80 -80 MR, MC, & Profit 8.00 7.00 6.00 $/Unit 5.00 4.00 3.00 5 85 255 3 205 1.67 50 6 95 285 3 235 3.00 55 7 100 300 3 255 5.00 45 2.00 1.00 0.00 0.00 20.00 40.00 60.00 80.00 100.00 120.00 Output 8 101 303 3 280 25.0 23 9 95 285 3 305 -4.17 -20 10 85 255 3 330 -2.50 -75 MR MC The firm will continue to expand production until MR is equal to MC, i.e., profit is maximized when MR = MC. With P being $3/unit, profits are maximized by producing 95 units of output. Profit Maximization by the Competitive Firm: Approach II: MR = MC Stage III Stage II Stage I Input (L) TP (Q) AP (Q/L) MP MC MR Profit 0 -80 0 0 0.00 1 10 10.00 10 2.50 3 -75 2 25 12.50 15 1.67 3 -55 3 50 16.67 25 1.00 3 -5 4 70 17.50 20 1.25 3 30 5 85 17.00 15 1.67 3 50 6 95 15.83 10 3.00 3 50 7 100 14.29 5 5.00 3 45 8 101 12.63 1 25.0 3 23 9 95 10.55 -6 -4.17 3 -20 10 85 8.50 -10 -2.50 3 -75 Max Profit Max Output When the Firm Should Produce? Given price “P”, the AR and MR are given by the horizontal line at P. AR = MR P Profit is maximized by producing Q level of output, where MR = MC. A E B D C 0 Q TR is given by the area PAQ0 TFC is given by the area EBCD TVC is given by the area DCQ0 TC is given by the area EBQ0 Profit is given by the area PABE When the Firm Should Produce? At P1, the firm is making profit P1 At P2, the firm is at the break-even point P2 P3 At P3, the firm continues to produce to minimize loss P4 At P4, the firm may continue to produce P5 0 At P5, the firm will close down Q5 Q4Q3Q2 Q1 Thus, a profit maximizing firm will continue to produce as long as the price of the product is above the AVC. Supply Supply is a direct price and quantity relationship indicating how suppliers (producers, sellers, & mgrs) of a product respond to differing price levels. It states what suppliers are WILLING and ABLE to supply at a given price. Derivation of Supply Curves Supply curve for the individual firm is based on the cost structure of the firm & how managers respond to alternative product prices as they attempt to maximize profits. We discussed earlier that profit maximizing firms will shut down if the price of the product falls below the AVC. This implies that the MC curve above AVC represents the firm’s supply curve. P1 Q1 The Competitive Firm’s Supply Responses The Competitive Firm’s Short-Run Supply Curve Law of Supply The Law of Supply says that the quantity of goods &/or services offered will vary DIRECTLY with the price. Price increase will result in an increase in quantity supplied. Price decrease will result in a decrease in quantity supplied. Price S P3 P2 P1 Q1 The amount of increase or decrease, however, depends on the Elasticity of Supply. Q2 Q3 Output Firms and the Industry A market always involves both buyers and sellers of a product or commodity. It may involve only firms, as when farmers sell grains to elevators A firm is an individual business. The industry is made up of a set of firms competing in a particular market. Firm1 + Firm2 + … + Firmn = Industry The Competitive Industry Supply Curve The Competitive Industry and the Firm A Rise in Marginal Costs Why is the competitive environment important in marketing? Marketing managers operate in REAL MARKETS. Competition is not the same in all markets Recognize opportunities and constraints of the environment Begin to understand firm choices Begin to understand competitive reaction